Modelling Real Exchange Rate Behaviour with the Taylor Rule

advertisement

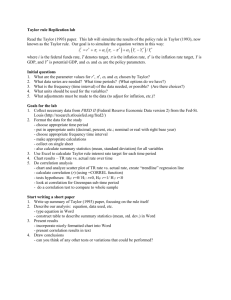

Modelling Real Exchange Rate Behaviour with the Taylor Rule: An Empirical Analysis Bulent Guloglu Pamukkale University, Department of Economics, Denizli, Turkey and Fuat Erdal Adnan Menderes University, Department of Economics, Nazilli, Aydin, Turkey Foreign exchange rate, interest rate and inflation rate are the main intermediate tools in many policy modeling and their interdependence are always debated. The aim of this study is to analyze the link between interest rate and real exchange rate by using a modified Taylor rule. The modified rule expresses nominal interest rate in terms of inflation gap, output gap and real exchange deviation, and relates current real exchange rate to expected real exchange rate on the one hand and to inflation and output on the other in conjunction with interest rate parity. The modified Taylor rule is tested for DM-Turkish Lira real exchange rate as Germany is the main trading partner of Turkey with its 23 % share in Turkish foreign trade. Using monthly data from 1987:01-2004:12, the vector auto-regressive econometric technique is used to explore the link between Taylor rule and exchange rate, and confidence intervals of auto-regressive coefficients are improved by applying Klian (1998) non-parametric bootstrap after bootstrap procedure. The findings are expected to illuminate the interdependence of the intermediate instruments in especially monetary policy modelling. Introduction The main objective of the theoretical models of exchange rate determination is to produce a clear understanding of the economic mechanisms governing the actual behaviour of exchange rates in the real world. In addition, they should give satisfactory explanations for the relationship between exchange rates and other important economic variables. Many models of the real exchange rate are reduced to test the Purchasing Power Parity. Breuer (1994) and also Bleaney and Mizen (1993) provide excellent surveys of the empirical studies. Equilibrium value of the real exchange rate is also investigated by using behavioral models such as Edwards (1988, 1989), Elbadawi (1994), Cottani et al (1990) and Ghura and Grenness (1993). A new strand of literature attempts to model the real exchange rate with the Taylor rule in which the real exchange rate is determined by expected inflation differentials and output gap differentials. In this paper, an attempt is made to analyze the behavior of the Deutsche Mark – Turkish Lira exchange rate with the Taylor Rule. Next section provides a brief review of literature on the Taylor Rule. This is followed by the introduction of the model and the variables. After the discussion of the empirical results, the paper is finalized by some policy remarks. Taylor Rule and the Real Exchange Rate Taylor rule is originally an interest rate reaction function which specifies the monetary policy rule of a central bank. Taylor (1993) expresses the rule as it = i* + 1.5(t- *) + 0.5yt. where it is the federal funds rate in quarter t, i* is the long-run rate, measured as average funds rate (4%), is four-quarter inflation * is targeted inflation rate, yt is the output gap. It is later modified to accommodate some other policy instruments including exchange rate because interest rate has been accepted as the main instrument of monetary policy of many central banks to reach inflation stability, output stability and even exchange rate stability. Engel and West (2004) and Clarida et al (1998) are among those who employ this approach to explain the behaviour of the dolar-DM exchange rate. Foreign exchange rate, interest rate and inflation rate are the main intermediate tools in many policy modelling and their interdependence are always debated. The role of interest rate differentials in the determination of the real exchange rate is not new. Uncovered interest parity is often used for that purpose. However, modelling the interest rate with the Taylor rule introduces a multivariate structure that produces a richer set of dynamics and interest rate forecasts that may be more accurate that those obtained from univariate time-series specifications (Mark, 2005). Fundamental determinants of the exchange rate are relative inflation gaps and relative output gaps when central banks conduct monetary policy by setting interest rates according to Taylor rule. Mark (2005) presented evidence that the real dolar-DM exchange rate is linked to Taylor rule fundamentals. McKinnon and Ohno (in de Andrade and