Solutions to the Review Problems

advertisement

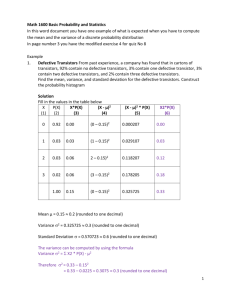

Solutions to the Review Problems 1. a) Cov(X,Y)=E(XY)-E(X)E(Y) E(XY)=.25(1)+.10(2)+.10(2)+.10(4)+.10(6)+.05(3)+.10(6)+.10(9)+.05(12)+.05(16)= 4.7 This implies that Cov(X,Y)= 4.7 -2.05(2)=.60 Since the covariance is positive that implies that Supply and Demand tend to move in the same direction. b) Z= Total televisions that are sold. Note that Z=minimum(X,Y). z p(z) 1 .25 +.10 +.05 + .10 =.50 Cells that contribute are (x,y)= (1,1),(2,1),(3,1),(1,2) 2 .10 +.10 +.10 =.30 Cells that contribute are (x,y)=(2,2),(3,2),(2,3) 3 .10 +.05 = .15 Cells that contribute are (x,y)=(3,3),(3,4) 4 .05 Cell that contributes is (4,4) E(Z)=.50(1)+.30(2)+.15(3)+.05(4)=1.75. Since Profit is 100Z, E(Profit) = $175 c) If supply equals 3 then the probability that demand is 1, 2, 3 or 4 is 1/6, 1/3 , 1/3, and 1/6. Hence the number sold has the following distribution z p(z) 1 1/6 Cell is (3,1) 2 1/3 Cell is (3,2) 3 1/2 Cells are (3,3) and (3,4) Since E(Z)= 1/6 +2/3 +3/2= 2.3333 hence E(Profit) = $233.33 12 12 2. a) E(X)=∫0 x(x/24-x2/288) dx = x3/72-x4/1152 ] 0 =24-18=6 V(X)= E(X2)-E2(X)= 43.2-62 =7.2 12 12 b) P(X > 10)=∫10 (x/24-x2/288) dx = x2/48-x3/864 ] 10 = [(3-2)-(2 .0833 – 1.1574)]= .0741 If normal it is P(Z> (10-6)/7.2 ½ = 1.49) = 1- .9319 = .0681 c) The total has mean of 20(6)=120 and variance of 20(7.2)= 144 or standard deviation of 12. P(Total > 150)= P(Z > (150-120)/12 = 2.5)= 1-.9938=.0062. d) We assumed the total is normal. By the central limit this is likely to be a good approximation. Using a normal approximation is preferred in c) over b). x x 3. a) F(x) = ∫-2 (12-3x2)/32 = [12x-x3 ]-2 /32 = (12x-x3 +16) / 32 for –2 < x <2 F(1)-F(-1) = 27/32 – 5/32 = 22/32 = .6875 b) P(X > 1) = 1 –P(X=0)=1-(.3125)3 = .9695 c) X = number that are within one millimeter. X is binomial (n=100, p =.6875). 100 Exact answer is Σ (100 choose x) (.6875)x (.3125)100-x x= 60 Approximate X by a normal with mean = np=68.75 and variance=npq=100(.6875)(.3125)= 21.4844. Std. deviation = 21.48441/2 = 4.6351 P(X >60) = P(Z> (60-68.75)/ 4.6351=-1.89)= .9706 2 2 2 2 4 d) E(X) = ∫x(12-3x )/32 dx = 6x -3x /4] /32 =0 -2 -2 e) m satisfies F(m)=1/2. It is clear from F(x) in a) that m=0. Note that E(X) and m=0 because f(x)=f(-x) so f(x) is symmetric about 0. 