important policy guidelines

advertisement

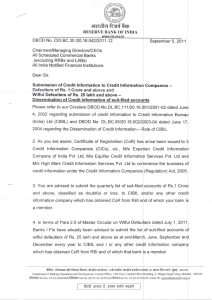

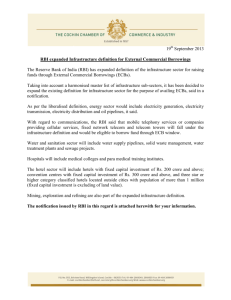

IMPORTANT POLICY GUIDELINES ( JANUARY TO DECEMBER 2012) BANKING POLICY CASH RESERVE RATIO (CRR): RBI had reduced the Cash Reserve Ratio (CRR) of Scheduled Commercial Banks by 25 basis points from 4.75% to 4.50% of their Net Demand and Time Liabilities (NDTL) with effect from the fortnight beginning Sept. 22, 2012. This reduction released Rs. 48,000 crore in the system. Further, CRR has been reduced by 25 basis points from 4.50 per cent to 4.25 per cent of their net demand and time liabilities (NDTL) from the fortnight beginning November 3, 2012. (For details please refer to Nov. 2012 issue ) REPO / REVERSE REPO: Repo and Reverse Repo are Liquidity Adjustment Facility (LAF) tools used by Reserve Bank. Repo is an instrument meant for injecting the funds required and Reverse Repo for absorbing the excess liquidity of the Banks. REPO RATE: The rate was increased by .25% to 8.50% on 25th Oct 2011. Further, repo rate was reduced by .50% to 8% w.e.f. 17th April 2012. REVERSE REPO RATE: The rate was increased by .25% to 7.50% on 25th Oct 2011. Further, it was reduced by .50% to 7% w.e.f. 17th April 2012. MSF: The rate was increased by .25% to 9.50% on 25th Oct 2011. It was however, reduced by .50% to 9% w.e.f. from 17th April 2012. In order to provide greater liquidity cushion, RBI decided to raise the borrowing limit of SCBs under the MSF from 1% to 2% of their NDTL outstanding at the end of 2nd preceding fortnight w.e.f. 17 April 2012. SLR: SLR for SCBs reduced from 25% of their NDTL to 24% from December 18, 2010. Further, RBI has reduced SLR to 23% of their NDTL with effect from the fortnight beginning August 11, 2012. BANK RATE: The Reserve Bank of India changed the Bank Rate with effect from February 13, 2012, by realigning it with the Marginal Standing Facility (MSF) rate, which in turn is linked to the policy Repo rate under the Liquidity Adjustment Facility. Accordingly, the Bank Rate was set at 9.5%. In view of reduction in repo rate, the bank rate was correspondingly adjusted to 9% w.e.f. 17th April 2012. (For details please refer to Nov. 2012 issue). IMPLEMENTATION DATE FOR BASEL III: The Reserve Bank of India has rescheduled the start date for implementation of Basel III to April 1, 2013 from January 1, 2013. IFRS: All scheduled commercial banks will convert their opening balance sheet as at April 1, 2013 in compliance with the IFRS converged IASs. COUNTERFEIT BANKNOTES: RBI has decided to revise the procedure to be followed on detection of counterfeit banknotes as follows: a) For cases of detection of counterfeit notes up to 4 pieces, in a single transaction, a consolidated report as per the format prescribed should be sent to the police authorities at the end of the month. b) For cases of detection of counterfeit notes of 5 or more pieces, in a single transaction, FIRs should be lodged with the Nodal Police Station / Police Authorities as per jurisdiction. (For details please refer to Feb. 2012 issue.) PPF SCHEME – AMENDMENTS: a) Maximum amount of deposit in a financial year in a PPF account in a financial year has been increased from Rs.70,000 to Rs.1,00,000. b) Interest Rate on Loan: Will be 2% p.a. more than the rate being paid. c) Interest Rate on Deposits: The subscriptions made to the fund on or after the 1-12- 2011 and balances at the credit of the subscriber shall bear interest @ of 8.6% p.a. This has been increased to 8.8% w.e.f. 1-4-2012. (For details please refer to Sept. 2012 issue) BANKING CO’s (NOMINATION) RULES, 1985: The nomination forms (DA1, DA2 and DA3) have been prescribed in the Nomination Rules as mentioned in the Banking Regulation Act 1949. These forms, prescribe that the thumb impression of the accountholder is required to be attested by two witnesses. RBI has examined the issue in consultation with IBA and has clarified that signatures of the accountholders in forms DA1, DA2 and DA3 need not be attested by witnesses. NOMINATION IN CASE OF JOINT DEPOSIT A/Cs: Some banks deny the facility of nomination to the customers opening joint a/cs with or without "E or S" mandate. RBI has clarified that nomination facility is available for joint deposit accounts also. INTEREST RATE ON SAVINGS DEPOSITS: RBI has decided to increase the interest rate on domestic and ordinary Non-Resident savings deposits as well as savings deposits under Non-Resident (External) Accounts Scheme by 0.5 percentage point from 3.5% to 4.0% pa. DDs FOR RS. 50,000/- AND ABOVE: RBI has reiterated that demand drafts, mail transfers, telegraphic transfers and travellers cheques for Rs. 50,000/- and above should be issued by banks only by debit to the customer's account or against cheques or other instruments tendered by the purchaser and not against cash payment. JANUARY 2013 1 DISHONOUR / RETURN OF CHEQUES: RBI has advised banks that instruments returned unpaid should have a signed / initialed objection slip on which a definite and valid reason for refusing payment must be stated, as prescribed in Rule 6 of the Uniform Regulations and Rules for Bankers’ Clearing Houses. PAYMENT OF CHEQUES / DRAFTS / PAY ORDERS: In exercise of the powers conferred by Section 35A of the Banking Regulation Act, 1949, RBI has directed that with effect from April 1, 2012, banks should not make payment of cheques/drafts/pay orders/banker’s cheques bearing that date or any subsequent date, if they are presented beyond the period of three months from the date of such instrument. DEMAND DRAFTS FOR RS. 20,000/- & ABOVE: RBI has advised banks to ensure that demand drafts of Rs. 20,000/- and above are issued invariably with account payee crossing. ACCOUNT PAYEE CHEQUES: RBI