Audit Reconsideration

advertisement

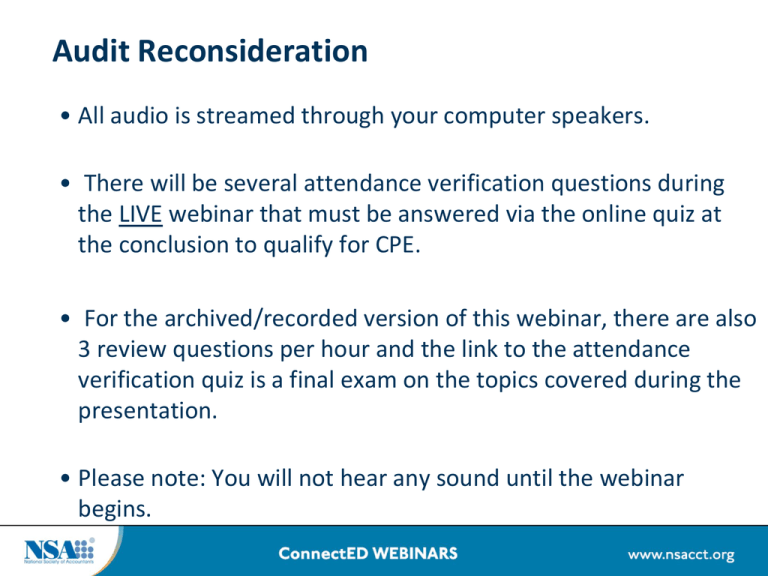

Audit Reconsideration • All audio is streamed through your computer speakers. • There will be several attendance verification questions during the LIVE webinar that must be answered via the online quiz at the conclusion to qualify for CPE. • For the archived/recorded version of this webinar, there are also 3 review questions per hour and the link to the attendance verification quiz is a final exam on the topics covered during the presentation. • Please note: You will not hear any sound until the webinar begins. Audit Reconsideration Presenter(s): Robert E. McKenzie ©2013 Arnstein & Lehr LLP 312.876.6927 Date: June 3, 2014 Time: 2:00-4:00PM Eastern Learning Objectives Upon completion of this webinar you will be able to: · Define audit reconsideration · Recognize problems created by correspondence exams · Identify problems created by taxpayers who get correspondence notices · List reasons for an audit reconsideration request · Advise your clients on when and when not to request audit reconsideration · List exam rules · Prepare audit reconsideration requests · Identify reasons for non-acceptance of requests · Identify options if a request is denied Problems Created by Correspondence Exams • IRS correspondence exams create many improper assessments • Even when taxpayer properly responds IRS often loses documentation Problems Created by Your Client • Failure to respond to IRS notices • Ignores correspondence notices • Failure to attend office exam • Failure to respond to a request for a field exam • Failure to provide adequate documentation • Bad attitude at an office exam or field exam Client Fails to File • IRS assesses a Substitute for Return (SFR) Table 14. Information Reporting Program, Fiscal Year 2013 Item Number or amount Number of information returns received (thousands) : Total Paper Electronic Other Automated Underreporter Program : Number of contacts (closed cases, thousands) Amount of additional assessments (thousands of dollars) Number of full-time equivalent positions Automated Substitute for Return Program : Number of contacts (closed cases, thousands) Amount of additional assessments (thousands of dollars Number of full-time equivalent positions 2,085,295 36,515 1,829,565 219,215 4,116 7,731,603 2,035 589 3,159,585 155 Audit Reconsideration (Overview) • • • • • • • Definition Discretionary Taxpayer perspective Practitioner perspective IRS perspective When should reconsideration be considered When should reconsideration not be considered • Use of the Taxpayer Advocate Service (TAS) • Ways of Making a Request for Audit Reconsideration • Documentation and Substantiation Review Questions for Self Study CPE: Now’s the time to answer the review questions 1-3. Click here: http://www.proprofs.com/quiz-school/story.php?title=NzI1NjU451ZU *Please leave quiz window open and wait to submit until prompted to complete questions 4-6. Once all questions are complete submit and close quiz window. AUR Problems • The IRS Does Not Always Answer the Phone <70% • The IRS Does Not Always Timely Respond by Mail IRS was late in responding to math error submissions about 40% of the time. • Many Assessments Not Collected IRS actually collected less than ten percent of the ASFR assessments from FY 2006 through FY 2011. IRS abates or reports as currently not collectible a significant %. • When should reconsideration be considered Definition • An Audit Reconsideration is the process the IRS uses to reevaluate the results of a prior audit where additional tax was assessed and remains unpaid, or a tax credit was reversed. If the taxpayer disagrees with the original determination he/she must provide information that was not previously considered during the original examination. It is also the process the IRS uses when the taxpayer contests a Substitute for Return (SFR) determination by filing an original delinquent return. Discretionary Note: Audit Reconsideration is a discretionary service provided by the IRS; it is not a matter of taxpayer right Taxpayer Probably Caused Problem • • • • Ignored IRS notices Failed to respond to correspondence exam Failed to appear at office audit Ignored 90 day letter Taxpayer Perspective (A last hope!) • Common Situation: Taxpayer has received many notices from the IRS, but has not responded: • Client does not appear for an audit, or • Client does not file an original return and the IRS prepares a substitute for return (SFR) under §6020(b) • Consequence: Client has an unpaid deficiency, and applicable statutory and administrative rights have expired • Opportunity: Taxpayer may present new information and argue the merits of the case Practitioner Perspective (Not an everyday practice tool) • Audit reconsideration is a process not well known or used in everyday tax controversy practice • Audit reconsideration is a process not well known or discussed in academic circles Most textbooks dedicate less than a page to the topic Reconsideration is not a topic of choice for law review or practitioner journals