Chapter 3: The Accounting Information System

advertisement

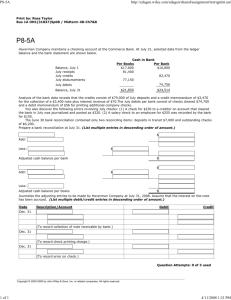

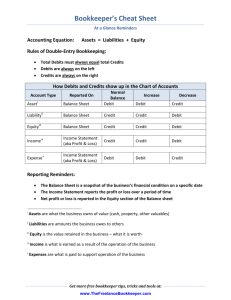

Chapter 3 page 1 of 12 Chapter 3: The Accounting Information System The purpose of this chapter is to explain and illustrate the features of an accounting information system. 1) Accounting Information System: Factors to consider when forming an info system are: nature of business, size of firm, volume of data, and informational demands a) Basic Technology: (Refer to page 63 for definitions.) i) Event: ii) Transaction: iii) Account: iv) Real and Nominal Accounts: Real (Permanent) Accounts: Nominal (Temporary) Accounts: v) Ledger: General Ledger: Subsidiary Ledger: vi) Journal: vii) Posting: viii) Trial Balance (TB): Adjusted Trial Balance: Trial balance taken immediately after all adjustments have been posted. Post-Closing (or After-Closing) Trial Balance: A TB taken immediately after closing entries have been posted. ix) Adjusting Entries: x) Financial Statements: Chapter 3 page 2 of 12 xi) Closing Entries: The formal process by which all nominal accounts are reduced to zero and the net income or net loss is determined and transferred to an owners’ equity account; also known as “closing the ledger,” “closing the books,” or merely “closing.” b) Debits and Credits: i) Debit(ing): ii) Credit(ing): This procedure is an accounting custom or rule. Debits = Credits provides the basis for double-entry system of recording transactions. If every transaction is recorded with equal debits and credits, then the sum of all debits to the accounts must equal the sum of all credits. iii) Debit Balance: The total of the debit amounts exceeds the credits. iv) Credit Balance: The total of the credit amounts exceeds the debits. All ASSET, EXPENSE, and DIVIDENDS accounts are increased on the debit (left) side and decreased on the credit (right) side. All LIABILITY, EQUITY, and REVENUE accounts are increased on the credit (right) side and decreased on the debit (left) side. Illustration 3-1: Double Entry (Debit and credit) Accounting System (p64) Normal Balance = Debit: Asset Account Expense Account Debit Credit Debit Credit Dividends Debit Credit Normal Balance = Credit: Liability Account Debit Credit Revenue Account Debit Credit Stockholders’ Equity Accounts Debit Credit Chapter 3 page 3 of 12 c) Basic Equation: In a double entry system, for every debit there must be a credit and vice versa. This leads to the basic accounting equation. (See Illustrations 3-2 and 3-3 on page 65.) Note: Common Stock (and APIC) (Real or permanent account) + Retained Earnings (Real or permanent account) - Dividends (Nominal or temporary account) + Revenues (Nominal or temporary account) - Expenses (Nominal or temporary account) Stockholders’ Equity or CS + RE - Div + NI (or - NL) = SHE d) Financial Statements and Ownership Structure: i) Common Stock and Retained Earnings are reported in the stockholders’ equity section of the balance sheet. ii) Dividends are reported on the statement of retained earnings. iii) Revenues and Expenses are reported on the income statement. iv) Dividends, Revenues, and Expenses are eventually transferred to retained earnings at the end of the period. Thus, a change in any of these three items affects Stockholders’ equity. v) Understand Illustration 3-5 on page 67. 2) The Accounting Cycle (See Illustration 3-6 on page 68.) a) Identifying and Recording Transactions and Other Events: A transaction: i) ii) b) Journalizing: i) General Journal: Book of original entry; chronological listing of events and transactions in terms of debits and credits to particular accounts. Note: ALL ADJUSTING ENTRIES GO INTO GENERAL JOURNAL. Each entry includes: (1) The accounts and amounts to be debited. (2) The accounts and amounts to be credited. (3) Date. (4) An explanation. ii) Special Journals: Used for large volume of transactions to same accounts. (1) Sales Journal: Record only credit sales. (2) Purchases Journal: Record all purchases of merchandise on credit. (3) Cash Receipts Journal: All cash receipts regardless of source. Chapter 3 page 4 of 12 iii) Four Steps to Correct Journal Entries: (1) Determine the specific accounts involved in the transaction (i.e., cash, A/R, A/P, etc.) (2) Determine the type of accounts involved in the transaction (i.e., asset, liability, equity, revenue, expense, or dividend). (3) Determine whether each account is increasing or decreasing. (4) Use the above information and the Journal Entry Equation (JEE) to correctly journalize the