has reiterated that banks should not collect account payee cheques for any person other than the payee constituent. Further, with a view to mitigate the difficulties faced by the members of co-operative credit societies in collection of account payee cheques, relaxation was extended in terms of which, banks may consider collecting account payee cheques drawn for an amount not exceeding Rs.50,000/- to the account of their customers who are co-operative credit societies, if the payees of such cheques are the constituents of such co-operative credit societies. SAVINGS BANK INTEREST RATE DEREGULATED: Savings bank deposit interest rate for resident Indians deregulated from October 25, 2011. Banks given the freedom to determine their savings bank deposit interest rate, subject to the conditions that: i) Each bank should offer a uniform interest rate on savings bank deposits up to Rs.1 lakh, irrespective of the amount in the a/c within this limit; ii) For savings bank deposits over Rs.1 lakh, a bank may provide differential rates of interest, if it so chooses, subject to the condition that the bank should not discriminate in the matter of interest paid on such deposits, between one deposit and another of similar amount, accepted on the same date, at any of its offices. Further, RBI has clarified that the revised guidelines would be applicable to domestic savings bank deposits held by residents in India. Further, the interest rates applicable on the domestic SB deposit will be determined on the basis of end-of-day balance in the account. (For details please refer to Feb. 2012 issue) SMALL SAVINGS SCHEMES - INTEREST RATES: The Govt. have notified that from April 1, 2012, the interest rates on Public Provident Fund Scheme, 1968 (PPF, 1968) and Senior Citizens Savings Scheme, 2004 (SCSS, 2004) for the financial year 2012-13: SCHEME Interest rate p.a. from 1.12.2011 Interest Rate p.a. from 1.04.2012 5 year SCSS, 2004 9.0% 9.3% PPF, 1968 8.6% 8.8% FRAUDS – CLASSIFICATION AND REPORTING: On a review and as a part of rationalisation of process and procedures, RBI has decided to discontinue the practice of reporting attempted fraud cases of Rs.10 million and above to RBI, Fraud Monitoring Cell. However, the banks should continue to place the individual cases involving Rs.10 million and above before the Audit Committee of its Board. ( For details please refer to Dec.2012 issue ) UNCLAIMED DEPOSITS LYING WITH BANKS: The Reserve Bank has directed banks as follows: Play a more pro-active role in finding the whereabouts of the account holders, whose accounts have remained inoperative. Annually review accounts in which there are no operations for more than one year. Consider launching a special drive for finding the whereabouts of the customers/legal heirs in respect of existing accounts which have already been transferred to the separate ledger of “Inoperative Accounts”. Allow operations in such accounts after due-diligence and not to levy any charge for activation of inoperative accounts. (For details please refer to May 2012 issue) OPENING A/Cs OF PROPRIETARY CONCERNS The Reserve Bank of India has decided to include the following documents in the indicative list of documents for opening accounts of proprietary concerns: a) The complete income tax return (not just the acknowledgement) in the name of the sole proprietor where the firm's income is reflected duly authenticated / acknowledged by the income tax authorities. b) Utility bills, such as, electricity, water, and landline telephone bills in the name of the proprietary concern. USE OF BUSINESS CORRESPONDENTS The Finance Minister in his speech on Union Budget 2012-13 has stated that Ultra Small Branches are being set up at these habitations where Business Correspondents (BCs) would deal with cash transactions. Accordingly, RBI has advised that for furthering financial inclusion, banks may: Establish outlets in rural centres from which BCs may operate. These BC outlets may be in the form of low cost simple brick and mortar structures. JANUARY 2013 2 With expanding access to banking services, it is also important that quality services are provided through the ICT based delivery model. An intermediate brick and mortar structure (Ultra Small Branch) between the present base branch and BC locations so as to provide support to a cluster of BC units at a reasonable distance. These Ultra Small Branches may be set up between the base branch and BC locations so as to provide support to about 8-10 BC Units at a reasonable distance of 3-4 kms. These could be either newly set up or through conversion of the BC outlets. Such Ultra Small Branches should have minimum infrastructure such as a Core Banking Solution terminal linked to a pass book printer and a safe for cash retention and would have to be managed full time by bank employees. Banks should ensure that such an arrangement does not result in BCs limiting operations to serving customers at such branches only, if owing to geographical spread, such arrangements may lead to BC services not being easily available in the entire area of their operations. SERVICE CHARGES: SPEED CLEARING RBI has advised the follows: Banks which have fixed their service charges for out-station / speed clearing for instruments valuing above Rs.1 lakh as percentage to the value of instruments should review the same and fix the charges on a cost-plus basis. Banks may note to ensure that collection charges fixed for instruments valuing above Rs.1 lakh is lower under Speed Clearing vis-a-vis Out-station Cheque Collection so as to encourage the use of Speed Clearing. The updated service charge structure may be incorporated in the Cheque Collection Policy (CCP) and customers notified accordingly. The revised rates may