Accounting information system (AIS) effectiveness and firm

advertisement

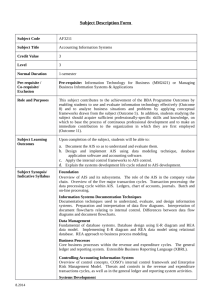

CAUSES AND CONSEQUENCES OF AIS EFFECTIVENESS IN MANUFACTURING FIRMS: EVIDENCE FROM THAILAND Wathana Yeunyong Ph.D. (Accounting) ABSTRACT The aim of this study is to investigate causes and consequences of accounting information system (AIS) effectiveness. Its causes are organization context, organizational coordination and control (OCC) that affect the quality of information, which is produced from AIS of the firm. The information is obtained from information sharing among subunits, electronic data interchange across organizations. Next, to investigate the consequences of AIS effectiveness that will influence competitive advantage and firm performance. Besides, there is to test the association between competitive advantage and firm performance. Drawing up on a sample of 95 manufacturing firms in Thailand. The firms use computer-based systems for operating of AIS. Results are that the causes, particularly information interdependence and formalization, are positively and significantly associated with AIS effectiveness, but the linkage between interorganization and AIS effectiveness is not significant. In addition, AIS effectiveness is positively and significantly related to competitive advantage. Moreover, firm performance is also directly affected by AIS effectiveness. Keywords: AIS Effectiveness, Organizational Coordination and Control, Task Uncertainty, Competitive Advantage, Firm Performance 1. INTRODUCTION Accounting information system (AIS) refers to collecting, recording, classifying, summarizing information to help managers to make planning, controlling and evaluating (Bruggeman and Slagmulder, 1995). Therefore, planning is conducted to state the goals of the firm in the future to create activities that consist of a strategic plan, and then the strategies used to attain the goals (Flamholtz, 1983). Likewise, controlling is one role of AIS that is important when the manager wants to control employee behavior to obtain increasing profitability according to stated goals in their plan. To follow up the plan (e.g. strategic plan), thus, evaluating refers to a mechanism to measure performance in order to assess whether the level of performance is satisfactory when the performance is compared with the goal of the plan (Flamholtz, 1983). Planning, normally, will be obtained before control operation, and then evaluation. Thus, AIS produces more information to each operation such as planning and control information, and performance evaluation information. Moreover, the planning is employed to control and coordination in production activities (Scarbrough et al., 1991). The performance evaluation information comprises both financial performance information and non-financial performance information. Financial performance information is used to measure the degree of attaining the goal in terms of return on asset (ROA), return on sale (ROS) and return on investment (ROI) (Miller, 1992). Non-financial performance information measures qualitative information, for example, customer satisfaction, product quality, and cooperation (Harrison and Poole, 1997). Management accounting system is a part of AIS. It can improve production performance (Shoe, 2004). In the present, technology is developing fast, particularly information technology (IT) that is employed to support AIS to produce the information. IT has high capacity to capture, store, retrieve, and communicate data. It is an appropriate tools for producing information, especially to response complexity of AIS that consists of many subsystems such as revenue system (i.e., billing, account receivable, cash receipts), expenditure system (i.e., purchasing, account payable, cash disbursements), production system (i.e., planning, control, cost accounting), general ledger and business reporting system (i.e., classify, summary, financial statement). These subsystems are integrated to information sharing by IT, and produce electronic data and various report forms according to information user needs. Therefore, IT is a strategy to generate global competitive advantage of business that leads to improved organization performance (Gunasekaran et al., 2001). Likewise, Byrd el al. (2001) finds that the flexible IT infrastructures relate to competitive advantage: information sharing and knowledge. The roles of IT influence on AIS are to increase effectiveness in various functions such as financial information to report on web. This way is useful to inform users how to access information easily. Indeed, auditors’ monitoring is efficient when AIS uses computerized systems. Moreover, this 1 influence is related with corporate systems and management accounting area. The control structure, user responsibilities, and accounting information process are changed by enterprise system technology (Sutton, 2005). The relationship between AIS and decision making is important when AIS is installed with computer-based systems to increase fast reporting, accuracy, precision, and up-todate information. Nicolaou (2000), in previous research, finds that organizational coordination and control are associated with information integration dealing with AIS effectiveness, but the relationship between AIS effectiveness and competitive advantage, and firm performance was not examined. This gap is to study causes, organization context, whether they affect AIS effectiveness or not, and how AIS consequences influence competitive