Rutgers Model United Nations Republic of Indonesia Economic and

advertisement

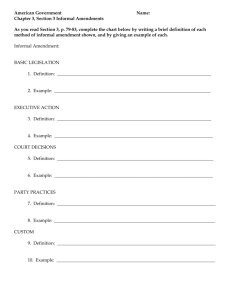

Rutgers Model United Nations Republic of Indonesia Economic and Financial Committee Informal Value Transfer Systems Ken Bier and Andy Lang East Brunswick High School Informal Value Transfer Systems, or alternative remittance systems, date back as far as India, 5800 BCE, serving as “settling accounts” within villages (Passas 3). Informal Value Transfer Systems serve many beneficial purposes, including governmental uses, immigrants remitting money to their families, and cheaper transfer of currency. These Informal Value Transfer Systems; however, allow customers to escape taxes, ensure anonymity, and refrain from leaving documented trailers or passing currency through financial institutions. Such fundamental practices have developed into unregulated and therefore precarious systems, utilized by the most simplistic Middle Eastern merchants to possibly terrorist organizations. International action is necessitated to either completely abolish the vulnerable system or regulate and secure the validity of the system. Informal value transfer systems have been utilized for hundreds of years. There are various forms of IVTS all over the world, including hawala, hundi, fei chien, black market peso exchange, and several others (Passas 2). Essentially, these systems are used to transfer money between locations “without leaving a formal paper-trail of the entire transaction or without going through regulated financial institutions at all” (1). In fact, the money in these informal value transfer systems do not move directly. Hawala originated in the Middle East before formal banking systems were created. Fundamentally, a customer in one country can rely on hawala to transfer money to another country while avoiding government regulations. First, a money changer (or hawaladar) asks a money changer in another country do dispense the money asked for. The hawaladar in the receiving country has the money sent to the intended person in that country. These systems operate around the globe and function largely on trust between hawaladars (Vaknin 2). It is estimated that in India alone, $680 billion circulated through hawala in 1998, approximately the size of Canada’s entire economy (Looney 2). In the United States, up to $5 million are transferred annually, estimates Pakistani Minister of Finance, Shaukut Aziz (Vaknin 3). Despite their power in regions of the world, IVTS such as hawala have gained negative attention in recent years, after the terrorist attacks on the United States of America on September 11, 2001. It is speculated that portions of the money used to fund the attacks were possibly obtained through underground fund transfer mechanisms such as hawala, leading to panic about IVTS (Passas 1). Crimes committed through IVTS include money laundering, financing terrorism, payments for illegal immigrant welfare, funding of illicit drugs and weapons, organ smuggling, and tax evasion (2). However, IVTS are generally used for legal and legitimate transfers of money. Often they are used because duties are not required to send money. Also, they are fast, reliable ways to do this, and are useful when formal banking systems are not an option (House 1). Even though IVTS like hawala are informal and sometimes used for violent actions, they are extremely large and powerful, and strategic approaches must be taken to oversee their transfers. Indonesia recognizes the threat of terrorist funding through IVTS and understands what must be done to stop this. It is recognized as a source of major remittances to other nations (Yang 3). Also, it is known to receive remittances from other nations too. In total, it is estimated to receive over $1.5 billion in remittances (Blackwell 39). A recent revelation shows that there are 2000 money-changer branches in Indonesia (“Informal Funds Transfer Systems in the APEC Region 57). Though Indonesia has yet to meet the recommendations of the Financial Action Task Force, it will strive to prevent abuses of IVTS (S/2002/1338 11). In the wake of the resort car-bombing in Bali by Al Qaeda, and the discovery of Al Qaeda training camps in Poso, Sulawesi, attempts have been made to crack down on terrorism and arms trade in Indonesia (14). “In Indonesia, remittances are being carefully examined in relation to [Asian Development Bank’s] continued support to the country’s anti-money-laundering