Blanchard4e_IM_Ch19

advertisement

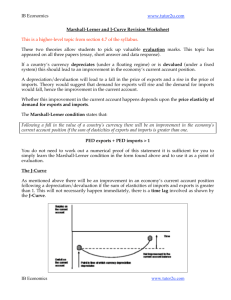

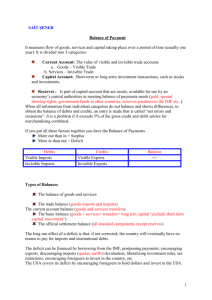

CHAPTER 19. THE GOODS MARKET IN AN OPEN ECONOMY I. MOTIVATING QUESTION How Is Output Determined in the Short Run in an Open Economy? As in a closed economy, output is determined by goods market equilibrium, the condition that goods supply equals goods demand. In the open economy, however, goods demand includes net exports. II. WHY THE ANSWER MATTERS The full treatment of short-run equilibrium in an open economy requires several steps. This chapter integrates openness in the goods market into the Keynesian cross model. To consider the goods market in isolation from financial markets, the chapter assumes that the interest rate is fixed and considers the real exchange rate a policy variable. Chapter 20 integrates openness in asset markets into money market equilibrium, then combines goods and financial market equilibrium into an open economy IS-LM model. III. KEY TOOLS, CONCEPTS, AND ASSUMPTIONS 1. Tools and Concepts i. The chapter introduces an open economy Keynesian cross by adding net exports to the demand for domestic goods. ii. The Marshall-Lerner condition ensures that a real depreciation will improve the trade balance. The condition, derived in an appendix, requires that the proportional change in relative prices (the proportional real depreciation) lead to a greater than proportional increase in relative quantities (the sum of the proportional increase in exports and the proportional decrease in imports). iii. The J-curve describes the dynamics of trade balance adjustment after a real depreciation. Initially, the trade balance falls, since the real depreciation tends to increase the relative value of imports. Over time, however, consumers and firms start buying more home goods and fewer foreign goods (since real depreciation makes home goods cheaper), and the trade balance improves. 2. Assumptions The chapter considers the short-run goods market in isolation from financial markets, so it assumes that the interest rate is fixed and that the real exchange rate is a policy variable. In keeping with the analysis of Chapter 20, as well as the closed economy IS-LM analysis, a more precise way to state these assumptions is that the home and foreign price levels are fixed, and the nominal exchange rate is a policy variable. Since the price levels are fixed, the nominal exchange rate determines the real exchange rate. In addition, production is assumed to respond one-for-one to changes in demand without changes in price (the AS curve is horizontal at the initial price), so demand determines output. 90 IV. SUMMARY OF THE MATERIAL 1. The IS Relation in an Open Economy When the economy is open to trade in goods, it becomes important to distinguish the domestic demand for goods, given by C+I+G, from the demand for domestic goods, denoted by Z and given by Z=C+I+G-IM/+X. (19.1) The domestic demand for goods is specified as in Chapter 5, i.e., C(Y-T)+I(Y,r)+G. Real exports (X) and real imports (IM/ε) (measured in units of the foreign good) are given by: X=X(Y*,). + - (19.2) IM=IM(Y,). + + (19.3) Exports increase when foreign income (Y*) increases, since foreigners have more to spend, and when there is a real depreciation (an decrease in ), since home goods become less expensive relative to foreign goods. Imports increase when home income increases, since home residents have more to spend, and when there is a real appreciation, since foreign goods become less expensive relative to home goods. Substituting equations (19.2) and (19.3) into the demand for domestic goods produces a new IS relation: Y=C(Y-T)+I(Y,r)+G-IM(Y,)/ +X(Y*,). (19.4) Note that real imports are divided by the real exchange rate to convert them into units of the home good. Figure 19.1 displays graphically the effect of introducing net exports into the Keynesian cross model. The domestic demand for goods is denoted DD. To derive the demand for domestic goods, first shift the DD curve down by the value of imports (IM/). The new curve, denoted AA, is flatter than DD, because the value of imports increases with income. Now add exports to the AA curve to arrive at the demand for domestic goods (ZZ). Note that exports are independent of income, so the vertical distance between ZZ and AA is constant and the two curves have the same slope. The gap between the curves DD and ZZ is by construction the trade balance (sometimes called net exports (NX)), depicted in the lower panel in Figure 19.1. Since the value of imports increases with income, the trade balance decreases with income. Note that Figure 19.1 assumes that the real exchange rate is fixed. 