advantage and firm performance. Moreover, the organization context may be affected by high level task uncertainty, and related to AIS effectiveness. For this, AIS has to provide more information on decision and control when compared with low task uncertainty. Research questions • • • How does the context of organizational coordination and control (OCC) influences AIS effectiveness? Does AIS effectiveness affects the firm performance, and is it mediated by the competitive advantage? Does task uncertainty moderate the relationship between OCC and AIS effectiveness? The purpose is to examine the relationship between (1) OCC and AIS effectiveness, moderated by task uncertainty, (2) AIS effectiveness and competitive advantage, (3) AIS effectiveness and competitive advantage, and (4) to investigate the association among competitive advantage, AIS effectiveness, and performance. 2. RELATION MODEL AND HYPOTHESES The theoretical framework (see Fig.1) is explained by the contingency theory. From organizational context, particularly involving information dependence, formalization, and interorganization dependence affects AIS effectiveness. These contexts encourage AIS effectiveness that is measured by user information satisfaction and monitoring (Nicolaou, 2000). Then AIS effectiveness affects competitive advantage and performance. The design of organizational context is a mechanism affecting managerial and economic effectiveness (Galbraith, 1995; Zimmerman, 1995). AIS is important in organizational mechanisms to provide information on decision making and control in the organization (Jensen, 1983; Zimmerman, 1995). Therefore, design of organizational coordination and control is different for each organization, leading to different AIS for each firm as well. That is, contingencies may occur. This framework can be explained by the contingency theory the same organization because AIS produces information to evaluate managerial, organizational, and environment. Therefore, the contingency theory can link the relationships in the AIS effectiveness model. In addition to organization context, task uncertainty also influences AIS effectiveness, when organizations have to operate depending on customer needs. Goods and services are responded to customer satisfaction. Certainly, good AIS should be employed to present quality information to do that. The information is not only used for decision-making how to produce and service, but it has also encouraged controlling to attain goals. Consequences of AIS effectiveness affects competitive advantage in various ways such as using information for purchasing orders, raw material handling, production quality, and delivery. These activities use good information that leads to competitive advantage, and then influences firm performance. This framework is designed to investigate the relationships among competitiveness, AIS effectiveness, and firm performance as well. 2 FIGURE 1 RELATION MODEL OF AIS EFFECTIVENESS: CAUSES AND CONSEQUENCES Task Uncertainty Organizational Coordination and Control Information interdependence Formalization Interoganization dependence AIS Effectiveness Control variables System years Firm size Industry type Competitive Advantage Firm Performance 2.1 AIS Effectiveness, Organizational Coordination and Control 2.1.1 AIS Effectiveness AIS effectiveness refers to perceiving of user information satisfaction to decision making and monitoring when organization has coordination and control with information that is produced from AIS (Nicolaou, 2000). This AIS uses computer-based systems to information interdependence among function areas (e.g. information sharing between purchase and accounting function) when organizational structure is a degree of formalization, and dependence in interorganization (i.e., information sharing with external organizations) such as, electronic data interchange. Moreover, monitoring is efficient when users employ information from AIS for controlling. Therefore, each firm has designed a different organizational coordination and control as well as a different accounting system. Accordingly, the contingency theory explains exogenous environment factors and endogenous firm-specific factors that influence organizational structure, particularly, management accounting practices to planning and control, performance measure and evaluation (monitoring), and cost management. Then affect firm performance finally (Anerson and Lanen, 1999). Hence, AIS of the firm depends on the organizational context. 2.1.2 Information Interdependence Information interdependence refers to using information sharing across subunits within an organization. Thus, these subunits coordinate their activities together. Subunits in organization are highly interdependent to better serve need and benefit from semantic standard (i.e. consistent definitions, names, identifiers, domains and constraints for data elements across systems and subunits). Coordinating activities is efficient and effective, provided they speak the same language (Lee et al., 1992). Therefore, when the firm encounters a task uncertainty, subunits are interdependent among each other in information sharing in same semantic standard, which is a necessity. Information systems are employed to promote faster, more accurate, more complete, and more coordinated information across business function for instance, purchasing, accounting, manufacturing and distribution (Alter, 1996). Moreover, using an information system is more capable of enhanced information processing such as, connection, tapping, combination and recombination of capabilities across function activities to create new skills leading to rapid and flexible production and service activities (Malone el al., 1999). 