Overview - Novannet

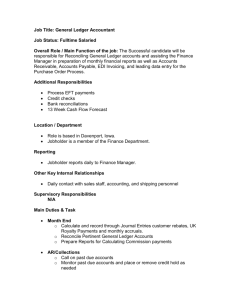

advertisement