Sub_orbital_Biz_jet_proposal_11-30-08

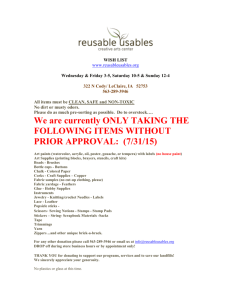

advertisement