3 2.1.3 Formalization Formalization is the degree to which workers are provided with rules and procedures that deprive and encourage creative, autonomous work and teach (Miner, 1982). In the organization theory literature, formalization is divided into two types, a high degree of formalization related to a mechanistic structure and a low degree of formalization linked to organic structure (Burns and Stalker, 1961). In the relation model of Jensen and Mecking (1992), formal authority structure and control role are associated. They argue that in an organization two problems exist: the decision right assignment problem and the control problem. Both problems are inter-related, but an economic model of behavior can encourage two common problems in attaining the same goal. Therefore, control systems can be designed and implemented to employees in the best interest of the firm (Zimmermna, 1997; Jensen, 1998). AIS is one form of control systems to produce information to assess managers. That is, using information employs performance measures when firms have contracts with employees to give reward system or incentive based-compensation system (Shields, 1997). 2.1.4 Interorganization Dependence Interorganization dependence refers to communication across organizations using electronic data interchange (EDI) in the same format. For example, electronic manufacturers use EDI with partner firms to exchange data such as, a number of goods needed (i.e. purchasing/sale), product design, and delivery time. Nicolaou (2002) examines the perceptions of cost management system effectiveness influencing EDI when adopts just-in-time to production process. Findings are that EDI affects cost management system effectiveness. EDI systems are useful interoganization systems that facilitate communication and information sharing among organizations via electronic data link (Bakos, 1991). Using this system, uncertainty can reduce deliveries to customers when the systems use computer-based systems in order to produce order, invoices, payments etc. Moreover, EDI systems also implement purchasing orders from vendors such as raw materials, deliveries etc. Therefore, one of the role of AIS is to integrate information from external organizations into information sharing across subunit functions within the organization. 2.1.5 Task Uncertainty Task uncertainty refers to the difference between the amount of information needed and the amount of information already available (Galbraith, 1997). Ghani (1992) suggest that task variability affects the amount of information required to handle unexpected events. A number of researchers argue that the capacity of information processing must fit the processing requirement to obtain high managerial performance (Macintosh, 1978). That is, under high task uncertainty, managers need more timely accounting information to control the daily operation and to solve unusual problems or events. In summary, the design of organizational coordination and control is efficient that it is supported by AIS. There is coordination among subunits within an organization in information sharing (information interdependence). Besides, the degree of formalization in the organization, performance measure is employed to assess employees, and used information that is produced from AIS. Moreover, there is to use EDI systems to information sharing with partner firms (e.g., vendors, customers) undertaking uncertainty environment to operation efficiency. Therefore, hypothesis 1a, 1b, 1c, and 1d are stated: H1a: A firm with higher information interdependence will have greater AIS effectiveness. H1b: A firm with higher formalization will have greater AIS effectiveness. H1c: A firm with higher interorganization dependence will have greater AIS effectiveness. H1d: Task uncertainty will moderate the organization coordination and control -AIS effectiveness. 2.2 Competitive Advantage and Firm Performance 2.2.1 Competitive Advantage Competitive advantage is a potential resources for the entire firm (Porter, 1986). Porter describes a value chain model to create added value to the firm. This model comprises nine value added activities and four secondary activities. These value activities can conduct competitive strategies and implementation. In the model of value chain activities, primary activities are inbound logistics: receiving, storing, and distributing material for manufacturing; operations transforming input into finished products; outbound logistics storing and distributing products; marketing and sales promotion and sale efforts; service maintain or enhance product value through post-sale services. Secondary activities consist of corporate infrastructures (i.e. support for the entire value chain, including general management, planning, finance, accounting, legal service, government affairs, and quality 4 management), human resource management (i.e., recruiting, hiring, training, and development of employees), technology development (i.e., improvement products and manufacturing process), and procurement (i.e., purchasing inputs) (Porter, 1985). The value chain model is applied to the firm that it leads to competitive advantage: cost leadership, differentiation, and focus strategies. Information system-based resource for competitive advantage