Chapter 008 Consumer Purchasing Strategies and Legal Protection

advertisement

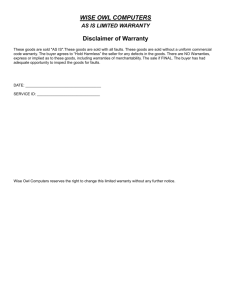

Finance 1200 Test 3 Chapters 8-9 True / False Questions 1. (p. 244) Overspending is a common cause of financial difficulties. TRUE 2. (p. 244) The opportunity costs associated with consumer purchases refer to the cost of an item and any finance charges if the item was purchased on credit. FALSE 3. (p. 245) The most consistent quality is usually found with nationally known, brand-name products. TRUE 4. (p. 247) An implied warranty is usually in written form. FALSE 5. (p. 260) Most consumer complaints need legal action to be resolved. FALSE 6. (p. 264) Representation by a lawyer is usually required in small claims court. FALSE 7. (p. 264) A class action suit allows many people with the same complaint to take action as a group. TRUE 8. (p. 246) Unit pricing uses a standard unit of measurement to compare prices of packages of different sizes. TRUE 9. (p. 247) A limited warranty covers all aspects of the product and does not require the buyer to incur any of the costs for shipping and repairs. FALSE Multiple Choice Questions 10. (p. 244) A personal opportunity cost associated with a consumer purchase refers to: A. buying on credit. B. selecting a commonly known brand. C. the influence of advertising on consumers. D. time used to compare prices. E. government regulation of deceptive business-government activities in an effort to prevent consumer fraud. 1 Finance 1200 Test 3 Chapters 8-9 11. (p. 245) Impulse buying refers to: A. evaluating alternatives. B. gathering information. C. comparison shopping. D. selecting the least desirable alternative. E. unplanned purchasing. 12. (p. 245) The highest consistency of quality is associated with ____________ brand items. A. generic B. national C. regional D. store E. manufacturer 13. (p. 246) A 32-ounce package selling for $1.60 would have a unit price of: A. $1.60. B. $2.00 a pound. C. 5¢ an ounce. D. 80¢ a quart. E. 12¢ an ounce. 14. (p. 247) Which of the following types of warranties is a specific agreement created by the seller or manufacturer? A. express B. implied C. full D. contingent E. limited 15. (p. 247) Howard Ramsell recently became aware of implied warranties that exist for consumer purchases. An implied warranty exists as a result of: A. a stated intent of the seller. B. actions by consumers. C. the intended use of a product. D. rulings of federal consumer agencies. E. a written statement from the manufacturer. 16. (p. 248-249) The major criticism of service contracts is: A. poor service from repair companies. B. limited coverage of repairs. C. weak government regulation of service contract companies. D. high costs and a low chance of need. E. that few places are available for repairs. 2 Finance 1200 Test 3 Chapters 8-9 17. (p. 260) Most consumer complaints are resolved by: A. legal action. B. assistance from a government agency. C. contacting a company's headquarters. D. returning to the place of purchase. E. obtaining help from an action line. 18. (p. 263) ____________ is the settlement of a difference by a third party whose decision is legally binding. A. A legal aid society B. Mediation C. Arbitration D. A consumer action panel E. Cooperative action 19. (p. 264) The purpose of small claims court is to: A. regulate fair business activities. B. provide hearing on proposed consumer protection laws. C. allow consumers with similar complaints to take action as a group. D. resolve minor consumer complaints. E. assist low-income consumers who need legal help. 20. (p. 264) Small claims court requires a person to have: A. written testimony. B. a case involving less than a set amount. C. representation by an attorney. D. evidence screened in advance of the hearing 21. (p. 264) Recently, Jim Dahl was on a bus tour in a mountain area. The bus broke down forcing the group to stay overnight. Group members had to pay for their own hotel bills. Jim believes that the hotel cost for the group should be paid by the tour company. Which legal action would be most appropriate? A. small claims court B. mediation C. legal aid society D. arbitration E. class action suit 3 Finance 1200 Test 3 Chapters 8-9 22. (p. 247) An implied warranty that comes with a used car is that: A. major repairs are the responsibility of the seller. B. government agencies will repair safety defects. C. the vehicle must be in operating condition. D. hidden defects will be repaired at no cost to the buyer. E. a vehicle must operate properly for at least one year. 23. (p. 247) A vehicle sold "as is" has: A. a limited warranty. B. no express warranty. C. a 30-day guarantee. D. a full warranty on parts but not labor. E. no implied warranties. 24. (p. 253) Most cars bought from private parties have: A. no implied warranties. B. a 30-day return privilege. C. a limited warranty. D. no express warranty. E. a government-supported repair guarantee. 