Current State Business Process Assessment

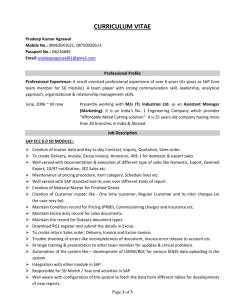

advertisement