Financial Management - Philadelphia University Faculty Websites

advertisement

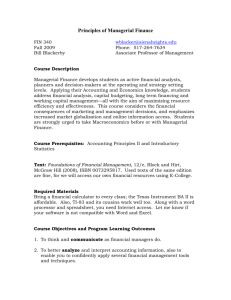

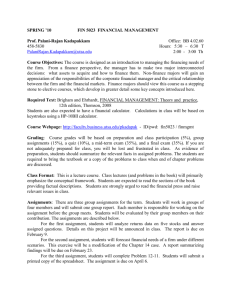

SCHOOL OF BUSINESS ADMINISTRATION SYLLABUS FINC-301 FINANCIAL MANAGEMENT FALL 2015 Instructor Office Phone E-mail Web Page Office Hours appointment : Dr. D.K. Malhotra : 104B Tuttleman Building : (215) 951-2813 : Malhotrad@philau.edu : http://faculty.philau.edu/MalhotraD : 11.00 a.m. – 12:30 p.m. Mondays and Wednesdays or by Required Text: Foundations of Finance: The Logic and Practice of Financial Management by Keown, Martin, and Petty, 8th Edition, Prentice Hall/Pearson, ISBN-10: 0133423999 Calculators: A calculator that has a power function will be necessary for the course. Relatively inexpensive will suffice. No programmable (text storing) calculators will be allowed for tests. Calculators performing financial functions are allowable. If you have a smartphone, you can download financial calculator application on it. IT IS MANDATORY TO BUY A BUSINESS/FINANCIAL CALCULATOR FOR THIS COURSE. Digital Resources: Power point notes will be available on http://bb.philau.edu Course Description: This is an introductory level finance course that will examine the role of the financial decision-maker at the corporate level. The emphasis will be on the goal of the firm, the efficient market hypothesis, discounted cash flow analysis, and the trade-off between risk and return. Prerequisite: All students must have completed ACCT 101, STAT 201, or MATH 321. It is the students' responsibility to make certain that they have successfully completed these courses. If at any time during the semester it is learned that a student has not successfully completed these prerequisites, he/she will be dropped from the course receiving, neither credit nor tuition refunds. Course Objective: The objective of the course is to teach students how to approach and solve the fundamental financial problems facing all businesses including non-profit and government. Each topic explored in the course represents a real-life financial problem facing the "firm". Much of what the students will learn currently is in use in firms across the state and nation. Course Outcomes: A successful student should have the ability to use a financial calculator and excel spreadsheet in finance Understand the goal of a firm Understand the external financial environment Compute expected return and risk of a security? understand the significance of portfolio and compute risk and return of portfolio explain the concept of beta and application to portfolio theory compute present and future value of a series of cash flows identify an annuity and a perpetuity distinguish between preferred and common stock compute the value of common stock and preferred stock explain the basic features of bonds compute fair market value of bond distinguish between current yield and yield to maturity compute payback period and interpret it compute Net Present Value and interpret it compute IRR and interpret it compute PI and interpret it Requirements: 1. 2. 3. Attend class regularly. Do homework. Study class notes prior to next class and come prepared to the class to participate actively in discussions. 4. Be able to take time pressure tests. Attendance: Attendance is mandatory. You are responsible for what is covered in the class and any absence on your part leaves you responsible for finding out what was presented in class. You will benefit a lot from the course by doing problems and reviewing concepts, which are covered in the class. Grading: EXAM I EXAM II FINAL EXAM QUIZZES Class Participation 25% 25% 25% 15% 10% No late homework will be accepted. No makeup exams will be given. If you miss an exam due to an unavoidable reason, the grade on the missed exam will be transferred to the final exam. THE FINAL EXAM IS COMPULSORY AND COMPREHENSIVE. DO NOT EXPECT ANY SCALING ON THE GRADES. Help Sessions: I do plan on devoting a class before each exam reviewing the material that will be covered on the test. Academic Honesty: Students are expected to perform according to a code of academic honesty that prohibits cheating on tests and plagiarizing others’ work. Violation of this code may result in failure of the course. Disability Services (http://www.philau.edu/disabilityservices/index.html) Philadelphia University does not discriminate on the basis of disability, in accordance with the Americans with Disabilities Act and Section 504 of the Rehabilitation Act of 1973. The University makes accommodations for students with disabilities who seek accommodations in the