Optimal Stopping Under Certainty and Uncertainty

advertisement

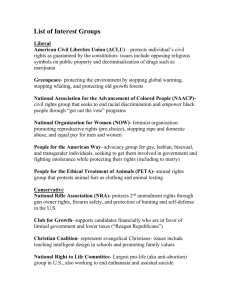

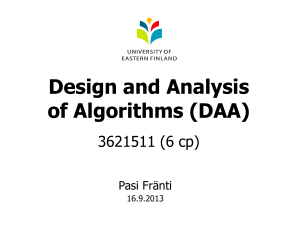

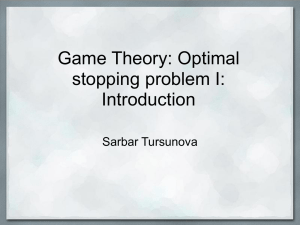

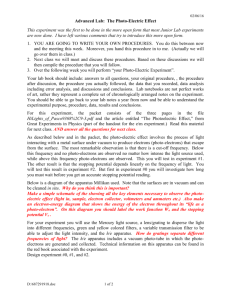

Optimal Stopping Under Certainty and Uncertainty* Graham A. Davis Division of Economics and Business Colorado School of Mines 1500 Illinois St. Golden, CO 80401 gdavis@mines.edu Robert D. Cairns Department of Economics, McGill University 855 Sherbrooke St. W. Montreal, Canada H3A 2T7 robert.cairns@mcgill.ca February 17, 2006 Keywords: investment timing, stopping rules, investment under uncertainty, r-percent rule, real options, postponement value, quasi-option value. JEL Codes: C61, D92, E22, G12, G13, G31, Q00 Abstract: In investment problems under certainty it is optimal to stop the program such that net present value is maximized. An equivalent, r-percent stopping rule suggests that the program should be stopped when the project’s rate of appreciation falls to the force of interest. We extend the r-percent stopping rule to the case of uncertainty, in which the program is again stopped once the project’s rate of appreciation falls (in an expectations sense) to an adjusted force of interest. This rule has all of the intuition of the rule under certainty, and the adjustment to the force of interest reveals additional insights. * Cairns was supported by FCAR and SSHRCC. Davis acknowledges support from CIREQ. The authors would like to thank Margaret Insley for helpful comments. Optimal Stopping At any time in any industry there may be several potential lumpy investment prospects, or more generally several lumpy economic decisions, that are known but have not been implemented. Some would have been profitable (would have produced a positive discounted cash flow in complete markets) if implemented at the time, but are instead optimally held “on the shelf”. Such lumpy, irreversible investment problems are broadly termed stopping problems. An early analysis of binary choice stopping problems under certainty was Faustmann’s discussion of the optimal timing of cutting trees. Another was Wicksell’s wine storage problem. Both appear in modern-day mathematical economics textbooks (e.g., Chiang 1984, Hands 2004), and there have been extensions of the tree cutting problem to considerations of uncertainty.1 Lumpy irreversible investments and the associated stopping problem under certainty and uncertainty are also prevalent more generally, with ongoing treatments in land development, non-renewable resource extraction, public works projects, and equipment replacement.2 Traditional analyses suggest that lumpy projects be initiated immediately if their net present value (NPV) is positive. The real options view of irreversible lumpy investment (e.g., Dixit and Pindyck 1994) emphasizes that a positive NPV is necessary but not sufficient for optimal immediate investment; the option of waiting to invest must also be evaluated, bringing intertemporal, equilibrium market forces into play. Several authors have compared the timing decision under certainty and uncertainty (e.g., Malliaris and Brock 1982, McDonald and Siegel 1986, Clarke and Reed 1989, 1990a, Dixit and Pindyck 1994, BarIlan and Strange 1995, Capozza and Li 2002,), with the analyses revealing little in common between the calculus of and the intuition behind the variously derived stopping rules. 1 Malliaris and Brock (1982), Brock, Rothschild, and Stiglitz (1989), Clarke and Reed (1990a, 1990b), Reed and Clarke (1990), Reed (1993), and Saphores (2003). 2 See, for example, Marglin (1963), Arnott and Lewis (1979), Brennan and Schwartz (1985), Hartwick, Kemp and Long (1986), Capozza and Li (1994, 2002), Mauer and Ott (1995), Bjerksund and Ekern (1990), Cairns (2001), and Holland (2003). 2 Optimal Stopping In this paper we argue that much of the intuition of irreversible investment under uncertainty and the premium associated with the option to wait can be directly compared with the case of equilibrium investment under certainty. We begin with a review of investment timing under certainty, derive an unconventional yet intuitive r-percent stopping rule for that case, and then derive a comparable rule for investment timing under uncertainty. To allow for closed-form solutions we initially focus on projects that can be delayed indefinitely, reflecting complete property rights over the investment timing decision. To avoid “now or never” decisions we also assume that asset values are initially rising at a sufficient rate to warrant investment delay, but that the rate of rise falls at some point such that investment is triggered in finite time. I. Stopping Problems under Certainty The investment projects we consider involve an irreversible capital expenditure, a plan that specifies outputs in future time periods, a shut-down time and possible other choices. Typically there is an underlying “virtual” asset that becomes a “real” asset only upon development at some time t0. In contrast to financial options, there is no existing supply of underlying real assets that trade hands upon the option’s exercise; rather, exercising the option creates the underlying asset.3 There are also no cash flows thrown off by the underlying asset while the agent waits to invest, and its rate of capital appreciation can exhibit a “rate of return shortfall” (McDonald and Siegel 1984). Let the present be time t = 0. The level of investment and the production plan depend on the time of initial investment, t0, and the future equilibrium price path of outputs and inputs, among other things. The firm need not be a price taker. For simplicity, we assume that investment is instantaneous and fixed in scale with cost C. A profit-maximizing agent chooses an optimal time of investment tˆ0 such that the project’s value, as of time t = 0, is maximized. 3 For example, lumber is created when a tree is harvested, adding new lumber supply to the market. 3 Optimal Stopping Under conditions of certainty, there are at least four approaches to this optimal timing problem. Analysis can be conducted in either the time or the value domain. A. Method 1) Direct optimization with t0 as the choice variable (time domain) Let Y(t0) be the forward NPV received by irreversibly creating an asset worth W(t0) at time t0 0 by incurring an investment cost C: Y(t0) = W(t0) - C. Without loss of generality we assume for the moment that C = 0. We also assume that W(t0) > 0 for at least some non-degenerate interval of time, and that W(t0) is differentiable. The forward value of the project at time t t0 is (t , t0 ) D(t , t0 )W (t0 ) , (1) t0 where D(t, t0) = exp[ r ( s ) ds ] is a riskless discount factor integrated over the spot rates of interest.4 t Traditional expressions of NPV assume t0 = t whenever W(t) > 0, at which point the forward value is (t , t ) D(t , t )W (t ) W (t ) (Dixit and Pindyck 1994: 4-5, 145-47). But immediate investment upon W(t) becoming positive is not necessarily optimal. Maximizing the forward (and current) value by choosing the optimal time of investment tˆ0 , and assuming an interior solution t < tˆ0 < , we find from (1) that t0 (t , t0 ) Dt0 (t , t0 )W (t0 ) D(t , t0 )W (t0 ) 0 . (2) The solution to (2) yields tˆ0 and the relationship Dt (t , tˆ0 ) W (tˆ0 ) 0 r (tˆ0 ) . W (tˆ0 ) D(t , tˆ0 ) (3) Equation (3) states that at the optimal time of investment the NPV of the asset is rising at the spot rate of interest. The second-order condition requires that 4 We can also write D(t, t0) = exp[r (t , t0 )(t0 t )] , where r (t , t0 ) defines a yield curve (Ross 2003). 