LIKE-KIND EXCHANGES

advertisement

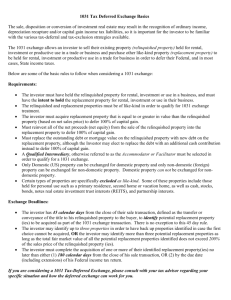

1031 Like-Kind Exchange Overview: What Attorneys Need to Know! April 22, 2015 By Gregory M. Johnson, CPA, Attorney-at-Law MartinWren, P.C. 400 Locust Avenue, Suite 1 Charlottesville, VA 22902 Telephone (434) 817-3100 Facsimile (434) 817-3110 e-mail: gjohnson@martinwrenlaw.com website: www.martinwrenlaw.com © MartinWren, P.C. 2015 1 Chapter I Background The federal government has afforded like-kind exchanges preferential treatment as far back as the Revenue Act of 1921. The historical reasons for requiring nonrecognition of either the gain or loss from an exchange which qualifies as a like-kind exchange under the federal tax laws have included the following: 1. Congress’s desire not to impose a tax on theoretical or paper gains where a taxpayer has (a) not cashed in on the taxpayer’s investment and (b) continued the taxpayer’s investment in “like-kind property”; and 2. Recognition of the administrative burden required to detect and evaluate countless barters and swaps consummated each year (not a reason now as taxpayers are now required to report all like-kind exchanges on their federal income tax returns on Form 8824. The simple and straightforward two-party simultaneous exchanges envisioned in 1921 are somewhat rare today, at least in the real estate world which is subject of this handbook. Today, the typical like-kind exchange involves four parties, namely the (a) Exchangor, (b) Intermediary, (c) buyer of the property the Exchangor is relinquishing in the exchange (“Relinquished Property”) and (d) the seller of the property the Exchangor is acquiring in the exchange (“Replacement Property”). As you would expect, the tax rules governing like-kind exchanges have evolved over time to a point where buried in even the simplest of exchanges are traps for the unwary. The current version of Section 1031 of the Internal Revenue Code of 1986 provides for the deferral, not the exclusion, of the recognition of the gain (and any resulting federal income tax thereon) or loss realized on qualifying exchanges of the following types: 1. 2. 3. 4. Multi-party simultaneous exchanges, Deferred or Starker exchanges, Reverse-Starker exchanges and Build-to-suit exchanges. The objective of this handbook is teach attorneys the basic rules governing likekind exchanges and the issues to be addressed as their real estate clients navigate the exchange process, beginning prior to the client’s purchase of the real estate all the way through to its ultimate sale or other disposition. Hopefully the readers of this handbook will find it helpful and will use it as a resource on a regular basis. Personal property exchanges will only be discussed to the extent that they may be a part of a real estate exchange. © MartinWren, P.C. 2015 2 All initially capitalized terms not defined somewhere else in this handbook will be defined in Appendix B. Chapter II What Attorneys Need to Know About Like-Kind Exchanges 1. What is a like-kind exchange and what are the consequences of doing a like-kind exchange? A like-kind exchange is the disposition of qualifying property, (“Relinquished Property”), and the acquisition of qualifying property, (“Replacement Property”), in (a) contractually interdependent transactions; or (b) as part of an integrated plan. They are commonly referred to as like-kind exchanges, section 1031 exchanges or tax deferred exchanges, all of which mean one and the same thing. a. The Law According to Congress. Section 1031(a) of the Code states that: [n]o gain or loss shall be recognized on the exchange of property held for productive use in a trade or business or for investment if such property is exchanged solely for property of like kind which is to be held either for productive use in a trade or business or for investment. To fully understand the requirements and tax consequences of a like-kind exchange under Section 1031 of the Code, one must dissect this Code section completely as each word has its own legal significance. b. Tax Deferral Under Section 1031 is Mandatory, not Optional. If the requirements of Section 1031 of the Code are met, deferral of the recognition of the gain (and the payment of the tax thereon), or loss, realized from the sale of the Relinquished Property is mandatory, not optional. The fact that the application of Section 1031 is mandatory, not optional, means that the advance tax planning discussed in detail elsewhere in this handbook will typically be necessary to ensure that the transaction falls under its requirements if the deferral of the recognition of the resulting gain or loss is in the taxpayer’s best interests. c. Section 1031 Provides for Deferral of Gain and Loss, not Exclusion from Income. It is a misnomer to call Section 1031 exchanges “tax-free”. The recognition of the gain or loss from the sale of the Relinquished Property is generally deferred until the Replacement Property is disposed of in a currently taxable transaction. As will be discussed in more detail in Sections 6.h. and i. below, it is, however, possible to permanently avoid recognizing that gain or loss. d. Don’t Touch that Money from the Sale of the Relinquished Property! Under Section 1031, the transaction must be structured as an “exchange.” Contrary to what many people believe, if a taxpayer closes on the sale of real estate and the taxpayer or the taxpayer’s agent receives the proceeds from that sale, the taxpayer © MartinWren, P.C. 2015 3 cannot then decide to purchase other real estate as part of a like-kind exchange under Section 1031 of the Code. Simply put, the Exchangor must take steps prior to the closing on the sale of the Relinquished Property to properly structure that transaction as an exchange so that the taxpayer or his agent does not receive (actually or constructively) the sales proceeds and to otherwise satisfy the requirements of Section 1031 of the Code. e. What Property is Considered “Like-Kind”? For real estate exchanges, the definition of “like-kind” is actually quite broad and satisfying the “likekind” requirement is usually relatively easy. “Qualifying Property” may include (i) raw land, commercial rental property, residential rental property, farm land and outbuildings and other commercial buildings and land, (ii) long term leases with a remaining life of over 30 years in property described in e.(i) and (iii) tenants in common interests in property described in e.(i). For example, you can satisfy the like-kind requirement by exchanging raw land for and apartment building or farm land for residential rental property so long as the other requirements of Section 1031 are met. However, as will be discussed below in Section 2.b.ii. in more detail, both the Relinquished Property and the Replacement Property must be held by the Exchangor either for (a) investment purposes or (b) productive use in a trade or business. For example, the Exchangor’s principal residence would not be qualifying property in a like-kind exchange because it is not considered held by the taxpayer for investment purposes or in a trade or business. But, keep in mind, there are ways to convert the use of the principal residence to or from investment purposes or in a trade or business that will be discussed below. f. Certain Agreements and other Documents Must be Signed Before the Closing on the Sale of the Relinquished Property. Prior to the closing on the sale of the Relinquished Property in a forward or Starker exchange, the Exchangor, with the help of his or her advisors, will have to either (a) initiate contractually interdependent transactions or (b) adopt an integrated plan in order to accomplish a like-kind exchange. These requirements are typically satisfied through the execution at or before closing of agreements between the Exchangor, on the one hand, and a qualified intermediary, escrow agent, exchange accommodation titleholder and/or Seller of Replacement Property, on the other hand, which spell out in some detail the specific terms of the exchange. Conversely, if the Exchangor wishes to acquire the Replacement Property before the Exchangor disposes of the Relinquished Property (this is generally known as a reverse-Starker Exchange), the Exchangor must not only (a) initiate contractually interdependent transactions or (b) adopt an integrated plan, but must also arrange for the legal title to the Replacement Property to be conveyed to some unrelated third-party, generally known as an Exchange Accommodation Titleholder or EAT, by the seller thereof until the Exchangor disposes of the Relinquished Property, meaning that steps must be taken by the Exchangor prior to the closing on the purchase of the Replacement Property to accomplish a like-kind exchange. g. Are not Just Exchanging Equity. In a like-kind exchange, in order to defer the entire gain and the payment of the income taxes on the entire gain, the Exchangor must generally receive Replacement Property, the fair market value of which equals or exceeds the net sales price (total sales price less customary closing costs, which © MartinWren, P.C. 2015 4 include attorneys’ fees, realtor’s commissions, grantor’s tax, and termite inspection, to name a few, but do not include the mortgage to be paid off at closing) of the Relinquished Property. Note that the Exchangor still has the opportunity to defer a portion of the gain even if the fair market value of the Replacement Property is less than the net sales price of the Relinquished Property but generally only if the cost of the Replacement Property exceeds the Exchangor’s basis in the Relinquished Property. h. Receipt by Exchangor of Cash or other Non-Qualifying Property May Mean There Are Taxes to Pay. If the Exchangor receives cash or other nonqualifying property on the sale of the Relinquished Property, the Exchangor will have to recognize gain on that sale to the extent of the cash or non-qualifying