transaction. c) Posting: Must post transactions from general journal to general ledger. General Ledger: A collection of all the asset, liability, stockholders’ equity, revenue, and expense accounts. Subsidiary Ledger: Provides detailed information. For example, provides detailed info of individual credit customers (A/R) or suppliers (A/P). Other examples are Cash and Fixed Assets. The sum of the balances in the subsidiary ledgers should match your control account. Types of accounts: i) Real: (See notes, p1.) ii) Nominal: (See notes, p1.) iii) Mixed Accounts: Have nominal and real components (e.g., Purchases account is separated into COGS (nominal) and Inventory (real). Mixed accounts are separated through adjusting entries. The following two types of accounts are found within Real and Nominal accounts: iv) Adjunct Accounts: an account whose balance is added to its related account. (1) Premiums: add to Bonds Payable. (2) Freight-In: add to Purchases. v) Contra Accounts: reduces the balance of an account to which it relates (1) Depreciation (2) Allowance for Bad Debt (3) Sales Discounts d) Trial Balance: List of all accounts and their balances at a given time. The purpose of the TB is to show that debits equal credits. Errors may be uncovered during this process. However, if the Trial Balance balances, this does not mean there are no errors! e) Adjusting Entries: To ensure revenues are recorded when earned and expenses recognized when incurred, adjusting entries are made at the end of an accounting period. (That is, adjustments help ensure revenue recognition and matching principles are followed.) Required every time financial statements are prepared. Typically, adjustments are recorded after the BS date and dated as of the BS date. HINT: Chapter 3 page 5 of 12 i) Types of Adjusting Entries: (1) Prepayments: Prepaid Expenses (cash paid to third party); Unearned Revenue (cash received from third party) (2) Accruals: Accrued Revenues; Accrued Expenses (3) Depreciation (4) Bad Debt Expense ii) Adjusting Entries for Prepayments: -If the adjustment is needed for both types of prepayments, the asset and liability are overstated and the related expense and revenue are understated. -If the adjustment is needed for prepaid expenses: Expenses are understated, Net Income is overstated, SHE is overstated, and Assets are overstated. -If the adjustment is needed for the unearned revenues: Revenues are understated, Net Income is understated, SHE is understated, and Liabilities are overstated. (1) Prepaid Expenses: Expenses paid in cash and recorded as assets before they are used or consumed. Expire with the passage of time (e.g., rent) or through use and consumption (e.g., supplies). ADJ ENTRY: (a) Supplies: Buy supplies for $50. ex: ADJ ENTRY Orig Entry: AJE: At the end of the year, have $20 of supplies remaining. Orig Entry: AJE: Chapter 3 page 6 of 12 (b) Insurance: Purchase 6 months of car insurance on October 31 for $50/month. ex: ADJ ENTRY Orig Entry: AJE: Orig Entry: AJE: See example in separate handout. (c) Depreciation: (i) Need for Depreciation Adjustment: (ii) Statement presentation: Accumulated Depreciation is a contra asset account. This means that the accumulated depreciation account is offset against the related asset account (e.g., plant, property, & equipment) on the balance sheet and that its normal balance is a credit. Book Value: Equal to the (historical) cost of a depreciable asset less its related accumulated depreciation. Note: Book Value is NOT the same thing as Market Value!! Chapter 3 page 7 of 12 (2) Unearned Revenues or Deferred Revenues: Revenues received in cash and recorded as liabilities before they are earned. Examples that may lead to unearned revenues: rent, magazine subscriptions, tuition received prior to semester; OPPOSITE OF PREPAID EXPENSES! ADJ ENTRY: ex: ADJ ENTRY; 12 month magazine subscription sold on 8/01/xx for $120. Orig Entry: AJE: Orig Entry: AJE: See example in separate handout. iii) Adjusting Entries for Accruals: Accruals refer to when cash is exchanged AFTER revenue is earned or expense is incurred. (1) Accrued Revenues: Revenues earned but not yet received in cash or recorded. (ex: interest, rent, unbilled services) ADJ ENTRY: Example 1: Earn $2,000 for advertising services in October. Bill is sent in November. On October 31, ADJ ENTRY: Chapter 3 page 8 of 12 Example 2: Company A gets 6 month, $10,000 note receivable bearing 10% interest on November 1. December 31 is the end of the accounting period. $10,000 x 0.10 x 2/12 = $166.67 Earned Interest Nov 1 Dec 31 May 