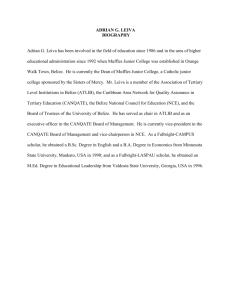

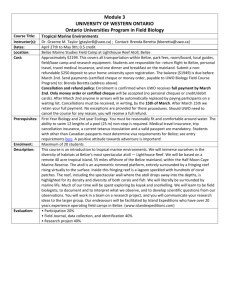

English

advertisement