RETAINED WEALTH AND FAMILY FIRM IPO

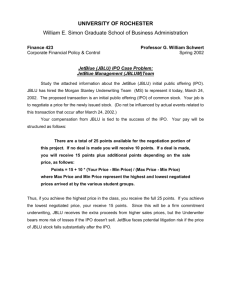

advertisement