is made using AIS effectiveness: coordination and control, and can provide appropriate information to decision making and control. AIS effectiveness can use EDI for information sharing with vendors leading to a few inventory stocks. Next, production systems of AIS are collected and reported to non-value added activities to obtain the way to reduce cost by eliminating the non-value added activities. Moreover, production processes undergo continuous improvement. As on the production process has quality to encourage fewer wastes. Indeed, AIS can share information across subunits to encourage reducing the quantity of work, leading to decreasing labor costs. The roles of EDI systems are to exchange information with customers dealing with customer needs for goods and service (Mische, 1992). Therefore, the firms will receive information on topic such as product design, and amounts of goods needed in a specific time period. The information will help in fast development of new products, in quality of delivery, and encouraging customer satisfaction (Spekman, 1998). Kearns and Leaderer (2004) find that the firm applies IT system to generate competitive advantage. In summary, accordingly, Porter’s value chain activities, AIS effectiveness (supported computerbased system) influences cost reduction of raw material handing, production process (i.e. decreasing wastes, labor costs), development of new products, reducing time to bring a product on the market, increasing product quality, and high deliverability (i.e., information sharing). The value chain activities are aligned with IT in AIS, they affect competitive advantage. Therefore, Hypothesis H2 proposes that: H2: A firm with greater AIS effectiveness will achieve better competitive advantage. 2.2.2 Firm Performance Firm performance is the result of strategies the firm employs to achieve market-oriented and financial goals (Yamin, 1999). Strassman (1998) finds significant correlations between IT spending and sales growth, effectiveness, quality or productivity. Moreover, there is a positive and highly significant association with IT used such as IT participation in business planning, and alignment of the IT plan with the business plan to produce competitive advantage (Kearns and Lederer, 2004). Furthermore, firm performance may be affected directly by AIS effectiveness, especially its effect on high managerial performance. Including, AIS effectiveness will influence firm performance. Therefore, Hypothesis 3a and 3b state that: H3a: A firm with greater AIS effectiveness will achieve better firm performance. H3b: A firm with greater competitive advantage will achieve better firm performance. 3. METHOD 3.1 Data collection The samples were randomly drawn from 1,000 manufacturing firms in Thailand that have AIS which employs computer-based systems and ISO implementing. The sampling frame was listed from an ISO firm database. The questionnaire was constructed covering contents according to each variable that was operationalized for empirical studies. It is pre-tested with managers to determine the validity and reliability, particularly construct validity which is commented by AIS experts, and then it is improved in its contents, wording, and item ordering. Reliability was tested by Cronbach’s alpha reliability coefficients of all constructs to make sure that the items of the questionnaire were designed to measure consistency for each concept. Later, 500 questionnaires were sent to CFO firms to provide data for this study via mail. After two weeks 72 questionnaires were received. There were 14 questionnaires that could not be sent to receivers and these were returned. One week later, 31 more questionnaires were received. Thus, the response rate was 19.5%. However, 8 received questionnaires were incomplete, and were not included in the data analysis. In addition, non-response bias was investigated by t-test, and results were not significant. Therefore, it was implied that these received questionnaires as non-response bias. 5 3.2 Reliability and Validity Constructs, multi-item scale, were tested by Cronbarch Alpha to measure reliability of data. Table 1 shows an alpha coefficient higher than .6, (Nunally, 1978). Alpha coefficients of constructs have values ranging from .75 to .92, the lowest coefficient for task uncertainty and the highest coefficient for AIS effectiveness. That is, internal consistency of the measures used in this study can be considered good for all constructs. Factor analysis is employed to test the validity of data in the questionnaire. Items are used to measure each construct that is extracted to be one only principal component. Table 1 shows factor loading of each construct that presents a value higher than .5. Thus, construct validity of this study is tapped by items in the measure, as theorized. That is, factor loading of each construct should not be less than .4. (Hair et al., 2006) TABLE 1 FACTOR LOADING AND ALPHA COEFFICIENTS OF CONSTRUCTS Constructs Firm performance AIS effectiveness Competitive Advantage Information Interdependence Formalization Interorganization Dependence Task Uncertainty Factor Loading Alpha Coefficient .52-.86 .53-.81 .52-.83 .73-.83 .53-.75 .65-.83 .57-.87 0.92 0.90 0.91 0.86 0.75 0.76 0.79 3.3 Statistic Technique OLS regression analysis is employed to estimate parameters in hypothesis testing. From the relation model and the hypotheses the following seven equation models are formulated: Equation 1: AISEF = 01 + 1INFOM + 2FORM+3INTE +4TASK+5 