property received in the exchange. Cash received from the sale of the Relinquished Property may apparently not be netted against the cash paid by the Exchangor for the purchase of the Replacement Property from sources other than the exchange funds. Treas. Regs. §1.1031(k)-1(j)(3), Example 2. Mortgages on the Relinquished Property can generally be netted against mortgages on the Replacement Property. For example, if the Exchangor disposes of a Relinquished Property, which has a basis of $50,000 and a mortgage of $25,000, for a net sales price of $100,000 and receives Replacement Property with a cost of $75,000 in an otherwise qualifying like-kind exchange, then the Exchangor will have a realized gain of $50,000 (net sales price of $100,000 minus basis of $50,000), but, in the year of the sale of the Relinquished Property will only have to recognize $25,000 of that gain and pay the taxes due thereon. i. Held for Productive Use in a Trade or Business or for Investment. Both the Relinquished Property and the Replacement Property must be (A) “Held for Productive Use in a Trade or Business” or (B) “Held for Investment”. Any of these properties which would be considered Dealer Property, Property Held Primarily for Sale or property held for personal use in the hands of the Exchangor at the time of the exchange would not qualify for a like-kind exchange. See the definitions of “Dealer Property”, “Held for Productive Use in Trade or Business”, “Held for Investment” and “Other Property Held Primarily for Sale” in Appendix B for a discussion of the factors to be considered in making this analysis 2. When and why to do an exchange? The Exchangor should consider the following tax and non-tax factors in deciding whether to do a like-kind exchange: a. The magnitude of the federal and state income taxes to be deferred as a result of the built-in capital gains and ordinary income. By structuring a transaction as a like-kind exchange and not a sale, the Exchangor can, subject to some exceptions, defer the recognition of the gain resulting from the sale of the Relinquished Property. If the Exchangor never sells the Replacement Property and holds the Replacement Property at his death, the heirs to or devisees of that property can, under current tax laws, receive a step-up in basis to the property’s then fair market value and, consequently, avoid the capital gains tax altogether should the property be sold for an amount less than or equal to the stepped-up basis. After the client’s tax advisor determines the magnitude of the gain and the resulting federal and state income taxes © MartinWren, P.C. 2015 5 which would be deferred, not avoided, as the result of a like-kind exchange, the client can then evaluate the other factors mentioned below to determine whether an exchange would be economically or otherwise feasible. b. Whether the transactions can legally be structured as an exchange. The client and his tax advisors should then determine whether the contemplated transactions would qualify as a like-kind exchange. i. Personal Residence in an Exchange. For example, if the client wishes to sell his rental property and immediately reinvest the proceeds in a new personal residence, then a like-kind exchange would not work. Conversely, if the client wants to sell his principal residence and reinvest the proceeds in rental property, a likekind exchange would not work. However, other rules contained in Section 121 of the Code may provide for an exclusion of the gain realized on the sale of the principal residence of up to $250,000 ($500,000 if married filing jointly). On the other hand, if that same client wants to sell his rental property and is willing to reinvest the proceeds in a rental property which he would then later convert into his principal residence a year or two after the sale, a like-kind exchange may work, so long as the Replacement Property is not sold within five years of the date of its purchase. ii. Trade or Business or Investment Property. The client and client’s tax advisors should determine whether the Relinquished Property and the desired Replacement Property at all applicable times would, in the hands of the Exchangor, be considered (A) “Held for Productive Use in a Trade or Business” or (B) “Held for Investment”. c. The costs, including attorneys’ fees, accountant’s fees, intermediary’s fees, etc, which would be incurred in an exchange. Attorneys’ fees alone can be anywhere from $2,000 on up depending on the complexity of the exchange. For even the simplest of exchanges, intermediary’s fees can be $750 and up. Other applicable fees and costs such as accountant’s fees, costs to establish an Exchange Accommodation Titleholder, appraisals, and recordation taxes, should be considered as well in evaluating the feasibility of doing a like-kind exchange. d. Whether the Exchangor actually wants to reinvest the proceeds in qualifying real estate or other non-qualifying investments as a result of other financial or investment planning objectives. The financial and investment plan of the client may dictate that real estate may not be a suitable investment for the reinvestment of the proceeds from the sale of the Relinquished Property. The client’s portfolio may be over-concentrated in real estate and the proceeds should be invested in the stock or bond market. For non-financial reasons, the client may not want to reinvest in real estate for the very simple reason he is tired of being a landlord. Quite frankly, most clients want cash out of the deal, regardless of whether they are doing a like-kind exchange of not. While this can generally be accomplished be properly structuring borrowing either before or after the exchange, care should be taken to insure that the client does not run afoul of the constructive receipt rules. © MartinWren, P.C. 2015 6 e. The age and health of the Exchangor. While not always the main consideration, the age and health of the client may dictate the need to do an exchange. A young client may decide to go ahead and pay some taxes now and do a taxable sale if he thinks he can get a higher after-tax return over time from a non-real estate investment. Conversely, an older client who is in poor health may decide he does not want to pay any taxes now and, because now may be a good time to sell the Relinquished Property, a likekind exchange would enable him to pass real estate on to his children with a stepped-up basis, thereby avoiding the capital gains tax altogether. f. The availability of sufficient acceptable replacement property. One of the major challenges to successfully completing a like-kind exchange is locating suitable replacement property, especially in the Charlottesville and Central Virginia area. Investment properties are difficult to find and if the Relinquished Property has significant value, say over $1,000,000, the Exchangor may have to locate several properties (in some cases ten or more) to avoid receiving any boot. This challenge can also be dealt with in the contract for the sale of the Relinquished Property by providing for a delayed closing to give the Exchangor the benefit of more time to locate the Replacement Property, which can be purchased before or after the sale of the Relinquished Property. In addition, the real estate brokerage market continues to evolve so that more and more high grade net lease commercial properties are available for purchase nationwide, either as a tenants in common interests or through Delaware Statutory Trusts. g. The need to dispose of the Relinquished Property for other tax and non-tax reasons. Due to the age and condition of the property, the Exchangor’s relocation to another area of the country, or other non-tax reasons, the Exchangor may have to sell the Relinquished Property and take advantage of a like-kind exchange. 3. Who and what to look for in those to be involved in the exchange? Accountants, attorneys and other tax advisors, real estate attorneys, intermediaries, facilitators, or escrow agents, realtors, and investment advisors may be involved in an exchange. The attorney will generally be asked to locate the exchange facilitator which could be the attorney, if he has not provided other legal services to the client within the last two years, a title company, even if the title company has issued a title policy to the Exchangor in the past, a bank, or other companies organized to serve as a facilitator. The Exchangor should use due diligence in selecting advisors who are well versed in the laws governing Section 1031 exchanges. In selecting the exchange facilitator, the Exchangor should determine whether the facilitator (a) will segregate the exchange funds to the extent necessary to protect the funds from creditors; (b) has an adequate surety bond; (c) pays interest to the Exchangor on the exchange funds; (d) can move the exchange funds where needed in a timely fashion; and (e) fully discloses ifs fee schedule. Please see the definition of Exchange Facilitator in Appendix B. 4. Different Types of Exchanges. There are many ways to structure a like-kind exchange and they may involve two, three, or four parties and they range from quite simple to very complex. Following are four of the most common types of exchanges: © MartinWren, P.C. 2015 7 a. The Two-Party Simultaneous Exchange. The two-party exchange, or swap, is the purest and simplest form of exchange. Two-party exchanges are quite rare, since in the typical exchange the buyer of the Relinquished Property is not the seller of the Replacement Property. As the name implies, only two parties are involved and they simply exchange their properties simultaneously. Title to the Relinquished Property is conveyed by the Exchangor to the buyer and title to the Replacement Property is conveyed by the Seller to the Exchangor. b. The Simultaneous Exchange with Intermediary. Some times the buyer of the Relinquished Property or the seller of the