also be placed on the bank's web site. (For details please refer to June 2012 issue ) COMPENSATION FOR DELAYED PAYMENT: Agency bank has been advised to compensate an investor in relief / savings bonds, for the financial loss due to late receipt / delayed credit of interest warrants / maturity value, at a fixed rate of 8 per cent per annum. (For details please refer to May 2012 issue) BANKING SERVICES IN VILLAGES WITH POPULATION BELOW 2000: The State Level Bankers' Committees (SLBCs) are now mandated to prepare a roadmap covering all unbanked villages of population less than 2000 and notionally allot these villages to banks for providing banking services, in a time-bound manner. The notional allotment is only intended to ensure that all villages are provided with at least one banking outlet for providing banking services and does not deny or bar any other bank from operating in these areas based on the available business potential. While preparing the roadmap for providing banking services in all unbanked villages of population less than 2000 through a combination of BC and branches, it should be ensured that there is a brick and mortar branch to provide support to a cluster of BC units, i.e., about 8-10 BC units at a reasonable distance of 3-4 kilometers. Therefore, while allotting the unbanked villages, the Sub Committee of DCC should ensure optimal utilization of BC infrastructure already created by banks and accordingly consider the following: Existing Brick and Mortar network of banks in the district. Distance of the village from the nearest bank branch and the ratio of low cost simple brick and mortar branches to BC outlets to be maintained by banks. Geographical contiguity to the existing BC outlets. As far as possible, avoid allotment of a lone isolated village to any bank. Priority for BC location or bank branch to be given to villages having population greater than 1500. Emphasis should be given to providing banking access in villages of North East States. (For details please refer to July 2012 issue ) FINANCIAL INCLUSION With a view to doing away with the stigma associated with the nomenclature ‘no-frills’ account and making the basic banking facilities available in a more uniform manner across banking system, RBI has advised banks to offer a ‘Basic Savings Bank Deposit Account’ which will offer following minimum common facilities to all their customers: a) The ‘Basic Savings Bank Deposit Account’ should be considered a normal banking service available to all. b) This account shall not have the requirement of any minimum balance. c) The services available in the account will include deposit and withdrawal of cash at bank branch as well as ATMs; receipt/credit of money through electronic payment channels or by means of deposit/collection of cheques drawn by Central/State Government agencies and departments; d) While there will be no limit on the number of deposits that can be made in a month, account holders will be allowed a maximum of four withdrawals in a month, including ATM withdrawals; and e) Facility of ATM card or ATM-cum-Debit Card. 2) The above facilities will be provided without any charges. Further, no charge will be levied for non-operation/activation of inoperative ‘Basic Savings Bank Deposit Account’. JANUARY 2013 3 3) Holders of ‘Basic Savings Bank Deposit Account’ will not be eligible for opening any other savings bank deposit account in that bank. If a customer has any other existing savings bank deposit account in that bank, he will be required to close it within 30 days from the date of opening a ‘Basic Savings Bank Deposit Account’. 4) The existing basic banking ‘no-frills’ accounts should be converted to ‘Basic Savings Bank Deposit Account’ as per the instructions contained above. (For details please refer to Sept 2012 issue ) TIER-III CAPITAL FOR STAND-ALONE PDS RBI has since reviewed the guidelines and has decided to phase out short term subordinated debt (Tier-III bonds) as an eligible source of capital for standalone PDs. Accordingly, PDs should not raise fresh funds through issuance of Tier-III bonds with effect from July 1, 2012. However, PDs which are already having Tier-III capital may continue to recognise it as an eligible capital till the maturity of such subordinated debts. (For details please refer to July 2012 issue ) RELAXATION IN BRANCH LICENSING POLICY In order to enhance the penetration of banking services in Tier 2 centres, RBI has decided to allow RRBs to open branches in Tier 2 centres on par with the policy for Tier 3 to 6 centres. Accordingly, RRBs allowed to open branches in Tier 2 centres (with population of 50,000 to 99,999 as per Census 2001) without the need to take permission from the RBI in each case, subject to reporting, provided they fulfil the following conditions: a) CRAR of at least 9%; b) Net NPA less than 5%; c) No default in CRR / SLR for the last year; d) Net profit in the last financial year; e) CBS compliant. RRBs not fulfilling the conditions stated above will have to continue to approach RBI / NABARD, as earlier. Opening of branches by RRBs in Tier 1 centres (centres with population of 100,000 and above as per Census 2001) will also continue to require prior permission of Reserve Bank of India. (For details please refer to Sept. 2012 issue ) PREPAID PAYMENT INSTRUMENTS IN INDIA A) Rationalisation in the categorisation and value limits of PPIs: The five categories of Semi-closed Prepaid instruments as per the extant guidelines, have been replaced with three broad categories as under: a) Semi-closed system prepaid payment instruments can be issued upto Rs.10,000/- by accepting minimum details of the customer provided the amount outstanding at any point of time does not exceed Rs 10,000/- and