efforts, and more broadly in the context of overall financial sector reform.” Thus, with the help of the Asian Development Bank, Indonesia will help combat crimes such as money-laundering that can be committed through IVTS. Indonesia is also examining remittances from the country to help combat money laundering, with the support of the Asian Development Bank (Yang 3). In these ways, Indoneia is committed to assisting the regulation of informal value transfer systems, to help combat the funding of terrorism through these systems. Thus, Indonesia pledges to fight illegal transfers of money, and with the assistance of the Asian Development Bank, will attempt to deter this crime. Also, it is committed to controlling the funding of terrorism and arms trade through informal value transfer systems, to prevent attacks like those in Bali. Finally, Indonesia is willing to analyze its remittances to further stop money laundering. Indonesia also offers solutions to combat the abuses of informal value transfer systems that fund terrorist activity. Although terrorist attacks against Indonesia have garnered recent skepticism of Informal Value Transfer Systems, the country still sympathizes with citizens of less developed countries who face difficulty through sending money through Formal Value Transfer Systems. As stated in the Abu Dhabi Declaration on Hawala, participating countries in the United Arab Emirates’ International Conference understood the need to regulate informal remittance systems while maintaining the systems effectiveness in order to preserve customer’s interests. The Informal Value Transfer Systems are an effective approach to remittance to inaccessible countries with the evasion of impeding government regulations. In order to preserve customer interests while ensuring systemic transparency, government supervision is necessary in several areas of Informal Value Transfer Systems. Countries should be emphasized to pass legislation requiring hawaladars and Informal Value Transfer Systems operators to report remittances to the federal government. Acknowledging the difficulty of contacting the federal government in many nations, it should be included that hawaldars or operators can relay information regarding remittances to local governments, who will then send this information to federal governments. These measures will eradicate the potential of systematic abuse, both financially and for terrorist profit, the federal governments of these nations must thoroughly confirm the validity of these remittances. It should also be emphasized that no penalization or disadvantages, such as taxes, institutional intervention, or the hindrance of formal banking systems, will occur. As Indonesia does not impose the international community to abolish the Informal Value Transfer Systems, suspicion over the system has caused the Indonesian government to favor formal remittance systems. Incentives, rather than forcing citizens to utilize formal remittance systems, are a more effective approach to dealing with the dangers of Informal Value Transfer Systems. Indonesia, comprised primarily of conservative Muslims, does not wish to enforce impulsive liberal change. Lowering taxes, expanding banks to facilitate accessibility, creating government sponsored alternatives, and speeding up or simplifying the formal process can entice citizens to use formal remittance systems. As more people switch to using the formal systems, fraudulent abusers and illegitimate users will be revealed to the federal government. In brief, Indonesia has mixed feelings over the Informal Value Transfer Systems, feeling it should not be abolished but slightly monitored for security purposes. Informal Value Transfer Systems provide fast, cheap, and effective remittance systems for citizens in relatively inaccessible locations. The global community often neglects unnecessary reforms in accordance to individual nations’ best interests. These unnecessary reforms also produce more law offenders by criminalizing innocent customers of Informal Value Transfer Systems. Creating more criminals will complicate the process of rooting out terrorist organizations by creating a larger pool of criminals. Economist Richard Cowen writes of another unattended, harmful consequence of government illegalization of unnecessary practices in his “Iron Law.” Cowen noted that the more intense the government outlaws regulates these practices, nations have historically