Replacement Property is not willing to act as an accommodation party and risk the possibility of owning unwanted property should the exchange fail. In such a case, the Exchangor will have to employ the services of an Intermediary who will serve as a straw man or facilitator. Quite frankly, it is generally more desirable to limit the involvement of the seller of the Replacement Property and the buyer of the Relinquished Property and use an Intermediary in all exchanges. In a simultaneous exchange with an Intermediary, the Exchangor assigns to the Intermediary his rights in the contract to sell the Relinquished Property as well as his rights in the contract to purchase the Replacement Property. At the direction of the Intermediary, title to the Relinquished Property is transferred by the Exchangor to its buyer at closing and title to the Replacement Property is simultaneously transferred by its seller to the Exchangor. Cash received by the Intermediary from the buyer of the Relinquished Property is transferred to the seller of the Replacement Property. Please note that very rarely will an Intermediary want to take actual title to the property unless an Exchange Accommodation Titleholder is used. c. The Deferred Exchange with Intermediary (Starker Exchange). i. The Typical Exchange. The deferred or Starker Exchange is the most common type of exchange as the Exchangor generally does not know what property he wants to acquire by the date on which he is required to close on the sale of the Relinquished Property. The structure of the deferred exchange with intermediary is basically the same as the same as the simultaneous exchange with an intermediary except that the closing on the sale of the Replacement Property from its seller to the Exchangor occurs some time after the closing on the sale of the Relinquished Property to its buyer. ii. Deadlines. From the date of the closing on the sale of the Relinquished Property, the Exchangor has 45 days to identify to the Intermediary the Replacement Property (“Identification Period”). The Exchangor must receive the Replacement Property by the earlier of (A) 180 days to from the date of the sale of the Relinquished Property or (B) the due date, including extensions, for the Exchangor’s federal income tax return (“Exchange Period”). iii. Number of Properties which can be Identified. Generally, the Exchangor can identify (i) up to three Replacement Properties without regard to their value; or (ii) any number of Replacement Properties so long as the combined value of all © MartinWren, P.C. 2015 8 of the properly identified Replacement Properties does not exceed 200% of the combined value of all of the Relinquished Properties; or (iii) any number of Replacement Properties so long as the Exchangor closes on the identified Replacement Properties whose combined value is at least 95% of the combined value of all of the properly identified Replacement Properties by the end of the Exchange Period. “Fair market value” does not take into consideration any liabilities secured by the property. iv. No Extensions Allowed. The Identification Period and Exchange Period cannot be extended and the last day for performance may fall on a Saturday, Sunday, or a legal holiday. v. Multiple Relinquished Properties. When there are multiple Relinquished Properties and they are transferred at different times as part of the same deferred exchange, the Identification Period and Exchange Period begin on the date of the earliest transfer. vi. Revocation of Designation of Replacement Property. The designation of any property as Replacement Property can be revoked at any time during the Identification Period by a written document executed and delivered in the same manner as required for the original notice. d. The Reverse-Starker Exchange with Intermediary and EAT. Becoming increasingly popular after the issuance of Rev. Proc. 2000-37 by the IRS, reverse-Starker exchanges involve the purchase of the Replacement Property before the sale of the Relinquished Property. The Exchangor would still enter into an exchange agreement with the Intermediary with the exception of the fact that title to the Replacement Property would be transferred by the seller to an Exchange Accommodation Titleholder, which would generally be a single-member limited liability company wholly owned by the Intermediary. See Appendix C for Rev. Proc. 2000-37 which provides a safe harbor for completing a reverse-Starker exchange and Appendix D for Rev. Proc. 2004-51 which modified Rev. Proc. 2000-37 to exclude from its safe harbor certain property previously held by the Exchangor. 5. Steps to take to document and otherwise carry out the average like-kind exchange!!! The client and his advisors need to do the following: a. Ascertain Status of Title to Property and any Related Party Issues. Confirm with the client’s attorney that title to the Relinquished Property is held by the persons interested in a like-kind exchange. See the discussion below about what to do if the Relinquished Property is held by an entity and must be deeded in whole or in part out to the Exchangor. Also determine whether there are any related party issues that would jeopardize the exchange under Section 1031(f) of the Code and plan around those issues. For example, the Exchangor may need to (i) wait additional time before selling the Relinquished Property to allow the two-year period set forth in Section 1031(f) to expire where Exchangor acquired the Relinquished Property from a related party in a like-kind exchange or (ii) ascertain that an exception to the related party rules under Section © MartinWren, P.C. 2015 9 1031(f)(2) is available, the most common of which is that the prior exchange did not have as one of its principal purposes the avoidance of Federal income tax. b. Listing Agreement. As early as the listing of the Relinquished Property for sale, the Exchangor should consider whether a like-kind exchange would be appropriate as the actual timing of the sale may be significantly impacted by a like-kind exchange as well as the fact that potential purchasers should be informed of the fact that the seller is at least contemplating an exchange. c. Exchange Agreement. The Exchange Agreement should be prepared or reviewed by an attorney even though the form may, in many cases, be provided by the Intermediary. The Exchange Agreement must be executed by the Exchangor and the Intermediary prior to closing on the sale of the Relinquished Property. d. Contract for sale or purchase and assignment to intermediary, facilitator or other party, containing cooperation clause. These contracts and all addendums should be reviewed by the Exchangor’s tax advisor even though prepared by others. Language should be included in these contracts which (i) references the fact that the Exchangor is intending for the transaction to be part of a like-kind exchange; (ii) requires the other party to cooperate with the Exchangor in accomplishing a like-kind exchange, which generally will not delay closing or result in any additional expense to the other party; (iii) permits the Exchanger to assign the Exchangor’s interest in the contract to either an Intermediary or an Exchange Accommodation Titleholder; and (iv) if tangible personal property is a material part of the purchase price, separately allocate a portion of the purchase price to that tangible personal property and account for the funds separately. e. Notice to other party of assignment A notice must be delivered to the other party involved in the sale or purchase prior to closing, unless the other party to the contract actually executes the assignment. f. Identification of Replacement Property . The identification of the Replacement Property must be in writing and signed by the Exchangor and hand delivered, mailed, or faxed to the Intermediary before the end of the Identification Period. The identification must be unambiguous and can identify the property by street address or distinguishable name. See Section 4.c above for more information on the identification of Replacement Property. g. Deed Language. Language should be included in the deed referencing the exchange as consideration in addition to the monetary consideration for the real estate only (excluding portion of purchase price allocated to personal property). See attached Exhibit E. h. Closing Statement. The closing statement should contain language referring to Exchangor as the seller or buyer, as applicable. © MartinWren, P.C. 2015 10 i. Real Estate Taxes and Other Prorated Items and Security Deposits. Payment of Exchangor’s share of pro rated real estate taxes and rents as well as all security deposits should be made outside of closing to the other party to the contract to avoid Boot problems. j. Exchange Accommodation Titleholder. The Exchangor’s attorney will generally be responsible for organizing the limited liability company which would serve as the Exchange Accommodation Titleholder in either a reverse-Starker exchange or a deferred exchange involving construction of improvements. k. W-9 Form. The attorney for the Exchangor will generally be required to complete the IRS Form W-9 necessary to provide the Exchangor’s taxpayer identification number to the intermediary or exchange facilitator. l. Bill of sale. For the sale of personal property, a bill of sale should be used. There should be an allocation in the contract or addendum of a portion of the purchase price to any tangible personal property or other non-qualifying property being conveyed pursuant to the contract. m. Tell the Accountant about the Like-Kind Exchange. Send the Exchangor’s accountant copies of the exchange documents right away so that the accountant can (i) properly report the exchange on the Exchangor’s income tax return for the year of the sale of the Relinquished Property on IRS Form 8824 and (ii) file an extension request for the Exchangors tax return to the extent necessary to maximize the length of the Exchange Period. 