evolution of banks in pakistan - Asif ullah khan BBA-IT

advertisement

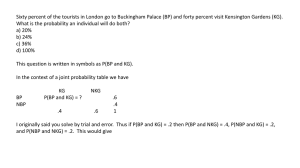

CHAPTER # 1 INTRODUCTION OF STUDY 1.1 Introduction As a part of the academic requirement for completing BBA-IT (H) , each student is required to under go for two (2) months internship with a business organization. The basic purpose of the program is to enable the business students to learn how the business organizations perform their routine transaction and serving the society as well as government. As a matter of fact theory without practice is blind and the sole purpose is to serve this pre-eminent objective. This report is about National Bank of Pakistan Choowk Bazar Branch Bannu City. National Bank of Pakistan was established in 1949 and since its inception it has expended its network becoming the largest commercial Bank of the country and offers wide range of services to the customers at large. 1.2 Purpose of the Study The main purpose of the study in hand is together relevant information to compile internship report on National Bank of Pakistan Chowk Bazar Branch Bannu City. To observe, analyze and interpret the relevant data competently and in a useful manner. 1.3 To work practically in an organization. To develop interpersonal communication. Scope of Study As an internee in NBP Chowk Bazar Branch Bannu City the main focus of my study was on general banking procedures. These operations include remittances, deposits, advances. Similarly different aspects of overall of NBP are also covered in this report. Internship Report on NBP Chowk Bazar Branch Bannu City. 1 1.4 Objectives of the Study Discuss thorough study of National Bank of Pakistan. To understand the various operations and to equip with practical knowledge of the National bank of Pakistan. 1.5 Limitation of the Study Some thing is better than nothing. No matter that how efficiently a study is conducted, it cannot be perfect in all respects. This study was conducted in accordance with the objectives of the study. The study may not include broad explanations of facts and figures due to the nature of the study. Secondly, the limitation, which affects the study, is the restriction on mentioning every fact of the bank due to the problem of secrecy of the bank. In addition, the availability of required data was a problem as all the documents and files are kept strictly under lock and key due to their strictly confidential nature. Thirdly, the problem of short time period also makes the analysis restricted as one cannot properly understand and thus analyze all the operations of a bank just a very short time of eight weeks. 1.6 Benefit of the Study The study done will benefit the finance students in particular the banking students in general because the financial analysis section of this report comprehensively encompasses all respects of financial analysis. Furthermore, NBP may also benefit from the recommendations made at the end of the report. 1.7 Research Methodology The report is based on my two months internship program in National Bank of Pakistan Chowk Bazar Branch Bannu City. The methodology reported for collection of data is primary as well as secondary data. The biggest source of information is my personal observation while working with staff and having discussion with them. Internship Report on NBP Chowk Bazar Branch Bannu City. 2 Primary data: Primary data include Personal observation and Interviews of the staff members. Secondary data: Secondary data consist of Manuals, Journals, magazines, Annual Reports and Internet. Internship Report on NBP Chowk Bazar Branch Bannu City. 3 Chapter#2 Introduction of National Bank of Pakistan 2.1 INTRODUCTION There are different opinions that how the word ‘Bank’ originated. Some of the author’s opinion that this word is derived from the word ‘Bancus’ or Banque, which means a bench. The explanation of this origin is attributed to the fact that the Jews in Lombard transacted the business of money exchange on benches in the market place; and when the business failed, the people destroyed the ‘bench’. Incidentally the word ‘Bankrupt’s said to have evolved from this practice. Some of the authors are of opinion that the word ‘Bank’ is derived from the German word back, which means ‘joint stock fund’. Later on when the German occupied major part of the Italy the word ‘Back’ was italicized into ‘Bank’. In fact human left the need of bank when it begins to realize the importance of money as a medium of exchange. Perhaps it where the Babylonian who developed banking system as early as 2000 B.C. At that time temples were used as banks because of their prevalent respect. During the rule of king Hamurabi (1788 – 1686 BC) the founder of Babylonians Empire, loans were started being granted for interest. The borrower has to provide guarantee or he had to pledge his goods or valuables. King Hamurabi drew up a code wherein he laid down standards rules for procedures for banking operations by temples and great landowners. Also in Greece, the temples were used as banks, where the people deposited their money and other valuables for safe custody and security. In Europe with the ‘revival of civilization’ (Renaissance) in the middle of twelve century, trade and commerce started expanding and this development compelled the business community to borrow the money from the Hebrew moneylenders on high rates of interest and usury. Seeing the great demand, these moneylenders started organizing themselves and bank started up at the principle seaports of southern Europe. Soon Venice and Geneva became Internship Report on NBP Chowk Bazar Branch Bannu City. 4 the most important money markets of the time and banking though different from its present form, flourished. What we know as ‘modern banking’ originated in the 14th century in Barcelona. 2.2 Definitions of Bank "A financial institution, which deals with money and credit. It accepts Deposits from individuals, firms and companies at a lower rate of Interest and gives at higher rate of interest to those who need them.” A financial establishment which uses money deposited by customers for investment, pays it out when required, makes loan at interest, exchanges currency, etc. J.W Gilbert in his principles and practice banking defines a banker in these words: “A banker is dealer in capital or more properly, a dealer in money. He is intermediate party between the borrower and the lender. He borrows of one and lends to another”. Sir John Paged defines banker in these terms: “That no person or body, corporate or otherwise, can be a banker who does not Take deposits accounts. Take current accounts, Issue and pay Cheques and Collect Cheques crossed and uncrossed for his customers” The American defined the term banker in a very broad sense as under: “By banking, we mean the business of dealing in credits and by a ‘Bank’ we include every person, firm or company having a place of business where credits are Internship Report on NBP Chowk Bazar Branch Bannu City. 5 opened by deposits of collection of money or currency. Subjects to be paid or remitted on Cheques or order, money is advanced or loaned on stocks, bonds, bullion, bill of exchange, promissory notes are received for discount or sale”. 2.3 Evolution of Banking in Pakistan The first phase in evolution of banking in Pakistan sees very hard days for the whole banking sector. Starting virtually from scratch in 1947, the country today possesses a full range of banking and financial institutions to cope with various needs of the economy. The area now constituting Pakistan was, relatively speaking, fairly well provided with banking facilities in undivided India, in March 1947 there were 3496 offices of Indian scheduled banks out of which as many as 487 were situated in territories now constituting Pakistan. The Reserve bank of India was the central banking authority in India. At the time of partition it was decided that in the interest of smooth transition it should continue to function in newly emerging state of Pakistan, until 30th Sep.1948. In 1947 due to uncertainty and unsuitability the banking sector suffer heavy losses. This resulted in a negative effect on baking service in Pakistan. The banks, which had their registered offices in Pakistan, transferred them to India. In an effort to bring about the collapse of the new state by pushing a deliberate policy of withdrawals the Indian bank offices closed quickly. Those banks, which stayed, operated only in name pending the winding up of their business. The number of scheduled banks thus declined form 487 branches before independence to only 195 branches by 30th June1948. 