4 Optimal Stopping r (t0 ) W (t0 ) for t0 tˆ0 W (t0 ) (4) r (t0 ) W (t0 ) for t0 tˆ0 . W (t0 ) (5) and Equations (3) to (5) constitute an r% rule for investment timing under certainty: invest only when the rate of rise of forward NPV of the project falls to the contemporaneous force of interest. If there are multiple such points, that which provides the greatest value should be chosen. This r% rule, while previously being recognized as being satisfied at stopping points in tree-harvesting problems (e.g., Clarke and Reed 1990a), has not generally been defined as an investment timing rule.5 Where it has been defined as a timing rule (Clarke and Reed 1989, Reed and Clarke 1990) it has only been applied to tree harvesting. Yet clearly, it is very general, holding for all types of well-defined projects in all types of markets.6 The intuition of the rule is also impeccable. At the stopping point the benefit of waiting, the growth in NPV, is exactly offset by the opportunity cost of waiting, the time value of money. Prior to the optimal investment time the NPV is rising at greater than the rate of interest, and it is intuitive that waiting is optimal. Given the presumption that markets operate according to optimality conditions, the forward (time t) market or equilibrium (option) value of the (optimally managed) investment opportunity is tˆ0 (t , tˆ0 ) D(t , tˆ0 )W (tˆ0 ) exp[ r ( s ) ds]W (tˆ0 ) . (6) t 5 Clarke and Reed (1990a), for example, mention only boundaries on value or age as stopping rules. The r% rule in (3) is a boundary on the rate of asset appreciation. 6 By well-defined, we mean that if there is no investment expense the rate of growth of the asset must not be a constant greater than the discount rate. If there is an investment expense, the rate of growth of the portfolio of the asset and the investment liability must be such that the optimal investment time is finite. 5 Optimal Stopping The difference (t , tˆ0 ) W (t ) is the option premium associated with waiting. To emphasize the intertemporal nature of this option premium Mensink and Requate (2005) call it pure postponement value (PPV). Prior to stopping PPV is positive, and at the stopping point PPV is zero. Differentiation of equation (6) with respect to t yields a result that we will use later, t (t , tˆ0 ) r (t )(t , tˆ0 ) ; (7) at all times prior to investment the market value of the investment opportunity is rising at the spot rate of interest. A simple example modeled on Wicksell's insights can make our analysis more concrete. The example illustrates that the r% rule is applicable to any lumpy economic decision – disinvestments as well as investment, consumption providing utility as well as investment providing monetary gain. Example 1. Suppose that a connoisseur has a bottle of wine that can provide one util if served immediately or can be stored costlessly and served after t0 periods to yield exp( t0 ) utils. Let the instantaneous utility-discount rate be r, a constant, and let t = 0. If the wine is stored for t0 periods, the present value of the wine is, in utility terms, (0, t0 ) D(0, t0 )W (t0 ) = exp(rt0 ) exp( t0 ) . (1) Equation (2) above implies that tˆ0 = 1/(4r2): the connoisseur will wait 1/(4r2) periods before serving the wine, even though serving it now will provide a positive benefit of one util. We confirm equation (3) by observing that 0.5 W (tˆ0 ) 0.5(tˆ0 ) exp( tˆ0 ) 0.5(2r ) r . W (tˆ0 ) exp( tˆ0 ) If r = 0.20, for example, the wine is served at tˆ0 = 1/(4r2) = 6.25. At that time it is worth W( tˆ0 ) = exp( tˆ0 ) = 12.1825 utils and has a present value of exp(rtˆ0 )exp( tˆ0 ) = 3.49 utils. The option 6 Optimal Stopping premium or PPV associated with the option to store the wine at time t = 0 is 3.49 – 1 = 2.49 utils, a full 71% of the wine’s value. There is a significant option premium even under certainty. Figure 1 plots equation (3) for a range of investment times for Example 1 when r = 0.20. In accordance with the r% stopping rule the program is optimally stopped when the rate of appreciation of forward NPV first crosses the hitting boundary r from above. B. Method 2) Direct optimization with W as the choice variable (value domain) In a related derivation the domain of analysis is value W rather than time. Let W = f(t0) and Wˆ f (tˆ0 ) , where Ŵ W in an interior solution. We assume that f(t0) is monotone in the relevant interval and so has an inverse. Then, t0 f 1 (W ) g (W ), and dW f (t0 )dt0 f g (W ) dt0 b(W )dt0 0 . (8) Equation (8) expresses the rate of capital gain on the underlying asset. Let V (W Wˆ ) be the market (option) value of the investment opportunity, with the change in notation to V due to the change in domain to value rather than time. A no-arbitrage or equilibrium condition expressing investors’ willingness to hold the investment opportunity over a small period dt0, given that it has some positive value, is the first-order linear differential equation R W V (W Wˆ )dt0 dV (W Wˆ ) V (W Wˆ )dW V (W Wˆ )b(W )dt0 , (9) where R is now the possibly value-dependent rate of interest. Equation (9) states that the opportunity cost of holding an investment opportunity that throws off no cash flows, R(W )V (W Wˆ )dt0 , must be offset by the opportunity’s capital gains dV (W Wˆ ) . Solving (9) for an initial value Ws yields 7 Optimal Stopping W R( y ) V (W Wˆ ) A exp dy . Ws b( y) (10) The constant A is determined by a boundary condition, in this case the value-matching condition Wˆ R( y) ˆ V Wˆ Wˆ A exp dy W , Ws b( y ) (11) Wˆ R( y ) A Wˆ exp dy . Ws b( y ) (12) from which The market value given forward asset value W is obtained by substituting (12) into (10): Wˆ R( y ) V (W Wˆ ) Wˆ exp dy (W Wˆ )Wˆ Wˆ W b( y ) (13) with equality at W Wˆ since (Wˆ Wˆ ) 1 .7 Equation (13) is analogous to equation (6), for a different domain. From (13) follows Dixit, Pindyck, and Sødal’s (1999) first-order optimality condition,8 derived for stopping under uncertainty, VW (W Wˆ ) W (W Wˆ )Wˆ (W Wˆ ) 0 . (14) Condition (14) is solved for Ŵ as an asset value stopping boundary. Example 2: For the wine problem with a constant interest rate R = r, W = f(t0) = e t0 ; (15) g (W ) t0 f 1 (W ) (ln W )2 ; (16) dt0 g (W )dW ; (17) 7 The discount factor is now written because it is a function of W rather than of time. 8 This is Dixit et al.’s equation (3) for the case of W (our notation) V – C (their notation). 