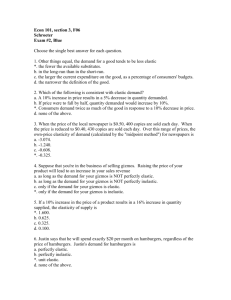

Econ 101, section 4, S07

advertisement

Econ 101, section 4, S07 Schroeter Exam #2, Blue Choose the single best answer for each question. 1. If the own price elasticity of demand for a good is -1.65, then a 3% decrease in price will result in a a. 5.55% increase in quantity demanded. *. 4.95% increase in quantity demanded. c. 1.82% increase in quantity demanded. d. 0.55% increase in quantity demanded. 2. Which of the following features of a good would tend to make the demand for the good elastic? a. The good is a necessity. *. The good has numerous close substitutes. c. Expenditure on the good represents a trivial share of the typical consumer's budget. d. All of the above. 3. Studies show that, as household income increases from $40,000 per year to $60,000 per year, the household's demand for wine increases from 20 liters per year to 40 liters per year. Over this range of income, the income elasticity of demand (calculated by the "midpoint method") for wine is a. 2.00. *. 1.67. c. 1.50. d. 0.60. 4. When Bob, the sidewalk hot dog vendor, charges $2.50 for a hot dog, he sells $300 worth of hot dogs per day. When he increases his price to $3.00, he sells $270 worth of hot dogs per day. Over this range of prices, the own-price elasticity of demand (calculated by the "midpoint method") for Bob's hot dogs is a. -1.7273. *. -1.5714. c. -0.6354. d. -0.5789. 5. Supply decreases in the competitive market for widgets and, as a result, the total revenue of widget sellers increases. From this information, we can conclude that a. the supply of widgets is elastic. b. the supply of widgets is inelastic. c. the demand for widgets is elastic. *. the demand for widgets is inelastic. 2 6. If a 10% increase in the price of good X results in a 3% increase in the quantity demanded of good Y, the cross-price elasticity of demand is a. positive and goods X and Y are complements. b. negative and goods X and Y are complements. *. positive and goods X and Y are substitutes. d. negative and goods X and Y are substitutes. 7. The market for wheat is competitive. Knowing that the demand for wheat is inelastic, which of the following is a possible result of a technological advance in wheat production? a. The price of wheat decreases by 6% and the quantity of wheat sold increases by 10%. b. The price of wheat increases by 6% and the quantity of wheat sold decreases by 10%. c. Wheat farmers' total revenue increases by 4%. *. None of the above. 8. Which of the following is true? In the market for gasoline, *. demand and supply are likely to be more elastic in the long-run than in the short-run. b. demand and supply are likely to be less elastic in the long-run than in the short-run. c. demand is likely to be more elastic and supply is likely to be less elastic in the long-run than in the short-run. d. demand is likely to be less elastic and supply is likely to be more elastic in the long-run than in the short-run. 9. Price controls are usually enacted a. at the urging of economists. b. as a means of raising revenue to pay for government activities. *. when policymakers believe that the price of a good is unfair to buyers or sellers. d. in order to correct inefficiencies in a market. 10. A price floor is binding if it a. is set at a level lower than the equilibrium price. b. results in an observed price that is the same as the equilibrium price. *. leads to a surplus. d. creates an incentive for illegal sales at prices above the floor. 11. A binding price ceiling causes a. excess supply. b. a surplus. *. a shortage. d. quantity supplied to exceed quantity demanded. 3 12. Recall lecture's analysis of a metropolitan rental housing market. Suppose that the market is currently in (long- and short-run) equilibrium. A rent control ordinance prohibits any increase in rent above the current level. Then the city experiences a big influx of population. Which of the following would we expect to see in the rental housing market? a. Rents will increase in the short-run, but return part of the way toward their initial level in the long run. b. In the short-run there will be a shortage of apartments, but in the long-run there will be a surplus of apartments. c. Tenants will likely have better quality housing than they would have had without rent control. *. There will be excess demand for rental housing that will persist in the long-run. 13. Suppose that the current equilibrium price in the competitive market for gizmos is $12. Then the government imposes a price ceiling at the level of $8. What will happen in the gizmo market as a result of the price ceiling? a. Nothing. (The price ceiling will be non-binding.) b. The demand for gizmos will shift to the right. c. The supply of gizmos will shift to the left. *. The number of gizmos purchased will decrease. 