2.4 Nationalization of Banks (1974) In Pakistan The banking reforms turned to be transitional and interim step and when they were hardly eighteen months old the government nationalized the banking systems, with the following main objectives. To enable the government to use the capital concentrated in the hands of Internship Report on NBP Chowk Bazar Branch Bannu City. 6 a few rich bankers for the rapid economic development of the country and the more urgent social welfare objectives. To distribute equitably credit too different classes sectors and regions. To coordinate the banking policies in various area of feasible joint activity without eliminating healthy competition among banks. The act passed for the nationalization of banks is known as the banks Nationalization Act 1974. Thus under this act the state bank of Pakistan and all the commercial banks incorporated in Pakistan and carrying business in or outside the country were brought under government ownership with effect from Jan 1, 1974. The ownership, management and control of all Pakistani banks stood transferred to and vested in the Federal government. The shareholders were provided compensation in the form of federal government bonds redeemable at par anytime within the period of fifteen years. Under the Nationalization act, the Chairman, Directors and Executives of various banks, other than those appointed by federal government were removed from their offices and the central boards of the banks and all local bodies were dissolved. Pakistan banking council was established to coordinate the activities of the Nationalized Commercial banks. At the time of Nationalization on December31, 1973 there were following 14 Pakistani commercial banks with 3323 offices allover Pakistan and 74 offices in foreign countries: National banks of Pakistan Habib bank limited Habib bank (overseas) limited United bank limited Muslim commercial bank limited Commerce bank limited Standard bank limited Internship Report on NBP Chowk Bazar Branch Bannu City. 7 Australia bank limited Bank of Bahawalpur limited Premium bank limited Pak Bank limited Sarhad bank limited Lahore commercial limited Punjab provincial co-operative bank limited The Pakistan banking council prepared a scheme for the recognition of banks. The bank (amalgamation) scheme 1974 was notified in April, providing for the amalgamation of the smaller banks with bigger ones and following the five units in there phases: National bank limited Habib bank limited United bank limited Muslim commercial bank limited Allied bank of Pakistan limited The first phase was completed on 30th June. 1974. When the bank Bahawalpur was merged with the National Bank of Pakistan. The premier Bank Limited with Muslim Commercial Bank limited and Sarhad Bank Limited and Pak bank limited and renamed as Allied Bank of Pakistan limited. The second phase was completed on 31st Dec.1974, when the commerce bank limited merged with the United Bank limited. Internship Report on NBP Chowk Bazar Branch Bannu City. 8 The third and the final phase were completed on 30th June 1975 when the standard bank limited was merged with Habib Bank limited. The nationalization was very smooth and gave very positive results. The number of branches, which stood at 3397 on Dec31, 1973, reached on 7661 by end June 1992. The bank deposits, which stood at Rs. 1925 corers at the end 1973, reached the highest, mark about 323 corers. 2.4.1 Islamization of Banking Another major development in the history of Pakistan Banking System was the introduced of interest free banking in selected Commercial Banks with effect form Jan1, 1981. This followed the effort to eliminated interest from the operation of Nation investment trust, the House Building Finance Corporation of Pakistan. Certain amendments were made in banking and other laws with the object of ushering in a new system of banking, which would confirm of Sharia. A new law Modaraba Companies Ordinance 1980 was promulgated. Separate interest free counters began to operate in all the nationalized commercial banks free counters began to operate in all the nationalized commercial banks. The state bank provides finance against participation term certificate and also against promissory notes supported by Modaraba certificate. In order to cover interest free transactions certain banking definitions such as creditors, debtor, and advances credits and deposits were revised. Stipulations concerning form of business in which banking companies may engage may also have been modified schemes were introduced to provide interest free loans to formers and deserving students. A private Limited Company named as Bankers Equity limited was incorporated in 1979 to provide financial assistance to the industrial sector primarily on interest free basis. A scheme to extend interest free productive loans to farmers and fisherman has also been introduced. Instead of interest, a system based on mark-up in price, exchange rate differential, and profit and loss sharing accounts were introduced. Internship Report on NBP Chowk Bazar Branch Bannu City. 9 Different financial schemes introduced in the Islamization process are: Musharika Financing. Hire Purchase Financing. Modaraba Financing. Specific Purpose Modaraba. 2.4.2 Interest Free Banking A new concept of interest free banking was introduced in 1981 and by now it has been established on sound footing and new trends and techniques are being implemented to make this system result oriented. New products and their systematic consumption are making Pakistani banking comparable to their several modern counterparts anywhere in the developed world. 2.4.3 History of NBP: The NBP was established vide NBP Ordinance No. XIX of November 9. 1949. British Govt. devalued its currency in September 1949, India devalued its rupees but Pakistan did not. It led to a crisis in trading between the two countries and India refused to lift the Pakistan Jute. To solve this problem i.e. to export jute NBP was established through an Ordinance of GOP. National Bank of Pakistan maintains its position as Pakistan's premier bank determined to set higher standards of achievements. It is the major business partner for the Government of Pakistan with special emphasis on fostering Pakistan's economic growth through aggressive and balanced lending policies, technologically oriented products and services offered through its large network of branches locally, internationally and representative offices. The Bank in 1950 had one subsidiary ‘The Bank of Bahawalpur’ on December4, 1947 by the former Bahawalpur State. Internship Report on NBP Chowk Bazar Branch Bannu City. 10 NBP was undertaking Treasury Operations and Managing Currency Chests or Sub Chests at 57 of its offices where the turnover of the business under the head amounted to Rs.2460 million. i) Deposits held by NBP constituted about 3.1% of total deposits of all Pakistani Banks in 1949, which rose to 38% in 1952. ii) Growth in Deposits was accompanied by increase in Bank portfolio in advances. NBP lent out to Textile, Yarn, Iron and Steel and played a pioneer role in support of agriculture and commerce. iii) NBP advances reached Rs.554.4 million by December 1959, which was one third of the total schedule bank credit. 2.4.4.1 HISTORY OF NBP CHOWK BAZAR BRANCH BANNU NBP Chowk Bazar Branch Bannu was to fulfill the banking requirement of the District Bannu and also the adjacent areas. This Branch is situated on Bank Street Bann City is the most prominent business area of Bannu. NBP Chowk Bazar Branch Bannu is a financial institution showing strong growth and development over the last period of time 2.4.4.2 MISSI0ON STATEMEN “To make the Bank complete and competitive with all international Standard in performing, quality of operations, staff, financial strength. And products and services to develop a culture of excellence in every spare of activity of the bank”. 2.4.4.3 GOALS AND OBJICTIVES “An organizational objective is the intended goal that prescribes definite scope and suggests direction to the panning efforts of a organization.” Internship Report on NBP Chowk Bazar Branch Bannu City. 11 2.4.4.4 GOALS AND OBJICTIVES NBP “To be the pre-eminent financial institution in Pakistan and achieve market recognition both in the quality and delivery of service as well as the range of product offerings.” 2.4.4.5 BOARD OF DIRECTORS NBP, Board of Directors list consist the following members and their designation. Table 1 NAME DISIGNATION Syed Ali Raza Chairman & President Mr. Sikandar Hayat Jamali Director Mr. Azam Faruque Director Mian Kausar Hameed Director Mr. Ibrar A. Mumtaz Director Mr. Tariq Kirmani Director Mr. Muhammad Arshad Chaudhry Director Mr. Mohammad Ayub Khan Tarin Director Mr. Ekhlaq Ahmed SEVP & Sectorary to BD Internship Report on NBP Chowk Bazar Branch Bannu City. 12 BOARD OF DIRECTORS 2.4.4.6 Syed Ali Raza (President) Mr. Sikandar Hayat Jamali Mr. Azam Faruqui Mian Kausar Hameed (Director) (Director) (Director) Mr. Tariq Kirmani Mr. Muhammad Arshad Chaudhry (Director) Mr. Ibrar A. Mumtaz (Director) (Director) (Director) Mr. Ekhlaq Ahmad (Secretary) 2.4.4.7 REGIONAL HEADQUARTERS: On May 13, 2002 a circular was issued in which zones were abolished and the whole country and Azad Kashmir was divided into 29 regions. The changeover process started from 1st August 2002 and was completed by 31st August 2002. The new setup was made fully functional by 15th September. 