Mapping of F1 to Standard Account Codes

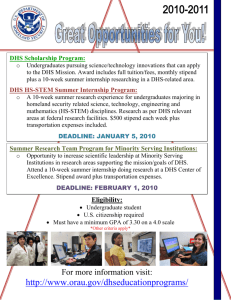

advertisement