INFOM*TASK+6FORM*TASK+ 7INTE*TASK+8SYST + 9SIZE + 10IDUS + Equation 2: AISEF = 02 + 11INFOM + 12FORM + 13INTE + 14SYST + 15SIZE + 16IDUS + Equation 3: COMP = 03 + 25AISEF + 26SYST+ 27SIZE + 28IDUS + Equation 4: FPER = 04+ 17COMP + 18SYST + 19SIZE + 20IDUS + Equation 5: FPER = 05+ 21COMP + 22SYST + 23SIZE + 24IDUS + where AISEF is AIS effectiveness; INFOM is information interdependence; FORM is formalization, INTE is interoganiation dependence; FPER is firm performance; TASK is task uncertainty; SYST is installed system years; SIZE is firm size; IDUS is dummy variable of industry type=1, if industry types are electronics, vehicles, and electronic equipment firms, others=0; is error term. These regression equations are employed to estimate inferred parameters whether the hypotheses are substantiated and fit an overall model (F value) or not. Then, the model variables and parameters are presented in various tables later. 3.4 Measure All variables in Table 1 that use the 5-point Likert scale not including control variables and show numbers of items in order to tap each variable. Organizational coordination and control comprises of information interdependence, and formalization, and interorganization dependence. These dimensions are measured by 6, 5, and 5 items, respectively (Nicolaou, 2000). AIS effectiveness is tapped dealing with user information satisfaction and monitoring contents; it is measured with 12 items (Nicolaou, 2000). Competitive advantage is measured by 15 items that have contents about price/cost, quality, delivery dependability, product innovation, and time to market (Li et al., 2006). Firm performance consists of contents involving market performance, financial performance, and product/service. This variable is measured by 8 items (Li, 2006). Task uncertainty is measured by 4 items (Chang et al., 2003). 6 Control variables comprise system years that are measured by installed time (year); firm size is measured by employee numbers; Industry type = Dummy variable, if industry types, electronics, vehicles, and electric equipment industries, are 1, others = 0. This dummy variable, industry type is included in the regression model so that whether it can indicate influence of industry type to independent variable of each model. This study focuses on a comparison between more variability product industries (electronics, vehicles, and electronic equipment) and less product change industries. 4. RESULT This paper is to examine the relationship between OCC and AIS effectiveness; AIS effectiveness and competitive advantage; AIS effectiveness and firm performance; competitive advantage and firm performance, analyzed by OLS regression model. Thus, the results will be presented by Table 3, 4, and 5 later. Table 2 shows the inter-correlation of all constructs to explore relating of each dual variable. Results find that AIS effectiveness, as would be expected, positively and significantly correlate with competitive advantage, firm performance, information interdependence, formalization, and interorganization dependence. TABLE 2 CORRELATION MATRIX FOR ALL CONSTRUCTS Constructs AISEF COMP FPER IFOM FORM INTE TASK SYST SIZE AIS effectiveness (AISEF) Competitive advantage (COMP) 0.55** Firm performance (FPER) Information interdependence (IFOM) Formalization (FORM) 0.35** 0.42** 0.53** 0.45** 0.16 0.47** 0.50** 0.25* 0.37** Interorganization dependence (INTE) 0.37** 0.37** 0.24* 0.37** 0.41** 0.36** 0.22* 0.13 0.13 0.32** 0.22* 0.13 0.05 0.09 0.15 0.03 0.15 - 0.15 0.14 0.16 0.08 0.36** 0.18 0.11 - 0.16 0.25* 0.07 0.11 0.19 0.25* 0.05 0.01 0.06 0.08 Task uncertainty (TASK) System years (SYST) Firm size (SIZE) Industry type (INDUS) 0.26* *p < .10 ** p < .05 The correlations among independent variables, information interdependence and formalization , information interdependence and interorganization dependence, formalization and interorganization dependence are not more high level; therefore multicolinearity is expected low level when multiple regression model is employed; the model has AIS effectiveness as dependent variable. As expected, control variables, system years, firm size, and industry type are not significantly correlated to each model equation. For this reason, using regression models should have the correlations among independent variables that are low levels, but the correlation among independent and dependent variables are high levels. 4.1 Influence of OCC and moderating task uncertainty on AIS effectiveness Table 3 shows the results of regression analysis to inference H1a, H1b, H1c, and H1d that these are proposed about effect of organizational coordination and control to AIS effectiveness that is measured via user information satisfaction and monitoring items, moderated by task uncertainty. The results indicate that in Model 2 of regression equation consisting of information interdependence, formalization, and interorganization dependence as independent variables, and AIS effectiveness as dependent variable, there is a significant and positive association between information interdependence and AIS effectiveness (b=.242; p<.05); therefore, H1a is supported. Likewise, the relationship between formalization and overall AIS effectiveness is significant and positive (b=.350; p<.01), which is consistent with H1b. However, H1c is not supported (b=.115; p = .258). General nature of Thai manufacturing firms, majority, is not likely to data exchange and no compatible EDI systems with other firms. They believe that diffusion of information might affect potential competitions. These results are consistent with Nikolaou (2000) who finds that a degree fit of organization between coordination and control is related to accounting information system design to be AIS effectiveness. 