2.4.4.8 Regional Management Committee: A regional management committee controls all regions. Regional management consists of Regional Business Chief Regional Operations Chief Risk management Chief Internship Report on NBP Chowk Bazar Branch Bannu City. 13 2.4.4.9 Provincial Level Region: Regional Headquarters 2.4.10 No of Regions Balochistan 2 Sindh 6 NWFP 5 Punjab 14 Azad Kashmir 2 Total 29 Name of Regions: No Region No Region 1 Karachi (South) 16 Bahawalpur 2 Karachi (West) 17 Dera Ghazi Khan 3 Hyderabad 18 Sahiwaal 4 Larkana 19 Federal Capital-Islamabad 5 Sukkhar 20 Rawalpindi 6 Quetta 21 Jehlum 7 Gawadar 22 Gujrat 8 Lahore Central 23 Gilgit 9 Lahore East 24 Peshawar 10 Gujranwala 25 Mardan 11 Sialkot 26 Dera Ismail Khan 12 Faisalabad 27 Abbotabad 13 Jhang 28 Muzaffarabad (A.K) 14 Sargodha 29 Mirpur (A.K) 15 Multan **** **** Internship Report on NBP Chowk Bazar Branch Bannu City. 14 3.4.11 Overseas Operations: National Bank of Pakistan has a strong international presence through 22 overseas branches and 5 representative offices situated in USA (Chicago), Canada, China, Azerbaijan, and Uzbekistan. Number of Country Number of Country Branches USA 2 Bahrain 1 Germany 1 Republic of Korea 1 France 1 Bangladesh 4 Hong Kong 2 Kyrgyzstan 1 Japan 2 Turkmenistan 1 Pakistan EPZ 1 Afghanistan 4 Azerbaijan 1 ************* ******** Branches Internship Report on NBP Chowk Bazar Branch Bannu City. 15 The Regional Head Quarters consist of the following Group:1. Management Support Group 2. Marketing Development Group 3. Inspection Group 4. Credit Policy & Management Group 5. Special Assets Management Group A Regional Chief Executive of the rank of Senior Executive Vice President or Executive Vice President heads each RHQ. A General Manager heads each Division 2.6.5 2.5.1 MANAGEMENT Management is a distinct process consisting of activities of planning, organizing, actuating and controlling performed to determine and accomplish stated objectives with the use of human being and other resources. The management has two types. 1. Centralized. 2. Decentralized. Centralized Management tends to concentrate decision making at the top of the Organization. Decentralized disperses decision-making and authority throughout and further down the organizational hierarchy. NBP have a centralized type of management because the top management takes all the decisions. 2.5.2 SENIOR MANAGEMENT OF NBP. Senior Management of NBP consists of following member and their respective designation. Internship Report on NBP Chowk Bazar Branch Bannu City. 16 Table 2 Masood Karim Sheikh SEVP & Group Chief, Corporate & Investment Banking Group and Chief Financial Officer S. M. Rafique SEVP & Secretary Board of Directors Derick Cyprian SEVP & Group Chief, Special Assets & Remedial Management Group Imam Bakhsh Baloch SEVP & Group Chief, Compliance Group Shahid Anwar Khan EVP & Group Chief, Commercial & Retail Banking Group Nadeem A. Dogar EVP & Group Chief, Information Technology Group Muhammad Sardar Khawaja EVP & Group Inspection Group Dr. Asif A. Brohi EVP & Group Chief, Operations Group Javed Mehmood EVP & Group Chief, Risk Management Group Muhammad Nusrat Vohra EVP & Group Chief, Management Group Amim Akhtar EVP & PSO to the President Dr. Mirza Abrar Baig Group Chief, Human Resources Management & Administration Group Uzma Bashir Group Chief, Organization D&T Group Chief, Audit & Treasury Internship Report on NBP Chowk Bazar Branch Bannu City. 17 Table 3 ORGANIZATION CHART OF NBP CHOWK BAZAR BRANCH BANNU Branch Manager Operational Manager Cash SVP Remittance SVP Pension SVP Computer S.SVP 2.6. Net Work of Branches: NBP have wide range of branches inside the country and outside the country. In Pakistan it has 29 regional offices, 1189 Branches and 4 Subsidiaries. In overseas it has 16 overseas branches, 6 other branches. .2.6.1 Objectives of NBP National bank of Pakistan is also a commercial organization and its main objective is profit maximization. This is achieved in two ways: 1. by increasing deposits. 2. By charging interest on loans provided to the private sector and business community. Internship Report on NBP Chowk Bazar Branch Bannu City. 18 2.6.2 Increase in deposits: Competition in banking is intense and every bank whether it is Pakistani, foreign, private or nationalized tries to increase its deposits by providing better facilities to its customers. By increasing its deposits a bank can extend greater amount of loan and hence achieves higher profit. NBP is also improving its facilities and services to attract customers with higher volume of deposits. There are two main factors involved in increasing the deposits. These factors are improving the services and courtesy. NBP is continuously working on these two factors to increase its deposits. 2.6.3 Extension of loans: The profitability of a bank largely depends on the amount given to people as loan and the type of people to whom credit is given i.e. the credit worthiness of the borrowers. This strategy has worked quite well for NBP. Deposits are collected from the people and invested in different projects. NBP prefers to give loans to financially sound and reliable parties, after securing the collators. NBP has an extremely well organized section. The staff is adequately trained, and educated and competent. They carry out extensive Financial analysis before deciding on the loan. Interest charged on the loans potentially contributes to higher profits. 2.6.4 Functions of NBP Since NBP is a commercial bank, it performs a variety of functions. Like other commercial banks, NBP is engaged in financing international trade. Its other major functions include receiving deposits, advancing loans and discounting of exchange. The functions performed by NBP are: Internship Report on NBP Chowk Bazar Branch Bannu City. 19 2.6.5 Accepting Deposits This function is important because banks largely depend on the funds deposited with them by its customers. Deposits are of many types: I. Current deposits Current deposits are also called demand liability on current deposits. NBP pays practically no interest on current deposits. Businessmen usually open current accounts. In NBP current account can be opened with a minimum amount of Rs.500/-. ii. PLS saving deposit Profit and loss sharing deposits (PLS) are also called checking accounts. One can deposit and draw money easily. Profit on PLS is calculated every month but paid after six months. PLS account can be opened with a minimum amount of Rs.500/ii. PLS term deposits Fixed term deposits are deposits with the bank for certain fixed period before the expiry of which they cannot be withdrawn unless giving due notice. In this case the rates of profit will be different depending upon the time period. 2.6.6 Summation We discussed in this chapter the evaluation of banking in Pakistan, banking reforms 1972, Nationalization of banks, History of NBP, History of National Bank Chowk Bazar Branch Bannu City, and Mission Statement of NBP. The next and onward chapter we will discuss the general banking information and departmentalization of NBP. Internship Report on NBP Chowk Bazar Branch Bannu City. 20 CHAPTER # 3 INFORMATION & DEPARTMENTALIZATION OF NBP 3.1 INTRODUCTION This chapter presents the services and departmentalization of NBP.Services is outputs of the firm, which are in intangible form. Which are the backbones of any organization to earn profit? NBP offers the following services to the people. 3.2 DEMAND DRAFTS If you are looking for a safe, speedy and reliable way to transfer money, you can now purchase NBP Demand Drafts at very reasonable rates. Any person whether an account holder of the bank or not, can purchase a Demand Draft from a bank branch. 3.3 SWIFT SYSTEM The SWIFT system (Society for Worldwide Inter bank Financial Telecommunication) has been introduced for speedy services in the area of home remittances. The system has built-in features of computerized test keys, which eliminates the manual application of tests that often cause delay in the payment of home remittances. The SWIFT Center is operational at National Bank of Pakistan with a universal access number NBP-APKKA. All NBP overseas branches and overseas correspondents (over 450) are drawing remittances through SWIFT. Using the NBP network of branches, you can safely and speedily transfer money for our business and personal needs. 3.4 LETTERS OF CREDIT NBP is committed to offering its business customers the widest range of options in the area of money transfer. If you are a commercial enterprise then our Letter of Credit service is just what you are looking for. With competitive rates, security, and ease of transaction, NBP Letters of Credit are the best way to do your business transactions. Internship Report on NBP Chowk Bazar Branch Bannu City. 21 3.5 TRAVELER'S CHEQUES Traveler’s cheques are negotiable instruments, and there is no restriction on the period of validity of the cheques. Rupee traveler’s cheques are available at all 700 branches of NBP. This can be encashed in all 400 branches of NBP. There is no limit on purchase of this cheque. It is one of the safest ways for carrying money. 3.6 PAY ORDER NBP provides another reason to transfer your money using our facilities. NBP pay orders are a secure and easy way to move your money from one place to another. And, as usual, NBP charges for this service are extremely competitive. The charges of NBP are very low all over the Pakistan. It charges Rs 50/- for NBP account holders on issuing one payment order. And charges Rs 100/- for NBP non-account holders on issuing one payment order. It charges Rs 25/- for students on payment of fees of educational institutions. If some one want a duplicate of payment order they charges Rs 100/- for NBP account holders and Rs 150/- for non account holders. 3.7 MAIL TRANSFERS Move your money safely and quickly using NBP Mail Transfer service. And NBP also offers the most competitive rates in the market. They charges Rs 50/- exchange rate and RS 75/- postage charges on issuing mail transfer. 