Reply to Pre-bid queries for RFP-ISSUE-1/2012

advertisement

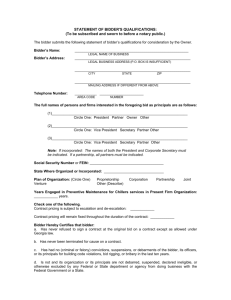

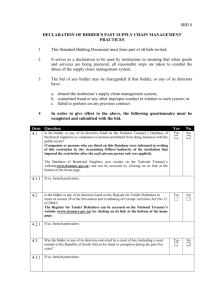

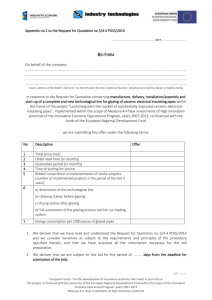

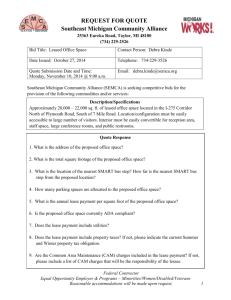

Reply to Pre-bid queries for RFP-ISSUE-1/2012 dated 24-01-2012 for END TO END SOLUTION FOR PERSONALIZATION AND ADMINISTRATION OF ALL TYPE OF DEBIT AND CREDIT CARDS OF VISA/ MASTERCARD/ NPCI and Other Interchange Network S No 1 RFP Reference/ RFP Clarification Sought Term Eligibility Criteria – 3 We are in the business of end to end Page No 4 card fulfillment business since last 6 years and providing the services for more than 10 institutions. For the Banks where we are offering end-to-end card issuance and management services, we have partnered with VISA/ MasterCard certified card manufacturing and personalization bureaus. Bank's Reply Clause may be read as “Bidder should have a VISA & Master Card/NPCI certified bureau in India having required infrastructure for Debit/ Credit card Personalization or Manufacturing conforming to all the guidelines issued by VISA / MasterCard/ NPCI. Considering the above, request the bank to allow the service providers like us to participate with the condition of procuring the card plastics and availing personalization services from VISA/ MasterCard certified agencies. 2. Eligibility Criteria – 5 Page no 4 Further to the point mentioned above, request that Bank allows bidders to partner with VISA/ MasterCard certified card manufactures who would fulfill this eligibility criteria. Bidder to comply with the RFP terms. 3. Eligibility Criteria – 6 . Page no 5 Further to the point mentioned above, request that Bank allows bidders to partner with VISA/ MasterCard certified card manufactures and perso bureaus who would fulfill this eligibility criteria. Bidder to comply with the RFP terms. Page 1 of 33 Reply to Pre-bid queries for RFP-ISSUE-1/2012 dated 24-01-2012 for END TO END SOLUTION FOR PERSONALIZATION AND ADMINISTRATION OF ALL TYPE OF DEBIT AND CREDIT CARDS OF VISA/ MASTERCARD/ NPCI and Other Interchange Network 4. Eligibility Criteria – 7. Page no 5 Further to the point mentioned above, Bidder to comply with the RFP terms. request that Bank allows bidders to partner with VISA/ MasterCard certified card manufactures who would fulfill this eligibility criteria. 5. Eligibility Criteria – 8, 1) Trust the Bank is referring to the By taking the view of the vendors present card management system of the in the pre-bid meeting, Bank has relaxed bidder being PCI-DSS compliant. this condition. Kindly confirm. Page no 5 2) MCT Cards & Technology Pvt. Ltd certified by VISA and MasterCard for secured banking card manufacturing and personalization. We follow data security norms as per VISA and MasterCard. As per VISA, MasterCard certification since we are certified by VISA & MasterCard for card personalization there is no need for PCI-DSS certification. MCT Cards & Technology Pvt. Ltd certified with ISO 27001-2005 Specification for Information Security and Management. Above mentioned certifications are of higher version comparing with PCI-DSS. So we Page 2 of 33 Reply to Pre-bid queries for RFP-ISSUE-1/2012 dated 24-01-2012 for END TO END SOLUTION FOR PERSONALIZATION AND ADMINISTRATION OF ALL TYPE OF DEBIT AND CREDIT CARDS OF VISA/ MASTERCARD/ NPCI and Other Interchange Network request you to consider above mentioned VISA, MasterCard and ISO 27001-2005 certification for bidder eligibility criteria. 6. Eligibility Criteria – 9, Page no 5 7. Eligibility Criteria – 10, Page no 5 8. Eligibility Criteria – 12, Page no 5 Further to the point mentioned above, Bidder to comply with the RFP terms. request that Bank allows bidders to partner with VISA/ MasterCard certified card manufactures and perso bureaus who would fulfill this eligibility criteria while maintaining the card issuance, PIN generation and printing in-house from bidder’s premises. Does the Bank expect the bidder to Bidder to comply with the RFP terms. have a Disaster Recovery arrangement or a fall-back arrangement to cater to business continuity? 1. While the buy-back of card plastics and stationery available with the Bank can be considered on mutually agreed rates, request that Bank relaxes the condition of buy-back of the existing embossing machines. 2. The details of the machines debit/cards should be provided to FSS. Details might include the date of purchase, cost of purchase, value Bidder to comply with the RFP terms. Details of two embossing machine are as per the following. (A) ZT 10 – 583781 Matica Embossing Machine DOP: 22.09.2005 OCP: 24,75,000.00 AMC Start Date: 11.10.2006 Card Page 3 of 33 Reply to Pre-bid queries for RFP-ISSUE-1/2012 dated 24-01-2012 for END TO END SOLUTION FOR PERSONALIZATION AND ADMINISTRATION OF ALL TYPE OF DEBIT AND CREDIT CARDS OF VISA/ MASTERCARD/ NPCI and Other Interchange Network at which it has to be taken over etc. (B) ZT20 - 7075393 Matica Embossing Machine DOP: 17.08.2007 OCP: 46,28,000.00 AMC Start Date: 17.08.2008 Card Bidder has to mention the commercial for two embossing machines along with the commercial bid. 9. Annexure B2 Page 47. Point number 1.1 1. Does bank expect bidder to provide 1. Bidder to comply with the RFP terms. the Card management system, to generate PAN, embossa data, Card 2. Access should be available to all Activation File, PIN and printing of Branches. PINs? 2. Also, does bank want to give access to branches for card generation requests? If so, how many branch accesses are required concurrently and in total. 