6. Other Special Issues in an Exchange. a. Residence or other Non-Qualifying Property Involved in an Exchange. When non-qualifying property is involved in an exchange, such as a principal residence in a farm sale, the tax advisors will have to make a reasonable allocation of a portion of the purchase price to the non-qualifying property and a portion to the qualifying property. This allocation should be reflected in the contract for the sale of the property or an amendment to that contract. While an appraisal would be ideal, an allocation based on tax assessments would generally be considered reasonable if agreed to by both parties. With respect to a farm sale, the tricky part is determining how much land should be allocated to the residence. There is no definitive answer to this question and you will have to examine the facts in each case to determine how much land is actually being used for residential purposes and how much for farming purposes. The IRS and courts have allowed up to twenty acres in certain cases. b. Multiple Relinquished Properties. If there are multiple Relinquished Properties involved in the same deferred exchange, keep in mind that Identification Period and Exchange Period start on the date of the first sale. If there will be more than one Relinquished Property, consider separate exchange agreements for each property so that the IRS will treat each disposition as a separate exchange. © MartinWren, P.C. 2015 11 c. Difficulty in Locating Replacement Property. If the Exchangor is having a difficult time locating suitable Replacement Property, he may want to consider a tenants in common interest in large shopping centers, apartment complexes, and office buildings currently being marketed by investment advisors. These types of investments are considered securities and are regulated accordingly. Care should be taken to ensure that such ownership interests will be considered real estate and not partnership interests by the IRS. In addition, the Exchangor would have to be willing to allow someone else to manage the Replacement Property in order to consider this option. d. Related Party Exchanges. While related party exchanges are permissible, if the Replacement Property is disposed of within two years of its acquisition, the exchange may be blown where the Exchangor or the related party is attempting to replace the low basis in a property we will call property A with the higher basis in a property we will call property B and then sell property A soon thereafter at a lower gain that the party would otherwise be entitled to. See the detailed rules in Appendix A. e. Build-to Suit-Exchanges. i. Seller or Intermediary to Construct Improvements. If improvements are to be constructed on the Replacement Property, either the seller of the Replacement Property or the Intermediary should construct the improvements prior to the transfer of the Replacement Property to the Exchangor. ii. May Delay Exchange. Be careful, adding the construction aspect to the exchange can in many cases push the envelope with respect to the receipt of the Replacement Property by the Exchangor by the end of the Exchange Period. Remember, there are no extensions available to extend the 180-day deadline for the Exchange Period. iii. Identification of Improvements. Where the Replacement Property will consist of improvements to be constructed by the seller or the Intermediary prior to Exchangor’s receipt, the improvements to be constructed must be identified in as much detail as is practicable. Further, upon receipt, the improvements must be substantially the same as those identified. The improvements will be considered “substantially the same” only if (A) the improvements constitute real property under local law, and (B) had construction been completed on or before the receipt date, the improvements would have been considered to be substantially the same property as identified. Treas. Regs. Section 1.1031(k)-1(e)(3)(iii). iv. Construction of Improvements-The Wrong Way. Any construction of improvements occurring after the Replacement Property is received by the Exchangor is considered boot. Treas. Regs. Section 1.1031(k)-1(e)(iv). © MartinWren, P.C. 2015 12 v. Use a single-member LLC to Hold Title While Constructing Improvements. If improvements are to be constructed as part of either a deferred exchange or reverse exchange, a single-member limited liability company, (“Exchange Accommodation Titleholder” or “EAT”), owned solely by the Intermediary, may have to be formed to take title to the Replacement Property during construction should the seller or Intermediary not wish to hold or take title thereto. The EAT should then contract for the construction of the improvements, generally with the Exchangor (i) guaranteeing the construction contract and (ii) to the extent necessary, loaning the funds to the EAT necessary to complete the construction. In such a case, the Exchangor will also have to loan the EAT the funds necessary to pay for real estate taxes, insurance, and other costs of maintaining the property while it is being held by the EAT. f. Property held by Partnership, LLC or other Entity. Hopefully you will find that most trade or business or investment property is held by limited partnership or limited liability companies. For single-member limited liability companies which are disregarded for tax purposes, the exchange can be completed by the LLC. However, for LLC’s with multiple members and limited partnerships, if some, but not all, of the owners of the entity are not interested in doing a like-kind exchange, care should be taken to structure the exchange to minimize the risk from IRS attack. i. Drop and Swap. A tenants-in-common interest in the Relinquished Property is timely conveyed by the entity to the entity owner(s) interested in participating in a like-kind exchange. By the word “timely” I mean both (i) prior to the negotiation and execution of any contract for the sale of the Relinquished Property and (ii) well in advance (as much as two years according to some commentators, not days, hours or minutes) of the closing on the sale of the Relinquished Property, so that the Exchangor can satisfy the “use” requirement and otherwise minimize the risk from IRS attack based on substance over form and step transaction arguments to be discussed below. ii. Swap and Drop. Each partner designates a separate replacement property and the partnership then exchanges its property for the designated replacement properties. The partnership then dissolves, distributing the replacement properties to the respective partners, tax-free. This method is also subject to IRS attack based on the failure of the partnership to hold the replacement properties for a qualified use where they are distributed immediately to the partners. © MartinWren, P.C. 2015 13 iii. Swap and Functional Division. Same as the Swap and Drop except that partnership continues to operate as a partnership after the exchange and specially allocates a substantial portion of the income, expenses and gain from each replacement property to the respective partner. The partnership later dissolves and distributes the replacement properties out to the respective partners at some point in time in the distant future, ideally during or after the second tax year following the exchange. This method is less than desirable where the partners do not wish to remain together or where the partnership governing documents do not permit the holding of the replacement properties. iv. Partnership Division. The partnership divides into two or more partnerships, each owned by at least two of the partners, before, after or during the exchange. IRC Section 708(b)(2). This method is subject to risk that the gain will be allocated to the original partners should one of the resulting partnerships fail to acquire the sufficient replacement properties. This method is less than desirable where the partners do not wish to remain together. v. Theories Advanced By IRS to Attack these Structures. A. Failure to Satisfy “Qualified Use” Requirement. Both the property disposed of and the property received must be held for a qualified use. Where a partner receives a TIC interest in the relinquished property immediately prior to the exchange, the IRS will generally argue that the partner is holding the relinquished property for sale, not for investment or in a trade or business. The courts generally rule in favor of the taxpayer in these cases, but you have to be willing to pay the cost to get in front of a judge. B. Substance over Form. The party disposing of the relinquished party is not the same party that received the replacement properties. For example, in a drop and swap transaction where a TIC interest is deeded out to a partner immediately prior to the exchange, the IRS would argue that the partnership is in substance disposing of the relinquished property while the partner is in substance receiving the replacement property, with the exchange thus failing. © MartinWren, P.C. 2015 14 C. Step Transaction. When you collapse all of the steps, the partner is in essence transferring his partnership interest for real estate, which is in circumvention of the broad prohibition of the exchange of partnership interests. vi. Other Tax Problems Associated with Corporations (S or C). If the Exchangor is an S or C corporation, some of the solutions that work in the partnership world will not work as the corporation will have to recognize gain on any distribution of appreciated property under IRC Section 311(b) as if the property had been sold to the shareholder. g. Mortgages on Replacement Property-Wait for the Cash. Most clients will want to get some cash out of a like-kind exchange. The best way to accomplish this goal is to obtain a loan secured by the Replacement Property, but only fund that