Problem 1: If Japanese car costs 500,000 yen, a similar American

advertisement

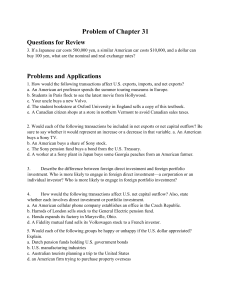

Problem set 5 Problem 1: If Japanese car costs 500,000 yen, a similar American car costs $10,000, and a dollar can buy 100 yen, what are the nominal and real exchange rates? Problem 2: Would each of the following transactions be included in net exports or net capital outflow? Be sure to say whether it would represent an increase or a decrease in that variable. a. b. c. d. A Turkish citizen buys a Sony TV. A Turkish citizen buys a share of Sony stock. The owner of Sony buys a bond from the Turkish treasury. A worker at Sony plant in Japan buys some apricot from a Turkish farmer. Problem 3: How would the following transactions affect Turkey exports, imports, and net exports? a. b. c. d. A Turkish business professor spends the summer touring museums in Europe. Students in Paris are coming to Turkey to see the latest movie from Yeşilçam “Turkish Hollywood” Your uncle buys a new Volvo. The student bookstore at Oxford University in England sells a pair of Mavi Jeans Problem 4: Describe the difference between foreign direct investment and foreign portfolio investment. Who is more likely to engage in foreign direct investment-a corporation or an individual investor? Who is more likely to engage in foreign portfolio investment? Problem 5: How would the following transactions affect Turkey’s Net capital outflow? Also, state whether each involves direct investment or portfolio investment. a. b. c. A Turkish textile company establishes an office in the Czech Republic. Arçelik sells stock to the General Electric company Ford expands its factory in Bursa, Turkey Problem 6: a. Does this table show nominal or real exchange rates? Explain. b. What are the exchange rates between Turkey and the United States and Turkey and Euro zone? Calculate the exchange rate between the United States and Euro zone. Problem set 5 c. If Turkey’s inflation exceeds United States’ inflation over the next year, would you expect TL to appreciate or depreciate relative to the U.S Dollar? Problem 7: Would each of the following groups be happy or unhappy if the TL appreciated? Explain. a. Dutch company holding Turkey’s Government bonds b. Turkish Manufacturing industries c. Australian tourists planning a trip to Turkey d. A Turkish firm trying to purchase property overseas. Problem 8: Assume that American rice sells for $100 per bushel, Japanese rice sells for 16,000 yen per bushel, and the nominal exchange rate is 80 yen per dollar. a. Explain how could make a profit from this situation. What could be your profit per bushel of rice? If other people exploit the same opportunity, what would happen to the price of rice in Japan and the price of rice in the United States? b. Suppose that rice is the only commodity in the world. What would happen to the real exchange rate between the United States and Japan? Problem 9: A case study in the chapter analyzed purchasing-power parity for several countries using the price of Big Macs. Here are for a few more countries: a. For each country, compute the predicted exchange rate of the local currency per U.S. Dollar. (Recall that the U.S. price of a Big Mac was $3.41.) b. According to purchasing-power parity, what is the predicted exchange rate between the Hungarian forint and the Canadian dollar? What is the actual exchange rate? c. How well does the theory of purchasing-power parity explain exchange rates? Problem set 5