course - Capital High School

advertisement

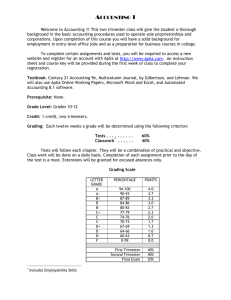

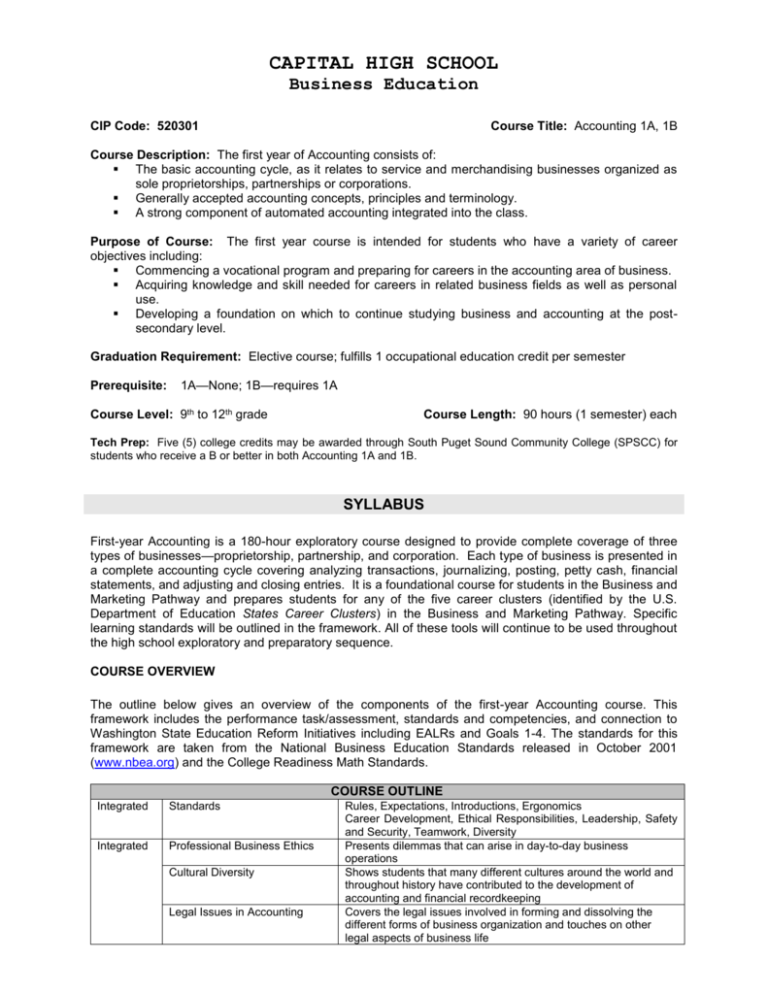

CAPITAL HIGH SCHOOL Business Education CIP Code: 520301 Course Title: Accounting 1A, 1B Course Description: The first year of Accounting consists of: The basic accounting cycle, as it relates to service and merchandising businesses organized as sole proprietorships, partnerships or corporations. Generally accepted accounting concepts, principles and terminology. A strong component of automated accounting integrated into the class. Purpose of Course: The first year course is intended for students who have a variety of career objectives including: Commencing a vocational program and preparing for careers in the accounting area of business. Acquiring knowledge and skill needed for careers in related business fields as well as personal use. Developing a foundation on which to continue studying business and accounting at the postsecondary level. Graduation Requirement: Elective course; fulfills 1 occupational education credit per semester Prerequisite: 1A—None; 1B—requires 1A Course Level: 9th to 12th grade Course Length: 90 hours (1 semester) each Tech Prep: Five (5) college credits may be awarded through South Puget Sound Community College (SPSCC) for students who receive a B or better in both Accounting 1A and 1B. SYLLABUS First-year Accounting is a 180-hour exploratory course designed to provide complete coverage of three types of businesses—proprietorship, partnership, and corporation. Each type of business is presented in a complete accounting cycle covering analyzing transactions, journalizing, posting, petty cash, financial statements, and adjusting and closing entries. It is a foundational course for students in the Business and Marketing Pathway and prepares students for any of the five career clusters (identified by the U.S. Department of Education States Career Clusters) in the Business and Marketing Pathway. Specific learning standards will be outlined in the framework. All of these tools will continue to be used throughout the high school exploratory and preparatory sequence. COURSE OVERVIEW The outline below gives an overview of the components of the first-year Accounting course. This framework includes the performance task/assessment, standards and competencies, and connection to Washington State Education Reform Initiatives including EALRs and Goals 1-4. The standards for this framework are taken from the National Business Education Standards released in October 2001 (www.nbea.org) and the College Readiness Math Standards. COURSE OUTLINE Integrated Standards Integrated Professional Business Ethics Cultural Diversity Legal Issues in Accounting Rules, Expectations, Introductions, Ergonomics Career Development, Ethical Responsibilities, Leadership, Safety and Security, Teamwork, Diversity Presents dilemmas that can arise in day-to-day business operations Shows students that many different cultures around the world and throughout history have contributed to the development of accounting and financial recordkeeping Covers the legal issues involved in forming and dissolving the different forms of business organization and touches on other legal aspects of business life Part 1: Accounting for a Service Business Organized as a Proprietorship In Part 1 the business begins as a proprietorship with only a cash investment by the owner. 1 week Starting a Proprietorship: Describes how a proprietorship is started and the transactions that Changes that Affect the occur when the business is organized. The accounting equation Accounting Equation is used to analyze the transactions. 1 week Analyzing Transactions into Continues with additional transactions for starting a business. It Debit and Credit Parts also analyzes transactions using T accounts. The theory of debit and credit is built around the relationship between the left and right sides of the accounting equation and the left and right sides of a T account. 1 week Journalizing Transactions Begins the journalizing process using the transactions from Chapters 1-2 for consistency and follow through. 1 week Posting to a General Ledger Analyzes posting procedures. 1 week Cash Control Systems Includes information on bank accounts and petty cash as they apply to a proprietorship. It also includes electronic funds transfers and debit card transactions. Cash control systems are important to each form of business. 2 weeks Reinforcement Activity 1— Presents the whole accounting cycle for a service business Part A organized as a proprietorship. 1 week Work Sheet for a Service Guides students through the preparation of a work sheet. Business Adjusting entries are introduced as they apply to a proprietorship. 