loan at the closing on the purchase of the Replacement Property to the extent necessary to close on that purchase, after exhausting the exchange funds. Then, after the closing on the purchase of the Replacement Property, have the lender fund all or part of the remaining balance of the loan amount which the Exchangor can then use however the Exchangor wants. Caution. Contrary to case law on this issue, the IRS will argue that the cash proceeds of a refinancing of the Relinquished Property immediately prior to the closing on its sale will result in boot to the taxpayer if the loan did not have independent economic substance. Ltr. Rul. 8434015. h. Avoid Capital Gains Tax by Converting the Replacement Property to Principal Residence. The Exchangor may be able to convert the Replacement Property to his principal residence and take advantage of the $250,000 ($500,000 for married taxpayers filing joint returns) exclusion available upon the ultimate sale of the Replacement Property under Section 121 of the Code so long as the Exchangor has (i) held the Replacement Property at least five years from the date of its acquisition as required under Section 121(d)(10) of the Code and (ii) has met the other requirements of Section 121 of the Code. i. Avoid Capital Gains Tax by Holding Replacement Property Until Death. The Exchangor may be able to avoid the capital gains tax altogether on the capital gains that have built-up over the life of the Exchangor by holding the Replacement Property until the death of the Exchangor, at which time the Exchangor can devise the Replacement Property to his intended beneficiaries who will then receive a step-up in the basis of the Replacement Property to its fair market value on the date of the death of the Exchangor under Section 1014 of the Code. WARNING: Holding until death could result in a step-down in basis if the fair market value of the property has decreased below its basis. © MartinWren, P.C. 2015 15 Appendix A-Section 1031-The Law According to Congress § 1031 Exchange of property held for productive use or investment. (a) Nonrecognition of gain or loss from exchanges solely in kind. (1) In general. No gain or loss shall be recognized on the exchange of property held for productive use in a trade or business or for investment if such property is exchanged solely for property of like kind which is to be held either for productive use in a trade or business or for investment. (2) Exception. This subsection shall not apply to any exchange of— (A) stock in trade or other property held primarily for sale, (B) stocks, bonds, or notes, (C) other securities or evidences of indebtedness or interest, (D) interests in a partnership, (E) certificates of trust or beneficial interests, or (F) choses in action. For purposes of this section , an interest in a partnership which has in effect a valid election under section 761(a) to be excluded from the application of all of subchapter K shall be treated as an interest in each of the assets of such partnership and not as an interest in a partnership. (3) Requirement that property be identified and that exchange be completed not more than 180 days after transfer of exchanged property. For purposes of this subsection , any property received by the taxpayer shall be treated as property which is not like-kind property if— (A) such property is not identified as property to be received in the exchange on or before the day which is 45 days after the date on which the taxpayer transfers the property relinquished in the exchange, or © MartinWren, P.C. 2015 16 (B) such property is received after the earlier of— (i) the day which is 180 days after the date on which the taxpayer transfers the property relinquished in the exchange, or (ii) the due date (determined with regard to extension) for the transferor's return of the tax imposed by this chapter for the taxable year in which the transfer of the relinquished property occurs. (b) Gain from exchanges not solely in kind. If an exchange would be within the provisions of subsection (a), of section 1035(a) , of section 1036(a) , or of section 1037(a) , if it were not for the fact that the property received in exchange consists not only of property permitted by such provisions to be received without the recognition of gain, but also of other property or money, then the gain, if any, to the recipient shall be recognized, but in an amount not in excess of the sum of such money and the fair market value of such other property. (c) Loss from exchanges not solely in kind. If an exchange would be within the provisions of subsection (a), of section 1035(a) , of section 1036(a) , or of section 1037(a) , if it were not for the fact that the property received in exchange consists not only of property permitted by such provisions to be received without the recognition of gain or loss, but also of other property or money, then no loss from the exchange shall be recognized. (d) Basis. If property was acquired on an exchange described in this section , section 1035(a) , section 1036(a) , or section 1037(a) , then the basis shall be the same as that of the property exchanged, decreased in the amount of any money received by the taxpayer and increased in the amount of gain or decreased in the amount of loss to the taxpayer that was recognized on such exchange. If the property so acquired consisted in part of the type of property permitted by this section , section 1035(a) , section 1036(a) , or section 1037(a) , to be received without the recognition of gain or loss, and in part of other property, the basis provided in this subsection shall be allocated between the properties (other than money) received, and for the purpose of the allocation there shall be assigned to such other property an amount equivalent to its fair market value at the date of the exchange. For purposes of this section , section 1035(a) , and section 1036(a) , where as part of the consideration to the taxpayer another party to the exchange assumed (as determined under section 357(d) ) a liability of the taxpayer, such assumption shall be considered as money received by the taxpayer on the exchange. (e) Exchanges of livestock of different sexes. For purposes of this section , livestock of different sexes are not property of a like kind. © MartinWren, P.C. 2015 17 (f) Special rules for exchanges between related persons. (1) In general. If— (A) a taxpayer exchanges property with a related person, (B) there is nonrecognition of gain or loss to the taxpayer under this section with respect to the exchange of such property (determined without regard to this subsection ), and (C) before the date 2 years after the date of the last transfer which was part of such exchange— (i) the related person disposes of such property, or (ii) the taxpayer disposes of the property received in the exchange from the related person which was of like kind to the property transferred by the taxpayer, there shall be no nonrecognition of gain or loss under this section to the taxpayer with respect to such exchange; except that any gain or loss recognized by the taxpayer by reason of this subsection shall be taken into account as of the date on which the disposition referred to in subparagraph (C) occurs. (2) Certain dispositions not taken into account. For purposes of paragraph (1)(C) , there shall not be taken into account any disposition— (A) after the earlier of the death of the taxpayer or the death of the related person, (B) in a compulsory or involuntary conversion (within the meaning of section 1033 ) if the exchange occurred before the threat or imminence of such conversion, or (C) with respect to which it is established to the satisfaction of the Secretary that neither the exchange nor such disposition had as one of its principal purposes the avoidance of Federal income tax. © MartinWren, P.C. 2015 18 (3) Related person. For purposes of this subsection , the term “related person” means any person bearing a relationship to the taxpayer described in section 267(b) or 707(b)(1) . (4) Treatment of certain transactions. This section shall not apply to any exchange which is part of a transaction (or series of transactions) structured to avoid the purposes of this subsection . (g) Special rule where substantial diminution of risk. (1) In general. If paragraph (2) applies to any property for any period, the running of the period set forth in subsection (f)(1)(C) with respect to such property shall be suspended during such period. (2) Property to which subsection applies. This paragraph shall apply to any property for any period during which the holder's risk of loss with respect to the property is substantially diminished by— (A) the holding of a put with respect to such property, (B) the holding by another person of a right to acquire such property, or (C) a short sale or any other transaction. (h) Special rules for foreign real and personal property. For purposes of this section — (1) Real property. Real property located in the United States and real property located outside the United States are not property of a like kind. (2) Personal property. (A) In general. Personal property used predominantly within the United States and personal property used predominantly outside the United States are not property of a like kind. (B) Predominant use. Except as provided in subparagraphs (C) and (D) , the predominant use of any property shall be determined based on— © MartinWren, P.C. 2015 19 (i) in the case of the property relinquished in the exchange, the 2-year period ending on the date of such relinquishment, and (ii) in the case of the property acquired in the exchange, the 2-year period beginning on the date of such acquisition. (C) Property held for less than 2 years. Except in the case of an exchange which is part of a transaction (or series of transactions) structured to avoid the purposes of this subsection — (i) only the periods