10. Annexure B2 Page 47. Point number 1.3 Trust the Bank is referring the Card Bank confirms the understanding. Bidder Authorization File (CAF) to be to comply with the RFP terms. generated from bidder’s card management system for refresh on the Bank’s Switch. 11. Annexure B2, Page no 47, 1.5 Trust the Bank is referring to the Bidder to comply with the RFP terms. bidder’s card issuance and management system to have the Page 4 of 33 Reply to Pre-bid queries for RFP-ISSUE-1/2012 dated 24-01-2012 for END TO END SOLUTION FOR PERSONALIZATION AND ADMINISTRATION OF ALL TYPE OF DEBIT AND CREDIT CARDS OF VISA/ MASTERCARD/ NPCI and Other Interchange Network requested features. Kindly confirm on our understanding. 12. General Premises hosting of 1. We assume that the application for 1. Bank confirms the understanding Card management to be hosted in application bidders premises. 2. Does the Bank expect the IP for the 2. Bank confirms the understanding card management system to be owned by the bidder? 13. General Card variants and projected volume for 3 year contract period 14. General Migration 3. Also, assume that the Bank would 3. Evaluation will be done as per the procedure mentioned in the RFP. have relevant weightage for the card management system offered by the bidder. Please provide the details as following Mentioned in the commercial bid published with this document. 1. Volume of cards under each variant and interchange. 2. Projected volume for next three years for each variants annually. Does bank expect to migrate all existing Bidder to comply with the scope of work card data to new application? mentioned in the RFP terms. If yes, what is the card volume variantwise and the volume of data for migration. Page 5 of 33 Reply to Pre-bid queries for RFP-ISSUE-1/2012 dated 24-01-2012 for END TO END SOLUTION FOR PERSONALIZATION AND ADMINISTRATION OF ALL TYPE OF DEBIT AND CREDIT CARDS OF VISA/ MASTERCARD/ NPCI and Other Interchange Network 15. General Credit Card Trust the bank will provide the embossa Bidder to comply with the scope of work data for Credit Cards to bidder for mentioned in the RFP terms. personalization. Trust the bank will generate Credit cards pin and will do pin printing for credit cards? 16. 17. We assume that bank is not expecting the bidder to provide Credit Card Management system. Request the Bank to kindly confirm the scope for the Credit Cards. General Kindly explain current card preparation No Relevance. and dispatch process in detail. Bidder to comply with the scope of work Current Debit card and mentioned in the RFP terms. Credit Card kit preparation Annexure – C1 Besides the PIN generation and printing Out of scope. during card issuance process, the Bidder to comply with the scope of work customers may request for duplicate/ mentioned in the RFP terms. re-PIN. Since the volume of re-PINs cannot be linked to card issuance, request the Bank to provide an option for the bidder to quote for such re-PIN requests as there would be infrastructure, operations and stationery costs associated with issuance of rePINs. Also request the Bank to provide the Page 6 of 33 Reply to Pre-bid queries for RFP-ISSUE-1/2012 dated 24-01-2012 for END TO END SOLUTION FOR PERSONALIZATION AND ADMINISTRATION OF ALL TYPE OF DEBIT AND CREDIT CARDS OF VISA/ MASTERCARD/ NPCI and Other Interchange Network current monthly volume of such re-PIN requests being processed. 18. Annexure-B2, point 1.1 Which all options will be accessed by Bank/ branches? Will be shared with the selected bidder. 19 Annexure-B2, point 1.5 What checks are expected for the same? Will be shared with the selected bidder. 20. Annexure-B2, point 1.9 1. Does the bank currently support 1. Banks has the compatibility for the software/ HSM based PIN Printing? requirement. 2. Since HSM based PIN printing is the 2. Bidder to comply with the RFP terms secure mode, it is advisable that the Bank chooses on HSM based PIN Printing option. 21. 22. Annexure-B2, point 1.16 General Tracking by Bank users can be done Bank expect to access the system by over Intranet. Does the Bank expect branches/ CO/ HO. end customers to access the system to track the status of card? If so, can an API integration through the bank’s internet banking site be provided? What support functions like hotlisting, Bidder to comply with the RFP terms/ account linking etc., does the Bank scope of work expect the bidder to support? Does the Bank expect these support Page 7 of 33 Reply to Pre-bid queries for RFP-ISSUE-1/2012 dated 24-01-2012 for END TO END SOLUTION FOR PERSONALIZATION AND ADMINISTRATION OF ALL TYPE OF DEBIT AND CREDIT CARDS OF VISA/ MASTERCARD/ NPCI and Other Interchange Network functions to be online between the card management and the switch? How does the bank currently handle these support functions and what is expected from the bidder? Does the bank envisage access to be provided to Bank’s call centre users for handling support functions or view status of cards? 23. 24. 25. 26. 