Divino, 2005) argue that Bank of Japan has given more emphasis on exchange rate targeting instead of inflation targeting and that exchange rate is a forcing variable and the domestic prices level an adjusting variable. De Andrade and Divino (2005) provide further evidence towards that argument in their empirical analysis. As an alternative policy rule, Us (2004) proposes Monetary Conditions Index (a combination of the changes in the short-term real interest rate and in the real effective exchange rate in a single variable). His analyses on the Central Bank of Turkey indicate that the economy stabilizes much more quickly and shows significantly less volatility under the MCI rule than the Taylor rule. Gerlach and Schnabel (2000) mentions about two advantages of Taylor rule: Firstly, it provides a degree of macroeconomic stabilisation close to that offered by an optimal rule. Secondly, using a rule known to the public may help reduce uncertainty about the future course of monetary policy and help avoid unnecessary macroeconomic instability. Model A two-country model is used in order to to explain the link between interest rate and real exchange rate according to a modified Taylor rule. Following Engel and West (2004), the monetary rules in the home and foreign countries can be described as: iht =et +1 Eth t+1+1yh t+uht (1) ift = 2 Etf t+1+2yf t+uft (2) where et = st-( ph-pf ) and E is mathematical expectations conditional on a period t information set. In these equations, iht and ift stand for respectively interest rate for home and foreign country, h and f are inflation rates in home and foreign country, ph and pf are domestic and foreign prices(in logarithmic terms), yh and yf represent output gap. In the first equation, et is the natural logarithm of the real exchange rate and s is the nominal exchange rate. Finally u ht and uft are monetary shocks in two countries. The first equation is a standard Taylor rule, while the second is a “modified” Taylor rule. Unlike Engel and West, we assume that the two countries have different monetary policy parameters. According to standard Taylor rule, we expect that the parameters of output gaps (1 and 2 ) and the parameter of real exchange rate () will be positive. We also expect the parameters of inflation rates (1 and 2) to be greater than unity. It is assumed that the monetary authority raises interest rates when the real exchange is above its long-run level. Note that when equation 1 is written without constant and trend, it gives the long-run level as zero (Engel and West, 2004)1. The first equation may be seen as the specific form of a Taylor rule which includes the nominal exchange rate (s) and its target (s*). The target is equal to the difference between domestic and foreign prices (ph-pf ).2 If we subtract the second equation from the first one, we can get idt =et +1 Eth t+1 -2 Etf t+1 + 1yh t -2yf t +udmt (3.a) Where idt = iht - ift and udmt=uht -uft According to the uncovered interest rate parity we can write it = Etst+1-st (4) 1 2 In our empirical work we add a constant to both equations. A constant is also added to this difference in empirical work. Denoting d, the difference between home and foreign country inflation rates and subtracting the expected value of next period’s inflation differential ( d ) from both sides of (3) we can obtain idt - Etd t+1=Etet+1- et thus et = Etet+1 -idt + Etd t+1 (5.a) where d =h -f In equation (5), we used the definition of real exchange rate. Finally substituting (3) into (5) produces: et = Etet+1 - et -1 Eth t+1 +2 Etf t+1 - 1yh t +2yf t -udmt + Etd t+1 rearranging this equation we can obtain the real exchange rate as et=[Etet+1 -1 Eth t+1 +2Etf t+1 + Etd t+1 - 1yh t +2yft ] (6.a) where =1/(1+) , 0<<1. Data Sources and Definitions In this study, Turkey is the home country and Germany is the foreign country. Since Germany is main trading partner of Turkey with its 22,68 % part in Turkish foreign trade, we examine Deutschmark-Turkish Liras real exchange rate behaviour. Moreover, Kesriyeli and Yalçın(1998) for Turkey, and Clarida et al. (1998) for Germany showed that Taylor rule may be valid for Turkish and Germany monetary policies. This study uses monthly data covering the period 1987:01-2004:12 for Turkey and the period 1980:01-2004:12 for Germany. All data for Turkey were obtained from the web site of the Central Bank of Turkey. Data for Germany were obtained from the International Financial Statistics and from Datastream. Interest rate is measured as annual money market rate, inflation as the first differences of the logarithm of consumer prices index. To calculate the real exchange rate, the difference of the logarithm of consumer prices index of two countries was taken and then this difference was subtracted from the nominal exchange rate defined as TL per DM. The output gap was calculated as the residual from quadratically detrended industrial production index, which is a proxy for output. Empirical Analyses Some arrangements are made before the estimation of the above model. Firstly, following Clarida et al.