3.8 FOREIGN REMITTANCES: To facilitate its customers in the area of Home Remittances, National Bank of Pakistan has taken a number of measures to: Increase home remittances through the banking system Meet the SBP directives/instructions for timely and prompt delivery of remittances to the beneficiaries Internship Report on NBP Chowk Bazar Branch Bannu City. 22 3.8.1 New Features: The existing system of home remittances has been revised/significantly improved and well-trained field functionaries are posted to provide efficient and reliable home remittance services to nonresident Pakistanis at 15 overseas branches of the Bank besides Pakistan International Bank (UK) Ltd., and Bank Al-Jazira, Saudi Arabia. Zero Tariffs: NBP is providing home remittance services without any charges. Strict monitoring of the system is done to ensure the highest possible security. Special courier services are hired for expeditious delivery of home remittances to the beneficiaries. 3.9 SHORT TERM INVESTMENTS NBP now offers excellent rates of profit on all its short-term investment accounts. Whether you are looking to invest for 3 months or 1 year, NBP’s rates of profit are extremely attractive, along with the security and service only NBP can provide. 3.10 COMMERCIAL FINANCE NBP dedicated team of professionals truly understands the needs of professionals, agriculturists, large and small business and other segments of the economy. They are the customer’s best resource in making NBP products and services work for them. 3.11 TRADE FINANCE OTHER BUSINESS LOANS There are two types of trade finance. 3.11.1 AGRICULTURAL FINANCE NBP provides Agricultural Finance to solidify faith, commitment and pride of farmers who produce some of the best agricultural products in the World. Internship Report on NBP Chowk Bazar Branch Bannu City. 23 3.11.1.1 Agricultural Finance Services: “I Feed the World” program, a new product, is introduced by NBP with the aim to help farmers maximize the per acre production with minimum of required input. Select farms will be made role models for other farms and farmers to follow, thus helping farmers across Pakistan to increase production. 3.11.1.2 Agricultural Credit: The agricultural financing strategy of NBP is aimed at three main objectives: Providing reliable infrastructure for agricultural customers Help farmers utilize funds efficiently to further develop and achieve better production Provide farmers an integrated package of credit with supplies of essential inputs, technical knowledge, and supervision of farming. 3.11.1.3 Agricultural Credit (Medium Term): Production and development Watercourse improvement Wells Farm power Development loans for tea plantation Fencing Solar energy Internship Report on NBP Chowk Bazar Branch Bannu City. 24 3.11.2 CORPORATE FINANCE I. Working Capital and Short Term Loans: NBP specializes in providing Project Finance – Export Refinance to exporters – Preshipment and Post-shipment financing to exporters – Running finance – Cash Finance – Small Finance – Discounting & Bills Purchased – Export Bills Purchased / Pre-shipment / Post Shipment Agricultural Production Loans ii. Loan Structuring and Syndication: National Bank’s leadership in loan syndicating stems from ability to forge strong relationships not only with borrowers but also with bank investors. Because we understand our syndicate partners’ asset criteria, we help borrowers meet substantial financing needs by enabling them to reach the banks most interested in lending to their particular industry, geographic location and structure through syndicated debt offerings. Our syndication capabilities are complemented by our own capital strength and by industry teams, who bring specialized knowledge to the structure of a transaction. 3.12 INTERNATIONAL BANKING National Bank of Pakistan is at the forefront of international banking in Pakistan, which is proven by the fact that NBP has its branches in all of the major financial capitals of the world. Additionally, NBP have recently set up the Financial Institution Wing, which is placed under the Risk Management Group. The role of the Financial Institution Wing is: To effectively manage NBP’s exposure to foreign and domestic correspondence Manage the monetary aspect of NBP’s relationship with the correspondents to support trade, treasury and other key business areas, thereby contributing to the bank’s profitability Generation of incremental trade-finance business and revenues Internship Report on NBP Chowk Bazar Branch Bannu City. 25 3.12.1 NBP offers: The lowest rates on exports and other international banking products Access to different local commercial banks in international banking 3.14.2 Cash and Gold Finance. Cash and Gold finance means that loan is given against the gold. The gold is mortgaged with the bank and loan is taken. It is the area of consumer finance. And borrower can take loan for common use. 3.12.3 Advance salary loan: This loan is given to those people who are government servants. They can get a loan up to the salary of fifteen months. 3.13 DEPARTMENTALIZATION Dividing an organization into different parts according to the functions is called departmentation. So NBP can be divided into the following main departments. 3.13.1 CASH DEPARTMENT Cash department performs the following functions 3.13.2 Receipt The money, which either comes or goes out from the bank, its record should be kept. Cash department performs this function. The deposits of all customers of the bank are controlled by means of ledger accounts. Every customer has its own ledger account and has separate ledger cards. Internship Report on NBP Chowk Bazar Branch Bannu City. 26 3.13.3 Payments It is a banker’s primary contract to repay money received for this customer’s account usually by honoring his cheques. 3.13.4 Cheque and their Payment The Negotiable Instruments. Act, 1881 “Cheque is a bill of exchange drawn on a specified banker and not expressed to be payable otherwise than on demand”. Since a Cheque has been declared to be a bill of exchange, it must have all its characteristics as mentioned in Section 5 of the Negotiable Instruments Act, 1881. Therefore, one can say that a Cheque can be defined as an: “An unconditional order in writing drawn on a specified banker, signed by the drawer, requiring the banker to pay on demand a sum certain in money to, or to the order of, a specified person or to the bearer, and which does not order any act to be done in addition to the payment of money”. 3.13.5 Parties to Cheque The normal Cheque is one in which there is a drawer, a drawee banker and a payee, or no payee but bearer. a) The Drawer b) The Drawee c) The Payee 3.13.6 Types of Cheques Bankers in Pakistan deal with three types of cheques Internship Report on NBP Chowk Bazar Branch Bannu City. 27 a) Bearer Cheque Bearer Cheque are cashable at the counter of the bank. These can also be collected through clearing. b) Order cheque These types of cheques are also cashable on the counter but its holder must satisfy the banker that he is the proper man to collect the payment of the cheque and he has to show his identification. It can also be collected through clearing. c) Crossed Cheque These cheques are not payable in cash at the counters of a banker. It can only be credited to the payee’s account. If there are two persons having accounts at the same bank, one of the account holder issues a cross-cheque in favor of the other account holder. Then the cheque will be credited to the account of the person to whom the cheque was issued and debited from the account of the person who has actually issued the cheque. 3.13.7 Payment of Cheques It is a banker’s primary contract to repay money received for his customer’s account usually by honoring his cheques. Payment of money deposited by the customer is one of the root functions of banking. The acid test of banking is the receipt of money etc. from the depositors, and repayment to them. This paying function is one, which is the distinguishing mark of a banker and differentiates him from other institutions, which receive money from the public. However the bankers’ legal protection is only when payment is in ‘Due Course’. The payment in due course means payment in accordance with the apparent tenor of the instrument, in good faith and without negligence to any person in possession thereof under circumstances, which do not afford a reasonable ground of believing that he is not entitled to receive payment of the amount therein Internship Report on NBP Chowk Bazar Branch Bannu City. 28 mentioned. It is a contractual obligation of a banker to honor his customer’s cheques if the following essentials are fulfilled. a) Cheques should be in a proper form: b) Cheque should not be crossed: c) Cheque should be drawn on the particular bank: d) Cheque should not mutilated: e) Funds must be sufficient and available: f) The Cheque should not be post dated or stale: g) Cheque should be presented during banking hours: 3.14 ADVANCES DEPARTMENT Advances department is one of the most sensitive and important departments of the bank. The major portion of the profit is earned through this department. The job of this department is to make proposals about the loans. The Credit Management Division of Head Office directly controls all the advances. As we known bank is a profit seeking institution. It attracts surplus balances from the customers at low rate of interest and makes advances at a higher rate of interest to the individuals and business firms. Credit extensions are the most important activity of all financial institutions, because it is the main source of earning. However, at the same time, it is a very risky task and the risk cannot be completely eliminated but could be minimized largely with certain techniques. Any individual or company, who wants loan from NBP, first of all has to undergo the filling of a prescribed form, which provides the following information to the banker. Internship Report on NBP Chowk Bazar Branch Bannu City. 29 3.14.1 Name and address of the borrower. a) Existing financial position of a borrower at a particular branch. b) Accounts details of other banks (if any). c) Security against loan. d) Exiting financial position of the company. (Balance Sheet & Income Statement). e) Signing a promissory note is also a requirement of lending, through this note borrower promise that he will be responsible to pay the certain amount of money with interest. 