II,1-4 Lesson Plan

advertisement

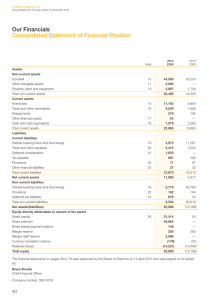

Ag Education II Colorado Agriscience Curriculum Section: Intro to Agribusiness II Unit: Using data to manage the agricultural business or employment experience Lesson Title: Completing and Analyzing the Balance Sheet Colorado Ag Education Standards and Competencies Standard 10.1 – The student will utilize data to manage an agricultural business or employment experience. Competency 1-4 – Completing and analyzing the balance sheet Colorado Model Content Standard(s): Student Learning Objectives: Math: 6.1 1. The student will learn how to complete the financial balance sheet 2. The student will calculate and analyze net worth statements 3. The student will calculate and interpret financial ratios from a balance sheet Time: Two fifty minute periods. Resource(s): Agribusiness: Decisions and Dollars by Jack Elliot, Delmar Publishing. Farm and Ranch Business Management by John Deere Publishing Italicized words are instructions to the teacher; normal style text is suggested script. Instructions, Tools, Equipment, and Supplies: Interest Approach: LCD projection equipment connected to computer to show PowerPoint as well as balance sheet examples (printed and computerized). A sample balance sheet is included with this lesson. You may want to print PowerPoint handouts for the students instead of having them write all the notes. Also included is a balance sheet assignment and key. Rough Draft A – a day or two ahead of time, collect small farm toy type figures and/or actual items that can represent various assets and liabilities. To introduce the lesson, ask students to group the items into 4 different categories based on similarities and what they have in common. This will start students visualizing items that fit into the current and noncurrent and asset and liability groups of a balance sheet. Unit 1, Lesson 4: Completing and Analyzing the Balance Sheet 1 Objective 1: The student will learn how to complete the financial balance sheet 1. What are the four major categories needed to complete the balance sheet? a. Current assets – items that can be used or sold and converted to cash within one year, without disrupting the business b. Non-current assets – items used to produce a product, not sold within a year. c. Current liabilities – debt payable with one year d. Non-current liabilities – debt that is due beyond one year 2. List multiple examples of current assets, non-current assets, current liabilities, and non-current liabilities: a. Current assets – cash, checking accounts, savings accounts, stocks, life insurance, market livestock, harvested and growing crops, accounts receivable, inventory purchased for resale, consumable supplies b. Non-current assets – breeding livestock, equipment, machinery, buildings, land, improvements to land (fences, etc.). c. Current liabilities – accounts payable, depreciation, interest, taxes, current portion of principal from non-current debt, operating loans d. Non-current liabilities – debt on non-current assets, mortgages, real estate debt. 3. What should be done to complete filling out the balance sheet? a. Accurately list the value of all assets and liabilities in the appropriate categories. b. Current assets are listed first followed by non-current assets, current liabilities and non-current liabilities. c. There are two ways to assign valuation for the assets and liabilities: Cost Valuation – better evaluation of performance Market Valuation – truer representation of asset values d. Add to get a total dollar value in each of the four categories as well as the value of TOTAL ASSETS and TOTAL LIABILITIES. e. Be sure to include the date of the balance sheet. f. The ending balance sheet for one year is the beginning balance sheet for the next year. Unit 1, Lesson 4: Completing and Analyzing the Balance Sheet 2 Objective 2: The student will calculate and analyze net worth statements 1. After completing the balance sheet, Net Worth (also called Owner’s Equity) can be calculated. Net Worth = Total Assets – Total Liabilities 2. If Net Worth is positive, then total assets exceed total liabilities. 