(1998, Engel and West (2004), we substituted expected annual inflation Et(ph t+12– ph t ) and Et(pf t+12– pft ) for monthly inflation in the monetary policy rules equations (1 and 2). With this change, the interest rate differentials equation (3) becomes idt =et +1 Et(ph t+12– pht ) -2 Et(pf t+12– pft ) + 1yh t -2yf t +udmt (3.b) Secondly, since the interest rates for both countries were measured at annual rates and monthly data used throughout, we can rewrite uncovered interest parity equation in real terms as ( idt/12) - Etd t+1=Etet+1- et from which we can deduce the real exchange rate as follows et =* [12 Etet+1 + 12Etd t+1 -1 Et (ph t+12– pht ) +2 Et (pf t+12– pft ) - 1yh t +2yf t -udmt ] (6.b) where *=1/(12+) Finally if this difference equation ( 6.b) is solved recursively forward 3, the solution can be written et =1/(12+) b j Et [12 d t+1 -1 (ph t+12– pht ) +2 (pf t+12– pft ) - 1yh t +2yf t -udmt ] (7) j 0 Estimation Technique We initially aim to obtain the fitted real exchange rate using equation (7) and compare it with the actual exchange rate. For this purpose, firstly equations (1) and (2) are estimated with a constant and a dummy variable using OLS technique. Dummy variable for Turkey allows for financial crises in April 1994, November 2000 and February 2001. From this estimation, we get the coefficient of nominal exchange rate (), the inflation rates coefficients (1and 2 ) and the output gaps coefficients (1 and 2 ). The coefficients for Turkey are =0.11, 1=3.49 and 1 =0.32. Those for Germany are 2=1.36 and 2 =0.26. The magnitudes and signs of the coeefficients are as expected. The coefficients for Germany are very close to those estimated by Clarida et al.(1998). After having estimated the interest rates equations, we 3 For details of this solution see Hamilton (1994,p.39) checked the stationarity of the variables using Dickey-Fuller. The results are illustrated in Table 1.4 Table 1: Augmented-Dickey Fuller Unit Root Tests Results No trend or constant Constant Constant and Trend Test statistic ih t qt ht ift ft Lag length Test statistic length -2.47*** -0.51 -1.07 -2.57** -1.19 1 1 11 4 11 -5.32*** -2.85** -8.77*** -2.01 -12.73*** Lag Test statistic length 1 1 0 4 0 -5.29*** -3.47** -8.62*** -3.91*** 12.92*** Lag 1 1 1 14 0 Lag lengths were chosen using Schwarz criterion. ** and *** indicate the rejection of unit roots at 0.01 and 0.05 significance level respectively. Probabilities are obtained from MacKinnon (1996). After having estimated monetary policy rules parameters we can “fit” equation (7)5. To do so, we forecast monthly inflation and output gaps with standard vector auto-regressive (VAR) technique. VAR estimations have been made using interest rates, monthly inflation and the output gap as endogenous variables and constant and dummies as exogenous. Unlike Engel and West (2004) who initially estimated a VAR using interest rates, inflation and output gap differentials, we estimate a separate VAR for Turkey and Germany. We also estimated a separate VAR with monthly and annual inflation rates. To sum up we have been estimated following VAR models. VAR1= (iht, ht , yh) VAR2 =( ift ,ft, yf) VAR3 =(iht, ph t+12– pht , yh ) VAR4 =(ift, pf t+12– pft , yf ) Using VAR1 VAR2 forecasts we calculate monthly inflation differentials ( dt) between two countries. Then forecasts from VAR3 and VAR4 were used to compute fitted et ( ê t ). Thus interest rates are used to predict the future inflation and output gaps. 4 5 These results are also confirmed by KPSS tests. We omit monetary shock udmt because of lack of an independent time series Let x denote a VAR model of order p xt = c + A1xt-1 + A2 x t-2 +....Ap x t-p + ut This VAR(p) model can be written in VAR(1) form(i.e in companion form) as Xt = C + AXt-1 + Ut Where Xt=(xt, xt-1, xt-2... xt-p+1), C=(c, 0,....0), U=(ut,0,0...0) and A is the companion matrix (Lutkepohl, 1991). It can be shown that ê t is linear in Xt. As long as inflation and output gap differentials are mean reverting, ê t will be so as well. As argued above, our purpose is to compare the properties of