3.14.2 Principles of Advances There are five principles, which must be duly observed while advancing money to the borrowers. a. Safety b. Liquidity c. Dispersal d. Remuneration e. Suitability a. a. Safety Character It is the most important factor in determining the safety of advance, for there is no substitute for character. A borrower’s character can indicate his intention to repay the advance since his honesty and integrity is of primary importance. If the past record of the borrower shows that his integrity has been questionable, the banker should avoid him, Internship Report on NBP Chowk Bazar Branch Bannu City. 30 especially when the securities offered by him are inadequate in covering the full amount of advance. b. Capacity This is the management ability factor, which tells how successful a business has been in the past and what the future possibilities are. A businessman may not have vast financial resources, but with sound management abilities, including the insight into a specific business, he may make his business very profitable. On the other hand if a person has no insight into the particular business for which he wants to borrow funds from the banker, there are more chances of loss to the banker. c. Capital This is the monetary base because the money invested by the proprietors represents their faith in the business and its future. The role of commercial banks is to provide short-term capital for commerce and industry, yet some borrowers would insist that their bankers provide most of the capital required. This makes the banker a partner. As such the banker must consider whether the amount requested for is reasonable to the borrowers own resources or investment. 3.15 REMITTANCE DEPARTMENT Remittance means a sum of money sent in payment for something. This department deals with either the transfer of money from one bank to other bank or from one branch to another branch for their customers. NBP offers the following forms of remittances. a) Demand Draft b) Telegraphic Transfer c) Pay Order d) Mail Transfer Internship Report on NBP Chowk Bazar Branch Bannu City. 31 3.15.1 Demand Draft Demand draft is a popular mode of transfer. The customer fills the application form. Application form includes the beneficiary name, account number and a sender’s name. The customer deposits the amount of DD in the branch. After the payment the DD is prepared and given to the customer. NBP officials note the transaction in issuance register on the page of that branch of NBP on which DD is drawn and will prepare the advice to send to that branch. The account of the customer is credited when the DD advice from originating branch comes to the responding branch and the account is debited when DD comes for clearance. DD are of two types. a) Open DD: Where direct payment is made. b) Cross DD: Where payment is made though account. NBP CHARGES FOR DD I. Up to Rs. 50,000/- is Rs 50/- only II. Over Rs. 50,000/- is 0.1% 3.15.2 Pay Order Pay order is made for local transfer of money. Pay order is the most convenient, simple and secure way of transfer of money. NBP takes fixed commission of Rs. 25 per pay order from the account holder and Rs. 100 from a non-account holder. 3.15.3 Telegraphic Transfer Telegraphic transfer or cable transfer is the quickest method of making remittances. Telegraphic transfer is an order by telegram to a bank to pay a specified sum of money to the specified person. The customer for requesting TT fills an application form. Vouchers are prepared and sent by ordinary mail to keep the record. TT charges are taken from the customer. No excise duty is charged on TT. The TT charges are: Internship Report on NBP Chowk Bazar Branch Bannu City. 32 Telegram/ Fax Charges on TT = Actual-minimum Rs.100. Cable telegram transfer costs more as compared to other title of money. In cable transfer the bank uses a secret system of private code, which is known to the person concerned with this department and branch manager. 3.15.4 Mail Transfer When the money is not required immediately, the remittances can also be made by mail transfer (MT). Here the selling office of the bank sends instructions in writing by mail to the paying bank for the payment of a specified amount of money. Debiting to the buyer’s account at the selling office and crediting to the recipient’s account at the paying bank make the payment under this transfer. NBP taxes mail charges from the applicant where no excise duty is charged. Postage Charges on mail transfer are actual minimum Rs. 40/- if sent by registered post locally Rs.40/- if sent by registered post inland on party’s request. 3.16 DEPOSIT DEPARTMENT: It controls the following activities: a) A/C opening. b) Issuance of cheque book. c) Current A/C d) Saving A/C e) Cheque cancellation f) Cash Internship Report on NBP Chowk Bazar Branch Bannu City. 33 3.16.1 Account opening The opening of an account is the establishment of banker customer relationship. Before a banker opens a new account, the banker should determine the prospective customer’s integrity, respectability, occupation and the nature of business by the introductory references given at the time of account opening. Preliminary investigation is necessary because of the following reasons. i. Avoiding frauds ii. Safe guard against unintended over draft. iii. Negligence. iv. Inquiries about clients. The relation of the banker and the customer is purely a contractual one, however, he must have the following basic qualifications. He must be of the age of majority. He must be of sound mind. Law must not disqualify him. The agreement should be made for lawful object, which create legal relationship Not expressly declared void. b) Types of Accounts Following are the main types of accounts 1) Individual Account 2) Joint Account Internship Report on NBP Chowk Bazar Branch Bannu City. 34 3) Accounts of Special Types Partnership account Joint stock company account Accounts of clubs, societies and associations Agents account Trust account Executors and administrators accounts Pak rupee non-resident accounts Foreign currency accounts 3.16.2 Issuing of cheque book: This deptt issue cheque books to account holders. Requirements for issuing chequebook a) The account holder must sign the requisition slip b) Entry should be made in the chequebook-issuing book c) Three rupees Per cheque should be recovered from a/c holder if not then debit his/her account. 3.16.3 Current account These are payable to the customer whenever they are demanded. When a banker accepts a demand deposit, he incurs the obligation of paying all cheques etc. drawn against him to the extent of the balance in the account. Because of their nature, these deposits are Internship Report on NBP Chowk Bazar Branch Bannu City. 35 treated as current liabilities by the banks. Bankers in Pakistan do not allow any profit on these deposits, and customers are required to maintain a minimum balance, failing which incidental charges are deducted from such accounts. This is because the depositors may withdraw Current Account at any time, and as such the bank is not entirely free to employ such deposits. Until a few decades back, the proportion of Current Deposits in relation to Fixed Deposits was very small. In recent years, however, the position has changed remarkably. Now, the Current Deposits have become more important; but still the proportion of Current Deposits and Fixed Deposits varies from bank to bank, branch to branch, and from time to time. 3.16.4 Saving account Savings Deposits account can be opened with very small amount of money, and the depositor is issued a cheque book for withdrawals. Profit is paid at a flexible rate calculated on six-month basis under the Interest-Free Banking System. There is no restriction on the withdrawals from the deposit accounts but the amount of money withdrawn is deleted from the amount to be taken for calculation of products for assessment of profit to be paid to the account holder. It discourages unnecessary withdrawals from the deposits. In order to popularize this scheme the State Bank of Pakistan has allowed the Savings Scheme for school and college students and industrial labor also. The purpose of these accounts is to inculcate the habit of savings in the constituents. As such, the initial deposit required for opening these accounts is very nominal. 3.16.5 Cheque cancellation: This deptt can cancel a cheque on the basis of; Internship Report on NBP Chowk Bazar Branch Bannu City. 36 a) Post dated cheque b) Stale cheque c) Wrong out cheque d) Wrong sign etc 3.16.6 Cash This department also deals with cash. Payment of cheques, deposits of cheques etc. .B) DEPARTMENTATION OF CHOWK BAZAR BRANCH BANNU. Dividing an organization into different parts according to the functions is called departmentation. So NBP Chowk Bazar Branch Bannu is divided into three main parts. 1. Cash Department 2. Operation Department 3. Government Department. 