8 Optimal Stopping dW dt0 dt0 Wdt0 . g (W ) (2ln W ) / W 2ln W (8) Equation (12) becomes, Wˆ r Wˆ 2r ln y V (W Wˆ ) Wˆ exp dy Wˆ exp dy y W b( y ) W ˆ We r (ln Wˆ )2 (ln W )2 (13) . The optimality condition (13) then yields e r (ln Wˆ )2 (ln W )2 ˆ 2r ln We r (ln Wˆ )2 (ln W ) 2 0, (14) from which Ŵ = exp[1/(2r)] = 12.1825 when r = 0.20, as in Method 1.9 In Method 2 the agent waits for W to rise to 12.1825 before investing, while in Method 1 the agent waits till the instantaneous rate of appreciation of the underlying asset slows to 20%. Figure 2 plots W against time and shows the optimal stopping point at W = 12.1825. The option premium (PPV) derived from waiting to serve the bottle of wine is the vertical distance between the two curves. The wine is consumed when the PPV goes to zero. C. Method 3) Indirect optimization using value matching and smooth pasting conditions (time domain). The real options approach to stopping problems determines the stopping point using value matching and smooth pasting conditions expressed in the value domain, W. Under certainty, comparable value matching and smooth pasting conditions can be expressed in the time domain. Consider a candidate interior time t 0* > 0. The market value of the asset at time t t 0* is defined in equation (1). The value matching condition is (t0* , t0* ) D(t0* , t0* )W (t0* ) W (t0* ) . 9 (18) The second order condition is that VWW (W | Wˆ ) 0 ; it holds strictly in this example. 9 Optimal Stopping As with analyses under uncertainty, the value matching condition is not sufficient for finding the optimal stopping time, for it yields an infinite number of solutions for t 0* , only one of which is optimal. An additional, smooth pasting condition is typically specified: the derivatives of both sides of the value matching condition are equated. In this case, the smooth pasting condition is t (t , t0* ) t t0* W (t0* ) . (19) Given (18) and (19), one can solve for the unique optimal stopping time t0 . Dividing the smooth pasting condition in equation (19) by the value matching condition in equation (18) yields that t (t , t0* ) t t0* (t0* , t0* ) W (t0* ) . W (t0* ) (20) By equation (7), the left-hand side of (20) equals r(t), generating the r% stopping rule, equation (3). Smooth pasting conditions are often specified in the real options literature as subtle and technical (Dixit and Pindyck, 1994, p. 109), and there are ongoing efforts to explain them in more intuitive terms (e.g., Sødal 1998). In the case of certainty, however, they correspond naturally to the r% rule presented in Method 1 above. Example 3: The value of the wine when served is (tˆ0 , tˆ0 ) = W( tˆ0 ) = exp( tˆ0 ) . At any time t < tˆ0 the forward value of the wine (in utility terms) is (t , tˆ0 ) = exp[–r( tˆ0 - t)] W (tˆ0 ) exp[r (tˆ0 t )]exp( tˆ0 ) . (6) The program is stopped when pastes smoothly to W. The value matching and smooth pasting conditions are depicted in Figure 2 for r = 0.20. Method 3 is a direct link between Method 1, which has the agent waiting until the rate of increase in forward value W is equal to the interest rate r (the time domain), and Method 2, which has the agent waiting till W rises to 12.1825 (the value domain). Here, the agent satisfies both conditions incidentally 10 Optimal Stopping and simultaneously by waiting (6.25 periods) until market value and NPV W are equal and rising at the interest rate r. D. Method 4)Indirect optimization using value matching and smooth pasting conditions (value domain). Our last stopping calculation involves value matching and smooth pasting conditions when asset value is the domain. The solution determines the free hitting boundary Ŵ . The process for W is as in equation (8). The value matching condition is V W Wˆ Wˆ (21) and the smooth pasting condition is VW W Wˆ 1 . (22) These two conditions are sufficient to solve for Ŵ . Example 4: In the wine example, ˆ ˆ r (lnW ) V W Wˆ We 2 (ln W )2 . The value matching condition holds trivially. The smooth pasting condition gives ˆ ˆ r (lnW ) 2r ln We 2 (ln W ) 2 1. (22) W Wˆ As in Method 2, the solution yields Ŵ = 12.1825 given r = 0.20. Figure 3 shows the wine stopping problem in this characteristic real options formulation, with option value plotted as a function of underlying asset value (e.g. Dixit and Pindyck 1994, p. 139). The wine should be consumed once the market value is equal to and rising at the same rate as the forward NPV, at W = 12.1825 when r = 0.20. As in Figure 2, the option premium (PPV) derived from waiting to serve the bottle of wine is the vertical distance between the two curves. The wine is consumed when the PPV goes to zero. 11 Optimal Stopping E. Discussion Stopping problems under certainty can be solved using any of the four closely related techniques. While Method 1 is the most common in optimal timing problems under certainty, Methods 2 and 4, which are used in real options problems, also provide the optimality conditions. Method 3 is an intuitive addition to these stopping algorithms, illustrating that value matching and smooth pasting optimality conditions are embodied within the r% stopping rule. This will prove useful in our derivations of a similar rule under uncertainty. Seeing stopping under certainty as an r% rule renders investment analysis dynamic (invest when rate of change of NPV falls to the rate of discount) rather than static (invest if NPV > 0). One should not stop the program, even if its NPV is positive, when its value is rising by more than the rate of discount. Given the option to wait, even projects whose value is negative if implemented now can have a positive market value due to an option premium called pure postponement value. This option premium is often solely attributed to uncertainty for reasons that we discuss below. Here we see that the premium also arises for irreversible investments under certainty. II. Stopping Problems under Uncertainty In this section we derive an r% stopping rule under uncertainty for the simplest case, a general, autonomous Itô process. The rule is remarkably similar to the rule derived under certainty. Then we use the rule to solve for stopping points for two common stochastic processes for the underlying asset’s forward value, Brownian motion and geometric Brownian motion. Once again we focus our analysis on situations that yield an interior stopping point. In the following section we generalize our results