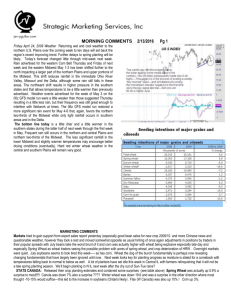

Argentina - Record global grain harvest

advertisement