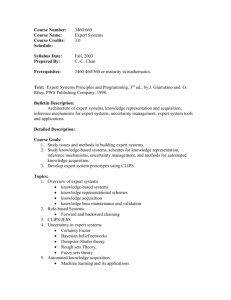

DMO STANDARD PROCEDURE

advertisement