the total value of reloads during any given month also does not exceed Rs 10,000/-. These can be issued only in electronic form. b) Semi-closed system prepaid payment instruments can be issued from Rs.10,001/- to Rs.50,000/- by accepting any ‘officially valid document’ defined under the Prevention of Money Laundering Act. Such PPIs can be issued only in an electronic form and should be non-reloadable in nature. c) Semi-closed system prepaid payment instruments can be issued upto Rs.50,000/- with full KYC and can be reloadable in nature. B) Domestic Money Transfer relaxations: In terms of the extant guidelines, domestic fund transfer is permissible: i) From a prepaid payment instrument to another prepaid payment instrument issued by the same issuer; and ii) From a prepaid payment instrument issued with full KYC to a bank account up to Rs. 5,000/- with a monthly ceiling of Rs 25,000/per remitter. Further, RBI has decided that all the three categories of prepaid payment instruments mentioned above will now qualify for domestic money transfer. (For details please refer to Nov. 2012 issue ) ADMINISTRATIVE/CONTROLLING OFFICES IN TIER 1 CENTRES: With a view to further increasing operational flexibility of banks, RBI has decided to permit domestic scheduled commercial banks (other than RRBs) to open offices exclusively performing administrative and controlling functions (ROs/Zonal Offices) in Tier 1 Centres without the need to obtain prior permission in each case, subject to reporting. However, this general permission would be subject to regulatory / supervisory comfort in respect of the bank concerned and RBI would have the option to withhold the general permissions now being granted, on a case-to-case basis, taking into account all relevant factors. Opening of branches including Central Processing Centres (CPCs) / Service Branches by domestic scheduled commercial banks (other than RRBs) in Tier 1 centres (centres with population of 100,000 and above as per census 2001) will continue to require prior permission of Reserve Bank of India. (For details please refer to Dec. 2012 issue ) JANUARY 2013 4 PRIORITY SECTOR PRIORITY SECTOR – REVISED GUIDELINES: Reserve Bank of India in August 2011 had set up a Committee to re-examine the existing classification and suggest revised guidelines with regard to PS lending classification and related issues under the chairmanship of Sh. M V Nair. On the basis of recommendations, RBI has issued the revised guidelines. HIGHLIGHTS: I) TARGETS a) The overall target for Scheduled Commercial Banks under Priority Sector has been retained at 40 percent as suggested by the Nair Committee. b) Foreign banks having 20 or more branches in the country will be brought on par with domestic banks for priority sector targets in a phased manner over a maximum period of 5 years starting April 1, 2013. They will be required to submit an action plan for achieving the targets over a specific time frame to be approved by RBI. c) The Foreign banks with less than 20 branches will have no sub targets within the overall priority sector lending target of 32%. This is expected to allow them to lend as per their core competence to any PS category. d) The targets under both direct and indirect agriculture are retained at 13.5% and 4.5% respectively while refocusing the direct agricultural lending to individuals, Self Help Groups (SHGs) and Joint Liability Groups (JLGs) directly by banks. II) AGRICULTURE a) Direct Agriculture: Bank loans to following entities would also qualify for lending to direct agriculture: Loans to Corporates including farmers' producer companies of individual farmers, partnership firms and co-operatives of farmers directly engaged in Agriculture and Allied Activities, viz., dairy, fishery, animal husbandry, poultry, bee-keeping and sericulture (up to cocoon stage) up to an aggregate limit of Rs 2 crore per borrower for the following purposes: i) Short-term loans for raising crops, i.e. for crop loans. This will include traditional/non-traditional plantations, horticulture and allied activities. ii) Medium & long-term loans for agriculture and allied activities (e.g. purchase of agricultural implements & machinery, loans for irrigation & other develop-mental activities undertaken in farm, & development loans for allied activities). iii) Loans for pre-harvest and post-harvest activities, viz., spraying, weeding, harvesting, grading and sorting. iv) Export credit for exporting their own farm produce. b) Indirect Agriculture: If the aggregate loan limit per borrower is more than Rs. 2 crore in respect of activities listed above, the entire loan should be treated as indirect finance to agriculture. III) MICRO AND SMALL ENTERPRISES (SERVICE SECTOR): Bank loans to Micro and Small Enterprises (MSE) engaged in providing or rendering of services will be eligible for classification as direct finance to MSE Sector under priority sector up to an aggregate loan limit of Rs. 2 crore per borrower/unit, provided they satisfy the investment criteria for equipment as defined under MSMED Act, 2006. IV) HOUSING: a) Bank loans to any governmental agency for construction of dwelling units or for slum clearance and rehabilitation of slum dwellers subject to a ceiling of Rs.10 lakh per dwelling unit. b) Loans sanctioned by banks for housing projects exclusively for the purpose of construction of houses only to economically weaker sections and low income groups, the total cost of which does not exceed Rs.10 lakh per dwelling unit, will qualify for priority sector status. For the purpose of identifying the economically weaker sections and low income groups, the family income limit of Rs. 1,20,000 per annum, irrespective of location, is prescribed. c) Bank loans to Housing