27. General How does the Bank want to handle the various fees like issuance fee, annual fees to be handled in the card management application? General. Does bank require the bidder to provide functionality to support loyalty programs? Annexure-B2, point 2.5 In PIN mailer bank is mentioning about separate content in Original & Duplicate copy, and in Hindi & English, We assume bank is referring to the content as a pre-printed stationary. Annexure-B2, point 2.1 / Request Bank to provide samples of all 2.2 card plastics and stationery referred in the RFP. Annexure-C1 1.2.4.4 and Bidder to comply with the RFP terms/ scope of work Bidder to comply with the RFP terms/ scope of work Bidder to comply with the RFP terms/ scope of work Samples are available at bank for collection. Bidder may collect the same from bank. point While the commercial template provides Bidder to comply with the RFP terms an option to quote the taxes under Page 8 of 33 Reply to Pre-bid queries for RFP-ISSUE-1/2012 dated 24-01-2012 for END TO END SOLUTION FOR PERSONALIZATION AND ADMINISTRATION OF ALL TYPE OF DEBIT AND CREDIT CARDS OF VISA/ MASTERCARD/ NPCI and Other Interchange Network current structure. Request the bank to consider compensating for any change in the tax structure during the tenure of the contract. While the Bank expects the bidder to pass the benefit in case of reduction in tax structure, request that bank considers payment of taxes at actuals, in case of increase in tax or change in tax structure. 28. Annexure-B2, point 1.11 Does the bank expect the bidder to Bidder to comply with the RFP terms provide POD for delivery of cards and PINs? 29. Scope of Work – Page 18 Does the Bank expect the bidder to Bidder to comply with the RFP terms/ support issuance of Credit and Prepaid Scope of works. Cards? If so, what is the scope of work to be offered for Credit and Prepaid Cards? Prepaid Card issuance would also require providing an online transaction host for authorization. Is the bank expecting the bidder to propose for prepaid authorization host also? If so, request the Bank to provide the volume of cards to be issued on an annual basis and the estimate of the transactions expected by the Bank. Page 9 of 33 Reply to Pre-bid queries for RFP-ISSUE-1/2012 dated 24-01-2012 for END TO END SOLUTION FOR PERSONALIZATION AND ADMINISTRATION OF ALL TYPE OF DEBIT AND CREDIT CARDS OF VISA/ MASTERCARD/ NPCI and Other Interchange Network 30. Annexure-C1 1. What are the specifications for the EMV cards? In terms of capacity and what type and how many applications bank is expecting to have on card? Is bank also expecting the combo card along with the chip cards? 1. EMV cards should have 16K chip onwards compatibility along with & DDA option. 2. What kind functionality expected? 2. DDA support is expected. of cryptographic (SDA/ DDA) is 3. What kind of contact (Wire bond, Gold, 6 or 8 contact) chip is expected? 3. As per the VISA/ MasterCard/ NPCI EMV CHIP specification. 4. Does the Bank expect any specific EMV crypto algorithm (Triple DES, RSA, etc.,) 4. As per the VISA/ MasterCard/ NPCI EMV CHIP specification. 5. When is the bank expecting to start issuing the EMV cards and what are the volumes expected to be issued on an annual basis? 5. Mentioned in the new commercial format enclosed with this document. 6. Owing to price considerations, request the bank to provide the minimum order quantity for each type of card. 6. Mentioned in the new commercial format enclosed with this document. Page 10 of 33 Reply to Pre-bid queries for RFP-ISSUE-1/2012 dated 24-01-2012 for END TO END SOLUTION FOR PERSONALIZATION AND ADMINISTRATION OF ALL TYPE OF DEBIT AND CREDIT CARDS OF VISA/ MASTERCARD/ NPCI and Other Interchange Network 31. General Whether the following are in the scope: 1. Reissuance of debit card Bidder to comply with the RFP terms/ Scope of work. 2. Repinning 3. Hotlisting/cancellation of cards 4. Addition/Deletion of secondary accounts If yes, then how the price has to be quoted for the same. Kindly provide who is the incumbent vendor. 33. 13.1 Format of Technical Bid Part A What is meant by present commitment? Bidder to comply with the RFP terms/ Is it number of years or number of cards Scope of work. issued? Kindly clarify on the same. Also we can provide the same only if the other bank accepts for sharing such data. 34. 21.1 Liquidated Damages for delay What is the completion schedule? This Bidder to comply with the RFP terms should be discussed with the vendor and the same should be agreed upon. Also this clause can be initiated only in the event of a delay purely attributable to the service provider and the same is not cured within an agreed period. 35. 21.2 Liquidated damages The bank should clearly specify what Bidder to comply with the RFP terms Page 11 of 33 Reply to Pre-bid queries for RFP-ISSUE-1/2012 dated 24-01-2012 for END TO END SOLUTION FOR PERSONALIZATION AND ADMINISTRATION OF ALL TYPE OF DEBIT AND CREDIT CARDS OF VISA/ MASTERCARD/ NPCI and Other Interchange Network 36. for non-performance: specifications have to be met to avoid penalty. Also the penalty should be clearly defined with an upper limit. Again this clause can be initiated only in the event of a delay purely attributable to the service provider and the same is not cured within an agreed period. 31. Penalty clause 1) Kindly clarify the schedule for design 1. Bidder to comply with the RFP terms. approval as it has not been specified Time limit shall be read as two working in the RFP (Point No 31.1 page no days. 24). 2) Kindly clarify what is considered as 2. Bidder to comply with the RFP terms serious manufacturing defects. Also please clarify whether the same penalty of Rs. 5000 etc will be deducted for rejected lots. Whether this clause will be invoked even if the rejected lots are replaced 37. 32. Indemnity 38. 34. Guarantees 1) Liability should be limited to total Bidder to comply with the RFP terms cost of the project. Also this clause can be initiated only if the claim is purely attributable to the service provider. 