sample midterm2 answ..

advertisement

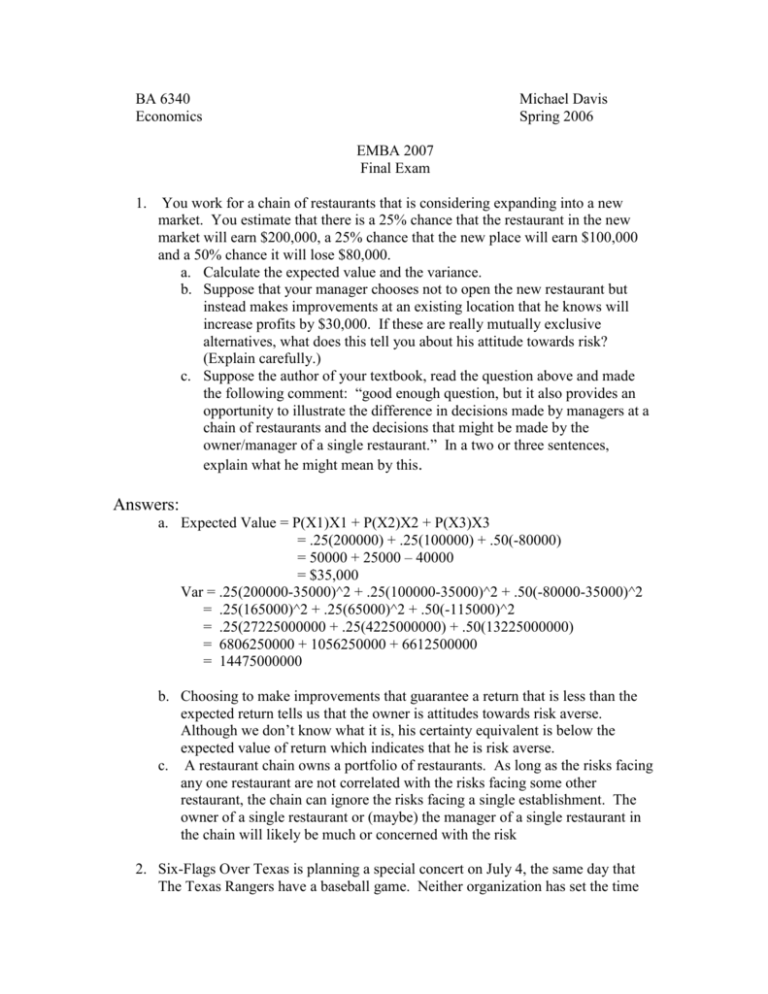

BA 6340 Economics Michael Davis Spring 2006 EMBA 2007 Final Exam 1. You work for a chain of restaurants that is considering expanding into a new market. You estimate that there is a 25% chance that the restaurant in the new market will earn $200,000, a 25% chance that the new place will earn $100,000 and a 50% chance it will lose $80,000. a. Calculate the expected value and the variance. b. Suppose that your manager chooses not to open the new restaurant but instead makes improvements at an existing location that he knows will increase profits by $30,000. If these are really mutually exclusive alternatives, what does this tell you about his attitude towards risk? (Explain carefully.) c. Suppose the author of your textbook, read the question above and made the following comment: “good enough question, but it also provides an opportunity to illustrate the difference in decisions made by managers at a chain of restaurants and the decisions that might be made by the owner/manager of a single restaurant.” In a two or three sentences, explain what he might mean by this. Answers: a. Expected Value = P(X1)X1 + P(X2)X2 + P(X3)X3 = .25(200000) + .25(100000) + .50(-80000) = 50000 + 25000 – 40000 = $35,000 Var = .25(200000-35000)^2 + .25(100000-35000)^2 + .50(-80000-35000)^2 = .25(165000)^2 + .25(65000)^2 + .50(-115000)^2 = .25(27225000000 + .25(4225000000) + .50(13225000000) = 6806250000 + 1056250000 + 6612500000 = 14475000000 b. Choosing to make improvements that guarantee a return that is less than the expected return tells us that the owner is attitudes towards risk averse. Although we don’t know what it is, his certainty equivalent is below the expected value of return which indicates that he is risk averse. c. A restaurant chain owns a portfolio of restaurants. As long as the risks facing any one restaurant are not correlated with the risks facing some other restaurant, the chain can ignore the risks facing a single establishment. The owner of a single restaurant or (maybe) the manager of a single restaurant in the chain will likely be much or concerned with the risk 2. Six-Flags Over Texas is planning a special concert on July 4, the same day that The Texas Rangers have a baseball game. Neither organization has set the time for the event, but both would prefer to set up an evening event, capped off with fireworks. They realize, however, that if the schedule at the same time, the traffic will be terrible and their customers would be angry. The table below gives payoffs for each outcome (the first entry is the payoff to the Rangers, the second payoff is for Six-Flags. Rangers Afternoon Evening Afternoon 3,4 5,3 Six-Flags Evening 2,7 1,2 a. Identify any Nash equilibrium b. Is this a prisoner’s dilemma (explain)? c. Explain what you think will happen (both with and without coordination). Answers: Six Flags Afternoon Evening Six Flags Best Choice Rangers Afternoon Evening R=3 S=4 R=2 S=7 R=5 S=3 R=1 S=2 Evening Afternoon Rangers Best Choice Evening Afternoon There are two Nash Equilibriums: 1. If Six Flags chooses Afternoon, then the optimal choice for the Rangers is Evening. If the Rangers choose Evening, then the optimal choice for Six Flags is the afternoon. In this case, both players are following the optimal strategy given what the other is doing. 2. If Six Flags chooses evening, then the optimal choice for the Rangers is the Afternoon. If the Rangers choose afternoon, then the optimal choice for Six Flags is the evening. In this case, both players are following the optimal strategy given what the other is doing. 2. b. This is not a prisoner’s dilemma because a prisoner’s dilemma requires that both participants have a dominant strategy. Here, neither participant has a dominant strategy. 2.c. Without coordination it is difficult to know for sure what will happen. It can be said that attitudes towards risk may be especially important. With coordination, it is much easier to predicit, since Six-Flags going in the evening and Rangers in the afternoon gives the highest combined payment. 3. The world of consumer electronics is apparently on the verge of another battle between competing technologies, this time the format for the HD DVD’s. (Here’s a link to a short article http://www.pcworld.com/news/article/0,aid,116471,00.asp). The problem resembles a very common game that we discussed in class. Explain the analogy and also any insights the game might offer as to how the issue is likely to be settled. Answer: Standards setting is a common example of the Battle of the Sexes game discussed in class. In this case we have two clear players; Sony with Blu-Ray and NEC with HDDVD. It’s in both companies best interest to have a common standard because consumers will more likely purchase with a standard across an industry. So two Nash Equilibriums are defined but which is chosen? This problem maps directly to our B-of-S game where Fred enjoys the opera and Wilma enjoys wrestling. They both have the highest individual payoffs when they are together than in any other state. Obviously to agree on a standard, there will need to be a compromise. From Sony’s perspective, they have experience with this having gone through it before with the BetaMax vs. VHS battle. Their poor positioning of