7 INDUS TABLE 3 EFFECT OF OCC AND INTERACTIONS OF EACH OCC DIMENSIONS WITH TASK UNCETAINTY ON AIS EFFECTIVENESS Models Independents Variables 1 .178* .293*** .092 .262*** -.021 -.175* -.024 .143 .024 .050 .336 Information interdependence (IFOM) Formalization (FORM) Interorganizational dependence (INTE) Task uncertainty (TASK) INFOM*TASK FORM*TASK INTE*TASK System years (SYST) Firm size (SIZE) Industry type (INDUS) Adjusted R2 *p < .10 **p < .05 *** p < .01 2 .242** .350*** .115 .079 -.048 .036 .275 The results of model 1 present according to Model 2 that the linkage between information interdependence and AIS effectiveness, and the linkage between formalization and AIS effectiveness are positive and significant. Indeed, this model is added moderator variable (e.g. interaction between task uncertainty and each independent variable). Finding shows only significant relationship between interaction of formalization and task uncertainty with AIS effectiveness (b=-.175; p<.1), but it is significantly and negatively moderate the relationship between formalization and AIS effectiveness. Other interactions are not significant (e.g.,INFOM*TASK and INTE*TASK). Therefore, H1d is partial supported. For this reason, it may be influenced by other factors such as computer literacy of user, quality of computer-based system (e.g. hard ware, soft ware) leading to low quality of information sharing both internal and external organization when it is analyzed by this collected sample. Due to information manager needs are changed when firms are under high task uncertainty to decisions and monitoring (Chang et al., 2003). Using control variables within the model explains AIS effectiveness, but all variables effect dependent variable no significant, system years, firm size, and industry type of all models. 4.2 Effect of AIS effectiveness on competitive advantage Results are presented in Table 4; regression analysis is employed to estimate parameters to test H2. For Model 3, there is a positive and significant relationship between AIS effectiveness and competitive advantage (b=.537; p<.01). Competitive advantage is explained by AIS effectiveness equaling 29 percent. VIF value among independent variables in less than 10 (Maximum of VIF value = 1.146), and little multicolinearity is accepted. Thus, H2 is supported. Beyond influencing AIS effectiveness on competitive advantage significantly, there are other variables that may affect the model as well. That is, control variables, particularly in this model, are three in number (System years, firm size, and industry type). These variables are added in the model to explain competitive advantage, but may not be affected significantly. Regression analysis shows that these control variables are not significant. 8 TABLE 4 INFLUENCE OF AIS EFFECTIVENESS ON COMPETITVE ADVANTAGE Model 3 Independent Variables Competitive Advantage System years Firm size Industry type Adjusted R2 .537*** .067 -.058 .135 .292 ***p<.01 TABLE 5 EFFECT OF COMPETITIVE ADVANTAGE AND AIS EFFECTIVENESS ON FIRM PERFORMANCE Models Independent Variables 4 5 .537*** Competitive Advantage AIS effectiveness System years Firm size Industry type Adjusted R2 .067 -.058 .135 .292 .355*** .037 -.022 .155 .127 *** p < .01 4.3 Influence of competitive advantage and AIS effectiveness on firm performance Table 5, Model 4, displays the results of the effect of competitive advantage on firm performance. That is, this model shows for testing H3a. There is a positive and significant association between competitive advantage and firm performance (b=.537; p<.01). Likewise, the linkage between AIS effectiveness and firm performance is also positive and significant (b=.355; p<.01), as well. Therefore, H3b is substantiated. However, the relationship between competitive advantage and firm performance is stronger than the relationship between AIS effectiveness and firm performance (i.e., regression coefficient=.537 and .355 respectively). That is, AIS effectiveness can directly influence firm performance or via competitive advantage. For this reason firm performance and competitive advantage are effected on quality AIS, but it may also be influenced by other factors for decision making, monitoring, and other management to be efficient and effective. Although some researchers argue that IT investment to create a competitive advantage is proxy for organizational performance (Kearns et al., 2004). That is, when IT and AIS operate together, various factors must be considered for perfect effectiveness. 5. DISCUSSION, LIMITATION, AND FUTURE RESEARCH An important point of this paper is to examine the relationships of antecedents and consequences of AIS effectiveness so that especially organization context is designed for various views such as information sharing among subunit to decreasing recording data and increasing information integration to flexible managerial reports. A firm is formalization that has rules and procedures of work to using computer-based system, and having data interchange for interorganzaition to use information to response customer needs: product design, delivery, and quality. These antecedents lead to high AIS effectiveness, and then influencing consequences of high AIS effectiveness will affect more competitive advantage and positive firm performance (Nikolaou, 2000, Nikolaou, 2002; Porter, 1986; Chang et al., 2003). Moreover, Choe (2004) finds evidence for the relationship between provision of information and performance improvement. 