4. a) P( R > 7) = P(Z > (7-5)/2=1) = 1-.8413=.1587 b) P(B > 14)= P(Z>(14-10)/4=1)=.1587 Probability that neither run out is .84132 = .7078. Probability at least one runs out is 1-.7078=.2922 c) Total has mean = 5+10=15 and variance = 4+16=20. P(T > 21)=P(Z >(21-15)/201/2 = 1.34) = 1-.9099=.0901 If the correlation were negative then the standard deviation of T would decrease. This would increase the z value and hence reduce the probability. d) z .8 = .84. Hence they should stock 15+.84(201/2 ) = 18.76 or 18,760. p(y) yp(y) y2p(y) 2 .3 .6 4(.3)= 1.2 3 .35 1.05 9(.35)=3.15 4 .35 1.40 16(.35)=5.6 E(Y)= 3.05 E(Y2)=9.95 So Var(Y)=9.95-3.052 =.6475 Standard deviation is .64751/2 = .8047 b) y p(y|X=4) yprob 2 .03/.30=.10 .2 3 .12/.30=.40 1.2 4 .15/.30=.50 2.0 E(Y|X=4)= 3.4 5. a) y c) E(XY)=.15(0*2)+.05(1*2)+.03(2*2)+.04(3*2)+.03(4*2) +.10(0*3)+ .05(1*3)+.02(2*3)+.06(3*3)+.12(4*3) + .05(0*4)+.05(1*4)+.05(2*4)+.05(3*4)+.15(4*4) = 6.55 Cov(X,Y)=6.55-2.0(3.05)= .45 Corr=.45/(2.71/2*.8047)= .3403 Since it is positive those who tend to do homeworks perform better. The fact that the number is not that high says the strength to which this occurs (linearly) is modest. 6. Sales is Binomial with n=250,000 and p=.1 250,000 P(Sales > 24,775) = (250,000 choose x) .1 x .9 250,000-x x=24,775 b) Sales is approximately normal. Mean =np=25,000, Variance=npq=22,500 std. dev = 150. P(Sales > 24,775) = P(Z > (24,775-25,000)/150 = -1.5) = .9332 c) Profit = 8 Sales -.5(250,000-Sales)= 8.5Sales -125,000 E(Profit)= 8.5(25,000)-125,000=87,500 Std. Dev(Profit) = 8.5 Std. Dev Sales= 8.5(150)=1,275 7. a) Prob of at least one offer is 1- Prob(no offer) = 1-.75 3= .5781 b) P(no job offer)= .85(.75)(.65)= .4144 So Prob at least one is .5856 c) i) P(B2)=P(B2|B1)P(B1)+P(B2|N1)P(N1) Note N is used as complement of B = .4(.25)+.2(.75)= .25 Note: To answer all of the questions in c it is easiest to list all atoms and probabilities. Atom Prob 1. B1 B2 B3 .25(.4)(.4)=.04 2. B1 B2 N3 .25(.4)(.6)= .06 3. B1 N2 B3 .25(.6)(.2) =.03 4. B1 N2 N3 .25(.6)(.8)=.12 5. N1 B2 B3 .75(.2)(.4)=.06 6. N1 B2 N3 .75(.2)(.6)=.09 7. N1 N2 B3 .75(.8)(.2)=.12 8. N1 N2 N3 .75(.8)(.8)=.48 i) Add up 1. 2. 5. 6. and get .04+.06+.06+.09=.25 ii) 1-Prob(no offer) = 1-.48=.52 iii) P(B1|B3) =P(B1 and B3)/P(B3). P(B1 and B3) = Add up 1. and 3. = .04+.03=.07 P(B3) = Add up 1. 3. 5. 7. =.04+.03+.06+.12= .25 Answer is .07/.25 = .28 8. a) E(A/3+2B/3)= 12/3 +2(15)/3 = 14. E(2A/3 +B/3) = 2(12)/3+ 15/3 = 13 Investment 1 is preferred. b) V(A/3+2B/3)=(1/3)2(18)2+ (2/3)2(27)2 +2(1/3)(2/3)(.6)(18)(27) = 489.6 V(2A/3+B/3)= (2/3)2 (18)2 + (1/3)2 (27)2+2(2/3)(1/3)(.6)(18)(27) =354.6 So investment 2 is less risky. c) In the long run- we need to consider Mean – Variance/2. Investment A: .12- (.18)2/2 = .1038 Investment B: .15-(.27)2/2 = .1136 So Investment B is preferred. Solutions Midterm Exam II 1. 