the property was held by the person relinquishing the property (or any related person) shall be taken into account under subparagraph (B)(i) , and (ii) only the periods the property was held by the person acquiring the property (or any related person) shall be taken into account under subparagraph (B)(ii) . (D) Special rule for certain property. Property described in any subparagraph of section 168(g)(4) shall be treated as used predominantly in the United States. © MartinWren, P.C. 2015 20 Appendix B-Definitions. Boot. Money or other property, other than like-kind or qualifying property, received or given by the Exchangor in the exchange. Code. The Internal Revenue Code of 1986, as amended from time to time. Dealer Property. Synonymous with “Stock in Trade”, as further defined below, or “Inventory”, the sale of which does not qualify for non-recognition treatment but which results in ordinary income. Deferred Exchange. An exchange in which the Replacement Property is acquired after the sale of the Relinquished Property and requires the use of an Intermediary of Escrow Agent. Also referred to as a Starker Exchange. Exchange Accommodation Titleholder of EAT. Person, other than the Exchangor, which takes title to the Replacement Property prior to the sale of the Relinquished Property in a Reverse-Starker exchange or which takes title to the Replacement Property subsequent to the sale of the Relinquished Property in a deferred or Starker Exchange in which the EAT is to contract for the construction of the improvements to the Replacement Property. Exchange Facilitator. Synonymous with “Facilitator”, “Intermediary”, and “Qualified Intermediary”. Treas. Regs. Section 1.1031(k)-1(g)(4)(ii) sets forth the guidelines for determining who can serve as the “Qualified Intermediary” in a like-kind exchange. Generally, any unrelated party who is not an agent of the Exchangor can serve as an intermediary. There are special rules governing when an attorney or his law firm can serve as an Intermediary but generally if the attorney has not provide legal services to the Exchangor within the two years prior to the exchange, the attorney can serve as the Intermediary and can provide legal services related to the disposition of the Relinquished Property and acquisition of the Replacement Property. Exchange Period. With a Starker Exchange, the period beginning on the date of the sale of the Relinquished Property and ending on the earliest to occur of (a) the end of the 45th day after the sale of the Relinquished Property, if no Replacement Properties have been designated; (b) the date after the end of the Identification Period on which all of the properly designated Replacement Properties have been received by the Exchangor; (c) the date on which all of the Exchange Funds have been used for the acquisition of properly designated Replacement Property or (d) the end of the 180th day after the date of the sale of the Relinquished Property; or (e) the due date for the filing of the Exchangor’s income tax return for the year of the sale of the Relinquished Property, taking into consideration properly filed extension requests. Exchangor. The party who would like to exchange the Relinquished Property for the Replacement Property in the exchange. Facilitator. See definition of Exchange Facilitator. © MartinWren, P.C. 2015 21 Held for Productive Use in Trade or Business. While this term is not defined in the Code or the Regulations, it is generally believed that this term is synonymous with term “used in trade or business” found in Sections 167 and 1231 of the Code. A minimal amount of personal use will not disqualify property from being trade or business or investment property. Priv. Ltr. Rul. 8103117. The Exchangor’s purpose for holding the property is determined when the exchange takes place. Fred S. Wagensen, 74 T.C. 653 (1980). The Exchangor’s purpose for holding the property may change while the property is being held. Rev. Rul. 57-244. The determination of whether the property has been held for a proper purpose is a question of fact. Gulf Stream Land and Development Corp., 71 T.C. 587. Held for Investment. Unproductive real estate which is held by a non-dealer for future use or future realization of the increase in value is held for investment. Treas. Regs. Section 1.1031(a)-1(b). Intermediary. See definition for Exchange Facilitator. Like-Kind. The term “Like-Kind” has reference to the nature and character of the property and not to its grade or quality. Treas. Regs. Section 1031(a)-1(b). The fact that real property is improved or unimproved relates only to its grade or quality and not to its kind or class. Whether property is real or personal is determined by state law. Aquilino v. U.S., 363 U.S. 509 (1960). The following have been held like-kind: 1. a leasehold with 30 years or more to run is like-kind with real estate in fee. Treas. Regs. Section 1.1031(a)1(c)(2); 2. vacant land is like-kind with improved real estate; 3. a tenancy in common is like-kind with a fee interest; 4. one property is like-kind with more than one property; 5. trade or business property is like-kind with investment property; 6. an interest in a single-member limited liability company which owns real estate is like-kind with a fee interest (please note that while a single member limited liability company is company is disregarded by the IRS, a partnership interest or common stock is not considered like-kind with any interest in real estate); and 7. an apartment building is like-kind with an office building. Other Property Held Primarily for Sale. Broader than the definition of Stock in Trade, it includes any property held for sale, not just property held as stock in trade for sale to customers in the ordinary course of business. Whether property is “held primarily for sale” is a question of fact. If the Exchangor has entered into a contract to sell the © MartinWren, P.C. 2015 22 Replacement Property before acquiring the property in the exchange, that property would be deemed held “primarily for sale”. Griffin v. Commissioner, 49 T.C. 253 (1967). Qualified Intermediary. See definition of Exchange Facilitator. Regulations. The Treasury Regulations promulgated under the Code. Relinquished Property. The property originally owned by the Exchangor and which the Exchangor would like to dispose of in the exchange. Replacement Property. The new property which the Exchangor would like to acquire in the exchange. Starker Exchange. See the definition of Deferred Exchange. Stock in Trade. Property which would be included in the inventory of a dealer of that type of property. Real property held as inventory does not qualify for non-recognition treatment under Section 1031(a). Land Dynamics (1978) 37 CCH T.C.M. 1119, 47 P-H T.C.M. Paragraph 78,259. A dealer who segregates property, however, may hold such segregated property for productive use in trade or business or for investment. Margolis v. Commissioner, 337 F. 2d 1001 (9th Cir. 1964). The factors to be considered in determining whether property is “stock in trade” are as follows: 1. the purpose for which the property was originally acquired; 2. the purpose for which the property was subsequently held; 3. the extent to which improvements, if any, were made to the property by the Exchangor; 4. the frequency, number, and continuity of sales by the Exchangor; 5. the extent and nature of the transaction involved; 6. the ordinary business of the Exchangor; 7. the extent of advertising, promotion, or other active efforts used in soliciting buyers for the sale of the property; 8. the listing of the property with brokers; and 9. the purpose for which the property was held at the time of sale. © MartinWren, P.C. 2015 23 Appendix C Rev. Proc. 2000-37 October 2, 2000 SECTION 1. PURPOSE This revenue procedure provides a safe harbor under which the Internal Revenue Service will not challenge (a) the qualification of property as either "replacement property" or "relinquished property" (as defined in § 1.1031(k)-1(a) of the Income Tax Regulations) for purposes of § 1031 of the Internal Revenue Code and the regulations thereunder or (b) the treatment of the "exchange accommodation titleholder" as the beneficial owner of such property for federal income tax purposes, if the property is held in a "qualified exchange accommodation arrangement" (QEAA), as defined in section 4.02 of this revenue procedure. SECTION 2. BACKGROUND .01 Section 1031(a)(1) provides that no gain or loss is recognized on the exchange of property held for productive use in a trade or business or for investment if the property is exchanged solely for property of like kind that is to be held either for productive use in a trade or business or for investment. .02 Section 1031(a)(3) provides that property received by the taxpayer is not treated as like-kind property if it: (a) is not identified as property to be received in the exchange on or before the day that is 45 days after [*2] the date on which the taxpayer transfers the relinquished property; or (b) is received after the earlier of the date that is 180 days after the date on which the taxpayer transfers the relinquished property, or the due date (determined with regard to extension) for the transferor's federal income tax return for the year in which the transfer of the relinquished property occurs. .03 Determining the owner of property for federal income tax purposes requires an analysis of all of the facts and circumstances. As a general rule, the party that bears the economic burdens and benefits of ownership will be considered the owner of property for federal income tax purposes. See Rev. Rul. 82-144, 1982-2 C.B. 34. .04 On April 25, 1991, the Treasury Department and the Service promulgated final regulations under § 1.1031(k)-1 providing rules for deferred like-kind exchanges under § 1031(a)(3). The preamble to the final regulations states that the deferred