GuidelinesCETrackingForm_102014

advertisement

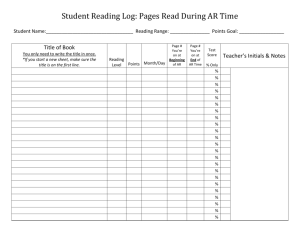

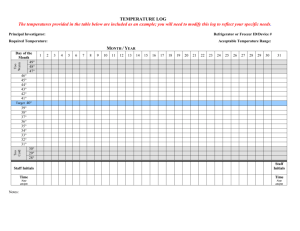

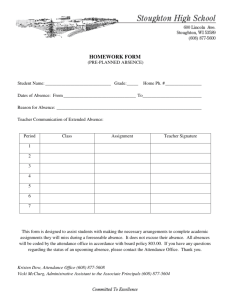

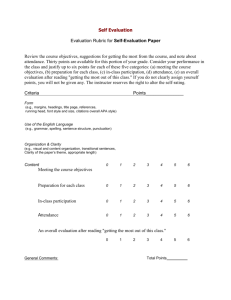

Instructions for Tracking and Obtaining Continuing Education Credits Licenses/Boards Offered: Attorneys: Florida Only National Association of State Boards of Accountancy (NASBA) Accounting CPE’s Global Risk Management Institute: RIMS Fellow (RF) Designation Hours Obtained: Proposed hours will be based on the following mandatory attendance. Hours are subject to change based on material review by the Accreditation Boards. Attorneys: Up to 9.9 hours for full attendance. RIMS Fellow: 7 hours of attendance will earn one credit towards 1 workshop credit. NASBA: Up to 9.5 hours for full attendance. Program level: Intermediate. Delivery Method: Group-Live. Obtaining Credit Following Conference: To obtain credit, attendees will be required to: 1. Track your sessions attended on the Attendance Tracker Form. It is your responsibility to track your sessions. Incomplete Tracking Forms cannot be verified after the fact and credit will only be given for sessions indicated. 2. Turn in your Attendance Tracker Form to Tricia Baxter at the Registration Desk located in the Regency Foyer, before you leave the conference along with the signed attestation statement located on the last page. If you are attending multiple days, maintain the Attendance Tracker until your final day, then turn in. 3. Please Note: Several licensing boards require CEU to submit information within 10 days after the course takes place. You have 7 days to submit your tracker form (by November 7). Once the form is submitted to CEU, attendance is verified and number of credits is calculated. If you did not turn in your completed form to Tricia Baxter at the registration desk: Scan and email to: astojic@ceuinstitute.net, Fax: 407-302-2185 or mail to CEU Institute. 4. Certificate of Completion will then be sent via email. This process typically takes 15-30 business days after receipt of your tracker. CLE/CPE Provider: CEU Institute 142 W. Lakeview Avenue, Ste. 2060 Lake Mary, FL. 32746 800-556-3559 info@ceuinstitute.net Page 1 of 6 Upon completion of each session, initial the left column. If you want to claim partial attendance for a course you arrived late or left early, indicated the number of minutes attended on the right-side column. Upon completion, sign the Attestation Statement at the end of this form and return to Tricia Baxter at the Registration Desk located in the Regency Foyer. Monday 10/27/2014: Concurrent Sessions 10:15am-11:45am (90 mins) Initials TOPIC If partial attendance, indicated number of minutes. The Measurable Value of Maturing Risk Management Practices In early 2014, The Journal of Risk and Insurance released “The Valuation Implications of Enterprise Risk Management Maturity”. The peer-reviewed study finds that organizations exhibiting mature risk management practices - as assessed with the RIMS Risk Maturity Model - realize a valuation premium of up to 25 percent. Hear from the study’s author and a risk professional who uses the RIMS RMM to drive risk management maturity within her organization. Becoming an “AGILE” ERM partner with Information Technology ERM assessments, reviews and programs cannot ignore the risks and rewards of IT systems. In this session, we will explore Agile project management and web development in a vulnerable and interconnected world. Learn how this rapid pace activity can help prepare for cyber-attacks, while becoming a key tool in ERM programs. Consider the Agile manifesto and tenets to guide security implementations and strengthen your ERM program. Managing Reputational Risk: A Practical Approach An increasing body of research indicates that good reputations bring measurable strategic value for organizations. The large number of influencers, dimensions and drivers of reputation call for a broadened and integrated approach for managing reputational risk. Learn how two organizations keep their fingers on the “reputational pulse” of their stakeholders to proactively manage this risk. . Monday 10/27/2014: Concurrent Sessions 1:15pm – 2:45pm (90 mins) *Only provides credit for Rims Fellow Designation Initials TOPIC If partial attendance, indicated number of minutes. Solutions Sharing: Using the RIMS Risk Maturity Model to Gain Measurable Value *Only Approved for Rims Fellow Credit* Solution Sharing: Delivering Data or Information? *Only Approved for Rims Fellow Credit* Solution Sharing: Covering Macro Issues *Only Approved for Rims Fellow Credit* Initials: _____________ Email:_____________________________________________ Page 2 of 6 Monday 10/27/2014: Concurrent Sessions 3:00pm – 4:30pm (90 mins) Initials TOPIC If partial attendance, indicated number of minutes. The Failure of Risk Management: Why it’s Broken and How to Fix It The inventor of “Applied Information Economics” takes a close look at commonly misused and misapplied risk management methods, and explains how to use Applied Information Economics for more effective risk management results. Tuesday 10/28/2014: Session 9:00pm-10:30pm (90 mins) Initials TOPIC If partial attendance, indicated number of minutes. Can a Risk Assessment Standard Work for You? Risk assessments are the cornerstone for managing uncertainties. Yet, organizations rarely consider the competence of the assessors, the variety of assessment methods, consistency of use, or potential biases inherently built into risk assessments. Hear how ASIS and RIMS are collaborating on developing an American Risk Assessment Standard to address these and other potential gaps in risk assessment approaches. Revving SRM: Training at Harley-Davidson Harley-Davidson, Inc. (HDI) has assigned accountability for Strategic Risk Management (SRM) updates and reporting to the strategic risk owners. Critical to sustaining an effective process is risk owner understanding of SRM concepts, the SRM process, and how to update SRM reports. Learn how Harley-Davidson revved up their SRM program through three on-line training