File - Jason M. Williams

advertisement

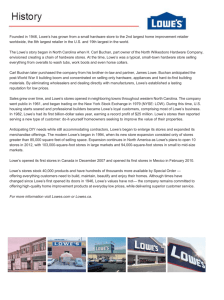

Running head: A LOOK AT LOWES COMPANIES INC A Look at Lowes Companies INC Jason Williams Siena Heights University 1 Running head: A LOOK AT LOWES COMPANIES INC 2 "We will provide customer-valued solutions with the best prices, products and services to make Lowe are the first choice for home improvement.” Background on Company Lowe’s was founded in 1946, in North Wilkesboro North Carolina by H. Carl Buchan. The idea came about when Mr. Buchan, who at the time was part owner of the North Wilkesboro Hardware Company, had a vision, of creating and owning a chain of hardware stores. During this time, Lowe’s was a bit different then it is today, as they sold everything from overalls, snuff, washtubs, to horse collars; most of these aren’t found in today’s stores. Mr. Buchan would later buy out his brother-in-law and partner James Lowe, and would change the store completely, foreseeing an up-coming building boom. He changed Lowe’s into a store that now sold appliances, hardware, and hard to find building materials. During this time, Buchan also decided to eliminate the wholesaler and deal directly with the manufacturer, resulting in lower prices, and what would eventually become the company’s slogan, “Everyday Low Prices.” The company would go public in 1961, and in 1979, it began to be publicly traded on the New York Stock Exchange (NYSE) under the acronym, “LOW.” In 1982, Lowe’s set a record year, with its first billion dollar sales year, with a record breaking 25 million dollar profit. During this time frame, Lowe’s changed its target market and become more geared towards a new type of customer, the DIY or do-it-yourself homeowner. Anticipating the needs of contractors, Lowes began to expand its stores during the 1990’s, and it in 1994 modern Lowe’s began, when new store expansion consisted of only large stores, defined as stores with greater than 85,000 square feet of selling space. Running head: A LOOK AT LOWES COMPANIES INC 3 Expansion continues as Lowe's opens a new store on average every week with our 117,000-square-foot stores in the nation’s larger metro markets and our newer 94,000square-foot stores in the nation’s small to mid-sized markets. Lowe's opened its first stores in Canada in December 2007 and opened its first stores in Mexico in February 2010. Today Lowes stores stock over 40,000 different items and have hundreds of thousands more available by special order. Lowe’s is currently ranked 42nd on Forbes Fortune 500 list, and was the first winner of the ENERGY STAR® Sustained Excellence Award in Retail. Although times may be tough, Lowe’s is also generous in its school and community contributions, donating over $30 million in 2009. Today, with the current state of the economy, Lowes along with the other building retail industry stores are struggling; as economist say that, “The majority of the DIY projects, are done during the first two years of home ownership.” However, with the current housing market in a downfall, people aren’t buying homes, and the stores are suffering. Recently, however things have begun to look up for Lowes, and hopefully will be a sign of great things to come. (Lowes History/Overview, 2010) The Management Team Currently, Lowe’s management team is set up similar to many other companies in the United States with a CEO, CFO, COO, and other major components, which are as follows: The CEO is Robert A. Niblock, who has been in this position since 2005, and with the company since 1993. Mr. Niblock also serves as the chairman for the board of directors. The President and COO of Lowe’s, is Larry Stone, who has been in the position since 2006 and with the company since 1969. ( I believe Mr. Stone recently stepped down from this position, with plans to retire) The Executive Vice President and CFO is Robert F. Hull, JR, who has been in this position since 2003, and with the company since 1999 Running head: A LOOK AT LOWES COMPANIES INC 4 The rest of the board and management team are made up of various Vice Presidents of their respective divisions, such as logistics, sales, information technology, customer support, etc. (Lowes History/Overview, 2010) Competition Lowe’s is a company that has both major and minor competitors. Their biggest competition comes in the form of the industry’s #1 retailer Home Depot. Lowe’s also faces competition from the #3 largest in the industry in Menards. Lowe’s faces different kinds of competition as well, as some stores sell similar products, but aren’t quite the same; stores like Tractor Supply Company. Also, Lowe’s faces competition from the “mom and pop” hardware stores and the other major “non-industry” retailers like Meijer, Wal-Mart, K-Mart, Target and other big box stores. Financial Ratios (Numbers from Google and Yahoo Finance) Current Ratio Current Assets/ Current Liabilities 2010-9,732,000/7,355,000=1.32 2009-9,190,000/7,560,000=1.22 2008-8,686,000/7,751,000=1.12 2010-For each dollar in current liabilities Lowe’s has, they have $1.32 in current assets. 2009- For each dollar in current liabilities Lowe’s has, they have $1.22 in current assets. 