3. If Net Worth is negative, then debt is greater than the assets 4. Calculate Net Worth from the following numbers: Current Assets = $5,432 Current Liabilities = $1,234 Non-current Assets = $246,810 Non-current Liabilities = $135,790 Solution: Total Assets = $252,242 -Total Liability = $137,024 Net Worth = $115,218 5. What are two ways to increase net worth? a. Increase assets b. Decrease liability Unit 1, Lesson 4: Completing and Analyzing the Balance Sheet 3 Objective 3: The student will calculate and interpret financial ratios from a balance sheet 1. Explain liquidity and how it is measured. a. Liquidity is the ability of a business to convert assets to cash quickly b. It can be measured two ways: Working Capital (current assets – current liabilities) businesses strive for a positive working capital figure business size has a large impact on working capital Current Ratio (current assets / current liabilities) a ratio of 1.5 to 1 indicates flexibility to withstand business crises the higher the ratio, the more liquid the business 2. What is solvency and how is it measured? a. a business is solvent if total assets exceed total liabilities, therefore, solvency is the ability to pay debts or liabilities. b. solvency can be measured by three ratios: Debt to Asset Ratio (total liabilities / total assets) measures proportion of total assets owed to creditors a ratio greater than .50:1 is risky Equity to Asset Ratio (net worth / total assets) also called the percent ownership ratio the higher the ratio, the more capital supplied by owner Debt to Equity Ratio (total liabilities / net worth) also called the leverage ratio less than 1:1 is preferred 3. Another measure of solvency is a Net Capital Ratio – also called Non-current Ratio a. Non-current Ratio (non-current assets / non-current liabilities) Review/Summary: Review this lesson in form of the Jeopardy Game Show. Name an asset or liability, students must respond in the form of a question like, “What is current asset.” Questions could also be asked about ratios, liquidity, and solvency. Unit 1, Lesson 4: Completing and Analyzing the Balance Sheet 4 Application-Extended Classroom Activity: 1. Complete the Balance Sheet Assignment (attached). Application--FFA Activity: Have students complete a balance sheet for the FFA Chapter. Application--SAE Activity: Instruct students to complete a balance sheet for their SAEP record book. 2. Using an Excel spreadsheet, have students create a balance sheet that will automatically calculates net worth and the various financial ratios. This will work much better if Standard 9.3, lesson 3-3, Using Spreadsheets, has been taught and mastered. Unit 1, Lesson 4: Completing and Analyzing the Balance Sheet 5 Evaluation: 1. Give one example each of a current asset, non-current asset, current liability, and noncurrent asset. (4 points) 25 points 2. Current assets and liabilities: (1 point) a. are usually associated with a time frame of 30 days b. have to be less than non-current assets and liabilities c. are usually associated with a time frame of less than one year d. have very little to do with the net worth statement 3. How is net worth calculated? (2 points) 4. If Net Worth increased from this year to last year, which of the following could have happened. (circle all that apply) (2 points) a. total assets increased b. total liabilities increased c. total liabilities decreased d. total assets decreased 5. True or False – Owner’s Equity and Net Worth are the same thing. (1 point) 6. True or False – Working Capital is current assets divided by current liabilities (1 point) 7. True or False – A businesses ability to pay it’s debts is called liquidity (1 point) 8. True or False – The Net Capital Ratio is one measure of solvency (1 point) Unit 1, Lesson 4: Completing and Analyzing the Balance Sheet 6 9. True or False – A Debt to Equity Ratio of less than 1:1 means total liabilities are less than net worth. (1 point) 10. What does a Debt to Asset Ratio of greater than 1:1 mean? (1 point) a. the amount of liabilities and assets are equal b. there are more assets than liabilities c. the business has moderate to low financial risk d. there