2) Kindly clarify what is malfunctioning? Also this clause can be initiated only if the claim is purely attributable to the service provider Kindly provide the format for providing Bidder may use the standard format for the Page 12 of 33 Reply to Pre-bid queries for RFP-ISSUE-1/2012 dated 24-01-2012 for END TO END SOLUTION FOR PERSONALIZATION AND ADMINISTRATION OF ALL TYPE OF DEBIT AND CREDIT CARDS OF VISA/ MASTERCARD/ NPCI and Other Interchange Network guarantee same. Bidder to comply with the RFP terms 39. 39. Cancellation of the 1) We cannot accept to this term as the Bidder to comply with the RFP terms contract & compensation cost at which the same is procured from the third party might not be the same. If this clause has to be accepted, then this clause can be invoked only after giving sufficient opportunity for the bidder to rectify the mistake. 2) Dues payable to the bidder in the current contract alone should be considered for setting off any dues. 40. 40. Defect Liability Bank should clearly specify what is required? Bidder to comply with the RFP terms 41. 2.9 Information System Who will bear the cost of dedicated connectivity Already explained in the RFP. Bidder to comply with the RFP terms 42. 2.10 Stock handling Who will bear the cost of inspection? Expenditure for visit of bank official will be borne by Bank. Bidder to comply with the RFP terms 43. Security Requirements 5.1, 5.9 1) Bank should share the secure configuration document upfront as this might have a cost impact. Bidder to comply with the RFP terms Page 13 of 33 Reply to Pre-bid queries for RFP-ISSUE-1/2012 dated 24-01-2012 for END TO END SOLUTION FOR PERSONALIZATION AND ADMINISTRATION OF ALL TYPE OF DEBIT AND CREDIT CARDS OF VISA/ MASTERCARD/ NPCI and Other Interchange Network 2) What kind of background check is required? Whether a separate BGV has to be conducted or BGV done by the bidder is sufficient? If a separate BGV has to be done who will bear the cost of BGV? 44. Annexure-B2, Requirements Functional 1) Scope should be clearly specified by the bank as each scope items carry a cost. 2) Any changes to the existing cards will have a cost impact. Hence the rates have to be negotiated accordingly. Also the bank has to provide notice in advance so that existing inventory has to be exhausted before moving into new design. 3) The bank has to clearly define the timelines and related penalty. 45. Space required at initial This is not specified anywhere in the period RFP. Kindly let us know what is required to be provided. 46. Performance Parameter Already mentioned in the scope of work. Bidder to comply with the RFP terms The bidder has to specify the necessary space and facilities required by them at the time of installation. The bidder shall submit details of such Bidder to comply with the RFP terms performance parameters for the products / services offered by them along with the Technical Bid - Part B and certify them. Page 14 of 33 Reply to Pre-bid queries for RFP-ISSUE-1/2012 dated 24-01-2012 for END TO END SOLUTION FOR PERSONALIZATION AND ADMINISTRATION OF ALL TYPE OF DEBIT AND CREDIT CARDS OF VISA/ MASTERCARD/ NPCI and Other Interchange Network 47. ANNEXURE – C1 Whether prices have to be given each line item wise i.e. against each pointer. Bidder to comply with the RFP terms. New format of Annexure – C1 has been published along with the same document. 48. Point number 13.1, Format of Technical Bid Part A, Page number 15. Power of Attorney / authorization with the seal of the bidder’s company / firm in the name of the person signing the tender documents. Kindly provide the format if any. Standard format may be used for the same. 49 13.1 FORMAT OF PERT Chart to be submitted to the bank TECHNICAL BID PART-B detailing functionality of different activities / and period proposed as per the RFP Kindly elaborate and also provide format if any. Standard format may be used for the same. 48. INTERFACES, Will be shared with the selected bidder. Kindly elaborate Page Number 22., point number 26.1 The selected bidder will be responsible for maintaining the interfaces required with other software of the Bank. Page Number 22, Point number 26.3 Such interfaces have to be delivered to the Bank Page 15 of 33 Reply to Pre-bid queries for RFP-ISSUE-1/2012 dated 24-01-2012 for END TO END SOLUTION FOR PERSONALIZATION AND ADMINISTRATION OF ALL TYPE OF DEBIT AND CREDIT CARDS OF VISA/ MASTERCARD/ NPCI and Other Interchange Network along with the customized software solution. 49. Page Number 40, Point Indent printing / laser printing are the Number 2.3 technology used for personalization of Nature of Printing cards. Personalization on front and reverse side are already mentioned as point number 2.1 and 2.2. Kindly confirm about point number 2.3 Technology should be used as per the standard of VISA/ MasterCard/ NPCI and other Interchange Network. 50 Page Number 47, Point Kindly elaborate Number 1.2 Will be shared with the selected bidder. 51 Digitization/ Data Entry of all type of Card application along with photo and other annexure and make them available to Bank in the web based application Point number 1.3 Page No Kindly confirm data for card Bank confirms the understanding 47 personalization to be generated by vendor (embossing file & PIN ) Submission of the data for all type of embossed cards to bank in the format asked by the bank for further dispatch to ATM Switch for card activation. Point number 1.9 Page No 48 Page 16 of 33 Reply to Pre-bid queries for RFP-ISSUE-1/2012 dated 24-01-2012 for END TO END SOLUTION FOR PERSONALIZATION AND ADMINISTRATION OF ALL TYPE OF DEBIT AND CREDIT CARDS OF VISA/ MASTERCARD/ NPCI and Other Interchange Network Printing of PIN stationeries, generation and printing of PINs, inclusive of duplicate (regenerated) PIN, when required. Bidders should be able to support HSM based PIN printing if needed. 