3.17 Cash Department: Cash department mainly deals in cash... “To facilitate people in the payments of their bills and taxes and repayments of cash” There are two main functions of cash department. i. Payment ii. Receipts i. Payments are the function that they pay their cheques and pay cash. ii. Receipts mean collection of utilities bills, taxes etc. Internship Report on NBP Chowk Bazar Branch Bannu City. 37 3.17.1 Operation Department. NBP Chowk Bazar Branch Bannu having an Operation Department. This department mainly deals with the branch employees. The main objective of this department is to “To regulate bank business”. Main functions of this department are: a) Keeps the record of attendance of employees. b) Employee’s salaries distribution. c) Employee’s bonuses etc. 3.17.2 Government Department NBP Chowk Bazar Branch Bannu having a Government Department. This department mainly deals with the Government securities and deposits. The main objective of this department is to “To regulate bank business”. Internship Report on NBP Chowk Bazar Branch Bannu City. 38 CHAPTER NO # 4 DEPOSIT DEPARTMENT Deposit department play very important role in the banks because it is the main source of obtaining the funds from the customers. The total number of customers having PLS and current accounts at Chowk Bazar Branch Bannu are 2298 and total amount of deposits are Rs.60 million. Following are the main accounts, which are kept with a bank by customers. They are: a. Current account b. Saving account c. PLS Account d. Joint Account e. Minor Account f. Individual Account 4.1 Current Account: National Bank of Pakistan maintains current accounts for its customers. A current account is a running account and the bank does not pay any interest on these deposits as they can be with drawn without notice. The bank has acts only as the custodian of money. It cannot employ these funds due to fear of withdrawal. It has to keep a higher reserve ratio to meet the demand liabilities. The current accounts are becoming very popular with the commercial banks in recent years. The current account is opened and operated by Traders, Institutions, Public service bodies and Industrialists etc. the initial amount of current account is Rs. 5000. Internship Report on NBP Chowk Bazar Branch Bannu City. 39 4.2 Saving Deposit Account: Saving deposit account is an ideal account for those who have money to save but cannot profitability invest it anywhere else, as the account is too small. The School Children, workers, employees, firm usually keep their saving by opening a saving account in the bank. 4.3 Profit and Loss Sharing Saving Accounts (PLS): In Pakistan Profit and loss sharing saving account (PLS) was introduced in January 1982. The main rules of the PLS saving accounts are as under: a. The PLS saving account can be opened with a sum of not less than Rs.500. b. The bank has full right to make investment of credit balance/deposit in PLS saving account. c. Withdrawal from PLS accounts are allowed oftener then 8 times in a calendar month and for a total amount not exceeding Rs. 25000 in a day. For withdrawals a large amounts seven days notice in writing is required to be given. d. Withdrawals can only be made by means of cheques issued by the bank. 4.4 National Income Daily ACCOUNTS (nida): It is a form of current account in which customers can get daily profit. A customer also gets a healthy rate of interest on their deposits under NIDA facility. The deposit starts with a minimum of Rs. 2000000, while there is no upper limit. There is also an unlimited withdrawal facility requiring no prior notice. 4.5 JOINT ACCOUNT: A joint account is a special account, which is opened in the name of two or more persons. For drawing of the amount all the persons in whose name the account stands should sign the cheque. However by agreement any one of them is allowed to draw the joint account without the consent or signature of the other on the death of the other party. For opening of a joint account the following precautions should be taken by the bank. Internship Report on NBP Chowk Bazar Branch Bannu City. 40 4.6 Minor Account: Minor is a person who is under the age of 18 years Minor is protected by law in case of a partnership firm and can bind all the partners in the ordinary course of business. The following point should be kept in mind. (a) If the minor does not disown his position as partner either before or within a reasonable time of his getting majority, he will be personally liable for the debt of the partnership incurred after his majority. (b) The minor may be permitted to draw cheques and overdraw the partnership account as an agent of the partners 4.7 Individual Account: Account of individual profit and loss saving account bank and current deposit are usually opened at branches of the bank. Therefore bank do not open account of minor person. However in order to create the habit of saving, the account is opened on certain conditions. a. At the time of opening of account he should not be minor and must have attained the age of majority. b. He must be a man of sound mind. According to the law any contract made with person of unsound mind is void. He should not be declared bankrupt. 4.8 Procedure of Opening of Accounts: There are many formalities, which are to be observed for opening of current or saving account with a bank. These formalities are: 4.8.1. Formal Application Form: It is a formal request by a customer to the bank to allow him to open and operate the current/saving account. 4.8.2. Obtaining Introduction: Before opening an account banker obtains introductory reference of new customer from an old customer. Internship Report on NBP Chowk Bazar Branch Bannu City. 41 4.8.3. Specimen Signature: When the banker is satisfied about the integrity of the customer, he agrees to open the account. The banker obtains the specimen signature of the customer on the application form and card. 4.8.4. Minimum Initial Deposit: In Pakistan the current account can be opened with a minimum of RS 5000 and the PLS saving account with minimum of RS 500. 4.8.5. Next of Kin: Letter of next of kin is signed by the customer, in which new customer allows his relative to operate his account if he is not available at the moment. 4.8.6. Operating the Account: When an account is opened with bank the banker gives to the customer. Pay-in-slip book 1. Cheque book 2. Pass book with a view to operating it. Internship Report on NBP Chowk Bazar Branch Bannu City. 42 Chapter # 5 Swot Analysis INTRODUCTION SWOT Analysis is the most important part of the report, because it depends on my personal observation. Only a good, keen and comprehensive analysis leads to good recommendations for the improvement of the existing conditions. Therefore in NBP I have observed many things and I have analyzed them to the best of my efforts & knowledge. 5.1 STRENGTHS Following are the main Strengths of NBP: 5.1.1 Serving as an Agent: National Bank of Pakistan Chowk Bazar Branch Bannu serve as an agent of State Bank of Pakistan. No other bank is allowed to do the Clearing task but NBP act on the behalf of SBP the clearing task where NBP exist. 5.1.2. No. of Branches: Strength of NBP is that there are 1254 branches in Pakistan and 22 branches in overseas of NBP. So NBP staff members are scattered on the land of Pakistan and World to provide benefits and serve the people. 5.1.3 Experience Employees: The staff members of NBP Chowk Bazar Branch are an experience, though they are not qualified people but yet they have enough experience to carry on the work of bank. It is Internship Report on NBP Chowk Bazar Branch Bannu City. 43 said, “Knowledge is power and experience is wisdom but experience cannot be defeated by knowledge”. 5.2 WEAKNESSES: Following are the main weaknesses of NBP: 5.2.1. Delegation of Authority: National Bank of Pakistan to great extent is a centralized bank. The manager of the Chowk Bazar Branch Bannu has very limited authority, especially in case of advances. Lack of delegation of authority creates problems and when the manager is not present in his office and customers have to wait for many hours. There is top to bottom flow of authority and lower level of employees cannot participate in the decision making process. The top level of the organization takes all the decision. This completely centralized decision-making decreases the interest and also reduces efficiency of the bank. 5.2.2. Seniority Based Promotions: Promotion in NBP is purely on seniority basis rather than on performance. This really demotivates the employees because they know that it doesn’t matter whether they perform well or bad. 5.2.3 Job Rotation: Most of the employees work in a particular department and they specialize only in one department. In case of absence of one employee, any other employee cannot perform this work. In this way bank not only loses the business but also results in dissatisfaction of the customer. 5.2.4 Lack of Theoretical Knowledge of Employees: There is a lack of theoretical knowledge of the employees of National Bank of Pakistan. Although their work is mostly routine and practical but sometimes low background Internship Report on NBP Chowk Bazar Branch Bannu City. 44 education can disturb the routine work. They have to consult the Regional Manager Office or General Manager Office. This factor affects their efficiency. 5.2.5 Discouragement of Small Depositors: The staffs members give proper attention and respect to those customers who have deposited huge amount of money while the small depositors mostly; the salaried people are discouraged to open an account within the branch. In this way they discourage saving habits in the general public. 