Accounting II Depreciation Theory Quiz

advertisement

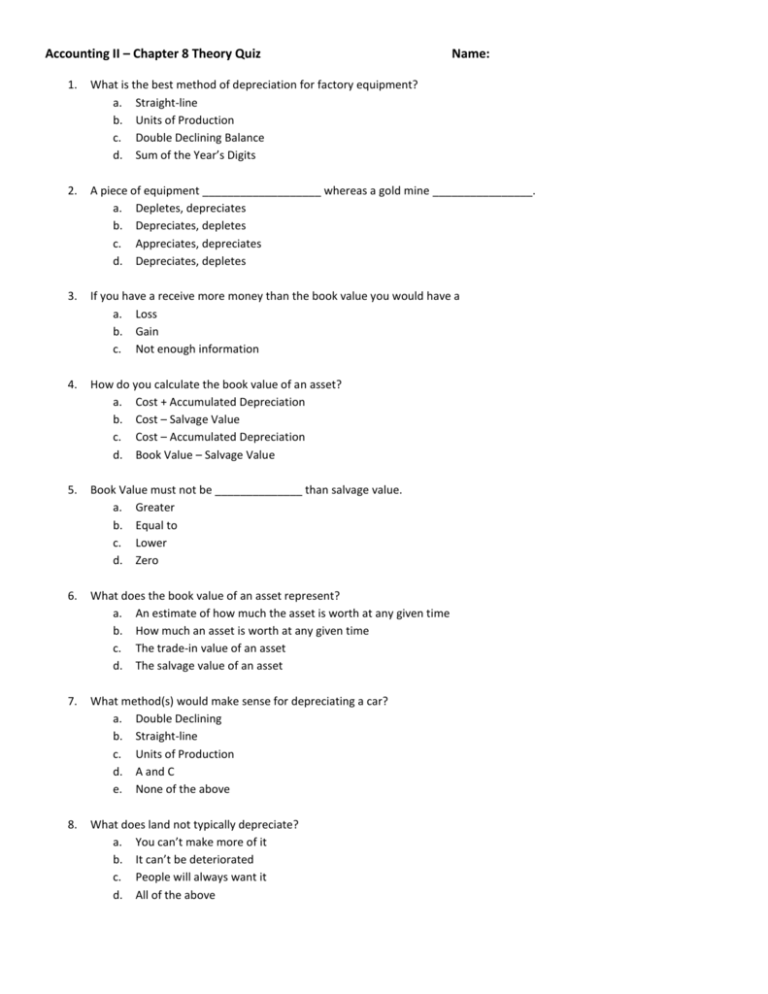

Accounting II – Chapter 8 Theory Quiz Name: 1. What is the best method of depreciation for factory equipment? a. Straight-line b. Units of Production c. Double Declining Balance d. Sum of the Year’s Digits 2. A piece of equipment ___________________ whereas a gold mine ________________. a. Depletes, depreciates b. Depreciates, depletes c. Appreciates, depreciates d. Depreciates, depletes 3. If you have a receive more money than the book value you would have a a. Loss b. Gain c. Not enough information 4. How do you calculate the book value of an asset? a. Cost + Accumulated Depreciation b. Cost – Salvage Value c. Cost – Accumulated Depreciation d. Book Value – Salvage Value 5. Book Value must not be ______________ than salvage value. a. Greater b. Equal to c. Lower d. Zero 6. What does the book value of an asset represent? a. An estimate of how much the asset is worth at any given time b. How much an asset is worth at any given time c. The trade-in value of an asset d. The salvage value of an asset 7. What method(s) would make sense for depreciating a car? a. Double Declining b. Straight-line c. Units of Production d. A and C e. None of the above 8. What does land not typically depreciate? a. You can’t make more of it b. It can’t be deteriorated c. People will always want it d. All of the above 9. What is the difference between the ACCOUNTING for depreciation and the THEORY of depreciation? (2 points) 10. What method(s) of depreciation would most closely resemble a building’s true depreciation? Why? (2 points) 11. Is it possible for land to depreciate in value? Explain. (2 points) 12. When selling an asset, how do you determine the gain or loss? (2 points) 13. When trading in an asset, how do you determine the cost of the new asset? (2 points) 14. Come up with your own asset and all pertinent information. Then, show the depreciation for this asset using a method other than straight-line. (5 points)