Finance Companies (HFCs), approved by NHB for their refinance, for on-lending for the purpose of purchase / construction / reconstruction of individual dwelling units or for slum clearance & rehabilitation of slum dwellers, subject to an aggregate loan limit of Rs.10 lakh per borrower, provided the all inclusive interest rate charged to the ultimate borrower is not exceeding lowest lending rate of the lending bank for housing loans plus two percent per annum. V) EDUCATION LOAN: Loans to individuals for educational purposes including for vocational courses upto Rs.10 lakh in India & Rs.20 lakh abroad. VI) MISCELLANEOUS: a) Loans to distressed farmers indebted to non institutional lenders. b) Overdrafts upto Rs.50,000/- in No-Frills account. c) Loans to individuals other than farmers upto Rs.50,000/- to prepay their debt to non- institutional lenders. (For details please refer to Aug. 2012 issue) "SMALL ACCOUNT": With a view to promote financial inclusion, RBI has introduced a new type of simple account aimed at general masses. i) The aggregate of all credits in a financial year does not exceed Rs.1 lac; ii) The aggregate of all withdrawals and transfers in a month does not exceed Rs.10,000; (iii) The balance at any point of time does not exceed Rs 50,000/-. INTEREST SUBVENTION ON HOUSING LOANS: The interest subvention scheme has been liberalized with effect from Financial Year 2011-12 by extending it to housing loans up to Rs.15 lakh where the cost of the house does not exceed Rs.25 lakh. The Scheme has since been extended by GoI and will remain in force up to March 31, 2013. (For details please refer to Oct. 2012 issue) JANUARY 2013 5 SUBSTITUTION OF TERM MSE IN PLACE OF SSI: RBI has circulated notification issued by the Ministry of Small Scale Industries regarding substitution of term 'Micro and Small Enterprises' in place of the term 'Small Scale Industries.' MICRO FINANCE INSTITUTIONS (MFIS): Micro finance institutions (MFIs) permitted to raise ECB up to USD 10 million or equivalent during a financial year for permitted end-uses, under the automatic route. HOME LOANS-LEVY OF FORE-CLOSURE CHARGES The Committee on Customer Service in Banks headed by the Chairman Sh. M. Damodaran had observed that foreclosure charges levied by banks on prepayment of home loans are resented upon by home loan borrowers across the board especially since banks were found to be hesitant in passing on the benefits of lower interest rates to the existing borrowers in a falling interest rate scenario. The RBI has therefore, decided that banks will not be permitted to charge foreclosure charges/pre-payment penalties on home loans on floating interest rate basis, with immediate effect. (For details please refer to July 2012 issue) REHABILITATION OF SICK MSE UNITS: A MSE is considered ‘sick’ when: a) Any of the borrowal account of the enterprise remains NPA for three months or more. OR b) There is erosion in the net worth due to accumulated losses to the extent of 50% of its net worth. The stipulation that the unit should have been in commercial production for at least two years has been removed. The decision on viability of the unit should be taken at the earliest but not later than 3 months of becoming sick under any circumstances. (For details please refer to Oct. 2012 issue) INTEREST SUBVENTION CROP LOANS: Government of India will provide: a) Interest subvention of 2% p.a. to Public Sector Banks for short-term production credit up to Rs.3 lakh during the year 2012-13. b) This amount of subvention will be calculated on the crop loan amount from the date of its disbursement / drawal up to the date of actual repayment of the crop loan by the farmer or up to the due date of the loan fixed by the banks for the repayment of the loan, whichever is earlier, subject to a max. period of one year. c) This subvention will be available to Public Sector Banks on the condition that they make available short-term production credit up to Rs. 3 lakh at ground level at 7% p.a. d) Besides, Govt. will also provide additional interest subvention of 3% p.a. to Public Sector Banks in respect of those prompt paying farmers who repay their short-term production credit within one year of disbursement / drawal of such loans. This subvention will be available to such farmers on a maximum amount of Rs.3 lakh. e) This additional subvention will be available to Public Sector Banks on the condition that the effective rate of interest on short-term production credit up to Rs. 3 lakh for such farmers will now be 4% p.a. This benefit would not accrue to those farmers who repay after one year of availing such loans. (For details please refer to Feb. 2012 issue) EDUCATIONAL LOAN SCHEME: RBI has been receiving a number of complaints where students have been refused educational loan as the residence of the borrower does not fall under the bank's service area. In this connection, RBI has advised that Service area norms are to be followed only in the case of Government sponsored schemes and are not applicable to sanction of educational loans. Hence, banks are advised not to reject any educational loan application for reasons that the residence of the borrower does not fall under the bank's service area. (For details please refer to Nov.2012 issue) LENDING TO MICRO ENTERPRISES IN THE 40:20 PROPORTION: In view of increase in price index and cost inputs, RBI has been receiving requests for revision of the limits within the overall ceiling of Rs.25 lakh for micro enterprises as defined in the MSMED Act. The matter was discussed in the 14th Standing Advisory Committee meeting and was decided to revise the existing guidelines. Consequently, the existing ceiling of lending to Micro enterprises in the 40:20 proportions has since been