5.2.6 Lack of Discipline: During my training in National Bank of Pakistan, Chowk Bazar Branch Bannu I observed lack of discipline in the way that some of the employees do not care about the office timings. They usually come late in the morning. Similarly employees take long leaves without any valid reasons. 5.2.7 Excessive Paper Work: There is excessive paper work in NBP, which takes more time and reduces the effective banking performance. 5.2.8 Lengthy Process of Loan: To meet the immediate requirements of the business, customers require quick financing but due to centralization of decision-making there are unnecessary delays in sanctioning of loans, resulting in dissatisfaction of the customers. 5.2.9 Low Rate of Return: Due to low rate of return, the depositors are drawing their money from the banks and depositing in the saving centers, which are offering a good rate of return as compared to the banks. Internship Report on NBP Chowk Bazar Branch Bannu City. 45 5.3 OPPORTUNITIES: Following are the main opportunities of NBP: 5.3.1 Financing: Now a day’s people have enough savings and they want some luxurious type’s products such as Car, House and Business etc. So the opportunity for NBP is to start car-financing scheme to be beneficial for the organization (Bank). 5.3.2 Modernization: Another opportunity for NBP is to modernize itself because all other banks have best methodologies to compete others and market their products. As I know that NBP have not enough modernize system to be compatible with other banks. 5.4 THREATS: Followings are the major threats for NBP: 5.4.1 Other Banks The major threat for NBP is other banks that have started function in Bannu such as Bank Alfalah, MCB, UBL, ABL, Khyber Bank etc. These are the banks that NBP face competition with them. These banks provides a vide variety of services as compared to NBP. 5.4.2 Political Interference: Banks are not free from political influences. Due to political pressures on the management for sanctioning the loans in favor of their political persons resulted in huge amount of bad debts because in this way the bank is unable to recover the loan very difficult, and these loans are not used for productive purposes. Internship Report on NBP Chowk Bazar Branch Bannu City. 46 5.4.3 Strong Competition: As we know that today’s era is the era of competition. In Bannu all the banks are involved in struck competition so; it is an opportunity for NBP to develop a strong marketing policies and campaign to further develop itself. 5.5 SWOT MATRIX OF NBP List the bank key external opportunities. List the bank key external threats. List the bank key internal strengths. List the bank key internal weaknesses. Match internal strengths with external opportunities, and record the resultant SO strategies in the appropriate cell. Match internal weaknesses with external opportunities. And record the resultant WO strategies. Match internal strengths with external threats, and record the resultant ST strategies. Match internal weaknesses with external threats, and record the resultant WT strategies. Internship Report on NBP Chowk Bazar Branch Bannu City. 47 SWOT Matrix of NBPChowk Bazar Branch Bannu. Strengths 1. NBP Weaknesses has a competitive 1. Centralized decision making. advantage over its rivals because 2. No job rotation due to which of Government support. loss of customer and job treatment of 2. The employees of the bank are dissatisfaction exists. more committed as compared to 3. other Banks. Partial customers. 3. NBP is the pioneer to start a foreign exchange in order to 4. People are in-forced to open regularize the inflow of money an account. transfer. 5. Due to Government 4. NBP has not only qualified but ownership the employees feel safe and hence no motivation. experience staff as well. 5 More training facilities to the 6. Lower chances of career development. employees. Opportunities 1. Government 6. Strong Financial Position 7. Female population not served SO Strategies WO Strategies favorable 1.(Market Development, Market policies because of nationalized penetration and Diversification Bank. strategies can be applied ) (O6,O5-S1,S6) 2. Car financing, home financing in the area of Bannu 2. Joint venture with UBL and 1. (Market Development, Product Development, Integration Strategies can be applied) (O3,O4,W4,W7) 2. By adopting these strategies the bank will Internship Report on NBP Chowk Bazar Branch Bannu City. 48 can be competitive. Bank Al-falah can be a fruitful strategy for 3. NBP has an opportunity to services. modernize itself with the latest IT and Online overcome the weaknesses by availing the opportunities. technologies available. 4. Good reputation in the eye of the customers because of competitive services. 5. A part of population can be accessed having no Bank Accounts. 6. Untapped market exists for female. Threats ST Strategies WT Strategies 1. Cut throat competition in the Due to Strong financial position Female side of the population Banking Sector and skilled work force the bank can be attracted by providing can overcome the threats of them more facilities and Political influence due to competitors and by offering support to encourage them for political pressures. different services to the availing more and more 2. 3. The competitors are utilizing more and more updated customers, potential customers banking can be attracted from the area. technologies as compare to Market Development and NBP. intensive Strategies can be good 4. People at Bannu are at facilities, Diversification Strategies can be effective.(T5-W7) for the Bank.(S4,S6-T1,T4) general avoiding Banks because of complications involved. dominated society at Bannu Internship Report on NBP Chowk Bazar Branch Bannu City. 49 5.6 INTERPRETATION The Banks in the area of bannu in general are using the same traditional approaches of banking, National bank is using modern approaches but there are still opportunities for advancements in this region. As mentioned above more customers can be attracted for opening accounts, for the reason the Bank should launch various awareness programs to attract more and more people towards the Bank. Advertisement is a basic way through which a business can inform and hence educate more people to use various products. Banks are both nationally and internationally using extensive advertisement at national and international level with attractive packages, in case of Pakistan also, advertisement is used as an effective tool, but in Bannu advertisement is ignored and more people are unaware of the services provided by Banks. If the national bank of Pakistan main branch bannu will appoint female workers, the motivation process will be increased for female investors. Secondly the bank will establish the IT and online systems for strengthen of financial position to facilitate the customer requirements. The availing of the opportunities (female services, IT and online etc.) so the bank will minimize those weaknesses. If the bank will appoint the well experience, skilled and qualified work force, and opening of a new branches in Bannu those area where the customers facing the various complications. In this situation the bank will be eliminate those threats. If the national bank of Pakistan main branch bannu implement those activities (encouraging female accounts) which are implemented other banks of big cities in Pakistan so the threats will be also minimize. The bank will motivate the customers to open an account in the bank so in this case the financial position of the bank will be strong and provided more opportunities to customers. Internship Report on NBP Chowk Bazar Branch Bannu City. 50 CHAPTER # 6 PROBLEMS AND SUGGETIONS 6.1 INTRODUCTION NBP is an effectively operating and profit making organization and carrying out its activities under a specified system of procedure. The main regulatory body is State Bank of Pakistan, which provides policy guidelines and ensures that the money market operates on sound professional basis. While the head office specifies the whole procedure of function and operations. This procedure has been modernized with the passage of time with a view to streamline the approach and underlying procedure for effective overhauling of its own capabilities so as to bring them at par with international practices. Here I am giving some suggestions, which in my view can add some input for efficiency and better performance of NBP as an organization in general and Chowk Bazar branch in particular. The recommendations are as follows: 6.2 Professional training NBP staff lacks professionalism. They lack the necessary training to do the job efficiently and properly. Although staff colleges in all major cities but they are not performing well. For this purpose these staff colleges should be reorganized and their syllabus should be made in such a way to help the employee understand the ever-changing global economic scenario. Banking council of Pakistan should also initiate some programs to equip the staff with much needed professional training. Internship Report on NBP Chowk Bazar Branch Bannu City. 51 6.3 Delegation of authority Employees of the bank should be given a task and authority and they should be asked for their responsibility. 