are more liabilities than assets 11. The larger the Equity to Asset Ratio: (1 point) a. the more money a business owes to creditors b. the more capital supplied by the owner c. the higher leveraged the business is d. the higher in liquidity the business is 12. Use the following information to make the calculations below. (9 points) Current Assets = $15,000 Current Liabilities = $5,000 Non-current Assets = $30,000 Non-current Liabilities = $10,000 Total Assets ______________ Total Liabilities _____________ a. Net Worth – b. Working Capital – c. Current Ratio – d. Debt to Asset Ratio – e. Equity to Asset Ratio – f. Debt to Equity Ratio – g. Non-Current Ratio – Unit 1, Lesson 4: Completing and Analyzing the Balance Sheet 7 Balance Sheets 2000 - 2004 Tucker farm business 12/31/00 12/31/01 12/31/02 12/31/03 12/31/04 Assets Current Assets Bank Balance Savings & CD's Hedging Account Marketable Stocks & Bonds Accounts Receivable Crops & Feed Inventory Market Livestock Inventory Prepaid Expenses Non-Farm Business/Other Total Current Assets $ $ $ $ $ $ $ $ $ 62,218 50,000 9,088 123,628 61,205 15,278 321,417 Non Current Assets Machinery, Buildings and Land Total Non-Current Assets $ 782,630 $ 782,630 Total Farm Assets $ $ $ $ $ $ $ $ $ $1,104,047 141,285 53,514 7,653 168,157 49,430 420,039 $ $ $ $ $ $ $ $ $ 768,480 $ 768,480 $1,188,519 94,542 55,056 21,124 105,317 48,077 324,116 $ $ $ $ $ $ $ $ $ 833,602 $ 833,602 $1,157,718 99,661 56,176 8,376 163,010 50,839 19,234 397,296 $ $ $ $ $ $ $ $ $ 117,793 50,000 3,900 127,965 64,590 8,257 372,505 626,546 $ 626,546 659,201 659,201 $1,023,842 $1,031,706 Liabilities Current Liabilities Accounts Payable w/Merchants $ Lease Payment $ Feed Accounts Payable/FSA $ CCC Loans $ Operating/Short Term Notes $ Est. Accrued Tax Liability (Income & SE) $ Accrued Interest $ Principal Due Within 12 Months Intermediate Notes $ Long Term Notes $ Total Current Liabilities Non-Current Liabilities Total Non-Current Liabilities Total Farm Liabilities Net Worth (Equity) $ 1,029 - $ $ $ $ $ $ $ $ $ 1,029 - $ 1,206 - $ $ $ $ $ $ $ $ $ 1,206 - $ 1,284 - 1,829 - $ $ $ $ $ $ $ $ $ 1,284 - $ $ $ $ $ $ $ $ $ 1,829 - $ $ (50) -50 - $0 $0 $0 $0 $0 $1,029 $1,206 $1,284 $1,829 -$50 $1,103,018 $1,187,313 $1,156,434 $1,022,013 $1,031,756 Taken from the 2005 National FFA Farm Business Management CDE Unit 1, Lesson 4: Completing and Analyzing the Balance Sheet 8 Balance Sheet Assignment On the form below, complete a market value balance sheet by filling in each item listed as either a current or noncurrent asset, or a current or non-current liability. December 31, 2005 Crop Inventory Machinery and Equipment Accounts Receivable Operating Loan Breeding Livestock Loan Checking Account Breeding Livestock – Dairy Real Estate Debt Buildings and Improvements Current Portion of Debt Land – 2 quarter sections Market Steers Account Credit at COOP $40,149 $121,093 $5,100 $61,000 $37,223 $2,620 $170,800 $127,176 $86,416 $17,921 $78,000 $27,170 $9,300 Balance Sheet as of Dec. 31, 2005 Current Assets: Current Liabilities: Total Current Assets:___________ Total Current Liabilities: __________ Non Current Assets: Non-Current Liabilities: Total Non Current Assets: ___________ Total Non Current Liabilities: ___________ Total Assets: __________ Total Liabilities: ___________ Net Worth: __________ Unit 1, Lesson 4: Completing and Analyzing the Balance Sheet 9 Calculate the following: (show your work) 1. Working Capital 2. Current Ratio 3. Debt to Asset Ratio 4. Equity to Asset Ratio 5. Debt to Equity Ratio 6. Net Capital Ratio Unit 1, Lesson 4: Completing and Analyzing the Balance Sheet 10 KEY for Balance Sheet Assignment Total Current Assets: $84,339 Total Current Liabilities: $78,921 Total Non Current Assets: $456,309 Total Non Current Liabilities: $164,399 Total Assets: $540,648 Total Liabilities: $243,320 Net Worth: $297,328 Calculate the following: (show your work) 1. Working Capital = $5,418 2. Current Ratio = 1.07 to 1 3. Debt to Asset Ratio = .45 to 1 4. Equity to Asset Ratio = .82 to 1 5. Debt to Equity Ratio = .55 to 1 6. Net Capital Ratio = 2.78 to 1 Unit 1, Lesson 4: Completing and Analyzing the Balance Sheet 11