ê t with actual et. To do so, we first calculate the correlation between these series and construct 95 % percentile confidence interval using Kilian’s (1998) boostrap-after boostrap method. We use Kilian procedure because bias and skewness in the small-sample distribution of OLS coefficients can cause traditional confidence intervals to be extremely inaccurate (Kilian, 1998). Obtaining bias-corrected coefficients involves following steps: 1) Estimating the VAR(2) with the actual and the fitted real exchange rate (et, ê t ). et = a1+b1et-1 +c1et-2 + d1 ê t -1 + f1 ê t - 2 + u1 ê t = a2+b2et-1 +c2et-2 + d2 ê t -1 + f2 ê t - 2 + u2 2) Resampling residuals estimated in step 1 (with replacement). 3) Computing new values of et and ê t using resampled residuals and estimated VAR coefficients. 4) ReestimatingVAR(2) model using new values of et and ê t . 5) By repeating this procedure 1000 times, one can obtain standard nonparametric bootstrap coefficients. After having obtained standard nonparametric bootstrap coefficients, one can estimate and correct bias as follows. 6) Calculate the bias by = B -B, where B is the bootstrap coefficients vector and B is the vector containing the averages of these coefficients. 7)Compute the modulus (m) of the largest root of companion matrix associated with B. 8)If m1 let B* (bias-corrected coefficient estimate) be equal to B ( B* =B). Otherwise B*=B- 9)Calculate the modulus (m*) of the largest root of companion matrix of B*.If m*1, let 1 = and 1=1 and denote i+1= ii and define i+1=i-0.01. 10) Set B*=B*i after iterating on B*i =B- i , i=1,2... until the modulus of the largest roots of companion matrix associated with B*i less than unity. 11)Using B*, repeat 2000 times the steps 2-10 and calculate pearson correlations between et and ê t . 12) Construct 95 % percentile confidence interval for correlation coefficients. Finally we repeat above procedure to get the correlation between the first difference of actual and fitted real exchange rate (et and ê t ) on the one hand and st and ŝ t on the other. Empirical Results Table 2 illustrates autocorrelations of model-based (fitted) and actual nominal and real exchange rate. As usual, the actual real exchange is highly autocorrelated. The first order autocorrelation of the actual exchange rate is very high (0.95). The growth rates of the nominal and the real exchange rates seem to have the first order autocorrelation. As for model based series, the real exchange rate is also serially autocorrelated. However unlike the actual real exchange rate, the growth rate of fitted real exchange rate is serially uncorrelated. The growth rate of fitted nominal exchange rate is less autocorrelated than that of the actual nominal exchange rate. Table 2: Autocorrelations of actual and fitted nominal and real exchange rates Lag et et st ê t ê t ŝ t 1 0.927 0.057 2 0.841 -0.069 3 0.761 -0.061 4 0.689 -0.095 5 0.622 0.005 6 0.56 -0.005 ŝ t = ê t +dt and st=et+dt 0.215 0.101 0.047 -0.019 0.021 -0.029 0.956 0.887 0.819 0.756 0.695 0.643 0.35 -0.004 -0.126 -0.077 -0.085 0 Table 3: Cross correlations of fitted nominal and real exchnage rates Series ydt dt ê t ê t ŝ t ê t 1 0.16 0.24 0.14 0.15 ê t 0.16 1 0.88 -0.32 0.16 ŝ t 0.24 0.88 1 0.12 0.15 0.14 -0.32 0.12 1 -0.032 dt d yt 0.15 0.16 0.15 -0.03 1 d d t and y t are actual inflation and output gap differentials respectively. 0.412 0.084 -0.001 -0.015 -0.0014 0.071 Table 4: Cross correlations of actual series rates Series et et st et 1 0.13 0.32 0.13 1 0.83 et 0.32 0.83 1 st d 0.38 -0.048 0.50 t d yt -0.011 0.051 0.028 dt 0.38 -0.048 0.50 1 -0.028 ydt -0.011 0.051 0.028 -0.028 1 Table 5: Bootstrapped correlations between fitted and actual nominal and real exchange rates and their 95 % percentile confidence intervals Series ê t ê t ŝ t et 0.81 (0.76) (0.90) 0.16 et (0.0036) (0.21) 0.051 st (0.0031) (0.128) The numbers in parenthesis are lower and upper limits of 95 % percentile confidence intervals The cross-correlations between the fitted real exchange rate (et) and the growth rates of real and nominal exchange rates (et and st ) are close to those between actual values. (Tables 3-4). However the correlation between the fitted real exchange rate and inflation differential (0.14) is lower than the correlation between the actual real exchange rate and inflation differentials. Also the correlation between the fitted real exchange rate and output differentials is very different than between the actual real exchange rate. The same can be argued for the nominal exchange rate. So our model fits less successfully the