6.4 Performance Appraisal The manager should strictly monitor the performance of every staff member. All of them should be awarded according to their performance and result in the shape of bonuses to motivated and incite them to work more efficiently. 6.5 Transfer Transfer is not properly carried out. Some of the employees are continually serving at the same post. They are simply rotated at the same branch. Therefore it is recommended that evenly rotation of every employee should take place after every three years in different braches of the bank. 6.6 Need of Qualified Staff Required, qualified staff should be provided to branch in order to improve the functioning of the branch. Especially a telephone operator should be appointed. 6.7 Utility Bill Charges Bank gets Rs. 2 to 3 to processes a utility bill, and it is very tire, tough and hard job despite this working resulting in a loss to then Rs 3 to5 per transaction. These charges should be increased to RS 10 per bill to enable the branch to cover their handling costs and make some profit. 6.8 Link with the Head Quarter 100 major branches of NBP should established a direct link with the, head quarter Internship Report on NBP Chowk Bazar Branch Bannu City. 52 In Karachi, through Internet. This will make the functions and decision making of the management easier and convenient. 6.9 Clean Loans Clean loan or clean overdraft is the credit facility extended to the customers without any security. These types of small term loans should not be extended to anybody, because sometime these loans are provided to blue-eyed people of the management and they become a part of bad debts. 6.10 Staff Relationship Good relationship among staff member leads to the peak performances in any organization. I observed that the staff relationship was normal other wise but some time I noticed that there existed a little conformity among the staff members. Another syndrome from which the staff suffered was that all of them considered themselves more important than others. Some of the officers used to say that if I am absent for a day the bank would stop working. So this sort of attitude is not good because it mars bank image and juniors’ willingness learn and work hard and in the end will hurt the whole team. 6.11 Improper Distribution of Work Proper distribution work leads to success in every organization. Proper distribution of work prevents the employee from over and under work situation. So for a smooth running of an organization proper distribution of work is the hint to be followed. During my internship I observed that there was no proper distribution of work in the bank. I saw that some of the employee worked like ants other sat idle starting here and there. So this created a lot of over work situation for while relaxation for other. Internship Report on NBP Chowk Bazar Branch Bannu City. 53 6.12 Inter Departmental Transfer I watched during my internship that, there is number of employee who have worked on one seat for many a year. It can have negative effects motivation of employee who is hard working and intelligent. Take the example of advances section. In advance section if the employee is transfer after sixth month or seven month, how can he be able to show his performances and how can he be able to know the bank customer in a short period of time. 6.13 Complaints of Customer There should be an information desk to provide the information and to receive the complaints of the customer in the bank. There is no complaint box available in the branch and not any person appointed to hear the complaints. Every person cannot go to the manager for the complaint because most of the people are hesitant. So I suggest management to install a compliant box in the branch, and recruit a special person for that guidance of the customer when they are unable to manage some difficulties in banking matters. 6.14 Housing and House Hold Goods loans Bank should initiate these loans because most of bank’s customers are middle class and they cannot afford to buy house or household goods at once by their own 6.15 Summation We discussed in this chapter about the recommendation and suggestion for NBP as an organization in general and NBP Chowk Bazar Branch Bannu in particular. The next chapter is about the implementation plan in the view of recommendation and suggestion. Internship Report on NBP Chowk Bazar Branch Bannu City. 54 CHAPTER # 7 IMPLMENTATION PLAN IMPLEMENTATION Every organization has its own strengths, weaknesses and opportunities and threats. Nothing is impossible in this world, as someone has rightly said, “An impossible is often untried”. Here are the implementation/action plans for the recommendations concluded in the previous chapter. 7.1 BUSINESS DEVELOPMENT PLAN: In order to develop the implementation procedure to reach business development objectives, the following steps should be taken: i. Campaigns to open More Accounts: In order to increase the number of accounts, there should be a clear market plan. The staff, branch managers and executives involved in business development should prepare lists of different groups of prospective account holders and their neighbors, friends and influential people and make efforts to open their volume of business and deposits by fixing monthly target. This should be done by coordination among the various branches of the Bank. ii. Campaigns for Mobilization of Deposits: Deposits are the main source of commercial banks and it is very important for an individual bank to get funds, because its basic function is to put them to work safely and profitably. The act of attracting funds is important but there are so many other processes of obtaining the funds, like the Bank can get funds by advertising, by direct contact or by contacts through their officers, managers and executives. Thus, they can get the customers and acquire them ultimately by furnishing banking services. Internship Report on NBP Chowk Bazar Branch Bannu City. 55 iii Campaigns To Increase Business Share: The management of the Bank should prepare a business development plan by taking into account the overall market position of the bank in the banking industry. In light of market share, business development targets should be fixed on an annual basis by fixing monthly targets for imports, exports, issuance of letters of guarantee, bills etc. The achievement of targets should be reviewed every month by the respective circles at the Head Office and necessary instructions and guidelines be provided to the respective area control and zones where the business performance are not according to the set targets. Iv.Training of Personnel: We all know that the profitability, growth and survival of a bank depend upon business development. Therefore, the Bank should take steps to impart training to the probationary officers, senior officers, managers and executives in modern business development techniques and public relations. Business development training is the process of imparting knowledge creating skills and shaping attitude, work habits, and consists of telling, showing and teaching the trainee and then monitoring his/her results and making constructive corrections. 7.2 PLAN FOR MONITORING & EVALUATION SYSTEMS The systems and procedures of the Bank must be dynamic, flexible and subject to continuous monitoring and evaluation. The pre-requisites of an effective monitoring and evaluation process are as follows: 1 A good, open and unbiased feedback system should be established to identify the problems and suggesting improvements. 2 The feedback system must include the customers and all the staff members from top to bottom within the Bank. 3 The feedback system must allow both as needed and fixed interval information. Internship Report on NBP Chowk Bazar Branch Bannu City. 56 4 The problems and errors must be analyzed and removed. The suggestions should be discussed at all levels and implemented if found useful. 1 Performance reporting and meetings could be effective tools. 2 The performance review must be aimed at improving employees’ skills and productivity by identifying training needs. 7.3 INTERNSHIP PROGRAM PLAN: One of the best and cost effective methods to select the right people and hire graduates from business and management schools as internees. The internship programmed should spread over a period of at least six months. During the internship programmed, a close watch should be kept on the internees. At the end of the internship programmed, the performance of the internees should be 7.4 Summation We discussed in the chapter about the two-implementation plan. This twoimplementation plan will save the time and will bring speed in tackling the customers. Internship Report on NBP Chowk Bazar Branch Bannu City. 57 BIBLIOGRAPHY 1. M. Saeed Nasir, Money Banking and Finance. 2. National bank of Pakistan Chowk Bazar Branch Bannu Employees interview. 3 Meenai, S.A. (2001). Money and Banking in Pakistan. Karachi: Oxford University Press. 4 C.H. James and J.M. Wachowicz.JR. 11th Edition, Foundation of Financial Management. New Jersey: Prentice-Hall, Inc. p.150 5 National Bank of Pakistan, (2006). Annual Report, Karachi 6 National Bank of Pakistan, (2007). Annual Report, Karachi. 6 National Banking of Pakistan, (2008). Annual Report, Karachi. 7 National bank of Pakistan of Pakistan, Brochures of Products & Services. 8 National bank of Pakistan, (2009) Annual Report. 9 www.nbp.com.pk 10 Fred.R.David. Strategic Management. 10th Edition. Chapter No. 6. ********************************************* Internship Report on NBP Chowk Bazar Branch Bannu City. 58