9 The results find a significant positive association between information interdependence and AIS effectiveness. Accordingly, consistent literatures when organization context is designed to share information among subunits to obtain quality of decision and monitoring, and then leads to competitive advantage. That is, AIS effectiveness is measured by user satisfaction and monitoring when managers would like to use information usefulness from AIS to decision-making and control (Jensen, 1983; Zimmerman, 1995). Accordingly, Nicolaou (2000) finds that effects of AIS fit to quality of information of system outputs. Likewise, there is a significant and positive link between formalization and AIS effectiveness. A degree of formalization in organization can explain about rules and procedures of work when a firm has a high organization structure. That is, controlling information is employed to be tools to measure performance of employees in the organization. Hence, high AIS effectiveness leads to information usefulness and quality of performance measures. However, according to these results, interorganization dependence is not significantly related to AIS effectiveness. It may be affected by other factors e.g. firms that do not want to exchange information such as product design, cost information, and other strategic information with external organizations. The relationship AIS effectiveness and interaction between formalization and task uncertainty is negative and significant that meaning is when the firm has more task uncertainty. It will affect AIS effectiveness dealing with using information for monitoring, because the managers have to use more information for controlling. The relationship between AIS effectiveness and completive advantage is significant and positive. That is, when the AIS is highly effective; it affects competitive advantage again. Both user information satisfaction and monitoring influence to be high managerial performance, and then affects potential competition for organization. Porter (1986) states that the value chain activities create competitive advantage. It starts with inbound activities such as purchasing order and raw material handling. Next, raw materials are put in the process for conversion to finished goods. Outbound activities include delivery of finished goods by the firm to customers. AIS is employed to produce quality information to support the value chain activities. The information provides purchasing order, raw material handling, information of each operation on the production process, delivery, and customer information. Quality information helps to decrease the cost of purchasing orders, raw material handlings, waste in production processes, deliveries, etc. Therefore, value chain activities are supported by quality information from firm AIS to obtain competitive advantage (i.e. cost reduction, quality of delivery, quality product generation). Similarly, Byrd el al. (2001) found that a flexible IT infrastructure is related to competitive advantage: information sharing and knowledge. Monitoring provides confidence of the way goals are achieved; hence, it generates a competitive advantage as well. There is a positive and significant relationship between competitive advantage and firm performance. When the relationship between AIS effectiveness and firm performance is tested, and then finds that it is a positive and significant. That is, information quality produced by AIS can directly affect firm performance. However, the linkage between competitive advantage and firm performance is stronger than linkage between AIS effectiveness and firm performance. This paper examines causes and consequences of AIS effectiveness, and its results may not be able to support all hypotheses. The samples are small size, and some variables may be omitted. Thus, future research should add appropriate variables such as linkage between AIS effectiveness and managerial performance, or add dimension of AIS effectiveness to measure user participation (e.g. attitude to use computer for support AIS). This paper focuses on measuring in managerial satisfaction and monitoring to measure AIS effectiveness. Moreover, the relation model should be included with other antecedents to increase AIS effectiveness such as appropriate information characteristics or other factors to construct information quality from AIS of the firm. This study examines task uncertainty, contingent effect, moderates the relationship between formalization-task uncertainty interaction and AIS effectiveness to be negative and significant. Therefore, H1d are partial supported. that is, when organization has more task uncertainty, it may affect to AIS effectiveness. Accordingly, Ghani (1992) argues that task variability affects the amount of information required to handle unexpected events. When a firm is under high task uncertainty or no abnormal events, the managers have to use more information to decision making and control. Thus, it influences on AIS effectiveness. 