a superior technology ultimately cost them the standard and consumers got an inferior technology. Coming back to the article, this may be why Sony is moving fast to get Blu-ray into the market. With market prices on these machines falling coupled with the Blu-ray based Playstation 3 poised to release this calendar year, Blu-Ray will get mass market penetration internationally. Sony should move swiftly to position Blu-ray with the studios, selling the technology and increased space per disc for multimedia distribution. Sony should also entice NEC with shared profits in the studio industry’s new production lines as well as introducing products based on Blu-ray technology. NEC will have a difficult time getting mass penetration of their product unless they can come in as a second mover and offer a cheaper or technically more advanced system. They should approach the studios to seal conversion deals of their equipment to produce HD-DVD based movies. They should also try to convince Microsoft to use HDDVD technology in the Xbox and media PC systems to compete with Sony on a mass international scale. 4. A well-known economist recently wrote in favorable terms about the French economy stating “it's true that France's G.D.P. per person is well below that of the United States but…”. Describe precisely what is being measured by GDP and what might follow the “but”. (That is, why GDP might not fully describe the economic conditions in the country.) Answer: Generally, GDP measures the final market value of goods and services produced by a nation. It does not measure overall economic activity. The components used to measure GDP are: a. Public consumption of goods and services Durable, non-durable, and services b. Gross private domestic investments New accumulated capital goods; not financial investments c. Net exports of goods and services Make sure to remove items built elsewhere and consumed here. What is built in the nation and exported is counted. d. Federal government spending/gross investment. There may be non-economic forces that drive down the GDP per capita measurement for France. European’s have more holiday and generally prefer to not keep the same hours of employment year round as US workers. This would naturally lower personal income and thus GDP measurements. Additionally, France’s overall unemployment rate may be much higher further contributing to lower GDP per capita than the US. 5. If the Chinese were to allow the yuan to freely float against the U.S. dollar it is widely expected that the dollar will fall in value in relation to the yuan, making Chinese goods more expensive in America and American goods less expensive in China. However, there would be other consequences, both desirable and undesirable, as well. Discuss these, both from the American and Chinese perspective. Answer: Desirable Effects: - The change in exchange rates would likely reduce imports from China, possibly creating some jobs in some American industries. - Floating the yuan would allow the Chinese more flexibility in the conduct of monetary policy since they would no longer have to buy dollars to support the exchange rate. - Floating the yuan may prevent a catastrophic devaluation such as happened in Thailand in 1997. - Floating the yuan may prevent the U.S. from imposing trade barriers on China. - Floating the yuan reduces the Chinese investment in U.S. financial assets and thus reduces their financial interest in the U.S. Undesirable Effects: (notice how some of these are dark-side of those things considered advantages). - More expensive Chinese imports to America would drive up product costs in the US for toys, clothes, electronics, and other cheaply made Chinese commodities. - Floating the yuan would give the Chinese the flexibility to engage in irresponsible monetary policy. - Floating the yuan would create exchange rate risk for those doing business in China and for Chinese businesses doing business outside China. - Floating the yuan reduces the Chinese investment in U.S. financial assets and thus reduces their integration and interest in the U.S. 6. Your company is thinking about opening large manufacturing operation and also to capture a significant market share in The Kingdom of Elbonia. At a recent board meeting one of the members made the following statement. ”Sure, Elbonia has long had a stable, prosperous economy with GDP growth rates of more than 4%, but they also have a huge current account deficit. This deficit must indicate that there is some real underlying weakness.” Criticize this statement. Answer: Having a current account deficit is not necessarily bad. In fact, combined with Elbonia’s GDP growth, it may actually indicate an even stronger economy than measuring GDP alone. A current account deficit occurs because capital is flowing into Elbonia. Opening a manufacturing company there would be a wise move. You have foreign investors who are investing heavily into Elbonia to create the capital account surplus. As an added benefit, Elbonian’s are becoming more and wealthier through a stable and prosperous economy. These Elbonian’s will be investing more in everything both domestic and abroad. One possible weakness is sustainability. How long will foreign investors hold Elbonia’s financial instruments? What happens when they sell everything and pull out?