50. Page Number 49, Point Number 1.12 Return card management has to be handled by the selected bidder and access to bidder return card management software has to be provided to bank for updating the record for customer and to know the status of the customer application Kindly elaborate 51. Page Number 49- 50-51 , 1) Query-resolution to branches/CO/ Point Number 1.15 and HO through telephone/email. 1.16 and 1.20 Queries will normally be for status of Card and PIN issuance/ dispatch and delivery Kindly elaborate Will be shared with the selected bidder. 1. Call centre support should be available during the bank office hours. Page 17 of 33 Reply to Pre-bid queries for RFP-ISSUE-1/2012 dated 24-01-2012 for END TO END SOLUTION FOR PERSONALIZATION AND ADMINISTRATION OF ALL TYPE OF DEBIT AND CREDIT CARDS OF VISA/ MASTERCARD/ NPCI and Other Interchange Network Page Number 64-65 Point Number 1.23 52. 53. Page Number 52. 2.1 , 2.2 Page Number 53. 2.2 Page Number 54. 2.2 Page Number 54-55. 2.2 General 2) Web-tracking facility for status of 2. Bidder to comply with the RFP scope of card to customers/branches/ CO/ work. Facility should be available to HO with different level access rights Branch/ CO/HO. to branches, CO/ HO. Kindly elaborate . 3) Costs of software/modifications for existing as well as new cards 3. Bidder to comply with the RFP terms introduced by Bank in future based on the new products launched by Bank from time to time, connectivity etc will be borne by finally selected Bidder. Kindly elaborate , The proposed Software Solution to Card Will be shared with the selected bidder. Division to be provided by the Selected bidder must comply with the various Security Policies / Guidelines issued by the Bank and RBI / IBA etc. from time to time. Kindly elaborate point 1) Envelope (Debit card/Credit card kindly elaborate/specify and qty. point 2) 1/24 RA1 size folded to 1/48 paper point 130 gsm, cover - 130 gsm/text. kindly specify the size/paper and col point and qty 1. If we don't do PIN generation, can we have a tie-up with someone in Chennai to generate the PIN who Already mentioned in the RFP. Present Sample may be collected by bidders for information and reference. 1. Bidder to comply with the RFP terms Page 18 of 33 Reply to Pre-bid queries for RFP-ISSUE-1/2012 dated 24-01-2012 for END TO END SOLUTION FOR PERSONALIZATION AND ADMINISTRATION OF ALL TYPE OF DEBIT AND CREDIT CARDS OF VISA/ MASTERCARD/ NPCI and Other Interchange Network 2. 3. 4. 5. 6. 7. 8. 9. 10. has HSM? What will be the per day volume for Debit and Credit card? When this project will start? On the EMV card - we need to know the type of chip, memory size, type of authentication, Visa or MC, applications you want to load on the chip, quantity - This is for the card printing. For the EMV personalization - we need to know the scripting you need and data you want to write on the chip Whether courier will be nominated by you? What will be card design for Debit and Credit Cards? Point 25.8 - Since this is service and not a product as such, how does we demonstrate. Please clarify whether it is presentation of the process. We need at least 1 week notice to plan Performance Guarantee period is too long. Can it be for one year? Also we don't know the total actual volume of card to calculate the final amount for the performance guarantee. You have mentioned 40 Lakh cards and 50,000 credit card per year. Out 2. Projection mentioned in the annexure – C1 published along with this document 3. Implementation schedule mentioned in the RFP. Bidder to comply with the RFP terms 4. Replied in response of query no 30 5. Replied in response of query no 30 6. Bidder to comply with the RFP terms 7. Will be shared with the select bidder. 8. Bank confirms the understanding 9. Bidder to comply with the RFP terms. Projection will be as per the details mentioned in the commercial bid enclosed with this document. 10. Projection mentioned in the annexure –C1 published along with this document Page 19 of 33 Reply to Pre-bid queries for RFP-ISSUE-1/2012 dated 24-01-2012 for END TO END SOLUTION FOR PERSONALIZATION AND ADMINISTRATION OF ALL TYPE OF DEBIT AND CREDIT CARDS OF VISA/ MASTERCARD/ NPCI and Other Interchange Network of this how many will be Visa, MC, Photo, Non Photo and RUPAY? What will be per day personalization required? We will have to first print the plastics for which we need to know the quantity as we cannot print based on the daily personalization volume. This has to be bulk production. Can we raise the invoice for the cards we printed and then for personalization it will monthly invoice? What if the projected quantity is less? 55. 56. General This clause narrowly inviting only two vendor to participate in your Global The Company must be a Tender. This clause should be removed Registered Corporation / to give fair chances for all the vendors. Company / Office in India and should have office in Bangalore as on date of submission of the bid. General This clause would again limit the vendor to participate in this tender activity. The bidder or holding Request you to remove this clause. Or company should have allow us to share our group (dz group) minimum annual average balance sheet. sales of Rs. 50.00 Crores in the last three consecutive financial years The copies of Bidder to comply with RFP terms Bidder to comply with RFP terms Page 20 of 33 Reply to Pre-bid queries for RFP-ISSUE-1/2012 dated 24-01-2012 for END TO END SOLUTION FOR PERSONALIZATION AND ADMINISTRATION OF ALL TYPE OF DEBIT AND CREDIT CARDS OF VISA/ MASTERCARD/ NPCI and Other Interchange Network audited Profit & Loss accounts and Balance Sheets, the latest being not earlier than F.Y. 201011 with auditor’s note to be submitted. 