2. Equilibrium Output and the Trade Balance Equilibrium in the goods market requires that the demand for domestic goods equals the production of domestic goods, namely that Y=Z. Since this chapter concentrates on the short run, it assumes that production responds one-for-one to changes in demand (without changes in the average price level). Graphically, equilibrium is determined by the intersection of the ZZ curve and the 45°-line (Figure 19.2). In general, equilibrium does not require balanced trade. Figure 19.2 depicts an equilibrium with a trade deficit. 91 Figure 19.1: The Demand for Domestic Goods and the Trade Balance (NX) 3. Increases in Demand, Domestic or Foreign When domestic demand increases (e.g., G increases, T decreases, or consumer confidence increases), the ZZ curve shifts up, so output increases and the trade surplus falls. When foreign demand (Y*) increases, the ZZ and NX curves shift up by the same amount. Output and the trade surplus increase. The increase in imports that arises from the increase in home output does not entirely offset the positive effect on exports from the increase in foreign demand. Note that increases in domestic demand have a smaller effect on output in the open economy than in the closed economy, because some of the increased income leaksout of the domestic economy through spending on imports. In other words, the multiplier is smaller in an open economy. A box in the text carries this analysis further and notes that smaller countries are likely to have larger marginal propensities to import out of income. As a result, fiscal policy will have a smaller effect on output in a smaller economy, but a greater effect on the trade balance. The relationship between foreign and home output suggests that policy coordination can be important when industrial countries as a group are operating below normal levels of output. Governments typically do not like to run trade deficits, because deficits require borrowing from the rest of the world. In the absence of coordinated action, an expansionary policy by an individual country in the midst of a worldwide recession will likely generate a trade deficit (or at least worsen the trade balance), because the increase in income will increase imports. Coordinated expansions will tend to have less effect on trade balances in individual countries, because imports 92 will increase more or less proportionately in all countries. On the other hand, coordinated expansions may be difficult to arrange. Countries that have budget deficits may be unwilling to consider expansionary fiscal policy. In addition, once an agreement has been negotiated, each country has an incentive to renege, thereby hoping to benefit from expansions abroad and to improve its trade balance. Figure 19.2: Equilibrium Output and the Trade Balance (NX) 4. Depreciation, the Trade Balance, and Output The trade balance (NX) is given by NX=X(Y*,) - IM(Y,)/. (19.5) A real depreciation has two effects: a quantity effect (an increase in exports and a reduction in imports), which tends to increase the trade balance, and a price effect (an increase in the relative price of imports), which tends to reduce the trade balance. The net effect will be positive if the Marshall-Lerner condition (derived in an appendix) is satisfied. If so, a real depreciation will improve the trade balance and increase output. With some qualifications, the Marshall-Lerner condition is usually satisfied in practice, and the text assumes that a real depreciation will improve the trade balance. If the government can affect the real exchange rate through policy, then it can use two policy instruments (fiscal policy and the real exchange rate) to achieve two policy targets (output and the trade balance). For example, suppose a country in recession had a trade deficit, and policymakers wished to achieve a specific, higher level of output and balanced trade. Expansionary fiscal policy would increase output, but would also worsen the trade 93 deficit. A real depreciation would increase output and improve the trade deficit, but there is no guarantee that it could achieve the output target under balanced trade. To achieve both targets, policymakers would need a policy mix. First, they would engineer a real depreciation sufficient to balance trade at the target output level. Then, they would use fiscal policy to ensure that the economy achieved the target output level. If output would be higher than desired after the real depreciation, policymakers would use contractionary fiscal policy; if output would be lower than desired, they would use expansionary fiscal policy. The text includes a table that summarizes other policy mixes under alternative initial conditions for output and the trade balance. 