to include non-autonomous and finite horizon problems, and processes with jumps. Under uncertainty, forward asset prices are described by a density function of which the moments are assumed to be known. To facilitate closed-form solutions in our examples we represent the asset birth value as the one-dimensional autonomous diffusion process in stochastic differentiable equation form 12 Optimal Stopping dW b(W (t0 ))dt0 (W (t0 ))dz (23) over any short period of time dt0, where dz is a Wiener process. As above, W(t0) is the forward NPV of the asset if brought to life or developed at time t0 for a known and constant stopping cost C 0. The typical optimal stopping rule given uncertainty is to invest at the time when the forward NPV reaches some trigger or boundary value Ŵ for the first time: tˆ0 inf t0 W (t0 ) Wˆ (24) (Brock et al. 1989, Dixit and Pindyck 1994). A main difference between decisions under certainty and uncertainty is that under certainty the investment decision can be made at time 0, even where investment timing is optimally postponed. In an interior solution under uncertainty the investment decision is continually deferred until certain stopping conditions are satisfied (e.g., equation (24)), at which point the investment decision and the timing of the investment are concurrent. In other words, a stopping rule under uncertainty is both an investment decision and a timing rule. Our r% rule in Section I was such a rule, and we seek to mimic that here. Let Y (W (t ); C ) be the forward NPV at time t, with the simplest case being Y = W(t) – C. Let > 0 be the risk-adjusted discount rate that incorporates the market risk of the project.10 At time t t0 , the project’s forward market (option) value is tˆ0 V (W (t ) W (tˆ0 )) E exp[ ds] Y W (tˆ0 ) . t tˆ0 With E exp[ ds] W (t ) W (tˆ0 ) (Dixit et al. 1999), we can write t V (W (t ) W (tˆ0 )) W (t ) W (tˆ0 ) Y W (tˆ0 ) . 10 (25) As is typical in dynamic programming problems we hold the discount rate constant (Insley and Wirjanto, 2005) 13 Optimal Stopping To reduce notational clutter we condense V (W (t ) W (tˆ0 )) to V (W ) , V (W (tˆ0 ) W (tˆ0 )) to V (Wˆ ) , VW (W (t0 ) W (tˆ0 )) to V (W ) , VW (W (tˆ0 ) W (tˆ0 )) to V (Wˆ ) , and Y (W (t ); C ) to Y (W ) . We assume that Y and V are twice differentiable. From Ito’s Lemma the expected rate of capital gain on the option value is 2 E[dV ] b(W )V (W ) 12 (W )V (W ) . V (W )dt V (W ) (26) and the expected rate of gain in forward NPV is 2 E[dY ] b(W )Y (W ) 12 Y (W ) . Y (W )dt Y (W ) (27) At an interior free boundary Ŵ > W the value matching and smooth pasting and conditions are that V( Ŵ ) = Y( Ŵ ) (28) V’( Ŵ ) = Y’( Ŵ ). (29) and In equilibrium, E[dV (W )] . V (W )dt0 Combining this with conditions (26) to (29) yields that at the stopping point there is an adjusted r% rule, 1 2 ˆ (W ) V (Wˆ ) Y (Wˆ ) E[dY ] 2 * . Y (Wˆ )dt0 Y (Wˆ ) (30) Rule (30) is analogous to the r% rule under certainty, equation (3). The left hand side of (30) is the expected rate of rise of the project’s NPV. The right hand side of (30) is the opportunity cost of realizing this gain. This opportunity cost is an “adjusted” force of interest * comprised of the constant riskadjusted discount rate , representing the opportunity cost of money, less a value/time-varying positive 14 Optimal Stopping term.11 The program is stopped—the decision is made to immediately invest—when the expected rate of rise of NPV over the next small time dt0 falls to this adjusted force of interest.12 Equation (3), the stopping rule under certainty, is the limit of equation (30) as 2 goes to zero. In both the certainty and uncertainty cases the smooth pasting optimality condition is embedded within the r% rule; they do not play a separate role in the stopping algorithm. The first term on the RHS of (30) is the cost of waiting. Given the intuition behind the r% rule under certainty, why not stop the program once the expected rate of rise of Y falls to the discount rate ? This unadjusted stopping rule, E[dY ] , Y (Wˆ )dt0 (31) has been called a myopic-look-ahead stopping rule (Clarke and Reed 1989, 1990a), an infinitesimal lookahead stopping rule (Ross 1970), and a certainty-equivalent stopping rule (Clarke and Reed 1990b). The rule is correct under uncertainty if open-loop decision making is optimal. Open-loop decision making is optimal when the stochastic process is monotone (Malliaris and Brock 1982, Brock et. al. 1989, Boyarchenko 2004), or more generally when, once a stopping point is reached, the process cannot deviate back into the continuation region (Ross 1970: 188-90). In these cases waiting indeed gains the discounted expectation over possible values of Y next period, since the program will be stopped and Y will be gained next period no matter what the outcome of the stochastic deviation. Trees with age-dependent growth are an example where open-loop decisions are optimal (Reed and Clarke 1990),13 as is any stopping problem 11 The term is positive as a second order condition to the optimality of Ŵ : prior to stopping V > Y and V < Y, which implies that V - Y > 0 at Ŵ . 12 The second-order conditions require that prior to stopping the expected rate of rise of NPV be greater than the adjusted force of interest. 13 This is not to say that V is zero in these problems, only that the term is not relevant when deciding when to stop the program. 15 Optimal Stopping under certainty. In these cases, only pure postponement value need be taken into account in the stopping algorithm. In the case at hand, and for diffusion processes in general (Brock et al. 1989), there is a positive probability that the process can drift back into the continuation region from Ŵ , at which point the process is not stopped. The decision alternatives move from the open-loop choice of investing now or committing now to invest next period to the closed-loop choice of investing now or conditionally investing next period, the later clearly being superior to a commitment strategy when the stochastic process can move disadvantageously. Previous analyses of stopping rules under these diffusion processes (including jump processes) have specified only that E[dY ] for stopping to be optimal in finite time Y (Wˆ )dt0 (e.g., Brock et al. 1989, Mordecki 2002). The RHS of (30) is the exact rate to which the expected drift in NPV must drop given (23). It is the intertemporal opportunity cost of delay, , less a credit for the pure informational “quasi-option value” created through delay. We now explain the functional form of the second-order adjustment term. In open-loop decision making the global properties of V, as exhibited by V in equation (30), are irrelevant, while in closed-loop decision making the program continues in the case of a downward movement in W (Reed and Clarke 1990). The