6. MANAGERIAL IMPLICATION The role of AIS in the information era is to design systems that respond to information needs. That is, the information is employed for decision making and control by managers. An information alignment strategy is applied to create competitive advantage, which ultimately affects firm performance. However, system designing to be AIS effectiveness depends on various factors such as, organization coordination and control. Therefore, the AIS effectiveness, which consists of data sharing among 10 subunits within an organization (coordination), uses performance measures to evaluate employees for rewards or other compensation to monitoring that AIS is employed to produce information. Accordingly, value chain activities when are supported by AIS leading to competitive advantage and ultimately affects on firm performance. 7. CONCLUSION Information quality is important to managers for decision making and controlling. AIS is used to provide information to do that. Therefore, this paper is to investigate how to design organization context particularly, information interdependence among subunits, formalization to control, and interoganization dependence to data interchange affects AIS effectiveness. Results show that high information sharing across function areas and formalization is likely to have higher AIS effectiveness. In contrast, the effect of interoranization dependence which is employed by EDI systems is not strong. Indeed, the consequences of AIS effectiveness are interesting. That is, AIS effectiveness can create strong competitive advantage, and indicate that firm performance is significantly and directly affected by AIS effectiveness as well. 8. REFERENCES Abernethy, M., Brownell, P., 1997, Management control systems in research and development organizations: the role of accounting, behavior and personnel controls. Accounting, Organizations and Society, 22 (3/4), 233–248 Alter, S., 1996. Information Systems: A Management Perspective. Benjamin/Comings, New York. Anderson, S.W., Lanen, N.W., 1999. Economic transition, strategy and the evolution of management accounting practice: the case of India. Accounting Organizations and Society, 24, 379-412. Bacos, J.Y., 1991. Information links and electronic marketplace: the role of interoganization information systems in vertical markets. Journal of Management Information system, 8, 31-52 Barns, T., Stalker, G.M. 1961, The management of innovation, Tavistock, London Byrd, A.T., Turner, E., 2001. An exploratory examination of the relationship between flexible IT infrastructure and competitive advantage, Information & Management, 39, 41-52 Chang, R.D., Chang, Y.W., Paper, D. The effect of task uncertainty, decentealization and AIS characteristics on the performance of AIS: and empirical case in Taiwan. Information & Management , 40, 691-703. Choe, J., 2004. The relationship among management accounting information, organizational learning and production performance, Journal of Strategic Information Systems, 13, 61-85 Choe, J.M., 1998. The effects of user participation on the design of accounting information systems, Information & Management, 34, 185-198 EmManuel, C., Otley, D., Merchant, K., 1990. Accounting form management control. London. Flamholtz, E., 1983. Accounting, budgeting and control systems in their organizational context: theoretical and empirical perspectives. Accounting, Organizations and Society 8, 153–169. Flamholtz, E., Das, T., 1985, Toward an integrative framework of organizational control, Accounting, Organizations and Society, 10 (1), 35–50 Ghani, J.A., 1992. Task uncertainty and the use of computer technology, Information and Management, 22, 69-79 Gunaasekaran, A., Love, E.D., Rahimi, F., Miele, R., 2001, A model for investment justification in information technology project, International Journal of Accounting Information Systems, 21, 349-364 Jensen, M. C., 1998, Foundation organizational strategy Cambridge, MA: Harvard University Press 11 Jensen, M. C., Mecking, W. H., 1992, Specific and general knowledge and organizational structure, Contract economics, Cambridge: Blackwell Publishers Kearns, .S G. , Lederer, 2004. The impact of industry contextual factors on IT focus and the use of IT for competitive advantage. Information and Management , 41, 899-919. Lee, S., Leifer., R.P. 1992. A Framework for Linking the Structure of Information Systems with Organizational Requirements for Information Sharing, Journal of MIS, 8(4), pp. 27-44 Malone, T.W., Crowston, K., Lee, J., Pentland, B., 1999. Tools for inventing organizations: toward a handbook of organizational processes. Management Science, 45 (3), 425–443. Miller, J.A., 1992. Designing and implementing a new cost management system. Journal of Cost Management (winter), 41–53 Miner, J.B., 1982, The structuring of Organizational Structure and Process, The Dryden Press, Chicago, IL. Mische, M., 1992, EDI in the EC: easier said than done. The Journal of European Business, 4(2), 1922. Nually, J., 1978, Psychometric Theory, McGraw-Hill, New York Porter, M., 1985, Competitive Advantage, New York: Free Press. Shields, M. D., 1997, Research in management accounting by North Americans in the 1990s, Journal of Management Accounting Research 9, 3-61 Spekman RE, Kamauff Jr JW, Myhr N., 1998. An empirical investigation into supply chain management: a perspective on partnerships. Supply Chain Management , 3(2): 53–67 Sutton, G., 2005, The role of AIS research in guiding practice, International Journal of Accounting Information Systems 6, 1-4. Yamin S, Gunasekruan A, Mavondo FT, Relationship between generic strategy, competitive advantage and firm performance: an empirical analysis, Technovation, 19(8), 507–18 Zimmerman, J., 1997, Accounting for decision making and control, Boston: Irwin/McGraw Hill 12