2008- For each dollar in current liabilities Lowe’s has, they have $1.12 in current assets. -Home Depot Numbers: 2010-1.34 2009-1.2 2008-1.15 Running head: A LOOK AT LOWES COMPANIES INC Quick Ratio (Current Assets-Inventories)/Current Liabilities 2010-(9,732,000-8,249,000)/7,355,000=.20 2009-(9,190,000-8,209,000)/7,560,000=.13 2008-(8,686,000-7,611,000)/7,751,000=.14 2010- For every dollar in current liabilities Lowe’s has, they have $.20 cents in current assets minus inventories 2009- For every dollar in current liabilities Lowe’s has, they have $.13 cents in current assets minus inventories 2008- For every dollar in current liabilities Lowe’s has, they have $.14 cents in current assets minus inventories -Home Depot Numbers: 2010-.36 2009-.24 2008-.23 Days-Sales-Outstanding Lowes didn’t present any receivable numbers; therefore this ratio can not be completed with the given data. Total Asset Turnover Sales/Total Assets 2010-47,220,000/33,005,000=1.43 2009-48,230,000/32,625,000=1.48 2008-48,283,000/30,869,000=1.56 2010-For every dollar in total assets, Lowes has $1.43 in total sales 2009-For every dollar in total assets, Lowes has $1.48 in total sales 2008-For every dollar in total assets, Lowes has $1.56 in total sales -Home Depot Numbers: 2010-1.65 2009-1.73 2008-1.75 5 Running head: A LOOK AT LOWES COMPANIES INC Debt-to-Assets Total Debt/Total Assets 2010-13,936,000,000/33,005,000=.42 2009-14,570,000,000/32,625,000=.45 2008-14,771,000,000/30,869,000=.48 2010-Lowes finances each dollar of assets with .42 cents in total debt 2009-Lowes finances each dollar of assets with .45 cents in total debt 2008-Lowes finances each dollar of assets with .48 cents in total debt -Home Depot Numbers: 2010-.53 2009-.57 2008-.60 Times Interest Earned EBIT/Interest 2010-2,825,000/0=N/A 2009-3,506,000/298,000=11.77 2008-4,750.000/239.000=19.87 2010-Lowes had no interest charges in 2010 2009-Lowes could cover any interest charges that might arise 11.77 times 2008-Lowes could cover any interest charges that might arise 19.87 times -Home Depot Numbers: 2010-2009-2008Profit Margin Net Income/Sales 2010-1,783,000/47,220,000=.037 or 3.7% 2009-2,195,000/48,230,000=.045 or 4.5% 2008-2,809,000/48,283,000=.058 or 5.8% 2010- For every one dollar in sales revenue that Lowes has, they have 3.7 cents in net income 2009- For every one dollar in sales revenue that Lowes has, they have 4.5 cents in net income 2008- For every one dollar in sales revenue that Lowes has, they have 5.8 cents 6 Running head: A LOOK AT LOWES COMPANIES INC in net income -Home Depot Numbers: 2010-4% 2009-3% 2008-5.6% Return On Assets Net Income/Total Assets 2010-1,783,000/33,005,000=.05 or 5% 2009-2,195,000/32,625,000=.067 or 6.7% 2008-2,809,000/30,869,000=.09 or 9% 2010-For every dollar invested in total assets, Lowes has 5 cents in net Income 2009-For every dollar invested in total assets, Lowes has 6.7 cents in net income 2008-For every dollar invested in total assets, Lowes has 9 cents in net income -Home Depot Numbers: 2010-6.5% 2009-5.5% 2008-9.9% Return on Equity Net Income/Common Equity 2010-1,783,000/19,069,000=.09 or 9% 2009-2,195,000/18,055,000=.12 or 12% 2008-2,809,000/16,098,000=.17 or 17% 2010-For every one dollar in stockholder’s equity Lowes has, they have 9 cents in net income 2009-For every one dollar in stockholder’s equity Lowes has, they have 12 cents in net income 2008-For every one dollar in stockholder’s equity Lowes has, they have 17 cents in net income -Home Depot Numbers: 2010-13.7% 2009-12.7% 2008-24.8% Book Value per Share Common Equity/Shares Outstanding 2010-19,069,000,000/1,459,000,000=13.07 2009-18,055,000,000/1,470,000,000=12.28 2008-16,098,000,000/1,458,000,000=11.04 -Home Depot Numbers: 2010-11.42 2009-10.48 2008-10.48 7 Running head: A LOOK AT LOWES COMPANIES INC 8 Horizontal Analysis Horizontal Analysis Lowe's Companies Inc-Income Statement For years 2010, 2009, 2008 Total Revenue Cost Of Revenue Gross Profit Operating Expenses Research Development Selling General and Admin Non Recurring Others Total Operating Expenses Operating Income or Loss Income From Continuing Operations Total Other Income/Expenses Net Earnings Before Interest and Taxes Interest Expense Income Before Tax Income Tax Expense Minority Interest Net Income from Continuing Ops Non-Recurring Events Discountiued Operations Extraordinary Items Effect Of Accounting Changes Other Items Net Income Preferred Stock and Other Adjustments Net Income Applicable to Common Shares Jan 29th,2010 Jan 30th, 2009 Feb 1st, 2008 47,220,000 48,230,000 48,283,000 30,757,000 31,729,000 31,556,000 16,463,000 16,501,000 16,727,000 - 11,688,000 49,000 1,614,000 - 11,074,000 102,000 1,539,000 2,825,000 2,825,000 1,042,000 - - 105.32% 72.34% 112.66% 100.00% 100.00% 100.00% 3,506,000 4,705,000 60.04% 74.52% 100.00% 18,000 3,506,000 298,000 3,506,000 1,311,000 45,000 4,750,000 239,000 4,511,000 1,702,000 62.62% 61.22% 40.00% 73.81% 124.69% 77.72% 77.03% 100.00% 100.00% 100.00% 100.00% 100.00% 63.47% 78.14% 100.00% - 59.47% - 2,195,000 1,783,000 - 2008 100.00% 100.00% 100.00% 111.16% 34.75% 118.16% 1,783,000 - 2009 99.89% 100.55% 98.65% 10,515,000 141,000 1,366,000 2,825,000 2010 97.80% 97.47% 98.42% 2,809,000 - 2,195,000 - - - - 2,809,000 63.47% 78.14% 100.00% 2,809,000 63.47% 78.14% 100.00% 1,783,000 2,195,000 Running head: A LOOK AT LOWES COMPANIES INC Works Citied Companies, L. (2010). Lowes: company overview. Retrieved from http://media.lowes.com/company+overview/ Companies, L. (2010). Lowes: the history. Retrieved from http://media.lowes.com/history/ 9