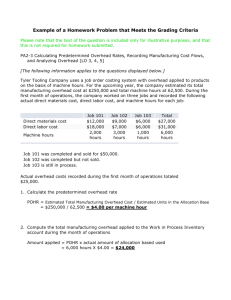

FREE Sample Here

advertisement