When Should Reconsideration Not Be Considered A request for reconsideration will not be considered if: – The assessment was made as a result of a closing agreement, or – The assessment was made as a result of final TEFRA administrative proceedings, or – The assessment was made as a result of the taxpayer entering into an agreement on Form 870-AD, “Offer to Waive Restrictions on Assessment and Collection of Tax Deficiency and to Accept Overassessment,” or – The United States Tax Court has entered a decision that has become final, or a district court or the United States Court of Federal Claims has rendered a judgment on the merits which has become final. Audit Reconsiderations: Collection Rules • To reevaluate the results of a prior audit when a taxpayer disagrees with the original determination by providing information that was not previously considered during the original examination • When the taxpayer contests an ASFR/SFR determination by filing an original delinquent return and the assessment remains unpaid or, as a result of the assessment, the tax credit is reversed. Reasons for Reconsideration • • • • • Did not appear for the audit; Moved and did not receive the IRS correspondence; Disagrees with an assessment from an audit of their return and has additional information to be considered; Disagrees with an assessment created under the authority of Internal Revenue Code 6020 (b) (ASFR/SFR); Has been denied tax credits such as EITC claimed, during a prior examination. Preparing Request • Must be in writing • Publication 3598 If Taxpayer Filed a Return • • • Written request or amended return which identifies the prior examination issue(s) and the reason for the abatement request; Attach examination report Form 4549, Income Tax Examination Changes or Form 1902-B, Report of Individual Tax Examination Changes. If he does not have a copy must explain why; Attach documents supporting their position. If TP Never Filed a Return: SFR • • Prepare a proper return Substantiation sufficient to allow the Service to consider abatement of the previous assessment. Preparing Request • Must be in writing • Publication 3598 Exam Rules • • • • Except for SFR’s taxpayer must have filed a tax return. The assessment remains unpaid or the Service has reversed tax credits that the taxpayer is disputing. The taxpayer must know which adjustments they are disputing. The Taxpayer must provide additional information not considered during the original examination [IRM 4.13.1.4 ] Non-acceptance • • • The taxpayer has already been afforded a reconsideration request and did not provide any additional information with his current request that would change the audit results. The assessment was made as a result of a closing agreement entered into under IRC section 7121, using Form 906 and "Closing Agreements on Final Determination Covering Specific Matters" or Form 866 "Agreement as to Final Determination of Tax Liability" , or some combination of the two forms. The assessment was made as a result of a compromise under IRC Section 7122. These agreements are final and conclusive. Identify a final compromise determination on IDRS by the posting of a TC 788. Non-acceptance • The assessment was made as the result of final TEFRA administrative proceedings. • The assessment was made as a result of the taxpayer entering into an agreement on Form 870-AD, "Offer of Waiver of Restrictions on Assessment and Collection of Deficiency in Tax". • The United States Tax Court has entered a decision that has become final, or a district court or the United States Court of Federal Claims has rendered a judgment on the merits that has become final. Options if Denied • TAS • Pay and file an amended return – If denied may sue IRS U. S. District Court or Court of Clams • Bankruptcy Use of the Taxpayer Advocate Service • Hardship Cases • Client is about to suffer a significant hardship • Client experienced a delay of more than 30 days to resolve their case • Client has not received a response by the date promised • Due to an IRS system failure, your client was unable to resolve their problem TAS Perspective (One of the many tools used to resolve cases) • Used to resolve underlying tax discrepancies often noted in TAS collection cases • Can achieve the same result as a Doubt to Liability filing without the $150 filing fee and the required compliance for the next five years Review Questions for Self Study CPE: Now’s the time to answer the review questions 4-6. Click here: http://www.proprofs.com/quiz-school/story.php?title=NzI1NjU451ZU *Once all questions are complete please submit and close quiz window. Thank you for participating in this webinar. Below is the link to the online survey and CPE quiz: http://webinars.nsacct.org/postevent.php?id=13327 Use your password for this webinar that is in your email confirmation. You must complete this survey and the quiz or final exam (for the recorded version) to qualify to receive CPE credit. National Society of Accountants 1010 North Fairfax Street Alexandria, VA 22314-1574 Phone: (800) 966-6679 members@nsacct.org