Form 20-F

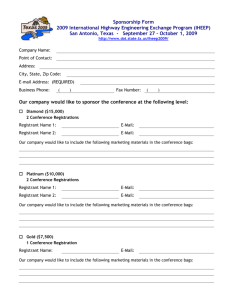

advertisement