Curriculum Map for (grade and subject)

advertisement

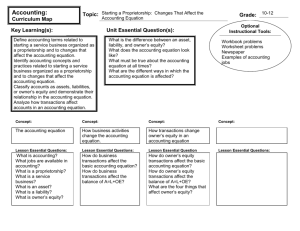

Curriculum Map for Grades 11 & 12 Teacher: A. Powers School: Month August Girard CUSD #3 Content Part 1 Accounting as a Career (Overview) Chapter 1--Accounting Careers: Communication and Ethics in the Workplace WHAT IS ACCOUNTING? JOB OPPORTUNITIES IN ACCOUNTING --Accountants --Bookkeepers --Accounting Clerks --General Office Clerks A CAREER IN ACCOUNTING --Professional Certification --Professional Organizations THE IMPORTANCE Goals a. Define accounting terms related to accounting careers b. Identify how accounting serves as a basis for careers c. Identify the tasks of various accounting occupations d. Describe how communication skills are important in reporting accounting Assessment Accounting Terms Questions for Individual Study Study Guide 1 for objective test as Chapter 1 Test. Essential Questions What accounting and career opportunities are available in the accounting profession? What skills play an important role for today’s worker? What are business ethics? What are some of the causes of unethical behavior? What is accounting? What kind of job opportunities does accounting offer? What careers are available in accounting? What is communication? When does unethical behavior occur? What are the three questions for analyzing ethical behavior? Standards OF COMMUNICATION AND ETHICS IN ACCOUNTING --Communication --Business Ethics --Causes of Unethical Behavior --Making Ethical Decisions information. e. Describe how individuals make ethical business decisions. Part 2 Accounting for a Service Business Organized as a Proprietorship (Overview_ To know accounting terminology related to an accounting system for a service business organized a proprietorship. To understand accounting concepts and practices related to an accounting system for a service business organized as a proprietorship. To be able to demonstrate accounting procedures used in an accounting system for a service business organized as a proprietorship. Chapter 2Starting a Proprietorship THE BUSINESS a. Define accounting terms related to Accounting Terms Questions for Individual Study What is a proprietorship? State the accounting equation. THE ACCOUNTING EQUATION HOW BUSINESS ACTIVITIES CHANGE THE ACCOUNTING EQUATION --Received Cash from Owner as an Investment --Paid Cash for Supplies --Paid Cash for Insurance --Bought Supplies on Account --Paid Cash on Account REPORTING FINANCIAL INFORMATION ON A BALANCE SHEET --Body of a Balance Sheet --Preparing a Balance Sheet SUMMARY OF HOW TRANSACTIONS CHANGE THE ACCOUNTING EQUATION starting a service business organized as a proprietorship. b. Identify accounting concepts and practices related to starting a service business organized as a proprietorship c. Classify accounts as assets, liabilities, or owner’s equity. d. Analyze how transactions related to starting a service business organized as a proprietorship affect accounts in an accounting equation. e. Prepare a balance sheet for a service business organized as a proprietorship from information in an accounting equation. Drills for Understanding Application Problems—2-1, 2-2,2-3 in class Assessment— Enrichment Problems—Mastery Problem 2-M Chapter 2 Problem Test What kinds of accounts go on the left side of the accounting equation? What kinds of accounts go on the right side of the accounting equation? What does it mean if the accounting equation is “in balance?” What must be done if a transaction increases the left side of the accounting equation? How can a transaction affect only one side of the accounting equation? List the three sections of a balance sheet? What kinds of accounts are listed on the left side of a balance sheet? What kinds of accounts are listed on the right side of a balance sheet? What should be done if a balance sheet is not in balance? Chapter 3 Starting a Proprietorship: Changes That Affect Owner’s Equity HOW TRANSACTIONS CHANGE OWNER’ --Received Cash from Sales --Paid Cash for Expenses --Paid Cash to Owner for Personal Use --Summary of Changes in Owner’s Equity REPORTING A CHANGED ACCOUNTING EQUATION ON A BALANCE SHEET SUMMARY OF TRANSACTIONS THAT AFFECT OWNER’S EQUITY a. Define accounting terms related to changes that affect owner’s equity for a service business organized as a proprietorship. b. Identify accounting practices related to changes that affect owner’s equity for a service business organized as a proprietorship.