57. Security The bidder should be certified for PCI-DSS ISMS for data security. 58. General The bidder should purchase our existing two embossing machines, Plastic of Debit / Credit Cards and other related stationeries under buy back mode as per mutually agreed rate. 59. General Digitization/ Data Entry of all type of Card application along with photo and other annexure and make them available to Bank in the All the requirements and log laid by PCI-DSS is covered under Visa/ Master Card guide line. Already replied in response of Query 5. Please specify the type of Machine, Year of Manufacture, and other Machine details. Also specify the plastic Already replied in response of Query 8. Seeking more clarification on the scope of work of Data entry for Card application/ Digitization of application. Bidder to comply with the RFP terms as per the scope of work. Page 21 of 33 Reply to Pre-bid queries for RFP-ISSUE-1/2012 dated 24-01-2012 for END TO END SOLUTION FOR PERSONALIZATION AND ADMINISTRATION OF ALL TYPE OF DEBIT AND CREDIT CARDS OF VISA/ MASTERCARD/ NPCI and Other Interchange Network web based application asked in the point 1 Place: Bangalore Date: Deputy General Manager Page 22 of 33 Reply to Pre-bid queries for RFP-ISSUE-1/2012 dated 24-01-2012 for END TO END SOLUTION FOR PERSONALIZATION AND ADMINISTRATION OF ALL TYPE OF DEBIT AND CREDIT CARDS OF VISA/ MASTERCARD/ NPCI and Other Interchange Network ANNEXURE – C1 NEW FORMAT FOR COMMERCIAL BID/ PRICE SCHEDULE Note: 1. This bill of material must be attached in Technical Offer as well as commercial offer. The Format will be identical for both technical and commercial offers, except that the technical Offer should not contain any price information. Technical offers without the bill of material will be liable for rejection. 2. Vendor must take care in filling price information only in the commercial offer, and ensure that there are no typographical or arithmetic errors. All fields must be filled up correctly. Sr. No. 1 Services offered Personalized Debit Cards with Photo Item Price /Per card rate without tax Taxes at present rate (A) (B) Total Price (in Rs. per card) (C =A+B) VISA Card Projection/ Rupay Card projection MasterCard Projection 20000 5000 Procurement of plastics, PIN mailer Data entry for Card application/ Digitisation of application PIN mailer printing Stationary printing Card Personalization and administration including return courier management Page 23 of 33 Reply to Pre-bid queries for RFP-ISSUE-1/2012 dated 24-01-2012 for END TO END SOLUTION FOR PERSONALIZATION AND ADMINISTRATION OF ALL TYPE OF DEBIT AND CREDIT CARDS OF VISA/ MASTERCARD/ NPCI and Other Interchange Network 2 3 Personalized Debit Cards without photo including ATM Admin cards, Procurement of plastics, PIN mailer Data entry for Card application/ Digitisation of application PIN mailer printing Stationary printing Card Personalization and administration including return courier management Non - Personalized cards without photo 4 200000 2000000 500000 10000 2000 Procurement of plastics, PIN mailer Data entry for Card application/ Digitisation of application PIN mailer printing Stationary printing Card Personalization and administration including return courier management Personalized Credit card with photo 1300000 Procurement of plastics, PIN mailer Data entry for Card application/ Digitisation of application PIN mailer printing Page 24 of 33 Reply to Pre-bid queries for RFP-ISSUE-1/2012 dated 24-01-2012 for END TO END SOLUTION FOR PERSONALIZATION AND ADMINISTRATION OF ALL TYPE OF DEBIT AND CREDIT CARDS OF VISA/ MASTERCARD/ NPCI and Other Interchange Network 5 Personalized Credit card without photo 6 Stationary printing Card Personalization and administration including return courier management 3000 50000 - Procurement of plastics, PIN mailer Data entry for Card application/ Digitisation of application PIN mailer printing Stationary printing Card Personalization and administration including return courier management Rupay Cards with & without Photo 35000 Procurement of plastics, PIN mailer Data entry for Card application/ Digitisation of application PIN mailer printing Stationary printing Card Personalization and administration including return courier management Page 25 of 33 Reply to Pre-bid queries for RFP-ISSUE-1/2012 dated 24-01-2012 for END TO END SOLUTION FOR PERSONALIZATION AND ADMINISTRATION OF ALL TYPE OF DEBIT AND CREDIT CARDS OF VISA/ MASTERCARD/ NPCI and Other Interchange Network 7 EMV Cards with & without Photo 500000 100000 - - - - Procurement of plastics with bank approved CHIP, PIN mailer Data entry for Card application/ Digitisation of application PIN mailer printing Stationary printing Card Personalization and administration including return courier management Total (1+2+3+4+5+6+7) 8 9 Buy Back Price for the two embossing machines (i) ZT 10 – 583781 Matica Card Embossing Machine DOP: 22.09.2005 OCP: 24,75,000.00 AMC Start Date: 11.10.2006 (ii) ZT20 - 7075393 Matica Card Embossing Machine DOP: 17.08.2007 OCP: 46,28,000.00 AMC Start Date: 17.08.2008 Leased line connectivity (2MBPS) with back up line - - - Page 26 of 33 Reply to Pre-bid queries for RFP-ISSUE-1/2012 dated 24-01-2012 for END TO END SOLUTION FOR PERSONALIZATION AND ADMINISTRATION OF ALL TYPE OF DEBIT AND CREDIT CARDS OF VISA/ MASTERCARD/ NPCI and Other Interchange Network 1. Vendor has to quote the prices for the two embossing machines under buy back arrangement. But prices only quoted under Sr No 1 to 7 will be considered for determining the commercial price. However, the bidder should purchase our existing two embossing machines under buy back mode as per mutually agreed rate above the commercial rate quoted in the commercial bid. 2. Charges for sending cards to customers by courier will be paid separately by the bank and this should not be included in the quote. 