1 week Financial Statements for a Presents financial statements and basic financial statement Proprietorship analysis for critical thinking. 1 week Recording Adjusting and Completes the accounting cycle for a proprietorship and explains Closing Entries for a Service how to record adjusting and closing entries. Business 2 weeks Reinforcement Activity 1— Completes the accounting cycle for a service business organized Part B as a proprietorship. Part 2: Accounting for a Merchandising Business Organized as a Corporation Part 2 presents a complete accounting cycle for a merchandising business organized as a corporation. The primary differences between a merchandising business and a service business are that a merchandising business purchases merchandise for resale, charges sales tax on sales of merchandise, and includes a cost of merchandise sold section on the income statement. The corporation form of business organization requires different equity accounts and an additional financial statement. The business in this part uses subsidiary ledgers and has a payroll system for compensating employees. 1 week Journalizing Purchases and Present the daily transactions of a merchandising business. Cash Payments Merchandise is purchased for cash and on account, and merchandise is sold for cash and on account. In addition, credit 1 week Journalizing Sales and Cash Receipts Using Special Journals card sales are described. 1 week Posting to General and Describes posting to the general ledger and the accounts payable Subsidiary Ledgers and accounts receivable subsidiary ledgers. 1 week Preparing Payroll Records Introduces payroll procedures. Covers the calculations for employee earnings and deductions and the completion of a payroll 1 week Payroll Accounting, Taxes, and register and employee earnings records. Continues with the Reports calculations for employer payroll taxes, the journal entries for payroll transactions, and payroll reports. 2 weeks Reinforcement Activity 2— Presents the whole accounting cycle for a merchandising Part A business organized as a corporation. 1 week Work Sheet for a Merchandising Begins the end-of-fiscal-period work by describing the work sheet Business and adjustments for merchandise inventory, supplies, prepaid expenses, uncollectible accounts, depreciation, and federal income tax. Methods used to estimate uncollectible accounts and depreciation adjustments, introduced in this chapter, are expanded in Part 3. 1 week Financial Statements for a Continues the end-of-fiscal-period work with the preparation of Corporation financial statements and introduces the statement of stockholders’ equity. 1 week Recording Adjusting and Completes the accounting cycle with the recording of adjusting Closing Entries for a and closing entries and the preparation of a post-closing trial Partnership balance. 2 weeks Reinforcement Activity 2— Completes the accounting cycle for a merchandising business Part B organized as a corporation. Part 3: Accounting for a Merchandising Business Organized as a Corporation—Adjustments and Valuation Part 3 presents the accounting cycle one more time, focusing on accounting procedures that result in additional end-of-fiscal-period adjustments. Accounting procedures for managing selected asset and liability accounts are introduced. The company illustrated is a merchandising business organized as a corporation. 1 week Accounting for Uncollectible Reviews the procedures for estimating uncollectible accounts Accounts Receivable 1 week Accounting for Plant Assets and Depreciation 1 week Accounting for Inventory 1 week Accounting for Notes and Interest Reinforcement Activity 3— Part A 2 weeks 1 week Accounting for Accrued Revenue and Expenses 1 week End-of-Fiscal-Period Work for a Corporation 2 weeks Reinforcement Activity 3— Part B introduced in Chapter 14. The writing off of uncollectible accounts is presented. Describes a full range of concepts and procedures related to accounting for and reporting plant assets. Straight-line depreciation, introduced in Chapter 14, is reviewed, and the double-declining balance method is presented. Disposal of plant assets is discussed, including the calculation and report of gains on losses on disposal. Focuses on merchandise inventory. Inventory is costed using the FIFO, LIFO, and weighted average methods. The gross profit method of estimating inventory is also presented. Presents a range of topics related to notes payable and notes receivable. Presents the whole accounting cycle for a merchandising business organized as a corporation including adjustments and valuations. Continues the discussion of notes payable and receivable, focusing on end-of-fiscal-period adjusting, closing, and reversing entries for accrued revenue and expenses. Presents the end-of-fiscal-period work for a merchandising business organized as a corporation. A work sheet and financial statements are prepared. Adjusting, closing, and reversing entries are prepared. Additional methods for analyzing financial statements are introduced. Completes the whole accounting cycle for a merchandising business organized as a corporation including adjustments and valuations.. Part 4: Additional Accounting Procedures Presents GiftPak, a business organized as a partnership, which sells gift baskets and boxes internationally through traditional and online sales. 