The balance sheet

advertisement

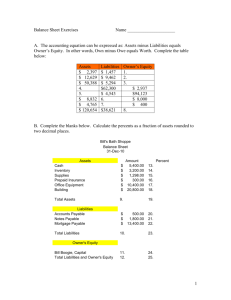

The balance sheet A balance sheet lists the assets, liabilities and equity of your business at a specific point in time. It is used to calculate a company’s net worth. NOTE: The balance sheet must balance. The basic equation is: Total assets = liabilities + equity Subtracting liabilities from assets will then show the net worth of the business. How to write a balance sheet The top section of the balance sheet should list your business’s assets in order of liquidity (from most to least liquid). Total assets Your business’s total assets are the sum of current and long-term assets. Current assets include: Cash or its equivalent Assets that will be used by the business in a year or less Long or fixed term assets include: Any assets that are durable Assets that will last more than one year Current assets Cash Accounts receivable Inventory Long-term or fixed assets Capital and plant Investment Miscellaneous assets bizconnect.standardbank.co.za Cash on hand when books are closed at the end of the fiscal year. This includes all cash, savings, cheques, and short-term investment accounts. The total amount of income received/derived from credit accounts. This is logged into the books at the close of the fiscal year. Related to the cost of goods. Inventory refers to the material used to manufacture a product not yet sold. The book value of all owned capital equipment and property, less depreciation. Any investments held by the company that can’t be converted to cash in under one year. These kinds of investments tend to take time to accumulate. All other long-term assets that do not fall into the categories listed above. Total liabilities After listing your business’s assets, you need to account for your liabilities. Like assets, these are classified as current or long term. Debts that are due in one year or less are current liabilities. Long-term liabilities are due in more than one year. Current liabilities Accounts payable Accrued liabilities Taxes Long-term liabilities Bonds payable Mortgage payable Loans payable All expenses incurred by the business. This includes purchases from regular creditors on an open account that are due and payable. All expenses incurred by the business that are required for operation, but haven’t been paid at the time the books are closed. These tend to include the company’s overheads and salaries. Payments still due and payable at the time the books are closed. The total of all bonds that are due and payable over a period exceeding one year. Loans taken out for the purchase of real estate. These are repaid over a long-term period. The mortgage payable is the amount still due at the close of each fiscal year. The amounts still owed on any long-term debts that will not be repaid over the course of the current fiscal year Calculating equity Owner’s equity is the difference between total assets and total liabilities. This means it can only be calculated once liabilities have been listed. Investors evaluate businesses based on the amount of equity the owner has in the company. It often determines the amount of capital the investor feels they can safely invest in the company. Remember, the calculation is total assets = liabilities + equity bizconnect.standardbank.co.za