3. The order for all activities (Plastic procurement, Personalization, Supply of Welcome Kits & Administration) for both the type of cards (VISA, MasterCard, NPCI and other interchange network) will be given only to a single vendor, qualifying in the technical evaluation by the Bank and quoting lowest in the commercial offer computed on total cost basis (cost of plastic procurement, cost of Personalization/Administration and cost of welcome kit Printing) for both types of card and welcome kit together. 4. Bank is having the ambitious plan of issuing around 40 lakhs debit cards per year and around 50 thousands credit cards per year. However, it has also to be noted that mentioned statistics may vary depending upon the business prospective and other eventualities. Page 27 of 33 Reply to Pre-bid queries for RFP-ISSUE-1/2012 dated 24-01-2012 for END TO END SOLUTION FOR PERSONALIZATION AND ADMINISTRATION OF ALL TYPE OF DEBIT AND CREDIT CARDS OF VISA/ MASTERCARD/ NPCI and Other Interchange Network MODIFIED CLAUSE FOR DETERMINATION OF THE L-1 PRICE & PRICE BID EVALUATION 3.1 EVALUATION OF BIDS: 3.1.1 The Technical Bids will be evaluated based on the Bidder’s ability to match the technical requirements and functional requirements as specified in (Annexure-B1 and Annexure B2 respectively) followed by evaluation based on any or all of demos, presentation, site visit and supporting documents. Detailed evaluation criterion is covered in the next section of this document. 3.1.2 The Commercial Bids will be evaluated based as per price schedule (Annexure-C1) 3.2 EVALUATION PROCEDURE 3.2.1 This RFP is looking for responses that explain clearly the deliverables offered in terms of functionality, technology and time frame required for deployment, which is convincing in terms of practicality, feasibility, cost effectiveness and overall benefit to the Bank. 3.2.2 In response to this RFP, Bank is expecting sufficient information to allow a complete analysis and evaluation of bidder’s capability and experience to focus on challenges in the field of end to end process of card procurement, Personalization of cards, Printing of PIN mailer, Welcome kit generation, Administration of all variant of cards and other functionalities mentioned in Functional Requirements of RFP. 3.2.3 All bids shall be evaluated by an Evaluation Committee set up for this purpose by the Bank. The evaluation shall be on the basis of technical competence and the price quoted. The Technical Evaluation and the Commercial Evaluation shall have the weightages of 50% and 50% respectively, and this weightage shall be taken into consideration for arriving at the Successful Bidder. The assessment methodology is covered in the next section: 3.2.4 Technical Evaluation (TA) Page 28 of 33 Reply to Pre-bid queries for RFP-ISSUE-1/2012 dated 24-01-2012 for END TO END SOLUTION FOR PERSONALIZATION AND ADMINISTRATION OF ALL TYPE OF DEBIT AND CREDIT CARDS OF VISA/ MASTERCARD/ NPCI and Other Interchange Network Out of the 50 marks, Allocation would be as under: (a) Technical Proposal Evaluation (TPE) would carry 30 marks secured on the basis of the Bidder’s response to the Functional Requirements (In Annexure B2) and Technical Requirements (In Annexure B1) Part of the RFP. (b) Technical Credential Evaluation (TCE) would carry 20 marks secured on the basis of any or all of the Bidder’s presentation, demo or supporting documents 3.2.4.1 Technical Proposal Evaluation (TPE): a) Functional and Technical Requirement Evaluation (FRE): Bank has classified each of the Functional Requirements as “MOST CRITICAL” and will be shown as values under the column BANK RATING. All bank Requirements has been marked as “Most Critical”. Value for classification under BANK RATING is as under: BANK RATING MOST CRITICAL VALUE 2 The Vendors is required to indicate “Feature Readily Available” or “Feature Customizable” under the column “VENDOR RESPONSE” for each of the functional & Technical requirement. Bank will assign the VENDOR SCORE as per the table below for each of the VENDOR RESPONSE indicated for the purpose of evaluation. DESCRIPTION FEATURE READILY AVAILABLE FEATURE CUSTOMISABLE VENDOR SCORE 3 2 Page 29 of 33 Reply to Pre-bid queries for RFP-ISSUE-1/2012 dated 24-01-2012 for END TO END SOLUTION FOR PERSONALIZATION AND ADMINISTRATION OF ALL TYPE OF DEBIT AND CREDIT CARDS OF VISA/ MASTERCARD/ NPCI and Other Interchange Network Here, Features Readily Available would mean features are readily available and should be provided by the bidder. Feature Customizable would mean that the features can be provided after customization at no additional cost and before going live. Bidder may note that the vendor score will be reduced by the Bank at the time of Technical Credential Evaluation, if found that what the bidder has declared is in contravention to what is available in the solution. This rating by the Bank based on the actual