1 week Accounting for Partnerships Covers forming and dissolving a partnership, as well as distributing the earnings of a partnership and preparing partnership financial statements. 1 week Recording International and Explains the challenges and accounting for international sales and Internet Sales how to record Internet sales. COURSE STRATEGIES Project-Based Curriculum. Project-based learning is a teaching and learning strategy that engages students in complex activities. It usually requires a cooperative learning group environment that focuses on a product or performance over several class periods. A project involves research, problem solving, synthesis and organizational skills. This way of teaching allows for incorporation of authentic assessments, higher order thinking skills, and experiences related to the student’s interests. In using authentic assessments, students will not be graded on an activity level, but on a project or performance level. Team Building/Peer Assessment. In a problem-based learning environment, team building plays a critical role. Students learn how to become a part of a successful team as they would in a working environment. The behaviors the students will learn are: pooling information and resources, sharing responsibility and leadership, building on the ideas of others, authentic communication skills and a level of trust and collaboration. Peer assessment promotes accountability, active participation and responsibility for individual learning. This is appropriate for group projects because team members are in the best position to judge the quality and effectiveness that each member has contributed to the project. Assessments will encourage reflection on what was learned and initiate great classroom discussions. This allows the teaching of positive communication skills. Authentic Assessment. Authentic assessment is an educational tool that guides the purposes of learning as well as evaluation. This allows clear criteria for students to self assess their work and the work of their peers. It provides the opportunity for revision and guides them in how to achieve the objectives. W hen given a clearly defined set of objectives, also known as a rubric, students themselves can be the source of feedback. Teachers will monitor students through checkpoints as the project progresses. Performance-Based Assessment. Performance assessments will be used to monitor student success as the curriculum builds from simple to more complex project-based curriculum. Students will be involved in the assessment model as the 36 weeks progress and will have the opportunity to excel based on their own decisions, their team decisions and their assessment decisions. TEACHER PREPARATION Teacher as Facilitator. Teachers are invited to empower students to become autonomous and be accountable for their own learning. A traditional way of teaching is “teacher-centered” where the teacher lectures and assigns readings and/or tasks. This type of teaching may not take into account individual learning styles. Project-based learning is “learner-centric”. In this model, teachers may introduce ideas and projects and students use the tools and resources available to them to find answers and complete projects. From the beginning, the students know the goals and base their learning by doing tasks that engage their minds. Students are encouraged to use critical thinking skills, teaming skills and “tools” that will increase reading, writing, and communications skills. ESSENTIAL ACADEMIC LEARNING REQUIREMENTS (EALRS): READING The student understands and uses different skills and strategies to read [1.0]. Build vocabulary through wide reading [1.3]. The student understands the meaning of what is read [2.0]. Demonstrate evidence of reading comprehension [2.1]. Expand comprehension by analyzing, interpreting, and synthesizing information and ideas in literary and informational text [2.3]. The student reads different materials for a variety of purposes [3.0]. Read to perform a task [3.2]. Read for career applications [3.3]. WRITING The student writes in a variety of forms for different audiences and purposes [2.0]. Writes for career applications [2.4]. COMMUNICATION The student uses listening and observation