exchange rules under § 1031(a)(3) do not apply to reverse-Starker exchanges (i.e., exchanges where the replacement property is acquired before the relinquished property is transferred) and consequently [*3] that the final regulations do not apply to such exchanges. T.D. 8346, 1991-1 C.B. 150, 151; see Starker v. United States, 602 F.2d 1341 (9th Cir. 1979). However, the preamble indicates that Treasury and the Service will continue to study the applicability of the general rule of § 1031(a)(1) to these transactions. T.D. 8346, 1991-1 C.B. 150, 151. © MartinWren, P.C. 2015 24 .05 Since the promulgation of the final regulations under § 1.1031(k)-1, taxpayers have engaged in a wide variety of transactions, including so-called "parking" transactions, to facilitate reverse like-kind exchanges. Parking transactions typically are designed to "park" the desired replacement property with an accommodation party until such time as the taxpayer arranges for the transfer of the relinquished property to the ultimate transferee in a simultaneous or deferred exchange. Once such a transfer is arranged, the taxpayer transfers the relinquished property to the accommodation party in exchange for the replacement property, and the accommodation party then transfers the relinquished property to the ultimate transferee. [*4] In other situations, an accommodation party may acquire the desired replacement property on behalf of the taxpayer and immediately exchange such property with the taxpayer for the relinquished property, thereafter holding the relinquished property until the taxpayer arranges for a transfer of such property to the ultimate transferee. In the parking arrangements, taxpayers attempt to arrange the transaction so that the accommodation party has enough of the benefits and burdens relating to the property so that the accommodation party will be treated as the owner for federal income tax purposes. .06 Treasury and the Service have determined that it is in the best interest of sound tax administration to provide taxpayers with a workable means of qualifying their transactions under § 1031 in situations where the taxpayer has a genuine intent to accomplish a like-kind exchange at the time that it arranges for the acquisition of the replacement property and actually accomplishes the exchange within a short time thereafter. Accordingly, this revenue procedure provides a safe harbor that allows a taxpayer to treat the accommodation party as the owner of the property for federal income tax purposes, [*5] thereby enabling the taxpayer to accomplish a qualifying likekind exchange. SECTION 3. SCOPE .01 Exclusivity. This revenue procedure provides a safe harbor for the qualification under § 1031 of certain arrangements between taxpayers and exchange accommodation titleholders and provides for the treatment of the exchange accommodation titleholder as the beneficial owner of the property for federal income tax purposes. These provisions apply only in the limited context described in this revenue procedure. The principles set forth in this revenue procedure have no application to any federal income tax determinations other than determinations that involve arrangements qualifying for the safe harbor. .02 No inference. No inference is intended with respect to the federal income tax treatment of arrangements similar to those described in this revenue procedure that were entered into prior to the effective date of this revenue procedure. Further, the Service recognizes that "parking" transactions can be accomplished outside of the safe harbor provided in this revenue procedure. Accordingly, no inference is intended with respect to the federal income tax treatment of "parking" transactions [*6] that do not satisfy the terms of the safe harbor provided in this revenue procedure, whether entered into prior to © MartinWren, P.C. 2015 25 or after the effective date of this revenue procedure. .03 Other issues. Services for the taxpayer in connection with a person's role as the exchange accommodation titleholder in a QEAA shall not be taken into account in determining whether that person or a related person is a disqualified person (as defined in § 1.1031(k)-1(k)). Even though property will not fail to be treated as being held in a QEAA as a result of one or more arrangements described in section 4.03 of this revenue procedure, the Service still may recast an amount paid pursuant to such an arrangement as a fee paid to the exchange accommodation titleholder for acting as an exchange accommodation titleholder to the extent necessary to reflect the true economic substance of the arrangement. Other federal income tax issues implicated, but not addressed, in this revenue procedure include the treatment, for federal income tax purposes, of payments described in section 4.03(7) and whether an exchange accommodation titleholder may be precluded from claiming depreciation deductions (e.g., as a dealer) [*7] with respect to the relinquished property or the replacement property. .04 Effect of Noncompliance. If the requirements of this revenue procedure are not satisfied (for example, the property subject to a QEAA is not transferred within the time period provided), then this revenue procedure does not apply. Accordingly, the determination of whether the taxpayer or the exchange accommodation titleholder is the owner of the property for federal income tax purposes, and the proper treatment of any transactions entered into by or between the parties, will be made without regard to the provisions of this revenue procedure. SECTION 4. QUALIFIED EXCHANGE ACCOMMODATION ARRANGEMENTS .01 Generally. The Service will not challenge the qualification of property as either "replacement property" or "relinquished property" (as defined in § 1.1031(k)-1(a)) for purposes of § 1031 and the regulations thereunder, or the treatment of the exchange accommodation titleholder as the beneficial owner of such property for federal income tax purposes, if the property is held in a QEAA. .02 Qualified Exchange Accommodation Arrangements. For purposes of this revenue procedure, property is held in a QEAA [*8] if all of the following requirements are met: (1) Qualified indicia of ownership of the property is held by a person (the "exchange accommodation titleholder") who is not the taxpayer or a disqualified person and either such person is subject to federal income tax or, if such person is treated as a partnership or S corporation for federal income tax purposes, more than 90 percent of its interests or stock are owned by partners or shareholders who are subject to federal income tax. Such qualified indicia of ownership must be held by the exchange accommodation titleholder at all times from the date of acquisition by the exchange accommodation titleholder until the property is transferred as described in section 4.02(5) of this revenue procedure. For this purpose, "qualified indicia of ownership" means legal title to the property, other indicia of ownership of the property that are treated as beneficial ownership of the property under applicable principles of commercial law (e.g., a contract for deed), or © MartinWren, P.C. 2015 26 interests in an entity that is disregarded as an entity separate from its owner for federal income tax purposes (e.g., a single member limited liability company) and that holds [*9] either legal title to the property or such other indicia of ownership; (2) At the time the qualified indicia of ownership of the property is transferred to the exchange accommodation titleholder, it is the taxpayer's bona fide intent that the property held by the exchange accommodation titleholder represent either replacement property or relinquished property in an exchange that is intended to qualify for nonrecognition of gain (in whole or in part) or loss under § 1031; (3) No later than five business days after the transfer of qualified indicia of ownership of the property to the exchange accommodation titleholder, the taxpayer and the exchange accommodation titleholder enter into a written agreement (the "qualified exchange accommodation agreement") that provides that the exchange accommodation titleholder is holding the property for the benefit of the taxpayer in order to facilitate an exchange under § 1031 and this revenue procedure and that the taxpayer and the exchange accommodation titleholder agree to report the acquisition, holding, and disposition of the property as provided in this revenue procedure. The agreement must specify that the exchange accommodation titleholder [*10] will be treated as the beneficial owner of the property for all federal income tax purposes. Both parties must report the federal income tax attributes of the property on their federal income tax returns in a manner consistent with this agreement; (4) No later than 45 days after the transfer of qualified indicia of ownership of the replacement property to the exchange accommodation titleholder, the relinquished property is properly identified. Identification must be made in a manner consistent with the principles described in § 1.1031(k)-1(c). For purposes of this section, the taxpayer may properly identify alternative and multiple properties, as described in § 1.1031(k)1(c)(4); (5) No later than 180 days after the transfer of qualified indicia of ownership of the property to the exchange accommodation titleholder, (a) the property is transferred (either directly or indirectly through a qualified intermediary (as defined in § 1.1031(k)-1(g)(4))) to the taxpayer as replacement property; or (b) the property is transferred to a person who is not the taxpayer or a disqualified person as relinquished property; and (6) The combined time period that the relinquished property and the replacement [*11] property are held in a QEAA does not exceed 180 days. .03 Permissible Agreements. Property will not fail to be treated as being held in a QEAA