revised. MICRO & SMALL ENTERPRISES (MSE) Existing sub targets for lending to MSE sector Revised sub targets for lending to MSE sector a) 40% of total advances to micro and small enterprises sector should go to Micro (manufacturing) enterprises having investment in plant and machinery up to Rs.5 lakh and micro (service) enterprises having investment in equipment up to Rs. 2 lakh; b) 20% of total advances to micro and small enterprises sector should go to Micro (manufacturing) enterprises with investment in plant a) 40% of total advances to micro and small enterprises sector should go to Micro (Mfg) enterprises having investment in plant and machinery up to Rs.10 lakh and micro (service) enterprises having investment in equipment up to Rs. 4 lakh; b) 20% of total advances to micro and small enterprises sector should go to Micro (Mfg) enterprises with investment in JANUARY 2013 6 and machinery above Rs.5 lakh and up to Rs.25 lakh, and micro (service) enterprises with investment in equipment above Rs.2 lakh and up to Rs.10 lakh plant and machinery above Rs.10 lakh and up to Rs.25 lakh, and micro (service) enterprises with investment in equipment above Rs.4 lakh and up to Rs.10 lakh LOANS & ADVANCES BANK FINANCE FOR PURCHASE OF GOLD: The Reserve Bank has advised banks not to grant any advances for purchase of gold in any form, including primary gold, gold bullion, gold jewellery, gold coins, units of gold exchange traded funds and units of gold mutual funds. Banks may, however, provide finance for genuine working capital requirements of jewellers. (For details please refer to Dec. 2012 issue) RESTRUCTURING OF ADVANCES BY BANKS: The RBI has decided as follows: a) To enhance the provisioning requirement for restructured accounts classified as standard advances from the existing 2.00 per cent to 2.75 per cent in the first two years from the date of restructuring. In cases of moratorium on payment of interest / principal after restructuring, such advances will attract a provision of 2.75 per cent for the period covering moratorium and two years thereafter; and that b) Restructured accounts classified as non-performing advances, when upgraded to standard category will attract a provision of 2.75 per cent in the first year from the date of upgradation instead of the existing 2.00%. In accordance with the above, loans to projects under implementation, when restructured due to change in the date of commencement of commercial operations (DCCO) beyond the original DCCO as envisaged at the time of financial closure and classified as standard advances would attract higher provisioning at 2.75% as against the present requirement of 2.00% remain unchanged. (For details please refer to March 2012 issue) NBFCs NOT TO BE PARTNERS IN FIRMS: RBI has observed that some NBFCs have large investments in various partnership firms or they have contributed to capital in some partnership firms. In view of the risks involved in NBFCs associating themselves with partnership firms, RBI decided to prohibit NBFCs from contributing capital to any partnership firm or to be partners in partnership firms. In cases of existing partnerships, NBFCs may seek early retirement from the partnership firms. (For details pl refer to April 2012 issue) LOANS / ADVANCES AGAINST IDRs: RBI has advised that no bank should grant any loan / advance for subscription to Indian Depository Receipts (IDRs). Further, no bank should grant any loan / advance against security / collateral of IDRs issued in India. (For details please refer to April 2012 issue) CERSAI: Govt. has notified the establishment of the Central Registry with the objective to prevent frauds in loan cases involving multiple lending from different banks on the same immovable property. This Registry has become operational on March 31, 2011. The Central Registry of CERSAI, a Government Company licensed under Section 25 of the Companies Act 1956 has been incorporated for the purpose of operating and maintaining the Central Registry under the provisions of the SARFAESI Act, 2002. DEFINITION OF INFRASTRUCTURE LENDING: The definition of ‘infrastructure lending’ has been revised as follows: Any credit facility in whatever form extended by lenders (i.e. banks, FIs or NBFCs) to an infrastructure facility as specified below falls within the definition of ‘infrastructure lending’. In other words, a credit facility provided to a borrower company engaged in developing or operating and maintaining, or developing, operating and maintaining any infrastructure facility that is a project in any of the following sectors, or any infrastructure facility of a similar nature: a) b) c) d) A road, including toll road, a bridge or a rail system; A highway project including other activities being an integral part of the highway project; A port, airport, inland waterway or inland port; A water supply project, irrigation project, water treatment system, sanitation and sewerage system or solid waste management system; e) Telecommunication services whether basic or cellular, including radio paging, domestic satellite service (i.e., a satellite owned and operated by an Indian company for providing telecommunication service), Telecom Towers, network of trunking, broadband network and internet services; f) An industrial park or special economic zone ; g) Generation or generation and distribution of power including power projects based on all the renewable energy sources such as wind, biomass, small hydro, solar, etc. h) Transmission or distribution of power by laying a network of new transmission or distribution lines. JANUARY 2013 7 i) j) Projects involving agro-processing and supply of inputs to agriculture; Projects for preservation and storage of processed agro-products, perishable goods