skills and strategies to gain understanding [1.0]. Uses listening and observation skills and strategies to focus attention and interpret information [1.1]. MATHEMATICS The student uses mathematics to define and solve problems [2.0]. Investigate situations [2.1]. Apply strategies to construct solutions [2.2]. The student uses mathematical reasoning [3.0]. Analyze information [3.1]. Make predictions, inferences, conjectures, and draw conclusions [3.2]. Verify results [3.3]. The student communicates knowledge and understanding in both everyday and mathematical language [4.0]. Gather information [4.1]. The student understands how mathematical ideas connect within mathematics, to other subject areas, and to real-life situations [5.0]. Relate mathematical concepts and procedures to other disciplines [5.2]. Relate mathematical concepts and procedures to real-world situations [5.3]. THINKING PROBLEM SOLVING SCHOOL AND WORK CONNECTION COLLEGE READINESS MATHEMATICS STANDARDS: ATTRIBUTES: Success in college depends on a student’s ability to respond to the challenges presented by new problems and new ideas. Demonstrates intellectual engagement. Takes responsibility for own learning. Perseveres when faced with time-consuming or complex tasks. Pays attention to detail. REASONING/PROBLEM-SOLVING: The student uses logical reasoning and mathematical knowledge to define and solve problems. [1.0] Analyze a situation and describe the problem(s) to be solved. [1.1] Formulate a plan for solving the problem. [1.2] Use logical reasoning and mathematical knowledge to obtain and justify correct solutions. [1.3] COMMUNICATION: The student can interpret and communicate mathematical knowledge and relationships in both mathematical and everyday language. [2.0] Summarize and interpret mathematical information which may be in oral or written formats. [2.1] Use symbols, diagrams, graphs, and words to clearly communicate mathematical ideas, reasoning, and their implications. [2.2] Produce mathematically valid oral, written, and/or symbolic arguments to support a position or conclusion, using both mathematical and everyday language. [2.3] CONNECTIONS: The student extends mathematical thinking across mathematical content areas, and to other disciplines and real life situations. [3.0] Use mathematical ideas and strategies to analyze relationships within mathematics and in other disciplines and real life situations. [3.1] Understand the importance of mathematics as a language. [3.2] Make connections by using multiple representations, e.g., analytic, numeric, and geometric. [3.3] Abstract mathematical models from word problems, geometric problems, and applications. [3.4] NUMBER SENSE: The student accurately describes and applies concepts and procedures related to real and complex numbers. [4.0] Understand the concept of real numbers. [4.1] Apply estimation strategies using real numbers. [4.3] Understand the concept of complex numbers and perform computations with complex numbers [4.4] PROBABILITY/STATISTICS: The student accurately describes and applies concepts and procedures from probability and statistics to analyze data. [6.0] Use empirical/experimental and theoretical probability to investigate, represent, solve, and interpret the solutions to problems involving uncertainty (probability) or counting techniques. [6.1] Develop informative tables, plots, and graphic displays to accurately represent and study data. [6.2] Develop and evaluate inferences and predictions that are based on data. [6.3] Create and evaluate the suitability of linear models for a data set. [6.4] FUNCTIONS: The student accurately describes and applies function concepts and procedures to understand mathematical relationships. [8.0] Recognize functional relationships presented in words, tables, graphs, and symbols. [8.1] CONTENT CAREER DEVELOPMENT FRAMEWORK: The technical core of Career Development will develop concepts related to career exploration, selection, and preparation integrated throughout the student's educational experiences. Students through this technical core standard will: Understand a variety of career options and how they are influenced by personal strengths, weaknesses, interests, and wants. Use a variety of career resources to learn about career opportunities. Use career planning skills. Use workplace readiness skills. ETHICAL RESPONSIBILITIES FRAMEWORK: The technical core of Ethical Responsibilities will develop an understanding of legal and ethical responsibilities and typically accepted practices, including expectations and the implications of practices on business systems. Students through this technical core standard will: Identify the laws and regulations that affect business. Understand ethical concepts as related to the business environment. LEADERSHIP