quasi-option value of deferring the decision one more period is a function of the deviation of V( Ŵ -h) from Y( Ŵ -h) in the event of a downward movement in W of magnitude h (see Figure 4), where h is a function of 2. The larger V( Ŵ -h) - Y( Ŵ -h), the greater the incentive to wait for more information prior to investing. In equation (30) this motivation to wait is engineered by the magnitude of the V - Y term, which to second order is proportional to the deviation of V( Ŵ -h) from Y( Ŵ -h). While equation (30) is not identical to the stopping rule under certainty, the “adjustment” to the intertemporal portion of the r% rule to take into account quasi-option value (the value of information) is not unprecedented. Clarke and Reed (1990b) discuss quasi-option adjustment factors applied to a 16 Optimal Stopping boundary on value, Ŵ , calculated from stopping rule (31). Our approach applies an adjustment factor to the (temporal) opportunity cost of waiting, which preserves the nature of the stopping rule as an r% rule. The discussion thus far supports the following proposition, which holds for all values of 2 0. Proposition 1: At the optimal stopping point the expected rate of appreciation of the project NPV is equal to an adjusted force of interest given in equation (30). That force of interest reflects both the intertemporal costs and informational gains from deferring the decision to invest. Prior to the stopping point project value is expected to rise at a rate greater than the adjusted force of interest. This proposition implies the following: Proposition 2: In conjunction with knowledge of the properties of the investment itself, the (path of the) adjusted force of interest is a sufficient datum for optimal stopping of the investment program. We illustrate these propositions in the following examples. Example 5: Arithmetic Brownian Motion Let the forward value of the underlying asset, W (t0 ) , follow the Brownian motion process dW bdt0 dz , (32) for constant positive values of b and σ. Such a process for birth value can be due to stochastic prices, operating costs, closure costs, or any combination of these. Typically, (32) represents the diffusion process for forward value only on an open set called the continuation region. For investment or development timing problems, which are the focus of this paper, 17 Optimal Stopping the upper bound to this continuation region is free, while at a lower bound Q there is some condition such as V(Q) = 0 (Brock et al. 1989). To keep matters tractable we assume that Q = -. Also, without loss of generality let there be no convenience yield or maintenance cost associated with waiting to develop the asset, and let development be costless (C = 0) and Y = W. As before, let tˆ0 be the optimal time to invest, though under uncertainty tˆ0 is not a deterministic parameter that can be decided upon at time 0. Also let be the constant risk-adjusted discount rate used to discount the investment payoff W (tˆ0 ) Ŵ . The market value of the opportunity or option to invest can be found by a combination of methods 2 and 4 above (e.g., Brock et al. 1989): the option value V (W ) satisfies the linear second-order linear differential equation, V (W ) bV (W ) 12 2V (W ) 0 , (33) from which option value can be obtained given the appropriate boundary conditions. The solution to (31) is of the form V (W ) A1eW A2e W (34) where > 0 and < 0 are roots of the characteristic equation 1 2 2 2 b 0 . (35) The boundary conditions are then used to solve for Ŵ and the current value of the option. In this case there are three boundary conditions. The first is that, in the absence of any holding costs and coerced stopping at a finite lower bound Q, lim V (W ) 0 . From this, A2 = 0. If the program is voluntarily W ˆ Wˆ and stopped at Ŵ , we must have the value matching condition V (Wˆ ) Wˆ so that A1 We ˆ (Wˆ W ) . V (W ) We (36) As was the case under certainty, V (W ) W 0 is the premium associated with the option to wait to develop the project when W < Ŵ . The smooth pasting condition 18 Optimal Stopping ˆ (Wˆ Wˆ ) Wˆ 1 V (Wˆ ) We produces the hitting boundary Ŵ 1 , which is the signal as to when to stop the program. We now perform the stopping calculation using the r% rule, equation (30). The left hand side of (30) equals b . Given equation (36) and Y 0 the second term on the right-hand side of (30) is W 1 2 2 2 ; the program is stopped when b 12 2 2 b , W (30) the second equality following from (35). Therefore, Ŵ 1 > 0 as before. From (30) the value of the option is: ˆ ˆ (W W ) , V (W ) We W 0; ˆ (Wˆ W ) , V (W ) We W > 0 and b > 12 2 2 ; W V (W ) W , W > 0 and b 12 2 2 . W The r% rule stopping calculation has not made explicit use of a smooth pasting condition. The latter is embodied within the r% rule, under which the asset owner measures project NPV in each period and invests in the project once its expected rate of rise falls to * 12 2 2 . Since all parameters of the model are assumed to be known, the adjusted force of interest * is a datum available to the investor and is all that is needed to assess the stopping point.14 The investor need not understand or use smooth pasting conditions nor solve for the value of the option in order to know when to invest; the investor simply stops the program when the net opportunity cost of waiting exceeds the capital gains from waiting. 14 The discount rate is r ( r ) , where r is the risk-free discount rate and is the required rate of return on an asset with rate of return deviations dz (McDonald and Siegel 1986). 19 Optimal Stopping The stopping point is now expressed in terms of the expected rate of increase in forward value as opposed to a boundary on value. Example 6: Geometric Brownian Motion Consider an asset whose value follows a geometric Brownian motion with constant rate of drift b, represented in differential form over a small time step dt0 as dW bWdt0 Wdz . (37) Let the required rate of return be represented by u and be constant and greater than b. Also let the riskfree rate be represented by r. With b constant the investment cost C must be positive to avoid bang-bang now/never stopping solutions. Let the forward NPV be Y W C . (38) Dixit et al. (1999) use method 2 to solve for the stopping point Wˆ C , where >1 is the positive 1 root of the fundamental quadratic equation 1 2 2 ( 1) b 0 (39) and r (u r ) u (McDonald and Siegel 1986). Here, we illustrate the r% stopping rule. From (37) and (38) the left-hand-side of (30) equals bW . W C Given that the option value is of the form (Dixit et al. 1999) W V (W ) (W )Yˆ Yˆ , Wˆ (40) the second term on the right-hand side of (30) is 1 2 2 ( 1) , where the variance in (30) is 2W 2 . At the stopping point Ŵ , therefore, bW 12 2 ( 1) b W C (30) 20 Optimal Stopping (with the second equality following from (39)). Given (30) 12 2 ( 1) b bW . W C Solving yields the stopping point, Wˆ C , as before. 