such as fruits, vegetables and flowers including testing facilities for quality; Educational institutions and hospitals. k) Laying down and / or maintenance of pipelines for gas, crude oil, petroleum, minerals including city gas distribution networks. l) Any other infrastructure facility of similar nature. (For details please refer to Nov. 2012 issue ) JANUARY 2013 8 FOREX NON RESIDENT DEPOSITS - SINGLE RETURN REVISED GUIDELINES: As the above system of reporting of Stat 5 and Stat 8 returns in soft copy has stabilized, RBI has now decided that the banks, dealing in foreign exchange (excluding RRBs and Co-operative banks) can stop sending hard copies to DSIM, Central Office. The soft copies as per the prescribed format should only be sent to DSIM, Central Office, henceforth. (For details please refer to Aug. 2012 issue ) FDI BY CITIZEN / ENTITY INCORPORATED IN PAKISTAN: RBI has decided that a person who is a citizen of Pakistan or an entity incorporated in Pakistan may, with the prior approval of the Foreign Investment Promotion Board of the Government of India, purchase shares and convertible debentures of an Indian company under Foreign Direct Investment Scheme, subject to the terms and conditions such as the Indian company, receiving such foreign direct investment, is not engaged or shall not engage in sectors / activities pertaining to defence, space and atomic energy and sectors/ activities prohibited for foreign investment. (For details please refer to Sept. 2012 issue ) IDR’s - LIMITED TWO WAY FUNGIBILTY: RBI has decided to allow a limited two way fungibility for IDRs (similar to the limited two way fungibility facility available for ADRs / GDRs) subject to the following terms and conditions: a) The conversion of IDRs into underlying equity shares would be governed by the stipulated conditions. Fresh IDRs would continue to be issued in terms of the extant guidelines. b) The re-issuance of IDRs would be allowed only to the extent of IDRs that have been redeemed /converted into underlying shares and sold. c) There would be an overall cap of USD 5 billion for raising of capital by issuance of IDRs by eligible foreign Co’s in Indian markets. This cap would be akin to the caps imposed for FII investment in debt securities & would be monitored by SEBI. d) The issuance, redemption and fungibility of IDRs would also be subject to the SEBI Regulations and the RBI. (For details please refer to Sept. 2012 issue ) FORWARDER’S CARGO RECEIPT: RBI has decided that authorized dealers may accept Forwarder’s Cargo Receipts (FCR) issued by IATA approved agents, in lieu of bill of lading, for negotiation/collection of shipping documents, in respect of export transactions backed by letters of credit, if the relative letter of credit specifically provides for negotiation of this document in lieu of bill of lading even if the relative sale contract with the overseas buyer does not provide for acceptance of FCR as a shipping document, in lieu of bill of lading. (For details please refer to Feb. 2012 issue ) BRIDGE FINANCE FOR INFRASTRUCTURE SECTOR - ECB POLICY RBI has decided to allow refinancing of such bridge finance (if in the nature of buyers’ / suppliers’ credit) availed of, with an ECB under the automatic route subject to the following conditions: a) The buyers’/suppliers’ credit is refinanced through an ECB before the maximum permissible period of trade credit; b) The AD evidences the import of capital goods by verifying the Bill of Entry; c) The buyers’/suppliers’ credit availed of is compliant with the extant guidelines on trade credit and the goods imported conform to the DGFT policy on imports; and d) The proposed ECB is compliant with all the other extant guidelines relating to availment of ECB. 4) The borrowers will approach the Reserve Bank under the approval route only at the time of availing of bridge finance which will be examined subject to stipulated conditions. (For details please refer to Oct. 2012 issue ) OVERSEAS INVESTMENT BY INDIAN PARTIES IN PAKISTAN: RBI has decided that the overseas direct investment by Indian Parties in Pakistan shall henceforth be considered under the approval route. These directions have been issued under Sections 10(4) and 11(1) of the Foreign Exchange Management Act (FEMA), 1999 (42 of 1999) and are without prejudice to permissions / approvals, if any, required under any other law. (For details please refer to Oct. 2012 issue ) UNHEDGED FOREIGN CURRENCY EXPOSURE: RBI has observed that despite all these instructions unhedged forex exposure risks are not being evaluated rigorously and built into pricing of credit by banks. RBI has emphasized that unhedged forex exposure of corporates is a source of risk to the corporates as well as to the financing bank and the financial system. Further, RBI has observed that large unhedged forex exposures of corporates have resulted in some accounts turning non-performing. Banks are therefore advised that in accordance with the guidelines they should put in place a proper mechanism to rigorously evaluate the risks arising out of unhedged foreign currency exposure of corporates and price them in the credit risk premium. They should also consider stipulating a limit on the unhedged position of corporates on the basis of banks’ Board-approved policy. (For details please refer to Dec. 2012 issue ) JANUARY 2013 9 CREDIT TO NRE ACCOUNTS: AD Category-I banks have been advised to allow repayment of loans taken by individual residents in India from their close relatives outside India, by credit to the non-resident (external) rupee (NRE) / foreign currency non-resident (bank) [FCNR(B)] account of the lender concerned subject to the conditions that a) The loan to the resident individual was extended by way of