BISKCPEasy Weekly Tax Update With E. Lynn Nichols, CPA March

advertisement

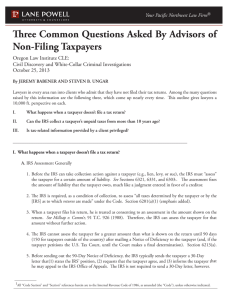

BISKCPEasy Weekly Tax Update With E. Lynn Nichols, CPA March 9, 2015 CITATIONS 1. American Opportunity Tax Credit May Be Refundable In Some Cases In e-mailed advice, the IRS explained when part of the section 25A(i) American opportunity tax credit would be refundable if the taxpayer claiming the credit is the student who incurred the expenses. (ECC 201509030: 2/27/2015) 2. Re-adoption Not Required to Claim Adoption Tax Credit In e-mailed advice, the IRS advised that although Rev. Proc. 2005-31 allows a taxpayer to choose the year of finality of an adoption if a foreign-country adoption is followed by a readoption in the United States, a re-adoption is not required to claim the adoption tax credit. (ECC 201509037; 2/27/2015) 3. Property Fails to Qualify for Petroleum Outlet Depreciation In a legal memorandum, the IRS concluded that retail motor fuel outlets are nonresidential real property with a 39-year recovery period for purposes of section 168(a) because less than 50 percent of revenue and floor space are devoted to petroleum sales. (ILM 201509029; 2/27/2015) 4. Estimated Tax Penalty Relief Provided to Some Farmers, Fishermen The IRS has announced that farmers and fishermen who miss this year's March 2 tax deadline because they are receiving corrected premium tax credit forms from the health insurance marketplace will have until April 15, 2015, to file their 2014 tax returns and pay any tax due. (IR-2015-36; 2/27/2015) 5. Marijuana Business Petitions Tax Court for Penalty Abatement A licensed medical marijuana business in Colorado petitioned the Tax Court for a redetermination and abatement of failure to deposit penalties, arguing that it was unable to comply with the electronic tax payment requirement because the nature of its business prevented it from obtaining a bank account. (Allgreens LLC v. Commissioner; United States Tax Court; No. 28012-14; 11/24/2014) IRS Responds to Marijuana Business's Challenge to Penalties The IRS filed its response to a medical marijuana business's Tax Court petition seeking an abatement of failure to deposit penalties, admitting that an IRS settlement officer determined that the business was making every effort to comply with the law but still denied an abatement request. (Allgreens LLC v. Commissioner; United States Tax Court; No. 28012-14; 1/29/2015) 1 6. 1099-C Issued Six Years Too Late – Taxpayer Does Not Have COD Income The Tax Court, in a summary opinion, held that an individual didn't have COD income in 2007, finding that a Form 1099-C the Federal Emergency Management Agency issued to her in that year was in error because the debt she owed FEMA had been extinguished in 2001 when the statute of limitations for a government claim against her expired. (Suzanne Moore Bacon; T.C. Summ. Op. 2015-15; 3/2/2015) 7. Taxpayers Can Claim EITC Using Later Acquired SSN At the request of Senate Finance Committee member Chuck Grassley, R-Iowa, the IRS reviewed the relevant statutes and found that a chief counsel advice allowing a taxpayer to claim the EITC for a tax year using a Social Security number acquired in a later year is correct, Commissioner John Koskinen said in a February 25th letter (2/25/2015) 8. No Spousal Relief for Deficiency Related to Her Schedule C The Tax Court, in a summary opinion, held that an individual wasn't entitled to innocent spouse relief from a joint tax liability with her former husband, finding that she had actual knowledge of the items that gave rise to the deficiency and because the disallowed deductions that resulted in the deficiency were for her food truck business. (Sandra L. Panetta ; T.C. Summ. Op. 2015-16; 3/2/2015) 9. Tax Injunction Act (TIA) Does Not Bar Suit on Colorado's Use Tax Law The Supreme Court unanimously held that the federal Tax Injunction Act does not bar a suit to enjoin enforcement of Colorado's sales and use tax reporting statute, reversing the Tenth Circuit's decision. (Direct Marketing Ass'n v. Brohl; United States Supreme Court; No. 13-1032; 3/3/2015) 10. Publication on Tax-Exempt Status for Organizations The IRS has released Publication 557 (rev. Feb. 2015), Tax-Exempt Status for Your Organization, explaining rules and procedures for organizations to obtain recognition of exemption from federal income tax under section 501(a) and discusses the procedures to obtain an appropriate ruling or determination letter recognizing the exemption. (Publication 557; 2/27/2015) 11. Proposed Consolidated Return Regs Revise Next-Day Rule The IRS has issued proposed regulations that revise the rules for reporting some items of income and deduction that are reportable on the day a corporation joins or leaves a consolidated group. (REG-100400-14/ 3/6/2015) 12. Taxpayer Cannot Recharacterize Transactions to Avoid Audit Adjustment A U.S. district court refused to alter or amend its prior opinion that denied a couple a tax refund and held them liable for a late-filing penalty, finding that they could not recharacterize a transaction to obtain more favorable tax treatment and they failed to provide reasonable cause for the late filing of their return. (Estate of Harold Stuller ; USDC C IL; No. 3:11-cv-03080; 3/4/2015) 2