classroom. All students interested in receiving accommodations must contact the Office of Disability Services by email at DisabilityServices@philau.edu, phone at (215.951.6830) or office visit. The office is located in Kanbar 102D. Students requesting accommodations in the classroom must present a current accommodation letter from the Office of Disability Services to the instructor, before accommodations may be made. Philadelphia University works with students with disabilities regarding equal access to all services and programs. Requests for accommodations may be made at any time (although accommodations are not retroactive). The University encourages all students who have any inquiries to contact Disability Services. Grading Policy: The following policy will be followed for assigning letter grades in this course. o o o o o o o o o o o 93 and above 90<93 87<90 83<87 80<83 77<80 73<77 70<73 65<70 60<65 Less than 60 A AB+ B BC+ C CD+ D F Retention of Student Exams, Papers, etc: Students’ materials will be retained for a minimum of four weeks into the subsequent semester. Academic Support Services: Learning and Advising Center Gutman Library Technology Assistance : : : http://www.philau.edu/learning http://www.philau.edu/library http://www.philau.edu/OIT Inclement Weather Policy To ensure the continuation of student learning in time of emergencies, including severe weather, it is the policy of Philadelphia University not to cancel classes. However, if on campus sessions are not possible, students are responsible for checking their university email and/or Blackboard for information regarding holding of classes through online adobeconnect. TENTATIVE COURSE OUTLINE: 08/25 Introduction to Financial Management (Chapters 1) Forms of Business Organization Goal of the Firm Why Managers should maximize shareholders’ wealth Ethics and Shareholder Wealth Maximization 08/27 Shareholder Wealth Maximization and Motivating Management (Chapter 1) 09/01 Financial Environment (Chapter 2) Role of Financial Markets Types of Financial Markets Primary versus Secondary Markets 09/03 Financial Environment (Chapter 2) 09/08 Risks and Return (Chapter 6) Meaning of Risk Meaning of Return o Actual Return o Expected Return of a Security 09/10 Risks and Return (Chapter 6) 09/15 09/17 Measurement of Expected Return of a Security Risk of a Security Measurement of Risk of a Security Risks and Return (Chapter 6) Meaning of a Portfolio Why Create a Portfolio? Expected Return of a Portfolio Risks and Return Measurement of Expected Return Risk of a Portfolio Measurement of Risk of a Portfolio 09/22 Risks and Return Capital Asset Pricing Model Security Market Line 09/24 Risk and Return and Review for Exam I 09/29 Exam I 10/01 Time Value of Money Meaning of Time Value of Money Why time value of money? Concept of Present Value and Discounting How to compute future value of a single cash flow? Concept of Future Value and Compounding How to compute future value of a single cash flow? 10/06 Time Value of Money (Chapter 5) Calculation of Interest Rate Calculation of time period 10/08 Time Value of Money (Chapter 5) The Effect of Compounding Multiple Cash Flows and Present Value 10/13 Time Value of Money (Chapter 5) Annuities 10/15 Time Value of Money Perpetuities 10/20 Bond Valuation (Chapter 7) 10/22 Features of a Bond Valuation of an Annual Bond Bond Valuation (Chapter 7) Valuation of Semiannual Bonds Bond Yields 10/27 Stock Valuation (Chapter 8) Features of a Stock Valuation of a Stock Zero Growth Model Constant Growth Model 10/29 Stock Valuation and Review for Exam 2 11/03 Exam 2 11/05 Capital Budgeting Analysis (Chapter 10) 11/10 Meaning and Significance of Capital Budgeting Techniques of Capital Budgeting Payback Period Internal Rate of Return Capital Budgeting Analysis (Chapter 10) Modified Internal Rate of Return Net Present Value Profitability Index Evaluation of various techniques of capital budgeting 11/12 Capital Budgeting Analysis (Chapter 10) 11/17 Capital Budgeting Analysis (Chapter 10) 11/19 Cash Flows Estimation for Capital Budgeting (Chapter 11) 11/24 Project Cash flows and Risk Analysis (Chapter 11) 11/26 Significance of Estimation of Project Cash Flows Relevant versus Irrelevant Cash Flows Impact of Net Working Capital Change on Project Cash Flows How to Estimate Project Cash Flows? Project Risk Analysis How to Evaluate Projects in the Presence of Risk? Thanksgiving Break (No Class) 12/01 Cost of Capital (Chapter 9) 12/03 Concept of Weighted Average Cost of Capital Cost of each component of capital Cost of Capital (Chapter 9) How to Calculate WACC? Review for Final Exam