correlation between the real exchange rate on the one hand and the output gap and inflation differentials on the other. The bias corrected bootstrap correlations and their 95 % percentile confidence intervals are shown in Table 5. As can be seen, the correlation between the fitted and the actual real exchange rate is very high (0.81). Also the lower and the upper limits of 95 % percentile confidence interval are very close to each other (0.76-0.90). Finally Figure 1 plots the fitted and the actual real exchange rate series. It can be seen that the real exchange rate is successfully fitted by the model. In figure 1 two series move very close to each other. Figure 1:Fitted (etf) and Actual (et) Real Exchange Rates 1330 1320 1310 1300 1290 1280 1270 1260 1250 1240 88 90 92 94 96 et 98 00 02 04 etf Concluding Remarks In this study we analyzed the empirical implications of Taylor rules for the DMTurkish Lira exchange rate. For this purpose, we used a modified Taylor rule. This modified rule expresses the nominal interest rate in terms of inflation gap, output gap and the real exchange deviation and relates the current real exchange rate to expected real exchange rate on the one hand and to inflation and output on the other in conjunction with interest rate parity. The model-based or fitted nominal and real exchange rates have similar patterns with the actual nominal and real exchange rates. The correlation between the fitted real exchange rate and the actual real exchange rate is quite high and our model predicts well the real exchange rate behavior. Also the correlation between the model-based nominal exchange rate and the actual nominal exchange rate is modest. However our model is less successful in reproducing the correlations between the real exchange rate on the one hand and the output gap and inflation differentials on the other. References Breuer, J.B. (1994): “An Assessment of the Evidence on PPP” in J. Williamson(ed.), Estimating Equilibrium Exchange Rates, Washington; Institute for International Economics: 245-277. Bleaney, M and Mizen, P. (1993): Empirical Tests of Mean Reversion in the Real Exchange Rates: A Survey, Discussion Papers in Economics, no: 93/8, University of Nottingham. Clarida, R., Gali, J. and Gertler, M. (1998): “Monetary policy rules in practice: Some international evidence”, European Economic Review, 42, 1033-1067. Cottani, J.A., Cavallo, D.F. and Khan, M.S. (1990): “Real exchange rate behaviour and economic performance in LDCs”, Economic Development and Cultural Change, 39, 61-76. De Andrade, J.P. and Divino, J.A. (2005): “Monetary policy of the Bank of Japan – Inflation target versus exchange rate target”, Japan and the World Economy, 17, 189-208. Edwards, S. (1988): Exchange Rate Misalignment in Developing Countries (World Bank Occasional Papers, no: 2), Baltimore: The John Hopkins University Press. Edwards, S. (1989): Real Exchange Rates, Devaluation and Adjustment, Cambridge(Mass.): The MIT Press. Elbadawi, I.A. (1994): “Estimating Long Run Equilibrium Exchange Rates” in J. Williamson (ed.), Estimating Equilibrium Exchange Rates, Washington; Institute for International Economics: 93-131. Engel, C. and West K. (2004) “Taylor Rules and The Deutschmark-Dollar Real Exchange Rate”, NBER Working Paper Series, 10995 Gerlach, S. And Schnabel, G. (2000): “The Taylor rule and interest rates in the EMU area”, Economics Letters, 67, 165-171. Ghura, D. and Grennes, T.J. (1993): “The real exchange rate and macroeconomic performance in Sub-Saharan Africa”, Journal of Development Economics, 42(1), 155-174. Hamilton J. (1994) “Time Series Analysis”, Princeton University Press Kesriyeli M., Yalçın C.(1998) “Taylor Kuralı ve Türkiye Uygulaması Üzerine bir Not” (A Note On The Taylor Rule and Its Application to Turkey, Discussion Paper,9802, The Central Bank Of The Republic of Turkey. Kilian L.(1998) “Small Sample Confidence Intervals for Impulse Response Functions” Review of Economics and Statistics, 80, 213-230 Lutkepohl H. (1991) “Introduction to Multiple Time Series Analysis”, Springer-Verlag. MacKinnon J. (1996) Numerical Distribution Functions For Unit Root and Cointegration Tests, Journal Of Applied Econometrics, 601-618. Mark, N.C. (2005): “Changing monetary policy rules, learning and real exchange rate dynamics”, NBER Working Paper Series, 11061. Schwartz, G. (1978). Estimating the Dimension of a Model, The Annals of Statistics, 5, No 2,461-464. Us, V. (2004): “Monetary transmission mechanism in Turkey under the monetary conditions index: An alternative policy rule”, Applied Economics, 36, 967-976.