PowerPoint Sunusu - The International Insurance Forum

advertisement

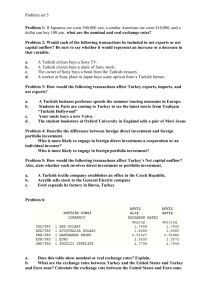

Alper Tan 1 Content Insurance Association of Turkey Turkish Insurance Industry Ongoing Projects of Association 2 Insurance Association of Turkey 3 Insurance Association of Turkey • The Association of the Insurance, Reinsurance and Pension Companies of Turkey is a specialist institution with the characteristics of a unique nongovernmental institution operating under Insurance Law No. 5684. Committees of the Association The Association established the following committees to facilitate the preparation and revision of all legislation, tariffs, working guides and general clauses relating to insurance; to foster the insurance sector and to conduct studies and research on sectoral problems: •Fire Insurance •Marine Insurance •Casualty Insurance •Non-life Claims •Engineering Insurance •Life Insurance •Risk Engineering Health Insurance Liability Insurance Agriculture Insurance Financial & Accounting Law & Legal Protection AML/CFT Actuary International Memberships • Insurance Europe, European Insurance and Reinsurance Federation www.cea.eu • IAIS, International Association of Insurance Supervisors www.iaisweb.org • IMIA, International Association of Engineering Insurers www.imia.com • IUMI, International Union of Marine Insurance www.iumi.com • ICC, International Chamber of Commerce www.iccwbo.org • FALIA, The Foundation for the Advancement of Life & Insurance www.falia.jp Turkish Insurance Industry 7 Turkish Insurance Industry 37 8 Non-life Life 1 18 Reinsurance Life & Pension 64 active companies 8 Turkish Economy 2013 GDP GDP per capita Inflation Inflation Unemployment 818 Billion $ 10,675 $ CPI 7.40% PPI 6.97% 10.02% ( * ) GDP and unemployment are estimated 9 World Insurance Industry vs Turkey World average - Premiums in percent of GDP is 6.5% Developed Countries Developing Countries 8.6% 2.7% USA UK Turkey 6.8% 11.2% 1.4% World average - Premiums per capita is 656 USD Developed Countries Developing Countries 3,677 $ 120 $ USA UK Turkey 4,047 $ 4,350 $ 146 $ SOURCE: Swiss Re, Sigma No: 3/2013. 10 Number of employees working in Turkish insurance industry 2009 2010 2011 2012 2013 16,300 16,568 17,314 17,704 18,137 11 MILLION USD Premium Production (2009-2013) ($) 12,000 10,000 8,000 6,000 4,000 2,000 0 Non Life Life Total 2009 6,770 1,168 7,938 2010 7,935 1,448 9,383 2011 8,616 1,598 10,214 2012 9,508 1,505 11,013 2013 9,762 1,590 11,352 Premium production in Turkey: More than 11 billion USD Real growth rate 13.5% (in USD) Total Premium Production Per Capita ($) 136 150 100 40 50 4 13 0 14 146 148 Profitability of Turkish Insurance Industry (Non-Life) (000 TL) 1,000,000 834,511 500,000 0 130,867 2009 -500,000 -660,354 2,940 2010 58,587 2011 -714,972 2012 -589,006 -652,627 -1,000,000 -1,500,000 -1,346,519 Total Technical Profit Profit of MOD+MTPL 15 2013 47,596 Ongoing projects of Association 16 Projects Association has focused on profitability of motor insurance. We have taken consulting services from two international firms. Projects; Direct settlement system Certification of body shops and spare parts used during repair Loss of support Fraud 17 Direct Settlement System With the implementation of direct settlement system no faulty insured will approach to his own insurance company (MTPL)… No faulty insured 1 7 6 4 5 No faulty client’s Insurance comnpany 3 Exchange Faulty client’s Insurance comnpany Body shop 2 18 Direct Settlement System Benefits of the system. Direct Settlement System Insured Improved customer satisfaction Insurance Company Insurance sector Decrease in IBNR Improved reputation Less conflict Faster claims handling Decrease in subrogation costs Repair shop networks Cost control New products 19 Certification of spare parts Certifation of eqivalent spare parts will increase trust of the client. Decrease in claims costs. 20 Loss of support Consistent approach in assumptions and methodology needed Will solve reserving and claims experience problems 21 Fraud SISBIS records should be updated Detection of fraud with analytical methods Focus on organised crime 22 for your attention! Thank youThank for you your attention