Assignment #7

advertisement

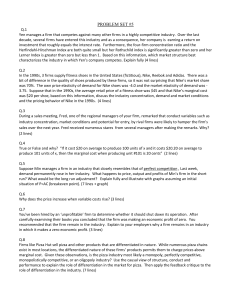

PROBLEM SET #6 1. Matching The terms on the left are associated with the conditions on the right. Match them by placing the appropriate letter in the space provided. ______ 1. long run A. (P - ATC) x Q ______ 2. shut-down point B. cut production in half and double these ______ 3. long-run equilibrium for a C. competitive firm AFC x Q = 0 ______ 4. reduce output D. MC > MR ______ 5. break-even E. P = LRATC = MC short run losses F. fixed plant and equipment short run G. P < AVC ____ 6. _____ 7. Q.2 ______ 8. total profit H. MR > MC _______ 9. average fixed costs I. ATC = P ______ 10. increase production J. ATC > P > AVC In the 1970s, 3 firms supply fitness shoes in the United States (fictitious), Nike, Reebok and Adidas. There was a bit of difference in the quality of shoes produced by these firms, so it was not surprising that Nike’s market share was 70%. The own price elasticity of demand for Nike shoes was -4.0 and the market elasticity of demand was -3.75. Suppose that in the 1970s, the average retail price of a fitness shoe was $45 and that Nike’s marginal cost was $20 per shoe, based on this information, discuss the industry concentration, demand and market conditions and the pricing behavior of Nike in the 1990s. One line answers + graphs if you want Q.3 Why do firms enter a market in a perfectly competitive industry when they know that economic profit is zero in the long run? Q.4 Is sunk cost a barrier to entry? Why? Q.5 Is it possible for a monopoly to produce more output and charge less price than a perfectly competitive industry? Explain Q.6 A product that sells for $10 cost $8 in material and labor to produce. Is the $2 difference an “economic profit”? Explain (3 lines) Q.7 Explain the meaning of a ‘long run average cost curve’. When is it downward sloping? (5 lines) Q.8 True or False and why? “If it cost $20 on average to produce 100 units of x and it costs $20.20 on average to produce 101 units of x, then the marginal cost when producing unit #101 is 20 cents” 3 line answers + graph if you want Q.9 True of False and why? “By definition a monopolist makes profits in the short run and long run” Explain fully and illustrate with graphs Q.10 Suppose that a sales tax is imposed on all producers in a perfectly competitive industry. How would this affect output and the market price? When is the burden of a sales tax heavier on customers? (4 lines) Q.11 Why does the price increase when variable costs rise? Q.12 Heard I a meeting “A single price is a characteristic of competition. Hence, if we see a single price charged by many competitors, then we have competition.” Do you agree? Why? Calculations Q.13 Walt Disney has copyrighted the image and name “Mickey Mouse.” The total cost of producing Q units of Mickey related merchandise is: TC (Q ) 10Q . The annual demand for Mickey related merchandise is P 10,010 200Q . Q is the number of units of Mickey related merchandise. The annual interest rate facing all agents in the economy is 8.75%. a. How many units of Mickey related merchandise should Walt Disney produce? What price should Disney charge for one unit of Mickey related merchandise? Clearly explain your reasoning. b. What is total revenue from Mickey related merchandise to Disney? What are Disney’s annual profits from Mickey related merchandise? c. Comcast wants to understand the value of the Mouse merchandising division. What is the value of the discounted present value annual profits from the Mickey related merchandise division? What is the most that Comcast should pay to buy just the Mouse merchandising division from Disney? d. Suppose the Disney copyright of “Mickey Mouse” was due to expire by Mid October 2012. Describe the new market structure that would occur if Mickey Mouse entered the public domain, meaning anybody could use Mickey Mouse. What would be the new price of one unit of Mickey related merchandise? How many units of Mickey related merchandise would be sold by the Mickey related merchandise industry? e. You, the manager of Disney, has just (mid October 2012, after your copyright has expired) received a cash offer from Comcast to buy just the Mouse merchandising division from Disney. How should you evaluate their offer? That is, what price should you target to receive from Comcast? Carefully, explain your reasoning.