availability of the features will be final and binding on all bidders. The score obtained for a requirement (R1) can be calculated by using the formula: T1R1= BR1 X VS1 Where T1R1 is the total score for requirement R1 BR1 is the Value assigned to the Bank Rating for requirement R1 (Most Critical – 2 marks) VS1 is the vendor score for requirement R1 evaluated and finalized by the Bank (Feature Readily Available – 3 marks and Feature Customizable – 2 marks) Similiarly T2R2, T3R3… TNRN will be computed. Total marks for the functional requirement as a whole is calculated by summing up total marks obtained for each requirement. Thus TOTAL MARKS (TMF) = T1R1+ T2R2 + T3R3 + …. + TNRN 3.2.4.1.1 Technical Credential Evaluation (TCE): Page 30 of 33 Reply to Pre-bid queries for RFP-ISSUE-1/2012 dated 24-01-2012 for END TO END SOLUTION FOR PERSONALIZATION AND ADMINISTRATION OF ALL TYPE OF DEBIT AND CREDIT CARDS OF VISA/ MASTERCARD/ NPCI and Other Interchange Network The credential of the bidder would be rated by the evaluation committee based on a questionnaire and the demos, presentations, site visit and supporting documents would be considered. 20 Marks is allocated for this category. Under this evaluation, 1. Demos, Presentation, Site Visit and supporting documents would be considered for evaluation of Bids. The Bank would request the Vendors to present and demonstrate the solution proposed. 2. Written reply, if any, submitted in response to the clarification sought by the Bank will be reviewed. 3. To assist in the examination, evaluation and comparison of bids Bank may, at its discretion, ask any or all the Bidders for clarification and response shall be in writing and no change in the price or substance of the bid shall be sought, offered or permitted. Total Marks under credential evaluation (TMC) will be allotted based on the bidder’s performance under this category. 3.2.4.1.2 Total for Technical Evaluation The marks obtained (TMF and TMC) by each bidder under the above categories will be added to arrive at the total marks scored by each bidder under Technical Assessment. Full marks (50 marks) will be allotted to the Bidder who secures the highest marks. While the highest bidder will get 50 marks, other Bidders will be awarded in proportion to the marks scored in relation to the highest bidder. Thus the other bidders will get marks < 50. Technical Score (TS) = Bidder Technical score/Max (Bidder Technical score)*50 Example: If bidder A scores – 480 marks and bidder B scores – 240 marks, bidder A will be allotted 50 marks on the grounds that he has scored highest marks in Technical Evaluation. Marks obtained by bidder B will be in relation to the highest marks obtained by bidder A (i.e. 50) Bidder B will obtain: Page 31 of 33 Reply to Pre-bid queries for RFP-ISSUE-1/2012 dated 24-01-2012 for END TO END SOLUTION FOR PERSONALIZATION AND ADMINISTRATION OF ALL TYPE OF DEBIT AND CREDIT CARDS OF VISA/ MASTERCARD/ NPCI and Other Interchange Network Technical Score = 240/480*50 = 25 marks The bidder scoring more than 60% of the total technical score (i.e. 50) will be technically qualified and eligible for commercial bid opening. 3.2.4.2 Commercial Assessment (CA) In case of Commercial Evaluation of Proposal, Full marks (50 marks) will be allotted to the Bidder who quotes the lowest financial proposal (LP) While the bidder with lowest financial proposal (LP) will get a financial score (FS) of 50 marks, other Bidders will be awarded in proportion to the marks scored in relation to the bidder with the lowest quote. Thus the other bidders will get marks < 50. The Financial scores (FS) of all other bids will be determined by the formula: FS=LP/F * 50 (Where F is the Financial Proposal quoted by this bidder) For ex: If Bidder A quotes Rs.150 and Bidder B quote Rs.50, Bidder B will be allotted 50 Marks on the ground that he is the lowest bidder. Bidder A will get (Inversely Proportional) FS = 50/150*50= 16.67 marks 3.2.4.3 Overall Assessment for calculation of Successful Bidder Proposals will finally be ranked according to their combined Technical (TA) and Commercial (CA) scores using a weight of 50% for technical proposal and 50% for financial proposal. The overall score (S) will be computed as follows: Page 32 of 33 Reply to Pre-bid queries for RFP-ISSUE-1/2012 dated 24-01-2012 for END TO END SOLUTION FOR PERSONALIZATION AND ADMINISTRATION OF ALL TYPE OF DEBIT AND CREDIT CARDS OF VISA/ MASTERCARD/ NPCI and Other Interchange Network S = TA (0.5) + CA (0.5) The bidder scoring highest marks (S) will be declared as the successful bidder i.e. T1L1 3.2.4.4 3.2.4.5 3.2.4.6 3.2.4.7 All those bidders who have submitted their responses may be required to be in preparedness to make product demonstration at a very short notice. The Bank shall communicate the venue, date and time of product demonstration to the bidders separately. No request for change in date/time shall be entertained after communicating by us. Each bidder shall be given a maximum of 1 day for demonstration. The bank reserves the right to change the venue, date, time with due intimation to the Bidders. Bank also reserves the right to give additional time for the demonstration and also to call for additional demonstration by any or all the bidders. If a bidder does not come up with the Product Demonstration at the appointed date and time, it will be construed that bidder is not interested in bidding for the project. The bidder has to show the capabilities of the solution to meet all the functional requirements specified in this document. Page 33 of 33