responded by producing more potent systems or forms of these crimes (“Alcohol Prohibition was a Failure”). Cowen notes that in the American Prohibition, the outlawed alcohol only becomes more potent, addictive, and utilized by the public. A comprehensive approach to Informal Value Transfer Systems and increase in the convenience of formal systems is the best possible solution to combating money laundering and informal system abuse. Recently funded terrorist attacks against the Republic of Indonesia have galvanized cynicism regarding Informal Value Transfer Systems. However, Indonesia does not wish to impose the international community to abolish Informal Value Transfer Systems, for the people’s interests are imperiled. Increased government supervision on Informal Value Transfer Systems to monitor terrorist transactions seems at the moment the most feasible solution to combating these grassroots fundamentalist organizations. An amalgamation of government inspection and incentive can effectively increase the sue use of formal system and root out the threat of money laundering of abuse by terrorist organizations. Works Consulted A/56/993. United Nations General Assembly. 20 June 2002. “A Comparative Assessment of Saudi Arabia With Other Countries of the Islamic World: Targeting Terrorist Finances Project.” Brown University: Watson Institute For International Studies. June 2004. Online. Internet. <http://www.cfr.org /content/ publications/attachments/Revised_Terrorist_Financing_AppendC.pdf> 23 October 2006. Blackwell, Michael and David Seddon. “Informal Remittances from the UK: Values, Flows, and Mechanisms.” Overseas Development Group Norwich. March 2004. Online. Internet. <www.livelihoods.org/hot_topics/docs/UK_Remittances.pdf> 23 October 2006. Buencamino, Leonides. “Informal Money Transfer Systems: Opportunities and Challenges for Development Finance.” United Nations Discussion Papers; Economic and Social Affairs. Online. Internet. <http://www.un.org/esa/desa/ papers/2002/esa02dp26.pdf> House, L. “Informal Value Transport Systems.” Kentlaw.Edu. Online. Internet. <http://www.kentlaw.edu/WhiteCollarCrime/caseStudies/IVTS.doc> 19 October 2006. “Informal Funds Transfer Systems in the APEC Region: Initial Findings and a Framework for Further Analysis.” APEC. 1-5 September 2003. Online. Internet. <http://siteresources.worldbank.org/EXTAML/Resources/3965111146581427871/APEC.Informal.FundsTransferSystemsReport.pdf> 18 October 2006. Johnson, R. Barry. “Regulatory Frameworks For Hawala and Other Remittance Systems.” International Monetary Fund. 2005. Online. Internet. <www.imf.org/external/pubs/nft/2005/hawala/hawala.pdf> 19 October 2006. Looney, Robert E. “Strategic Insight, Following the Terrorist Informal Money Trail: The Hawala Financial Mechanism.” Center for Contemporary Conflict. 1 November 2002. Online. Internet. <http://www.ccc.nps.navy.mil/rsepResources/si/nov02 / southAsia.asp> 19 October 2006. “Micro Loans for the Very Poor.” Grameen. 1998. Online. Internet. <http://www.grameeninfo.org/mcredit/nytimes.html> 31 October 2006. Passas, Nikos. “Hawala and Other Informal Value Transfer Systems: How to Regulate Them.” United States International Information Programs. Online. Internet. <http://usinfo.state.gov/eap/Archive_Index/Hawala_and_Other_Informal_Value_Transfe r_Systems_How_to_Regulate_Them.html> Passas, Nikol. “Informal Value Transfer Systems and Criminal Organizations; A Study Into SoCalled Underground Banking Networks.” United States International Information Programs. Online. Internet. <http://usinfo.state.gov/eap/img/ assets/4756/ivts.pdf> S/2002/1338. United Nations Security Council. 16 December 2002. Thornton, Mark. “Alcohol Prohibition was a Failure.” CATO Institute. July 1991. Online. Internet. <http://www.cato.org/pubs/pas/pa-157.html> 1 April 2006. Uhlfelder, Eric. “Micro Loans, Solid Returns.” BusinessWeek Online. 9 May 2005. Online. Internet. <http://www.businessweek.com /magazine/content/ 05_19/ b3932134_mz070.htm> 31 October 31, 2006.> Vaknin, Sam. “Hawala, or the Bank that Never Was.” Samvak.tripod.com. October 2001. Online. Internet. <http://samvak.tripod.com/nm104.html> 18 October 2006. Verandos, Angelo, M. Islamic Banking and Finance in Southeast Asia: Its Development Future. Hackensack: World Scientific Books Publishing Co. 2005. Yang, E. et al. “Technical Assistance For the Southeast Asia Workers’ Remittance Study.” Asian Development Bank. December 2004. Online. Internet.