1 Using the r% rule stopping point the option value is W ˆ ˆ Y, W WC W ˆ ˆ Y, W W > C and Y, W > C and bW 12 2 ( 1) W C bW 12 2 ( 1) . W C Once again, the investor need know nothing of smooth pasting conditions or the value of the option in order to optimally time investment, though they must know the functional form for option value, equation (40). The stopping point is fully calculable from (37), (38), and (40), given the parameters of the problem. Figure 5 depicts this stopping problem for a series of specific parameter values. In this case Wˆ 2 and Yˆ Wˆ C 1 . Note the similarity between the stopping rule in Figure 5, in the value domain, and the same rule depicted under certainty in Figure 1, in the time domain. III. More General Stochastic Processes If W follows a combined geometric Brownian motion with an independent downward Poisson jump of known percentage and arrival rate (Dixit and Pindyck 1994, pp. 167-173), the r% stopping rule (equation 30) will hold as (b )W 12 2 ( 1) , W C (30) where is now the positive solution satisfying 1 2 2 ( 1) b ( ) (1 ) 0 . 21 Optimal Stopping More general stochastic processes allow time to enter as a state variable, either via finite investment horizons or through the stopping cost C(t) or a time-dependent discount rate (t), or via the addition of time to the drift or variance terms in the continuous portion of the stochastic process for the underlying variable, dW b(W (t0 ), t0 )dt0 (W (t0 ), t0 )dz . (41) In these cases, and using the same derivation as previously, the r% rule for an interior stopping point 0 tˆ0 T is 1 Vt (Wˆ , tˆ0 ) Yt (Wˆ , tˆ0 ) 2 (Wˆ , tˆ0 ) VWW (Wˆ , tˆ0 ) YWW (Wˆ , tˆ0 ) 2 E[dY ] * * (tˆ0 ) . Y (Wˆ , t )dt0 Y (Wˆ , tˆ0 ) Y (Wˆ , tˆ0 ) (42) The partial derivative Vt is typically taken to be the depreciation of the option (Vt < 0) (Dixit and Pindyck 1994: 205-207), and Yt is any impact of inflating (Yt < 0) or deflating (Yt > 0) exercise costs. With time a state variable, and for other processes such as mean reversion, there is no closed-form solution for the option, and so the stopping rule in (42) is of more use intuitively than as an alternative to traditional stopping calculations since the first and second partial derivatives cannot be calculated except under simulation once the value surface has been solved. That intuition shows that at any interior stopping point, even for finite-lived options, the asset’s expected rate of rise falls to the intertemporal opportunity cost of waiting net of the value of information from further delay. IV. Discussion Under certainty the r% rule has the investor wait until the rate of rise of the NPV falls to a force of interest before exercising an irreversible investment option. Optimal timing under uncertainty is described as being “much more complicated” (Brealey and Myers 2003, p. 138), and indeed there previously has appeared to be no solution other than by stochastic dynamic programming (Clarke and Reed 1990b). We have shown that the same intuitive r% algorithm holds in the case of uncertainty; the r% rule under uncertainty has the investor waiting until the expected rate of rise of the NPV falls to an 22 Optimal Stopping adjusted force of interest. The adjustment adapts the intertemporal penalty of waiting to include a credit for the quasi-option value of the information gained by delay. The rule is very general, and holds for other stopping problems as well, such as optimal asset abandonment. In that case the asset manager waits until the rate of rise of the intrinsic value of a shut-down falls to the adjusted force of interest.15 The intuitive attractiveness of the r% rule under certainty (equation (3)) has led practitioners in mining and forestry to compare expected changes in asset value with the opportunity cost of capital when deciding when to start a mine or harvest a stand of trees, as in equation (31) (e.g., Torries 1998: 44, 75).16 Recognizing this, academics have argued that the unadjusted r% rule (31) is useful, though inefficient, as an approximate stopping rule under uncertainty (Brock et al. 1989, Clarke and Reed 1989, 1990a, 1990c, Reed and Clarke 1990). The adjusted r% rule that we develop in equation (30) has the same motivation, and yet is efficient. For simple stochastic optimization problems such as the examples in Section II, reallife decision makers need know nothing of smooth pasting conditions or of the option’s value; they need only know the functional form of the option value, the opportunity cost of capital, and the parameters associated with the stochastic process. Seeing stopping under uncertainty as an r% rule clarifies three areas of confusion in the real options literature. The first is the frequent claim that waiting to invest is only valuable under uncertainty.17 We showed in Section I of this paper that waiting to invest has value even under certainty, that value being a pure postponement value that has an exact counterpart under uncertainty The correct interpretation of waiting to invest under uncertainty is that a delayed investment decision is only warranted under 15 In this vein one can use (30) to solve for the stopping point for the oil well abandonment problem in Clarke and Reed (1990c), for example. 16 We have yet to learn of practitioners solving a stochastic dynamic programming problem for Ŵ . 17 Fisher (2000. p. 203), for example, states that “…the option to postpone the investment has value only because the decision-maker is assumed to learn about future returns by waiting. If this were not the case, nothing would be gained by postponing a decision to invest.” 23 Optimal Stopping uncertainty. Delayed investment timing can be warranted under uncertainty and certainty, since pure postponement value is common to both. The second claim often made about investment under uncertainty is that the value of waiting is driven by uncertainty (e.g., Amram and Kulatilaka 1999, p. 179). This acknowledges that there may be pure postponement value under uncertainty, but that it is significantly less than the quasi-option value that waiting under uncertainty creates. To examine this proposition, let the value boundary calculated from the unadjusted r% rule, equation (31), be represented by WˆM . Option value is NPV plus pure postponement value plus quasi-option value (Mensink and Requate 2005): V(W) = Y(W) + PPV(W) + QOV(W). (43) The option premium, the value of waiting, is then O(W) V(W) - Y(W) = PPV(W) + QOV(W), (44) comprised of both pure postponement value and quasi-option value. Given a geometric Brownian motion process and resultant option value (40), we can write (44) as W ˆ W W Wˆ C W C WˆM W W ˆ ˆ WM C W C W C WˆM C Wˆ Wˆ M . (45) The first term in the right-hand side is pure postponement value (which can be positive or negative), and the second term is quasi-option value (which is always positive). Figure 6 shows both types of value for the case of WˆM = 1.56 and Ŵ = 2.00. For W < Ŵ , the option premium is positive, and waiting is optimal. For W < 1.56 pure postponement value is positive because the asset is rising at greater than .18 At the open-loop stopping point WˆM pure postponement value is zero (and hence, under an open-loop strategy the program is stopped). For W > WˆM pure postponement value is negative (a cost) since the asset is rising at less than . At the optimal stopping point the option premium is zero, and via (43) the 18 Traditionally, postponement value has been calculated by setting 2 = 0 (e.g., McDonald and Siegel 1986), which may obfuscate the fact that there is postponement value under uncertainty. 