25. (p. 248) The purpose of an automobile service contract is to: A. reduce operating costs of the vehicle. B. cover regular maintenance. C. provide automobile insurance at a discount. D. repair major problems after the warranty expires. E. stay informed of government safety recalls. 26. (p. 255) A disadvantage of leasing an automobile would be the: A. unexpected costs with a closed-end lease. B. responsibility for repair costs. C. poor expense records for tax purposes. D. limited mileage in the lease agreement. 27. (p. 257) Which of the following is usually the largest fixed expense for a new vehicle? A. insurance B. gasoline C. registration, license, and fees D. parking E. depreciation 4 Finance 1200 Test 3 Chapters 8-9 28. (p. 254-255) Which of the following would be an advantage of leasing a vehicle? A. Automatic ownership interest in the car B. Unlimited mileage on the car C. No need to meet credit requirements D. Lease payments are likely to be lower than finance payments E. All of the choices are advantages of leasing a vehicle 29. (p. 255) The price that is paid for a vehicle in a lease is called: A. The residual value B. The unit price C. The capitalized cost D. The deductible E. The premium True / False Questions 30. (p. 274-275) Opportunity costs of housing can refer to time and effort involved in finding and repairing a place to live along with lost interest earnings on security deposits and down payments. TRUE 31. (p. 280) A lease protects the rights of both the landlord only. FALSE 32. (p. 283) Condominiums involve the purchase of an individual living unit rather than an entire building. TRUE 33. (p. 288) Negotiating a purchase price for a home usually involves an offer and counteroffers. TRUE 34. (p. 289) The amount of the down payment will affect the amount of mortgage a person can afford. TRUE 35. (p. 292) Amortization refers to changes in the monthly payment for a variable rate mortgage. FALSE 36. (p. 295) Adjustable rate mortgages with a payment cap can result in a situation of negative amortization. TRUE 37. (p. 299) An escrow account is designed to reduce the cost of a mortgage. FALSE 38. (p. 300) An appraisal refers to the price for which a home has been sold. FALSE 5 Finance 1200 Test 3 Chapters 8-9 Multiple Choice Questions 39. (p. 275) Renting is more advantageous than buying a home for: A. lower short-term living costs. B. financial benefits. C. long-term investment purposes. D. receiving tax benefits. E. permanence of residence. 40. (p. 274-275) A common opportunity cost associated with renting is: A. interest lost on the down payment. B. interest lost on closing costs. C. property taxes. D. maintenance costs. E. interest lost on the security deposit. 41. (p. 280) Renting would be most appropriate for people who: A. want to reduce their taxes. B. have difficulty establishing credit. C. have limited funds currently available. D. enjoy remodeling their residence. E. desire the financial benefits of increased equity. 42. (p. 280) Brenda Williams plans to rent instead of buy her housing. What advantage of renting will Brenda encounter? A. tax advantages B. lower initial costs C. community pride D. financial benefits E. home improvement flexibility 43. (p. 280) The legal document involved in renting an apartment is called a(n): A. service contract. B. mortgage. C. lease. D. security deposit. E. escrow account. 6 Finance 1200 Test 3 Chapters 8-9 44. (p. 281) The purpose of a security deposit is to: A. pay for potential damages. B. cover the costs of utilities. C. pay for the tenant's portion of real estate property taxes. D. cover increases in monthly rent. E. meet government housing regulations for a safe building. 45. (p. 282) Lonette and Al received a statement reporting that they paid $8,000 in mortgage interest during the past year. If they are in a 28 percent tax bracket, this deduction may reduce their taxable income by: A. $1,000. B. $2,240. C. $3,000. D. $4,000. E. $8,000. 46. (p. 283) A common financial risk of home ownership is that: A. interest rates may change with a conventional mortgage. B. property values may decrease. C. mortgage interest is not tax deductible. D. only a portion of real estate taxes are tax deductible. 47. (p. 288) The purpose of a counteroffer is to: A. negotiate the purchase price. B. reduce mortgage payments. C. lower real estate property taxes. D. avoid paying points at closing. E. avoid paying the real estate agent's commission. 48. (p. 288) Earnest money has the purpose of: A. paying real estate property taxes. B. reducing the mortgage interest rate. C. serving as good faith by a homebuyer. D. paying the real estate agent's commission. E. being a mortgage application fee. 7 Finance 1200 Test 3 Chapters 8-9 49. (p. 292) What is prepaid interest charged by a mortgage company? A. escrow B. points C. origination fee D. title fee E. deed 50. (p. 292) A conventional mortgage usually involves: A. a variable interest rate. B. a government guarantee. C. a balloon payment. D. equal payments. E. a payment cap. 8