14. Which of the following is true? a. As of today (February 21, 2007), Iowa's minimum wage is $5.15/hour. b. Governor Culver recently signed a bill that will increase Iowa's minimum wage to $7.25/hour by January 1, 2008. c. Last month, the U.S. House of Representatives passed a bill that would increase the federal minimum wage to $7.25/hour over a two-year period. *. All of the above are true. 15. If a $1.00/unit excise tax is imposed on a competitive market with elastic demand and inelastic supply, *. the price sellers receive (net of the tax) will decrease by more than $0.50/unit. b. the price buyers pay (inclusive of the tax) will increase by more than $0.50/unit. c. both a and b. d. impossible to determine without knowing whether buyers or sellers are required to send the tax payment to the government. 16. The Federal Insurance Contribution Act (FICA) tax is an example of a. an income tax. b. a sales tax. *. a payroll tax. d. an excise tax. 4 17. Consumer surplus is *. the amount a buyer is willing to pay for a good minus the amount actually paid. b. the amount a buyer is willing to pay for a good minus the cost of producing it. c. the price of a good minus the consumer's willingness to pay for the good. d. the amount a good that the consumer is able to purchase at below-equilibrium prices. 18. The competitive market for a good is in equilibrium to begin. Then the government imposes a binding price ceiling. Assuming that output is rationed to the consumers who value it most highly, what happens to total surplus as a result? a. It remains unchanged. b. It increases. *. It decreases. d. It could increase, decrease, or remain unchanged, depending on the elasticities of supply and demand. 19. The competitive market for a good is in equilibrium to begin. Then the government imposes a binding price ceiling. Assuming that output is rationed to the consumers who value it most highly, what happens to consumer surplus as a result? a. It remains unchanged. b. It increases. c. It decreases. *. It could increase, decrease, or remain unchanged, depending on the elasticities of supply and demand. Questions 20 and 21 refer to the following information. The table lists willingness to pay for the first, second, and third pizzas of the month for three hypothetical consumers. All three have zero willingness to pay for pizzas after the third of the month. Andy Baxter Catherine First pizza $15.00 $12.00 $18.00 Second pizza $14.00 $10.00 $15.00 Third pizza $8.00 $8.00 $11.00 20. If the price of pizzas were $12.50, the numbers of pizzas purchased each month by each consumer would be: a. Andy - 2; Baxter - 2; Catherine - 1. b. Andy - 1; Baxter - 1; Catherine - 2. c. Andy - 1; Baxter - 3; Catherine - 1. *. Andy - 2; Baxter - 0; Catherine - 2. 21. If the price of pizzas were to decrease from $12.50 to $10.00, who would experience the largest gain in consumer surplus? a. Andy. b. Baxter. *. Catherine. d. Andy and Catherine would be tied for the largest gain in consumer surplus. 5 22. Producer surplus measures a. the costs to sellers of supplying output. b. the total amount that buyers are willing to pay for the sellers' output. c. the revenue that sellers obtain from sales of their output. *. the benefit to sellers of participating in the market. 23. In a supply and demand graph of a competitive market, producer surplus in equilibrium is represented by a. the area below the supply curve to the left of the equilibrium quantity. b. the height at which the supply curve intersects the vertical axis. c. the vertical distance between the supply and demand curves at the equilibrium price. *. the area below the price and above the supply curve. 24. The government currently charges an excise tax of $1.00/unit on the competitive market for widgets. If the government were to boost the tax rate to $2.00/unit, the amount of the deadweight loss associated with the widget excise tax would a. double. *. more than double. c. definitely increase, but by less than double. d. none of the above. 25. The government currently charges an excise tax of $1.00/unit on the competitive market for widgets. If the government were to boost the tax rate to $2.00/unit, the revenue collected from the widget excise tax would a. double. b. more than double. c. definitely increase, but by less than double. *. none of the above. 26. Which economist argued, in the late 1970s, that reductions in federal income tax rates would actually raise tax revenue? a. Henry George. *. Arthur Laffer. c. Edward Prescott. d. Arthur Rolnick. 6 The following graph depicts supply and demand in a hypothetical market. Use it to answer questions 27, 28, 29, and 30. ($/unit) 8 6 Supply 4 3 2 Demand 750 1500 (units/day) 27. When the market is in equilibrium (with no excise tax), total surplus is a. $9000/day. b. $7500/day. *. $4500/day. d. $3000/day. 28. If the government were to levy an excise tax of $3.00/unit on this market, it would collect tax revenue of a. $4500/day. b. $3000/day. *. $2250/day. d. $1500/day. 29. With the excise tax of $3.00/unit in effect, consumer surplus in this market would be a. $2250/day. b. $1500/day. *. $750/day. d. $375/day. 30. The deadweight loss of a $3.00/unit excise tax on this market would be a. $3000/day. b. $2250/day. c. $1500/day. *. $1125/day.