24 Optimal Stopping quasi-option value exactly offsets the negative pure postponement cost: QOV(W) = -PPV(W) and O(W) = 0. Figure 6 shows that the value of waiting is driven by uncertainty, i.e., quasi-option value, only when W is near Ŵ . For low values of W pure postponement value makes up the majority of the value from waiting to invest, with the asset value is rising at a rate significantly greater than the rate of discount. Figure 6 also shows the destruction of value by using the myopic stopping rule (31) instead of the adjusted r% rule (30). Stopping at WˆM = 1.56 destroys only 8% of the investment’s value, its quasioption value, 1 V (WˆM | WˆM ) Y (WˆM ) Q(WˆM ) , 1 V (WˆM | Wˆ ) Y (WˆM ) Q(WˆM ) Y (WˆM ) Q(WˆM ) which in this case is Wˆ V (WˆM | WˆM ) 1 1 V (WˆM | Wˆ ) 1 Wˆ C W WˆM W Wˆ M C Wˆ Wˆ M Wˆ C Wˆ C M = 0.08. This is consistent with the previously noted claims that the unadjusted r% rule, though inefficient, may not destroy too much project value. The third area of confusion is that uncertainty creates additional investment delay, beyond any pure postponement value delay, by raising Ŵ . This is not the case. The r% rules under certainty and uncertainty show that under certainty (2 = 0) the discount rate falls to the riskless rate r and the second-order term in (30) falls away. The adjusted force of interest under uncertainty, *, against which asset appreciation is compared may be higher or lower than the force of interest under certainty, r, and investment timing may be sped up or delayed. This result, generally unrecognized, has been demonstrated by Sarkar (2000) and Davis (2002). For the example depicted in Figure 5, which is stopped at Ŵ = 2 under uncertainty, the expected rate of growth of the asset only falls to the riskless discount rate, 6%, when Ŵ = 6. For 2 W < 6 the program will be continued under certainty whereas it would be 25 Optimal Stopping stopped immediately under uncertainty. Additional investment delay under uncertainty is only guaranteed when = r (comparing equations 3 and 30). The r% rule has further implications for intuitive perceptions of equilibrium. For example, it dramatically changes the traditional view of lowest-cost first in heterogeneous nonrenewable resource extraction. Order of development is related to the rate of asset appreciation, rather than grade or cost differentials: the mine whose expected value appreciation falls first to the equilibrium force of interest is the first to come on line. In other cases discount rates can be different for similar assets. Ceteris paribus, assets that are discounted more heavily, perhaps due to political risk, are brought on line sooner (cf. Malliaris and Stefani 1994), in line with the economic intuition under certainty that higher discount rates are a result of higher opportunity costs of waiting. The determination of investment timing under uncertainty is thus the same as it is under certainty, the outcome of a complex sectorial equilibrium involving price paths and interest rates that bring forth investment as needed to match demand. The r% rule also supports the notion that this complex sectorial equilibrium involves project values that must be in at least weak backwardation for new investment to be forthcoming under uncertainty (Davis and Cairns 1999), since if the NPV of a project is always rising at or above the rate of discount the program will, due to the delay incentive of quasi-option value, never be stopped. This in turn supports evidence that commodities such as oil, which require irreversible lumpy investments to extract, have an interior equilibrium that exhibits backwardation (Litzenberger and Rabinowitz 1995). This crucial difference between equilibrium under certainty and uncertainty arises from the adjustment term in the r% rule under uncertainty. V. Conclusion It is of some significance to observe that hitting boundaries and smooth pasting conditions apply under conditions of certainty. Timing rules based on comparisons of mutually exclusive projects starting at different times will lead to optimal timing decisions under certainty, just as they do under uncertainty. 26 Optimal Stopping The substantive difference under uncertainty is one of method; problems are usually solved in the value domain rather than the time domain. By staying within the time domain we have shown that there is a consistent stopping algorithm, an r% rule, that applies to problems under both certainty and uncertainty. In each case investment takes place only once the NPV of the underlying project is expected to rise at a force of interest that represents the opportunity cost of delay. Under certainty the opportunity cost of delay is clear – it is the time value of money. Under uncertainty the opportunity cost of delay includes the time value of money and other influences that decrease the opportunity cost of waiting. In a simple example we show that practitioners need know nothing of smooth pasting or free boundaries to calculate the optimal stopping time under uncertainty; they need only track the expected rate of appreciation of the NPV of their asset and invest once it equals a force of interest that is fully calculable using the known parameters of the model. Seeing the stopping problem under uncertainty as an r% rule that has close parallels to the case under certainty reveals that the theory of investment under uncertainty is an incremental generalization of, not a qualitative break from, the theory of investment under certainty; certainty is simply the limiting case of uncertainty as volatility goes to zero. 27 Optimal Stopping References Amram, Martha, and Nalin Kulatilaka, 1999, Real options: managing strategic investment in an uncertain world, Harvard Business School Press. Arnott, Richard J., and Frank D. Lewis, 1979, The transition of land to urban use, Journal of Political Economy 87:11, 161-69. Bar-Ilan, Avner, and