as a result of any one or more of the following legal or contractual arrangements, regardless of whether such arrangements contain terms that typically would result from arm's length bargaining between unrelated parties with respect to such arrangements: (1) An exchange accommodation titleholder that satisfies the requirements of the qualified intermediary safe harbor set forth in §1.1031(k)-1(g)(4) may enter into an © MartinWren, P.C. 2015 27 exchange agreement with the taxpayer to serve as the qualified intermediary in a simultaneous or deferred exchange of the property under § 1031; (2) The taxpayer or a disqualified person guarantees some or all of the obligations of the exchange accommodation titleholder, including secured or unsecured debt incurred to acquire the property, or indemnifies the exchange accommodation titleholder against costs and expenses; (3) The taxpayer or a disqualified person loans or advances funds to the exchange accommodation titleholder or guarantees a loan or advance to the exchange accommodation titleholder; (4) The property is leased [*12] by the exchange accommodation titleholder to the taxpayer or a disqualified person; (5) The taxpayer or a disqualified person manages the property, supervises improvement of the property, acts as a contractor, or otherwise provides services to the exchange accommodation titleholder with respect to the property; (6) The taxpayer and the exchange accommodation titleholder enter into agreements or arrangements relating to the purchase or sale of the property, including puts and calls at fixed or formula prices, effective for a period not in excess of 185 days from the date the property is acquired by the exchange accommodation titleholder; and (7) The taxpayer and the exchange accommodation titleholder enter into agreements or arrangements providing that any variation in the value of a relinquished property from the estimated value on the date of the exchange accommodation titleholder's receipt of the property be taken into account upon the exchange accommodation titleholder's disposition of the relinquished property through the taxpayer's advance of funds to, or receipt of funds from, the exchange accommodation titleholder. .04 Permissible Treatment. Property will not fail to be [*13] treated as being held in a QEAA merely because the accounting, regulatory, or state, local, or foreign tax treatment of the arrangement between the taxpayer and the exchange accommodation titleholder is different from the treatment required by section 4.02(3) of this revenue procedure. SECTION 5. EFFECTIVE DATE This revenue procedure is effective for QEAAs entered into with respect to an exchange accommodation titleholder that acquires qualified indicia of ownership of property on or after September 15, 2000. © MartinWren, P.C. 2015 28 Appendix D Rev. Proc. 2004-51 August 16, 2004 Table of Contents SECTION 1. PURPOSE SECTION 2. BACKGROUND SECTION 3. SCOPE SECTION 4. APPLICATION SECTION 1. PURPOSE SECTION 4. QUALIFIED EXCHANGE ACCOMMODATION ARRANGEMENTS SECTION 5. EFFECT ON OTHER DOCUMENTS SECTION 6. EFFECTIVE DATE SECTION 7. DRAFTING INFORMATION SECTION 1. PURPOSE This revenue procedure modifies sections 1 and 4 of Rev. Proc. 2000-37, 2000-2 C.B. 308, to provide that Rev. Proc. 2000-37 does not apply if the taxpayer owns the property intended to qualify as replacement property before initiating a qualified exchange accommodation arrangement (QEAA). SECTION 2. BACKGROUND .01 Section 1031(a) provides that no gain or loss is recognized on the exchange of property held for productive use in a trade or business or for investment if the property is exchanged solely for property of like kind that is to be held either for productive use in a trade or business or for investment. .02 Section 1031(a)(3) allows taxpayers to structure deferred like-kind exchanges. Under § 1031(a)(3), property may be treated as like-kind property if it is (A) identified as property to be received in the exchange (replacement property) on or before the day that is 45 days after the date on which the taxpayer transfers the property relinquished in the exchange (relinquished property), and (B) received before the earlier of the date that is 180 days after the date on which the taxpayer transfers the relinquished property, or the due date (determined with regard to extensions) for the transferor’s federal income tax return for the taxable year in which the transfer of the relinquished property occurs. .03 Rev. Proc. 2000-37 addresses “parking” transactions. See sections 2.05 and 2.06 of Rev. Proc. 2000-37. Parking transactions typically are designed to “park” the desired replacement property with an accommodation party until such time as the taxpayer arranges for the transfer of the relinquished property to the ultimate transferee in a © MartinWren, P.C. 2015 29 simultaneous or deferred exchange. Once such a transfer is arranged, the taxpayer transfers the relinquished property to the accommodation party in exchange for the replacement property, and the accommodation party transfers the relinquished property to the ultimate transferee. In other situations, an accommodation party may acquire the desired replacement property on behalf of the taxpayer and immediately exchange that property with the taxpayer for the relinquished property, thereafter holding the relinquished property until the taxpayer arranges for a transfer of the property to the ultimate transferee. Rev. Proc. 2000-37 provides procedures for qualifying parking transactions as like-kind exchanges in situations in which the taxpayer has a genuine intent to accomplish a like-kind exchange at the time that the taxpayer arranges for the acquisition of the replacement property and actually accomplishes the exchange within a short time thereafter. .04 Section 4.01 of Rev. Proc. 2000-37 provides that the Internal Revenue Service will not challenge the qualification of property held in a QEAA “as either ‘replacement property’ or ‘relinquished property’ (as defined in § 1.1031(k)-1(a)) for purposes of § 1031 and the regulations thereunder, or the treatment of the exchange accommodation titleholder as the beneficial owner of such property….” Thus, taxpayers are not required to establish that the exchange accommodation titleholder bears the economic benefits and burdens of ownership and is the “owner” of the property. The Service and Treasury Department are aware that some taxpayers have interpreted this language to permit a taxpayer to treat as a like-kind exchange a transaction in which the taxpayer transfers property to an exchange accommodation titleholder and receives that same property as replacement property in a purported exchange for other property of the taxpayer. .05 An exchange of real estate owned by a taxpayer for improvements on land owned by the same taxpayer does not meet the requirements of § 1031. See DeCleene v. Commissioner, 115 T.C. 457 (2000); Bloomington Coca-Cola Bottling Co. v. Commissioner, 189 F.2d 14 (7th Cir. 1951). Moreover, Rev. Rul. 67-255, 1967-2 C.B. 270, holds that a building constructed on land owned by a taxpayer is not of a like kind to involuntarily converted land of the same taxpayer. Rev. Proc. 2000-37 does not abrogate the statutory requirement of § 1031 that the transaction be an exchange of like-kind properties. .06 The Service and Treasury Department are continuing to study parking transactions, including transactions in which a person related to the taxpayer transfers a leasehold in land to an accommodation party and the accommodation party makes improvements to the land and transfers the leasehold with the improvements to the taxpayer in exchange for other real estate. SECTION 3. SCOPE This revenue procedure applies to taxpayers applying the safe harbor rules set forth in Rev. Proc. 2000-37 in structuring like-kind exchanges. © MartinWren, P.C. 2015 30 SECTION 4. APPLICATION .01 Section 1 of Rev. Proc. 2000-37 is modified to read as follows: SECTION 1. PURPOSE This revenue procedure provides a safe harbor under which the Internal Revenue Service will treat an exchange accommodation titleholder as the beneficial owner of property for federal income tax purposes if the property is held in a “qualified exchange accommodation arrangement” (QEAA), as defined in section 4.02 of this revenue procedure. .02 Section 4.01 of Rev. Proc. 2000-37 is modified to read as follows: SECTION 4. QUALIFIED EXCHANGE ACCOMMODATION ARRANGEMENTS .01 In general. The Service will treat an exchange accommodation titleholder as the beneficial owner of property for federal income tax purposes if the property is held in a QEAA. Property held in a QEAA may, therefore, qualify as either “replacement property” or “relinquished property” (as defined in § 1.1031(k)-1(a)) in a tax-deferred like-kind exchange if the exchange otherwise meets the requirements for deferral of gain or loss under § 1031 and the regulations thereunder. .03 Section 4.05 is added to Rev. Proc. 2000-37 to read as follows: .05 Limitation. This revenue procedure does not apply to replacement property held in a QEAA if the property is owned by the taxpayer within the 180-day period ending on the date of transfer of qualified indicia of ownership of the property to an exchange accommodation titleholder. SECTION 5. EFFECT ON OTHER DOCUMENTS Rev. Proc. 2000-37 is modified. SECTION 6. EFFECTIVE DATE This revenue procedure is effective for transfers on or after July 20, 2004, of qualified indicia of ownership to exchange accommodation titleholders (as described in section 4.02(1) of Rev. Proc. 2000-37). SECTION 7. DRAFTING INFORMATION The principal author of this revenue procedure is J. Peter Baumgarten of the Office of Associate Chief Counsel (Income Tax & Accounting). For further information regarding this revenue procedure, contact Mr. Baumgarten at (202) 622-4920 (not a toll-free call). © MartinWren, P.C. 2015 31