5. Looking at Dynamics: the J-Curve Real depreciations have a dynamic dimension. The price effect happens immediately, but the quantity effects take time. As a result, the trade balance tends to worsen immediately after a real depreciation, but to improve over time. In other words, it takes some time for the Marshall-Lerner condition to be satisfied. This adjustment process of the trade balance—a temporary fall followed by a gradual improvement—is called the J-curve. Econometric evidence suggests that in rich countries, the trade balance improves between six months and a year after a real depreciation. 6. Saving, Investment, and Trade Deficits The national income identity (equation (19.1)) can be expressed as NX=Y-C-I-G=(S-I)+(T-G), (19.6) where private saving (S) is given by S=Y-C-T. The first equality in equation (19.6) illustrates that the trade balance equals income minus spending. The second equality of equation (19.6) illustrates that the trade balance is the excess of private savings over investment plus the government budget surplus. Ignoring the distinction between the current account and the trade balance, a trade surplus implies that a country is lending to the rest of the world. The funds for this lending are derived from the two sources on the RHS of equation (19.6). Since saving and investment are endogenous, equation (19.6) can be a misleading guide for policy analysis. For example, one might conclude from (19.6) that a real depreciation has no effect on the trade balance, because the real exchange rate does not appear. In fact, a real depreciation affects saving and investment, because it affects output. If the Marshall-Lerner condition is satisfied, a real depreciation will increase saving more than it increases investment, and improve the trade balance. V. PEDAGOGY The open economy saving-investment balance (equation (19.6)) is presented at the end of the chapter. There are two arguments for placing it at the beginning. First, the derivation of equation (19.6) illustrates that the trade balance is the difference between income and spending, an intuition that may not be sufficiently emphasized in Chapter 18. Second, by discussing equation (19.6) before the policy experiments, instructors can include the effects on saving and investment in the discussion of fiscal and exchange rate policy. This approach will reinforce the notion that saving and investment are endogenous and that the government surplus is not the only determinant of the trade balance. To illustrate the latter point, note that the U.S. federal budget deficit declined over the 1990s, but the trade deficit reached record levels. 94 VI. EXTENSIONS The discussion of policy coordination in the text could be formalized. Suppose the world economy consists of two countries, home and foreign. The goods-market equilibrium conditions for the two countries can be written as Y=aY+F-qY+q*Y* (19.7) Y*=a*Y*+F*-q*Y*+qY (19.8) where a and a* are the home and foreign marginal propensities to spend out of income, q and q* are the marginal propensities to spend on imports, and F and F* denote autonomous expenditure. Home imports, given by qY, equal foreign exports, and home exports equal foreign imports. Assume that initially F=F*, and the countries are perfectly symmetric, so that Y=Y*. The initial equilibrium is point A in Figure 19.3. Figure 19.3: Coordinated Versus Uncoordinated Policies Suppose that point A represents desired or normal output levels for the two countries. Now assume that F and F* fall by the same amount, reducing output by the same amount in each country, and moving the equilibrium to point B. Note that the trade balance remains at zero for both countries. If the countries coordinate policy, and increase F and F* by the same amounts, the original equilibrium will be restored. On the other hand, if the home country increases F, but the foreign country does not, the new equilibrium will be at point C. Both Y and Y* will increase, but since point C is above the 45°-line, Y will increase by more, implying that home imports will 95 increase more than foreign imports, and the home country will run a trade deficit. In this case, the foreign country will have an increase in output without doing anything, and its trade balance will improve. Thus, there is some incentive for each country to let the other country undertake the burden of adjustment. VII. OBSERVATIONS Real imports (IM) are measured in units of foreign goods. To revisit the example from Chapter 19, suppose the United States is the home country and produces only one good, airplanes, and Japan is the foreign country and produces only one good, cars. The real exchange rate is in units of cars/airplane: =EP/P*=(yen/dollar)(dollars/airplane)/(yen/car)=cars/airplane. Since IM is measured in units of cars, IM/ is measured in units of airplanes, the home good. Thus, IM/ is a proper measure of imports to include in the home real GDP equation, which measures all quantities in units of the home good. In a multi-good world, the same analysis applies, with “home production baskets” replacing “airplanes” and “foreign production baskets” replacing “cars.” 96