Phone Script for Tax Season

advertisement

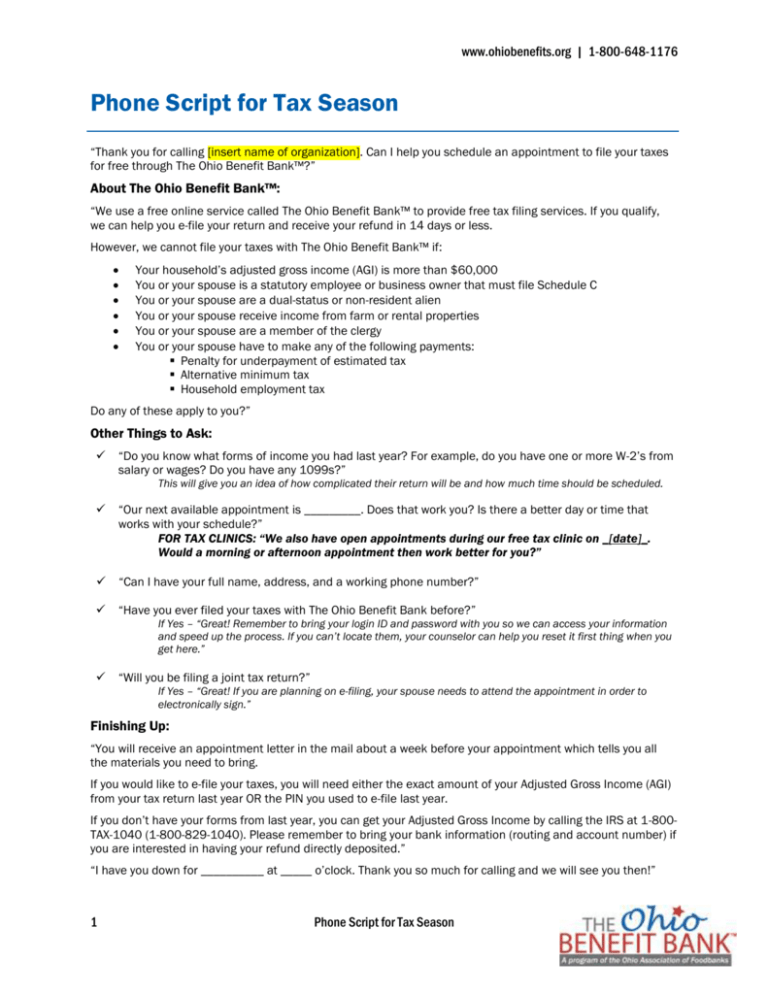

www.ohiobenefits.org | 1-800-648-1176 Phone Script for Tax Season “Thank you for calling [insert name of organization]. Can I help you schedule an appointment to file your taxes for free through The Ohio Benefit Bank™?” About The Ohio Benefit Bank™: “We use a free online service called The Ohio Benefit Bank™ to provide free tax filing services. If you qualify, we can help you e-file your return and receive your refund in 14 days or less. However, we cannot file your taxes with The Ohio Benefit Bank™ if: Your household’s adjusted gross income (AGI) is more than $60,000 You or your spouse is a statutory employee or business owner that must file Schedule C You or your spouse are a dual-status or non-resident alien You or your spouse receive income from farm or rental properties You or your spouse are a member of the clergy You or your spouse have to make any of the following payments: Penalty for underpayment of estimated tax Alternative minimum tax Household employment tax Do any of these apply to you?” Other Things to Ask: “Do you know what forms of income you had last year? For example, do you have one or more W-2’s from salary or wages? Do you have any 1099s?” This will give you an idea of how complicated their return will be and how much time should be scheduled. “Our next available appointment is _________. Does that work you? Is there a better day or time that works with your schedule?” FOR TAX CLINICS: “We also have open appointments during our free tax clinic on _[date]_. Would a morning or afternoon appointment then work better for you?” “Can I have your full name, address, and a working phone number?” “Have you ever filed your taxes with The Ohio Benefit Bank before?” If Yes – “Great! Remember to bring your login ID and password with you so we can access your information and speed up the process. If you can’t locate them, your counselor can help you reset it first thing when you get here.” “Will you be filing a joint tax return?” If Yes – “Great! If you are planning on e-filing, your spouse needs to attend the appointment in order to electronically sign.” Finishing Up: “You will receive an appointment letter in the mail about a week before your appointment which tells you all the materials you need to bring. If you would like to e-file your taxes, you will need either the exact amount of your Adjusted Gross Income (AGI) from your tax return last year OR the PIN you used to e-file last year. If you don’t have your forms from last year, you can get your Adjusted Gross Income by calling the IRS at 1-800TAX-1040 (1-800-829-1040). Please remember to bring your bank information (routing and account number) if you are interested in having your refund directly deposited.” “I have you down for __________ at _____ o’clock. Thank you so much for calling and we will see you then!” 1 Phone Script for Tax Season