William C. Strange, 1999, The timing and intensity of investment, Journal of Macroeconomics 21:1, 57-77. Bjerksund, Petter, and Steinar Ekern, 1990, Managing investment opportunities under price uncertainty: from “last chance” to “wait and see” strategies, Financial Management (Autumn), 65-83. Boyarchenko, Svetlana, 2004, Irreversible decisions and record-setting news principles, American Economic Review 94:3, 557-68. Brealey, Richard A., and Stewart C. Myers, 2003, Principles of corporate finance, 7th edition, McGrawHill Irwin. Brock, William A., Michael Rothschild, and Joseph E. Stiglitz, 1989, Stochastic capital theory, in George R. Feiwel, Ed., Joan Robinson and Modern Economic Theory, New York University Press, 591622. Cairns, Robert D., 2001, Capacity choice and the theory of the mine, Environmental and Resource Economics 18, 129-48 Capozza, Dennis, and Yuming Li, 1994, The intensity and timing of investment: the case of land, American Economic Review 84:4, 889-904. Capozza, Dennis, and Yuming Li, 2002, Optimal land development decisions, Journal of Urban Economics 51, 123-42. Chiang, Alpha C., 1984, Fundamental methods of mathematical economics, 3rd edition, McGraw-Hill. Clarke, Harry R., and William J. Reed, 1989, The tree-cutting problem in a stochastic environment: the case of age-dependent growth, Journal of Economic Dynamics and Control 13, 569-95. 28 Optimal Stopping Clarke, Harry R., and William J. Reed, 1990a, Applications of optimal stopping in resource economics. Economic Record (September), 254-65. Clarke, Harry R., and William J. Reed, 1990b, Land development and wilderness conservation policies under uncertainty: a synthesis, Natural Resources Modeling 4:1, 11-37. Clarke, Harry R., and William J. Reed, 1990c, Oil-well valuation and abandonment with price and extraction rate uncertain, Resources and Energy 12, 361-82. Davis, Graham A., and Robert D. Cairns, 1999, Valuing petroleum reserves using current net price, Economic Inquiry 37:2, 295-311 Davis, Graham A., 2002, The impact of volatility on firms holding growth options, Engineering Economist 47:2, 213-31. Dixit, Avinash, and Robert S. Pindyck, 1994, Investment under uncertainty, Princeton University Press. Dixit, Avinash, Robert S. Pindyck, and Sigbjørn Sødal, 1999, A markup interpretation of optimal investment rules, Economic Journal 109 (April), 179-89. Fisher, Anthony C., 2000, Investment under uncertainty and option value in environmental economics, Resource and Energy Economics 22, 197-204. Hands, D. Wade, 2004, Introductory mathematical economics, 2nd ed, Oxford University Press. Hartwick, John M., Murray C. Kemp, and Ngo Van Long, 1986, Set-up costs and the theory of exhaustible resources, Journal of Environmental Economics and Management 13, 212-24. Insley, Margaret, and T. S. Wirjanto, 2005, Contrasting contingent claims and dynamic programming approaches for valuing risky assets, Working Paper, University of Waterloo. Litzenberger, Robert H., and Nir Rabinowitz, 1995, Backwardation in oil futures markets: theory and empirical evidence, Journal of Finance 50:5, 1517-45. Malliaris, A. G., and W. A. Brock, 1982, Stochastic methods in economics and finance, North-Holland. Malliaris, A. G., and Silvana Stefani, 1994, Heterogeneous discount rates and models of exhaustible resources, Advances in Financial Planning and Forecasting 5, 227-47. Marglin, Stephen A., 1963, Approaches to dynamic investment planning, North-Holland. 29 Optimal Stopping Mauer, David C., and Steven H. Ott, 1995, Investment under uncertainty: the case of replacement investment decisions, Journal of Financial and Quantitative Analysis, 30:4, 581-605. McDonald, Robert, and Daniel Siegel, 1984, Option pricing when the underlying asset earns a belowequilibrium rate of return: a note, Journal of Finance 39:1, 261-65. McDonald, Robert, and Daniel Siegel, 1986, The value of waiting to invest, Quarterly Journal of Economics 101:4, 707-28. Mensink, Paul, and Till Requate, 2005, The Dixit-Pindyck and the Arrow-Fisher-Hanemann-Henry option values are not equivalent: a note on Fisher (2000), Resource and Energy Economics 27, 83-88. Mordecki, Ernesto, 2002, Optimal stopping and perpetual options for Lévy processes, Finance and Stochastics 6, 473-93. Reed, William J., 1993, The decision to conserve or harvest old-growth forest, Ecological Economics 8, 45-69. Reed, William J., and Harry R. Clarke, 1990, Harvest decisions and asset valuation for biological resources exhibiting size-dependent stochastic growth, International Economic Review 31:1, 14769. Ross, Sheldon M., 1970, Applied probability models with optimization applications, Holden-Day. Ross, Sheldon M., 2003, An elementary introduction to mathematical finance, 2nd edition, Cambridge University Press. Saphores, Jean-Daniel, 2003, Harvesting a renewable resource under uncertainty, Journal of Economic Dynamics and Control 28, 509-29. Sarkar, Sudipto, 2000, On the investment-uncertainty relationship in a real options model, Journal of Economic Dynamics and Control 24:2, 219-25. Sødal, Sigbjørn, 1998, A simplified exposition of smooth pasting, Economics Letters 58, 217-23. Torries, Thomas F., 1998, Evaluating mineral projects: applications and misconceptions, Society for Mining, Metallurgy, and Exploration, Inc. 30 Optimal Stopping 1.75 1.5 1.25 1 W W 0.75 0.5 r = 0.20 0.25 5 6.25 10 15 20 time Figure 1: Rate of appreciation of underlying asset as a hitting boundary problem for Example 1, r = 0.20. 31 Optimal Stopping Value (Utils x 100) 1750 1500 1250 1218.25 1000 750 500 250 W 2 4 6 6.25 8 time Figure 2: The stopping problem in Example 2 as a hitting boundary problem with W as the state variable, and in Example 3 as a value matching and smooth pasting condition in the time domain. 32 Optimal Stopping V(W, Ŵ ) (Utils x 100) 2000 1500 With option to wait 1000 500 No option to wait 500 1000 Ŵ 1500 2000 W (utils x 100) Figure 3: The stopping problem in Example 4 as a value matching and smooth pasting condition, asset value domain. • Value • V(W) Y(W) h h Ŵ W Figure 4: Possible deviations in W and program value given W = Ŵ . 33 Expected Rate of Growth Optimal Stopping 0.35 0.3 W<C W>C 0.25 0.2 0.15 0.1 Stopping Continue Region 0.05 Stop 0 0 0.5 1 1.5 2 2.5 Wˆ W Figure 5: The r% rule for geometric Brownian motion, comparing expected rate of growth of the project forward NPV Y with the adjusted force of interest 12 2 ( 1) for C = 1, r = 0.06, = 0.14, b = 0.05, = 0.20. 1 Option Value = NPV + PPV + QOV = NPV + Option Premium 0.8 Value Option premium Quasi-option Value 0.6 0.4 Pure Postponement Value NPV 0.2 1.2 1.4 1.6 1.8 2 W Figure 6: Investment timing under geometric Brownian motion, showing option premium, pure postponement value, and quasi-option value for C = 1, r = 0.06, = 0.14, b = 0.05, and = 0.20. 34