1 End of period Cash will be collected Principal + Interest 2 months interest Orig Entry: ADJ ENTRY: 12/31 May 1 Additional example provided in separate handout. LN: Handout bottom of PAGE 6. (2) Accrued Expenses: Expenses incurred but not yet paid in cash or recorded. (ex: interest, rent, taxes, salaries) ADJ ENTRY: Will debit an expense account and credit a liability account. (a) Accrued Interest: (b) Accrued Salaries: Example: Pay $5,000 in employee wages once a month on the 15th of every month. Dec 15 Dec 31 Jan 15 last pay date End of period Cash due ½ month incurred expense ($5,000 / 2 = $2,500) ADJ ENTRY: Following entry on 1/15: Chapter 3 page 9 of 12 Additional example provided in separate handout. (c) Bad Debts: Estimate for those credit sales (accounts receivable) that will not be collected. Example: Credit Sales = $100,000 Estimate for uncollectible accounts is 2 % of credit sales [$100,000 x 0.02 = $2,000] ADJ ENTRY: f) Adjusted Trial Balance: TB prepared after adjusting entries have been posted. Shows balance of all accounts, including those adjusted, at the end of the accounting period. (example: Illustration 3-33 on page 84.) After the Adjusted Trial Balance is prepared, the financial statements are prepared in the following order: g) Closing: i) Basic Process: Close all nominal (temporary) accounts to Income Summary. Note: May have preliminary closing entry if periodic inventory method is used. (See section (ii) below.) (1) (2) (3) (4) Chapter 3 page 10 of 12 ii) Inventory and Cost of Goods Sold (COGS): The above example assumes the use of a perpetual inventory system where purchases and sales are recorded directly in the Inventory account. The Inventory balance should thus represent the actual ending inventory amount. Inventory is updated upon each sale. (A physical count verifies this.) No Purchases account is used. Cost of Goods Sold (COGS) accumulates costs of inventory that is sold. When a sale takes place, Under the periodic inventory system, a Purchases account is used. During the period, Inventory remains the same. The ending inventory amount is determined by a physical count. If updated at the end of the period, the following formula is used to determine cost of goods sold: Preliminary closing entries under a periodic inventory system: 1. Entry to transfer all temporary holding accounts to inventory: 2. Adjust Inventory to appropriate ending balance: COGS will be the same regardless of method used! Chapter 3 page 11 of 12 h) Post-Closing Trial Balance: Shows that equal debits and credits have been posted to the Income Summary account. This TB only consists of asset, liability, and owners’ equity (real) accounts. i) Reversing Entries: Made at the beginning of next accounting period. Entry is exact opposite of related adjusting entry made in previous period. This is an OPTIONAL step in accounting cycle that may be performed at beginning of next accounting period. j) The Accounting Cycle Summarized: i) ii) iii) iv) v) vi) vii) viii) ix) 3) Using a Work Sheet (Refer to information in text.) Appendix 3A: Cash-Basis Accounting versus Accrual-Basis Accounting 1) Differences Between Cash and Accrual Bases: a) Accrual Basis of Accounting: b) Strict Cash Basis of Accounting: i) Income depends on revenue collection and expense payment. ii) Chapter 3 page 12 of 12 c) Differences: The difference between financial statements prepared on a cash basis and those prepared on an accrual basis is in the timing of net income. The balance sheet is also affected by the basis of accounting. d) Modified Cash Basis of Accounting: A mixture of cash basis and accrual basis. It is pure (strict) cash basis accounting with modifications for items such as capitalizing and depreciating plant assets or recording inventory. Often followed by professional services, retail, real estate, and agricultural firms. 2) Conversion From Cash Basis to Accrual Basis: Often, cash basis or modified cash basis financial statements are converted to accrual basis for presentation to investors and creditors. a) Service Revenue Computation: Refer to text, page 96 to 97. b) Operating Expense Computation: Refer to text, page 97 to 98. Additional information provided in separate handout. 3) Theoretical Weaknesses of the Cash Basis: Receivables and payables are forecasters of future cash inflows and outflows. Accrual-basis accounting aids in predicting future cash flows by reporting transactions and other events with cash consequences at the time the transactions and events occur, rather than when cash is received/paid.