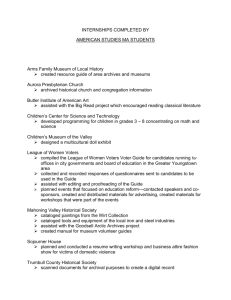

Word File3

advertisement

ASSISTED LIVING AS A FULL MEDICAL TAX DEDUCTION Everyone Has The Right to Legally Avoid Taxes Caution: The information and observations contained in this article may be subject to varied interpretations by senior care professionals. Each sponsor and owner/operator should seek independent advice and counsel from their own professionals. Sponsors should always advise Senior consumers to obtain independent second opinions on this important matter. How would you like to offer your assisted living prospects and existing residents a 13% to 20% discount on their year 2008 and future monthly service fees – without costing you anything? Sounds too good to be true? It’s possible. Your residents can deduct the complete assisted living monthly service fee costs – including all of the shelter, services and care components. As usual, some restrictions apply, but they are usually not serious deal killers. IRS Publication 502, “Medical and Dental Expenses” (Year 2007 version), states “You can include in medical expenses the cost of medical care in a nursing home, home for the aged or similar institution for yourself, your spouse or your dependents. This includes the cost of meals and lodging in the home if a principal reason for being there is to get medical care. Do not include the cost of meals and lodging if the reason for being in the home is personal.” But a reasonable rationale would be that the main purpose for being in nursing or assisted living is primarily to “get (consistent) medical care” – not for “personal” or discretionary reasons. IRS Publication 502 further defines the typical situation as involving a chronically ill individual: “You are chronically ill if, within the previous 12 months, a licensed health care practitioner has certified that the individual meets either of the following descriptions: • He or she is unable to perform at least two activities of daily living without substantial assistance from another individual for at least 90 days, due to a loss of functional capacity. Activities of daily living are eating, toileting, transferring, bathing, dressing and continence. Or . . . • He or she requires substantial supervision to be protected from threats to health and safety due to severe cognitive impairment.” These are direct quotes from IRS Publication 502. Doesn’t that sound like your typical highacuity assisted living resident? The 7.5% Exclusion – The publication also advises the taxpayer how the deductions work: “You can deduct only the amount of your medical and dental expenses that is more than 7.5% of your adjusted gross income (Form 1040, line 38).” Most income-qualified Seniors are already at that threshold deduction level before assisted living costs due to their current medical expense deductions (prescription drugs, medical co-payments, etc.) Think of it this way – with a $3,200 per month assisted living tax deduction, the after-tax benefit to a senior with a gross annual pre-tax income of $50,000 is equivalent to rolling back your base monthly service fee prices approximately 3 years to 2005 levels. That’s assuming you normally escalate your pricing 4 percent annually. For a senior with a gross annual pre-tax income of $65,000, the effective price roll back is about 4 years B to 2004 levels. An obvious question might be, “If this is a legitimate tax benefit, why is it just becoming common knowledge in the assisted living arena?” It’s not, a number of major assisted living companies have been quietly implementing this concept. They see it as their “competitive advantage” B so why spread the word to competitors? During these difficult economic times, we need everything working to our advantage. With the medical tax deduction for assisted living, the U.S. Government becomes our no hassle financial partner delivering attractive benefits to Seniors and their families.

![[Agency] recognizes the hazards of lead](http://s3.studylib.net/store/data/007301017_1-adfa0391c2b089b3fd379ee34c4ce940-300x300.png)