Definition of AIS.

advertisement

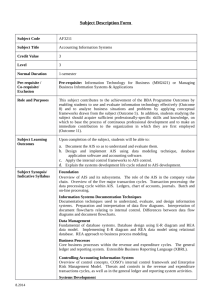

Chapter 1 – Role and Purpose of Accounting Information Systems Objectives. 1. Define “accounting information systems”. 2. Discuss why AIS is an important area of study for future accountants. 3. Compare and contrast AIS with other areas of study in accounting. 4. Explain the structure of most accounting information systems. 5. Locate and evaluate information sources on accounting information systems. 6. Describe the structure and content of the remainder of this text. Definition of AIS. 1. Interrelated activities, documents and technologies. 2. Collect data and process it. 3. Report information. 4. Diverse group of internal and external decision makers. FASB Conceptual Framework. 1. Developed in 1977. 2. Well-designed AIS can respond to many elements. 3. Components: Objectives of financial reporting. Elements of financial statements and qualitative characteristics. Assumptions, principles and constraints. ACC 3113 – Accounting Information Systems Chapter 1 | Page 1 ◦ Objectives of financial reporting • Framework lists multiple objectives • For AIS study, the most important may be the most basic: to provide information for decision making ◦ Elements of financial statements • Balance sheet: assets, liabilities, equity • Income statement: revenues, expenses, gains, losses • Other: comprehensive income ◦ Qualitative characteristics • • Primary • Relevance: information makes a difference in decisions • Reliability: information can be relied upon for decisions Secondary • Comparability: between organizations • Consistency: across time ◦ Assumptions of Conceptual Framework • Economic entity: a business is separate from its owners • Going concern: a business will survive long enough to meet its current obligations • Periodicity: the life of a business is divided into time periods for financial reporting • Monetary unit: the value of a dollar is stable ACC 3113 – Accounting Information Systems Chapter 1 | Page 2 ◦ Principles of Conceptual Framework • Historical cost: in general, items in the AIS are recorded at their historical cost • Realization: revenue can be recorded in the AIS when the earnings process is essentially complete • Matching: expenses should appear on the income statement with the revenue they helped generate • Full disclosure: give decision makers all the information they need ◦ Constraints of Conceptual Framework • Cost effectiveness: the benefit of having information must exceed the cost of obtaining it • Materiality: dollar amounts must be large enough to make a difference in decisions • Conservatism: when choosing between accounting practices, make the choice that presents the “worst case” scenario • Industry practices: follow the conventions of the industry in financial reporting Typical AIS structure. • Inputs Such as source documents • Processes Journals, ledgers, information technology • Outputs General purpose financial statements and other reports • Storage Paper-based or electronic • Internal controls Designed to safeguard assets, promote operating efficiency, encourage adherence to management rules and ensure reliable financial reports ACC 3113 – Accounting Information Systems Chapter 1 | Page 3 Information competence • Problems in accounting information systems often have more than one “correct” answer. • In other words, they are non-deterministic. • But, some answers are clearly incorrect. • Research is often required to address problems in AIS. • Therefore, accountants must be able to evaluate information. • Definition: Information competence is the ability to find, evaluate, use, and communicate information in all of its various formats (Curzon, 1995) • Types of information: • Sponsored / commercial Someone has paid a fee or given other consideration • Popular / practitioner Has been reviewed. May be descriptive in nature. • Scholarly Has been reviewed. Typically intended for academic audiences. • Criteria for evaluating information (UMUC) • Authority • Accuracy • Objectivity • Currency • Coverage ACC 3113 – Accounting Information Systems Chapter 1 | Page 4 ◦ Authority • Who created the information? • For what purpose? ◦ Objectivity • Does the information contain advertising? • Is it available freely? ◦ Accuracy • Where did the information come from? • Any obvious factual errors? • Information competence ◦ Currency • When was the information created / written? • When was it last updated? Coverage • Is the information continually “under construction?” • Does it provide sufficient depth? ACC 3113 – Accounting Information Systems Chapter 1 | Page 5