inward remittance in forex through normal banking channels or by debit to the NRE/ FCNR(B) account of the lender; and b) The lender is eligible to open NRE/FCNR(B) account within the meaning of the Foreign Exchange Management (Deposit) Regulations, 2000. Such credit would be treated as an eligible credit to the NRE / FCNR(B) a/c. (For details please refer to Feb. 2012 issue ) FOREX FOR MISCELLANEOUS REMITTANCES With a view to further liberalizing the documentation requirements, RBI has decided as follows: The limit for foreign exchange remittance for miscellaneous purposes without documentation formalities has been raised from USD 5000 to USD 25000 with immediate effect. ADs need not obtain any document, including Form A-2, except a simple letter as long as the foreign exchange is being purchased for a current account transaction (not included in the Schedules I and II of Government Notification on Current Account Transactions), and the amount does not exceed USD 25,000 or its equivalent. The payment is made by a cheque drawn on the applicant's bank account or by a Demand Draft. AD banks shall prepare dummy A-2 so as to enable them to provide purpose of remittance for statistical inputs for BOP. (For details please refer to June 2012 issue ) LIBERALISED REMITTANCE SCHEME (LRS): Resident Indian individuals are permitted to freely remit up to USD 2,00,000 per financial year for any current or capital a/c transactions or a combination of both. LRS facility is in addition to the other Remittances allowed. Gifts / Donations are now included in LRS facility within the overall limit of USD 200,000. There is no sub-limit. The RBI has further clarified as follows: a) The LRS for Resident Individuals is available to all resident individuals including minors. In case the remitter is a minor, the LRS declaration form should be countersigned by the minor’s natural guardian. b) Remittances under the facility can be consolidated in respect of family members subject to individual family members complying with the terms & conditions of scheme. c) Remittances under the scheme can be used for purchasing objects of art subject to the provisions of other applicable laws, such as, the extant Foreign Trade Policy. (For details please refer to April 2012 issue ) TRADE CREDITS FOR IMPORT INTO INDIA: On a review, RBI has decided to allow companies in the infrastructure sector, where “infrastructure” is as defined under the extant guidelines on External Commercial Borrowings (ECB) to avail of trade credit up to a maximum period of five years for import of capital goods as classified by DGFT subject to the following conditions: a) The trade credit must be abinitio contracted for a period not less than fifteen months and should not be in the nature of short-term roll overs; b) AD banks are not permitted to issue Letters of Credit/guarantees / Letter of Undertaking (LoU) / Letter of Comfort (LoC) in favour of overseas supplier, bank and financial institution for the extended period beyond 3 years. The all-in-cost ceilings of trade credit will be as under: Maturity period All-in-cost ceilings over 6 months LIBOR* Up to one year More than one year and up to three years 350 basis points More than three years and up to five years * for the respective currency of credit or applicable benchmark. (For details please refer to Oct. 2012 issue) FOREIGN INVESTMENT IN RETAIL TRADING: The FDI policy has since been reviewed and Govt. has decided as follows: a) FDI up to 100 per cent is now permitted in Single–Brand Product Retail Trading by only one non-resident entity, whether owner of the brand or otherwise, under the govt. route subject to the stipulated terms and conditions. b) FDI up to 51 per cent is now permitted in Multi-Brand Retail Trading under the Government route, subject to the terms and conditions as stipulated by the Department of Industrial Policy & Promotion, Ministry of Commerce & Industry, Govt. of India. c) Foreign airlines are permitted FDI up to 49% in the capital of Indian companies in Civil Aviation Sector, operating scheduled and non-scheduled air transport, under the automatic / Government route subject to the terms and conditions as stipulated by the Department of Industrial Policy and Promotion, Ministry of Commerce & Industry, Government of India. JANUARY 2013 10 d) FDI limits in companies engaged in providing Broadcasting Carriage Services under the automatic/Government route have been reviewed and the same would be subject to the terms and conditions as stipulated by the Department of Industrial Policy & Promotion, Ministry of Commerce & Industry, Govt. of India. e) FDI up to 49% is permitted in Power Exchanges registered under the Central Electricity Regulatory Commission (Power Market) Regulations, 2010, under the Government route, subject to the terms and conditions as stipulated by the DIPP. (For details please refer to Oct. 2012 issue ) LOANS AGAINST NRE / FCNR(B) DEPOSITS EXISTING PROVISION PROPOSED PROVISION RUPEE LOANS IN INDIA Loans against NRE / FCNR(B) Fixed Rs. 100 lac ceiling applicable Rupee loans to be allowed to depositor / third Deposits party without any ceiling subject to usual margin requirements. FOREIGN CURRENCY LOAN IN INDIA/ OUTSIDE INDIA Loans against NRE / FCNR(B) Fixed Rs. 100 lac ceiling applicable Foreign Currency loans to be allowed to Deposits depositor/3rd party without any ceiling subject to usual margin requirements. INTEREST RATE CEILING ON LINES OF CREDIT: RBI has decided that the interest rate ceiling on lines of credit with overseas banks will continue to be six months LIBOR / EURO LIBOR / EURIBOR plus 250 basis points till further orders. (For details please refer to Oct. 2012 issue ) (Cont. on Pages 14 ) JANUARY 2013 11 JANUARY 2013 12