1 A. E(x)= x(4 x 4 x 3 )dx .533 years. 0 x B. F(x)= (4 x 4 x 3 )dx 2 x 2 x 4 0 P(x>1/2)=1-F(1/2)=9/16=.5625 C. P(x>3/4)=1-F(3/4)=.1914 P(x>3/4|x>1/2)=P(x>3/4 and x>1/2)/P(x>1/2)=P(x>3/4)/P(x>1/2)=.3403 2. A. y p(y) yp(y) (y-2.1)2p(y) 1 .3 .3 .363 2 .3 .6 .003 3 .4 1.2 .324 E(y)=2.1 V(y)=.69 E(xy)=1(.1)+2(.1)+3(.1)+2(0)+4(.2)+6(.1)+3(0)+6(.1)+9(.3)=5.3 Cov(xy)=5.3-(2.4)(2.1)=.26 .26 Corr= .4719 .44 .69 Modest tendency for rating no increase with greater years of experience B. x 1 2 3 1 10000 5000 0 y 2 20000 15000 10000 ~~~~~profit 3 30000 25000 20000 P(profit>12500)=0+.2+0+.1+.3=.6 C. y 1 2 3 P(y|x=3) profit|(x=3) prob*profit .1/.5=.2 0 0 .1/.5=.2 10000 2000 .3/.5=.6 20000 12000 Expected profit when x=3 is 140000 3. A. E(2X − Y) = 2E(X)−E(Y) = 2×15 − 10 = 20 V(2X − Y) = 4V(X)+V(Y) + 2×2×(-1) ×Cov(X,Y) Since Cov(X,Y) = Corr(X,Y) σ(X) σ(Y) = 5 (20) (10) = 100 V(2X −Y) = 4(20)2 + 102 −4(100) = 1300 σ(2X −Y) = 36.0555. B. Since the coefficient in front of the covariance is negative (−4). If the correlation between X and Y were negative that could increase the standard deviation. P(Return < 0) = P(Z < z = (0 − 20)/(St.Dev)). A higher standard deviation makes the z larger in magnitude, which increases the probability. C. P(X<r) = P(Z<(r −15)/20), P(Y<r) = P(Z<(r −10)/10). For these to be the same, we need (r −15)/20 = (r −10)/10 10 r − 150 = 20 r − 200 r =5. 4. A. p = 0.2. P(X ≥ 30) = ∑ x=30100 (100x)(0.2)x(0.8)(100 −x) X is approximately normal with μ = np = 100 (0.2) = 20 and σ2 = np(1-p)=100(0.2)(0.8)= 16 σ = 4. P(X≥ 30) ≈ P(Z≥(30 − 20)/4 = 2.5) = 1 −0.9938 = 0.0062. B. The mean for 100 individuals is 100(30) = 3000. The variance for 100 individuals is 100(200) =20,000. Hence the standard deviation is √20,000 = 141.4214. To be on 99th percentile of a normal (by central limit theorem) corresponds to z=2.l33. Hence, the amount is 3,000+2.33(141.4214) = 3,329.52 ≈ 3,330 dollars. C. We want p2=0.99 p=√.99 = .994987 ≈ .995. 5. (CD=classify defective; CN=classify not defective) A. Defective Not defective Total CD 0.1*0.9=0.09 0.9*0.1=0.09 0.18 CN 0.1*0.1=0.01 0.9*0.9=0.81 0.82 So, P(Defective|CD)=0.09/0.18=0.5 B. . Defective Not defective Total st nd 1 2 CD CD 0.1*0.9*0.9=0.081 0.9*0.1*0.1=0.009 CD CN 0.1*0.9*0.1=0.009 0.9*0.9*0.1=0.081 CN CD 0.1*0.1*0.9=0.009 0.9*0.9*0.1=0.081 CN CN 0.1*0.1*0.1=0.001 0.9*0.9*0.9=0.729 So, P(Defective| Both CD)=0.081/0.09=0.9 0.09 0.09 0.09 0.73 C. P(2nd CD| 1st CD)=P(Both CD)/P(1st CD)=0.09/(0.09+0.09)=0.5