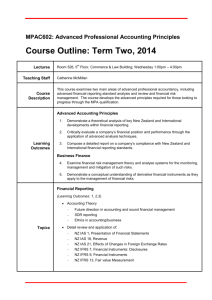

Workshop Outline

advertisement

International Financial Reporting Standards Introduction: Outright adoption of International Financial Reporting Standards (IFRS) or convergence with these standards is now a global phenomenon that is rapidly gathering pace. Australia, Russia, the entire 25 member counties of the European Union, several countries in the Middle East and Africa, and others have decided on wholesale, mandatory change to IFRS. EU legislation for instance requires listed European plc companies comply with IFRS in 2005 for their group financial statements. Ireland has very recently decided to permit all companies-not just plc’s to prepare their statements under IFRS. This is the biggest change to financial reporting in 25 years and makes the transition to IFRS an urgent issue for companies. Transparent corporate information is necessary now more than ever. Investors and lenders need clear, credible and internationally comparable financial and nonfinancial information on which to base their decisions. Audience: For senior and middle financial and accounting personnel from all divisions and units of the company. Objectives: The purpose of this course is to provide finance and accounting staff with a sound working knowledge of the all the IFRS standards relevant to the business and to identify the changes in accounting policies and procedures which will be required in order to make the change to IFRS. The technical requirements of IFRS will be explained and illustrated. Course Delivery The course is a mixture of short presentations, interactive discussion, individual exercises and group work. The course will make liberal use of, and reference to those IFRS considered most relevant to the client. Comparisons with US GAAP will also be included. The course will also make references to Interpretations of International Reporting Standards (SICs). Course Outline: Module 1 Background to International Financial Reporting Standards (IFRS) The need for IFRS International accounting harmonisation-implications for Qatar/QP EU Requirements for listed companies The use of IFRS around the world Integrating IFRS with national standards IASB structure and work programme Module 2 IASB Framework Underlying assumptions Expected qualitative characteristics Elements of financial statements Principles of recognition and measurement Concepts of capital and capital maintenance Module 3 Cash Flow Statements Cash Flow Statements: operating, investing and financing activities; direct and indirect methods; (IAS 7) Module 7 Non-current Assets and liabilities Property, plant and equipment: recognition and measurement, revaluations and depreciation (IAS 16) Borrowing costs: capitalisation (IAS 23) Impairment of assets: identification, measurement of recoverable amount (IAS 36) Provisions, contingent liabilities and contingent assets (IAS 37) Intangible assets: recognition and measurement, internally developed assets and research & development (IAS 38) Investment Property (IAS 40) Non-current assets held for sale and Discontinued Operations (IFRS 5) Module 6 Measuring financial performance Inventories (IAS 2) Accounting policies, changes in accounting estimates and errors. (IAS 8) Revenue: recognition and measurement (IAS 18) Related party disclosures (IAS 24) Earnings per share (IAS 33) Discontinuing operations (IAS 35) Module 5 IAS 1 Presentation of Financial Statements Responsibility for financial statements Components of financial statements Overall considerations Structure and content Module 4 Framework for the Preparation and Presentation of Financial Statements Group Accounting Business Combinations: Uniting of interests, acquisitions (IAS 22) Consolidated and Separate Financial Statements (IAS 27) Investments in Associates (IAS 28) Interests in Joint Ventures (IAS 31) Business Combinations (IFRS 3) Module 8 Income taxes: current tax and deferred tax liabilities and tax assets (IAS 12) Module 9 Financial Instruments Leases (IAS 17) Financial Instruments: Disclosure and Presentation (IAS 32) Financial Instruments: recognition and Measurement (IAS 39) Module 10 Income Tax Reporting Other issues Events after the Balance Sheet Date (IAS 10) Construction contracts (IAS 11) Segment Reporting (IAS 14) Employee Benefits (IAS 19) Accounting for Government Grants and Disclosure of Govt. Assistance (IAS 20) The effects of Changes in Foreign Exchange Rates (IAS 21) Accounting and reporting by retirement benefit plans (IAS 26) Financial Reporting in Hyperinflationary Economies (IAS 29) Disclosures in the Financial Statements of Banks and Similar Financial Institutions (IAS 30) Interim Financial Reporting (IAS 34) Agriculture (IAS 41) First Time Adoption of IFRS Standards (IFRS 1) Equity-settled share based payment transactions (IFRS 2) Insurance Contracts (IFRS 4) Proposed standards and changes in standards.