Reviewing your Business Plan

advertisement

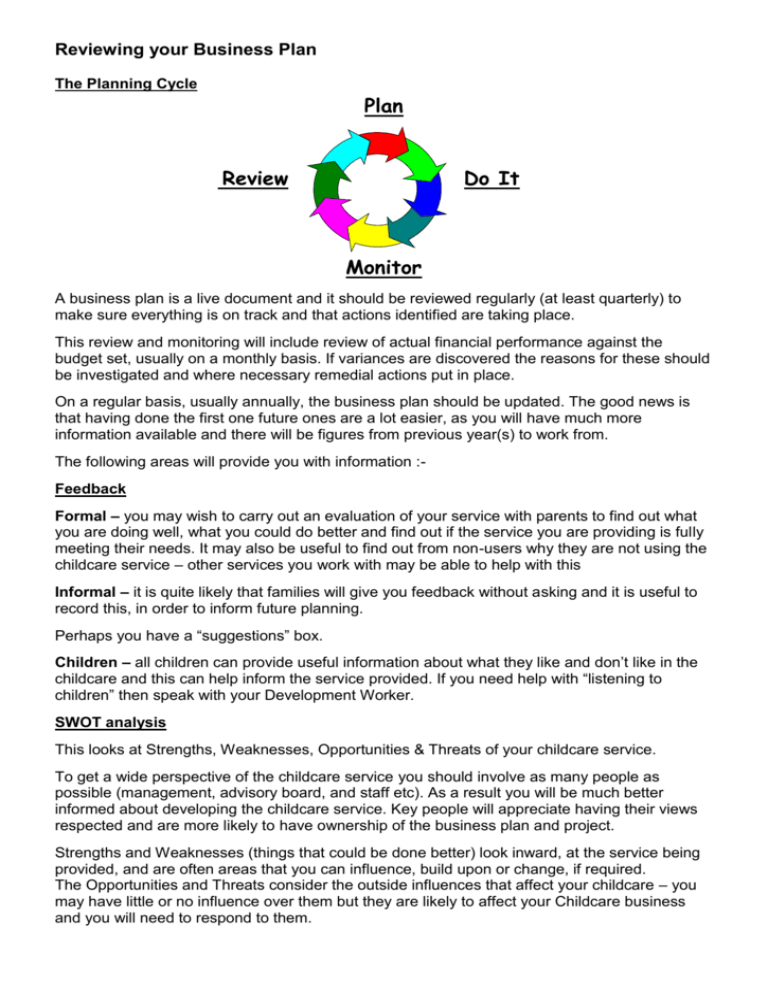

Reviewing your Business Plan The Planning Cycle Plan Review Do It Monitor A business plan is a live document and it should be reviewed regularly (at least quarterly) to make sure everything is on track and that actions identified are taking place. This review and monitoring will include review of actual financial performance against the budget set, usually on a monthly basis. If variances are discovered the reasons for these should be investigated and where necessary remedial actions put in place. On a regular basis, usually annually, the business plan should be updated. The good news is that having done the first one future ones are a lot easier, as you will have much more information available and there will be figures from previous year(s) to work from. The following areas will provide you with information :Feedback Formal – you may wish to carry out an evaluation of your service with parents to find out what you are doing well, what you could do better and find out if the service you are providing is fully meeting their needs. It may also be useful to find out from non-users why they are not using the childcare service – other services you work with may be able to help with this Informal – it is quite likely that families will give you feedback without asking and it is useful to record this, in order to inform future planning. Perhaps you have a “suggestions” box. Children – all children can provide useful information about what they like and don’t like in the childcare and this can help inform the service provided. If you need help with “listening to children” then speak with your Development Worker. SWOT analysis This looks at Strengths, Weaknesses, Opportunities & Threats of your childcare service. To get a wide perspective of the childcare service you should involve as many people as possible (management, advisory board, and staff etc). As a result you will be much better informed about developing the childcare service. Key people will appreciate having their views respected and are more likely to have ownership of the business plan and project. Strengths and Weaknesses (things that could be done better) look inward, at the service being provided, and are often areas that you can influence, build upon or change, if required. The Opportunities and Threats consider the outside influences that affect your childcare – you may have little or no influence over them but they are likely to affect your Childcare business and you will need to respond to them. Possible Outside Influences include: Children – numbers, ages and individual needs of children in your area Parents – working patterns – economic changes – welfare changes - expectations Employers – increase/decrease in employment opportunities New houses – who will live in them – other facilities such as schools, community halls Legislation – OFSTED + Welfare Standards, Qualification requirements, Health & Safety, Employment Law etc Central Government Policy - New coalition government - Deficit reduction - Every Child Matters - 10 year strategy - Children’s Centres - Early Years Foundation Stage + review - Free early years entitlement - Single Funding Formula - Revised Code of Practice for the Delivery of the free early years entitlement Local Government Policy – school admissions Funding – Working Tax Credit, Employers Childcare Vouchers, impact of deficit reduction, competitor fee levels Staff – maternity, illness, qualifications, pay expectations, recruiting Committees - recruitment, changes, responsibilities Competition - other providers or other employers Inflation – particularly staff costs Premises – lease, maintenance The unexpected! What do I do with this Information? Having received feedback from users and, ideally, potential users of your childcare service and carried out a SWOT analysis you are now in a position to re-assess the demand for childcare and, if required, make any changes to the service being provided. This can be cross checked against your mission statement / goals and objectives / what differences you wish to see etc. to make sure you are still on track - or perhaps they need to be reassessed in light of changes in circumstances? As part of this review the resources required to deliver the service and how you are promoting the service are reconsidered. A new financial budget will be drawn up, based upon the actuals from the previous year and taking into account any changes planned. It is strongly recommended that each year you review the staff salaries and fees being charged for the service. When considering when to implement new fees it is worth bearing in mind that April is a time that many parents will receive a pay rise themselves. The Working Tax Credit year starts at the beginning of April and usually any changes to the scheme take place at this time as well. Therefore parents may find April the most helpful time for fees to be altered. Finally a new action plan will be drawn up and this will be used to monitor that any changes identified are carried out and information is gathered for the next business plan review. David Mendham – Childcare Business Development Strategy Officer Updated October 2010