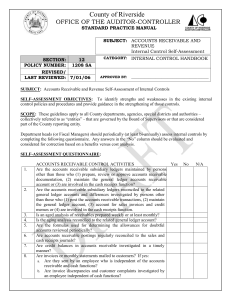

1208 SA Internal Control Self Assessment

County of Riverside

OFFICE OF THE AUDITOR-CONTROLLER

STANDARD PRACTICE MANUAL

SUBJECT: ACCOUNTS RECEIVABLE AND

REVENUE

Internal Control Self-Assessment

SECTION: 12

POLICY NUMBER: 1208 SA

CATEGORY:

REVISED/

LAST REVIEWED: 7/01/06

APPROVED BY:

INTERNAL CONTROL HANDBOOK

_________________________________________

SUBJECT: Accounts Receivable and Revenue Self-Assessment of Internal Controls

SELF-ASSESSMENT OBJECTIVES: To identify strengths and weaknesses in the existing internal control policies and procedures and provide guidance in the strengthening of those controls.

SCOPE: These guidelines apply to all County departments, agencies, special districts and authorities – collectively referred to as “entities” - that are governed by the Board of Supervisors or that are considered part of the County reporting entity.

Department heads (or Fiscal Managers) should periodically (at least bi-annually) assess internal controls by completing the following questionnaire. Any answers in the “No” column should be evaluated and considered for correction based on a benefits versus cost analysis.

SELF-ASSESSMENT QUESTIONNAIRE:

ACCOUNTS RECEIVABLE CONTROL ACTIVITIES Yes No N/A

1. Are the accounts receivable subsidiary ledgers maintained by persons other than those who (1) prepare, review or approve accounts receivable documentation, (2) maintain the general ledger accounts receivable account or (3) are involved in the cash receipts function?

2. Are the accounts receivable subsidiary ledgers reconciled to the related general ledger accounts and differences investigated by persons other than those who (1) post the accounts receivable transactions, (2) maintain the general ledger account, (3) account for sales invoices and credit memos or (4) are involved in the cash receipts function.

3.

4.

5.

Is an aged analysis of receivables prepared weekly or at least monthly?

Is the aging analysis reconciled to the related general ledger account?

Are the formulas used for determining the allowances for doubtful accounts reviewed periodically?

6. Are accounts receivable postings regularly reconciled to the sales and cash receipts journals?

7. Are credit balances in accounts receivable investigated in a timely manner?

8. Are invoices or monthly statements mailed to customers? If yes: a.

Are they sent by an employee who is independent of the accounts b.

receivable and cash functions?

Are invoice discrepancies and customer complaints investigated by an employee independent of cash functions?

4.

5.

Yes No N/A

9. Are accounts to be written off and other adjustments (returns, allowances, credits and other reductions) determined by a person not involved in the sales, accounts receivable recording or cash functions?

10. Does a responsible official, senior to the accounts receivable clerk, approve journal entries affecting accounts receivable?

REVENUE/SALES

1. Are services or sales initiated by someone independent of cash receipts?

Yes No N/A

2. Are there adequate procedures for initiating services or sales to the customers? If yes: a.

Is the credit of prospective customers investigated before it is extended to them? b.

Are deposits regularly reviewed and compared to balances outstanding?

3. Is there timely communication of new services and fees to personnel responsible for billing changes?

Are there standard price lists, fees or billing rates? If yes: a.

Are they reviewed periodically? b.

When required by Board Policy or governmental code, are the price lists, fees or billing rates recalculated and approved by the Board of c.

Supervisors?

Are sales invoices, order forms, licenses or certificates: a.

Pre-numbered if manually prepared or sequentially numbered if b.

c.

computer-generated and all numbers accounted for?

Checked for clerical accuracy?

Verified for prices or rates used?

6.

7.

8.

9.

Is the billing function performed by employees who are independent of the cash functions?

Are sales journals, receipt books or revenue reports reconciled to the postings to the general ledger?

Do all bills have established terms (e.g., 30 days from bill date)?

Are all bills generated within an established time after goods are delivered or services are performed?

Page 2 of 2

SECTION: 12

POLICY NUMBER: 1208SA

REVISED/

LAST REVIEWED: 7/01/06