ONE-PAGE VITA

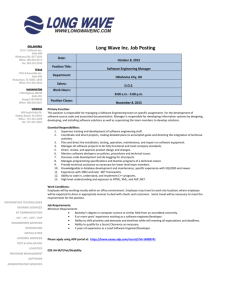

advertisement

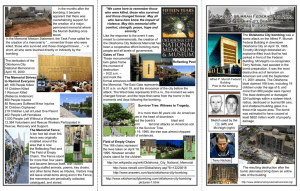

JONATHAN BARRY FORMAN (“Jon”) Alfred P. Murrah Professor of Law University of Oklahoma College of Law 300 Timberdell Road Norman, Oklahoma 73019 Telephone: (405) 325-4779 Fax: (405) 325-0389 jforman@ou.edu www.law.ou.edu/profs/forman.shtml EDUCATION: J.D. (magna cum laude, 1978, University of Michigan Law School), member of the University of Michigan Journal of Law Reform; Certificate in Labor and Industrial Relations; M.A. (1983, George Washington University–Economics); M.A. (1975, University of Iowa–Psychology); B.A. (1973, Northwestern University– Psychology). PRESENT EMPLOYMENT: Alfred P. Murrah Professor of Law, University of Oklahoma College of Law, teaching Individual Income Tax, Taxation of Business Entities and Oil and Gas Interests, Pension & Health Care Benefits, Nonprofit Organizations, and Tax Practice & Procedure. PRIOR EMPLOYMENT: Contributing Editor & Editorial Staff, Tax Notes, January–April, 1985; Tax Counsel to U. S. Senator Daniel Patrick Moynihan (D–N.Y.), September 1983–December 1984; Trial Attorney, U. S. Department of Justice, Tax Division, September 1979–August 1983; Judicial Clerk, Honorable Robert J. Yock, U. S. Court of Claims, Trial Division, August 1978–August 1979. PROFESSIONAL ACTIVITIES: Professor in Residence, Office of Chief Counsel, Internal Revenue Service, Washington, D.C., 2009–2010 academic year; Member of the State of Oklahoma Incentive Review Committee, 2008–2012; Member of the Board of Trustees of the Oklahoma Public Employees Retirement System (OPERS), 2003–2011; Member of the State of Oklahoma Task Force on Comprehensive Tax Reform, 2010–2011; Delegate, 2002 and 1998 National Summits on Retirement Savings; Member of the Internal Revenue Service Advisory Committee on Tax Exempt and Government Entities (ACT), 2001–2003; District of Columbia Bar Association; American College of Employee Benefits Counsel (fellow); Oklahoma Bar Association (special admission for law professors); American Bar Association Section of Taxation; American College of Tax Counsel (fellow); American Economic Association; American Tax Policy Institute (trustee 1997–2003, secretary 2001–2003, life sponsor); Association of American Law Schools; Employee Benefit Research Institute (fellow); National Academy of Social Insurance (member); National Tax Association; TIAA-CREF Institute (fellow). RECENT MAJOR PUBLICATIONS: Making America Work (Urban Institute Press, 2006); Making the Internal Revenue Service Work, 17(10) Florida Tax Review 725 (2015) (with Roberta F. Mann); Tontine Pensions, 163(3) University of Pennsylvania Law Review 755 (2015) (with Michael J. Sabin); Reconsidering the Tax Treatment of Pensions and Annuities, 18(1) Chapman Law Review 221 (2014); Supporting the Oldest Old: The Role of Social Insurance, Pensions, and Financial Products, 21(2) Elder Law Journal 375 (2014); Reforming the Second Tier of the U.S. Pension System: Tabula Rasa or Step by Step?, 46(3) John Marshall Law Review [11th Annual Employee Benefits Symposium] 631 (2013) (with George A. [Sandy] Mackenzie); The Cost of “Choice” in a Voluntary Pension System, 2013 New York University Review of Employee Benefits and Executive Compensation 6-1 to 6-55 (with George A. [Sandy] Mackenzie); Optimal Rules for Defined Contribution Plans: What Can We Learn from the U.S. and Australian Pension Systems?, 66(3) Tax Lawyer 613 (Spring 2013) (with University of New South Wales Senior Lecturer Gordon D. Mackenzie); Using Refundable Tax Credits to Help Low-income Taxpayers: What Do We Know, and What Can We Learn From Other Countries?, 8(2) eJournal of Tax Research 128 (December 2010). RECENT HONORS AND AWARDS: Alfred P. Murrah Professorship of Law, awarded March 2005; TIAACREF Institute fellow (since 2014); 2011 Abe Greenbaum Research Fellowship, Australian School of Taxation and Business Law, University of New South Wales, Sydney, Australia; Monthly Columnist, The Journal Record, Oklahoma City, Oklahoma, 1998–2009; Chair, Section on Employee Benefits, Association of American Law Schools, 2001.