FRAMEWORK: The mission of teaching Leadership will be to develop skills that empower students to assume and model responsible roles in family, community, and work. Identify appropriate leader characteristics and styles. Identify the purpose of various professional organizations. SAFETY AND SECURITY FRAMEWORK: The technical core of Safety and Security will develop an understanding of existing and potential hazards to customers and employees. Students will prevent injury or illness through safe work practices and follow health, safety, and security policies and procedures. Students through this technical core standard will: Know appropriate response to an emergency. Know basic security procedures and protocols. Know appropriate organizational and regulatory guidelines for area of work. Know how to reduce risks and hazards in the workplace. TEAMWORK FRAMEWORK: The technical core of Teamwork will develop active participation in a wide variety of work teams. Students will understand the various roles of team members and will interact effectively and sensitively with all team members. Students through this technical core standard will: Use a variety of team membership skills in different workplace settings. Understand how to work with team members from diverse backgrounds in the workplace. Know how to manage conflict within the workplace. DIVERSITY FRAMEWORK: The technical core of Diversity will develop an appreciation for and respectful interaction with diverse populations, the elimination of harassment, bias and stereotyping, and non-traditional training and employment opportunities. Students through this technical core standard will: Students demonstrate an appreciation for diversity of culture, ethnicity, physical capacity, age, and gender as societal strengths. Students respectfully interact with diverse populations in schools, communities, and workplaces. Students will recognize and support the elimination of harassment, bias, and stereotyping. COMPUTATION FRAMEWORK: The technical core of Computation will develop computation skills to apply to personal and business problems and operations. Students through this technical standard will: Use algebraic and geometric operations to solve problems. Use common international standards of measurement in solving problems. Analyze and interpret data using common statistical procedures, charts, and graphs. Use basic mathematical operations to solve problems. Understand basic concepts of banking and financial systems. ACCOUNTING FRAMEWORK: The mission of teaching Accounting will be to develop skills in preparation for the further study of accounting or for the application of basic accounting principles to entrepreneurial ventures or small business ownership. Students in the Business Cluster will: Understand and apply basic procedures in the accounting cycle. Understand and apply the accounting process according to generally accepted accounting principles. Assets. Liabilities. Owner’s Equity. Understand, prepare, interpret, and analyze financial statements. Apply appropriate accounting principles to various forms of ownership, payroll, and income taxation systems. Use automated accounting procedures to apply basic accounting principles. Research careers and apply skills needed for initial and continued employment in the accounting world. LEADERSHIP TRAITS/HABITS FOR EMPHASIS: Dependability (e.g., attendance, punctuality, tools, deadlines). Self-discipline (e.g., correct technique, working with distractions, paying attention, respect for equipment). Following oral instructions. Following written instructions. Problem-solving techniques. GRADING SCALE: GRADE A+ A AB+ B BC+ C CD+ D DF (Attempted) F (Not done) POINTS 12.0 11.4 10.9 10.7 10.2 9.7 9.5 9.0 8.5 8.3 7.8 7.3 3.6 0 PERCENT 98 - 100 92 - 97 90 - 91 88 - 89 82 - 87 80 - 81 78 - 79 72 - 77 70 - 71 68 - 69 62 - 67 60 - 61 0 - 59 0 GRADE SUMMARY: Based on total points: Leadership Study Guides Chapter Problems Chapter Tests Reinforcement Activities/Tests Unit Objective Tests Unit Problem Tests CLASSROOM RULES: No eating or drinking in the classroom. Be in class before the bell rings. CHS attendance policies will be followed. Cheating—1st offense=failure on assignment, parents notified 2nd offense=referral to administration Note: All students involved will receive the same consequence(s) If you are absent, it is your responsibility to find out what you missed. You are allowed the number of days absent (ex.) plus one (+1) to turn in the missed work—work not turned in by the deadline may receive a 0. Quizzes and tests are open book; notes are allowed. RESOURCES: Text: C21 Accounting 9E, Multicolumn Journal, Chapters 1-24 Web: www.c21accounting.com Online Workbook: www.aplia.com FBLA Event Prep Web: winningedge.swlearning.com