modules to enable a consistent and efficient process: What is Strategic Risk Management The HDI SRM Framework, and The SRM Status Reporting Process Seizing the PESTS for Strategy Success PESTLE analysis is a strategy planning and performance tool that examines the external influences that have a major impact on making decisions, market growth and expansion. Learn how two Colombian based ‘multi-latins’ are using PESTLE analyses for managing strategic risks in the different territories in which they operate. Initials: _____________ Email:_____________________________________________ Page 3 of 6 Tuesday 10/28/2014: Concurrent Sessions 10:45am-12:15pm (90 mins) TOPIC Initials If partial attendance, indicated number of minutes. Transitioning into ERM Results of the 2013 RIMS Enterprise Risk Management Survey suggest that organizations are overwhelmingly realizing ERM’s value, with more than 80% of the respondents indicating they are transitioning from a traditional risk-siloed approach to an ERM risk portfolio. Join the conversation and learn the success secrets from professionals who have succeeded in this transformative integration. Mastering Risks in Complex Global Value Chains Global, complex and intertwined value chains stretch today’s risk environments beyond an organization’s direct control. This session illustrates proven strategic approaches for understanding, prioritizing and treating risk along the entire value chain. Learn how technology can turn value chain risk data into risk intelligence for deploying scarce resources to gain maximum return. Game Theory–A Predictive Strategy Technique Game theory is gaining traction among risk professionals for analyzing strategic situations involving conflicting and parallel interests among opposing players. Understand the main principles of applying game theory, as well as understanding areas for potential cooperation and interdependence. Discover how one organization uncovered hidden allies and hidden opponents by using game theory - without the math. Tuesday 10/28/2014: Concurrent Sessions 1:30PM-3:00pm (90 mins) Initials TOPIC If partial attendance, indicated number of minutes. Using Six Sigma and Lean Initiatives in ERM What do quality initiatives have to do with risk management? Are the methods used competitive or complementary? Discover how organizations are using Six Sigma and Lean Initiatives to integrate ERM more deeply into operations, and still do more with less. Simplifying Risk Aggregation Aggregating risks across multiple business units, departments, and silos to create meaningful consolidated risk reports for the C-suite and the board can prove overwhelming. In this session learn methodologies for aggregating both easy and difficult to quantify risks into easy to understand reports to enable companies to better evaluate and more effectively take on more risk across the business. ERM Integration with Strategic Planning More than ever, senior executives and board members view risk management as a key strategic function in their organizations. The interdisciplinary intersection of strategic planning, risk management and strategy execution not only protects against losses, but reduces uncertainties and enables organizations to seize opportunities. Hear from one organization that has found a way to naturally and successfully integrate ERM with strategic planning. Initials: _____________ Email:_____________________________________________ Page 4 of 6 Tuesday 10/28/2014: Concurrent Sessions 3:15pm-4:00pm (45 mins) Initials TOPIC If partial attendance, indicated number of minutes. Synchronized Strategic Initiatives – ERM at the Toronto 2015 Pan American Games The Toronto 2015 Pan American/Parapan American Games are the second largest Games globally, exceeded only by the summer Olympics. Have you ever wondered how an Organizing committee sets up an Enterprise Risk Management practice for such a massive, complex and fast paced venture? Join us to discover how Toronto 2015 is structuring the synchronized execution of a very large number of strategic initiatives, while governing them under a recognized enterprise risk management (ERM) framework - all within a relatively short time frame. With just months to go before the opening ceremony, gain an insider’s view of the Games, its strategic initiatives, as well as how ERM interacts with established risk management practices. Initials: _____________ Email:_____________________________________________ Page 5 of 6 Attendee Attestation I hereby attest to attendance for sessions as indicated above. I understand that session attendance and my signature on this form are necessary in order to be eligible to receive CE/CLE/CPE credit. I understand that failure to comply or providing fraudulent information on this form could result in redaction of credit by the provider and/or other disciplinary action by the licensing boards. Print Last Name):____________________________ Print First Name: ____________________________ Street Address: _______________________________________________________________________ State/Zip: _________________________________ Email *: ________________________________ Signature: ________________________________________ Date: _________________________ My License/Cert is: [ ] Attorney [ ] Accountant [ ] RIMS Fellow License Number: ______________________________ State: _____________ License Number: ______________________________ State: _____________ License Number: ______________________________ State: _____________ License Number: ______________________________ State: _____________ Please ensure you provide a valid email address as this will be used to send your certificates of completion. Please note CEU Institute does not sell or otherwise use your information for any other purposes. Continuing Provider Name CEU Institute | 142 W. Lakeview Ave. Suite 2060 | Lake Mary, FL 32746 Office: 407.324.0500 | Fax: 407.302.2185 | www.ceuinstitute.net Questions/Suggestions/Complaints: info@ceuinstitute.net | CPE: www.learningmarket.com Initials: _____________ Email:_____________________________________________ Page 6 of 6