HARTFORD PUBLIC SCHOOLS

advertisement

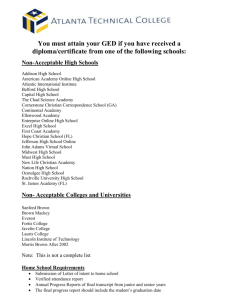

HARTFORD PUBLIC SCHOOLS Phase II School Design Specifications High School, Inc: Hartford’s Insurance & Finance Academy Overview of School Model Description of school type, accreditation & affiliation model High School, Inc. is a college preparatory school model for 400 high school students, grades 9-12, who are interested in pursuing careers in the insurance and financial services industries. During year one of implementation the Academy will enroll Grade 9 and Grade10 students and open its doors in August 2009. This new Academy will serve as a whole school design of what has been a successful but limited seat program at Bulkeley High School and Weaver High School for a small number of students. In order to create an optimum learning environment that maximizes the resources that exists in the City of Hartford, which is internationally known as the Insurance Capital, the academy will be located in the heart of downtown Hartford at 275 Asylum Street. This will afford students convenience and opportunity to participate in corporate field experiences, such as job shadowing and internships, as well as make a real-world connection to daily corporate life, especially as it relates to curriculum and classroom lessons. Additionally, √ The Academy will be a 21st century learning environment that combines rigorous academic courses and a related sequence of elective courses in insurance and financial services. √ Learning will be student focused, and content will be taught using a variety of teaching and learning strategies with a solid technological core, both inside and outside of the classroom. √ Students will have the necessary academic supports to succeed with high school work in a college preparatory curriculum. √ Students and families will commit to participation in the Academy as members of a learning community. √ Teachers, administrators and counselors will set high expectations for all students and will be committed to instructional strategies and support services that engage students, motivate their desire to learn and produce successful outcomes. √ Community, higher education, and business partners will be active participants with teachers and students and provide an enriched in-school environment as well as out-of-school experiences for students to understand the requirements of employment in high-skill, high-wage occupations. √ The school will maintain its own webpage with complete and updated school information for both current and future students. Theme/Content Focus The theme of the Insurance and Finance Academy will be based on the Financial Services Cluster which includes: √ Insurance (including medical insurance) √ Banking √ Investments/Securities √ International Business √ Financial Management Major School Partners Higher Education Partners The Academy will work with Capital Community College to provide a seamless transition into its new Insurance and Financial Services Associates Degree Program. This program has a pathway articulation with Connecticut’s four-year public colleges. The Academy will continue to develop curriculum that will be articulated with Capital Community so that students can receive both high school and college credit while attending high school. There are also dual enrollment credit opportunities through existing College Career Pathways (formerly Tech Prep) courses. Business Partners The Academy will partner with several local insurance and financial services companies who have agreed to serve as business partners in various capacities. In addition to representation on the Advisory Board these companies will offer mentoring, job shadowing, lectures, classroom visits, internships, staff training, and other activities as detailed in the Partnerships section of this proposal. Research Basis and Model Sites High School, Inc. will be based on the National Academy Foundation (NAF) Academy of Finance model. NAF creates partnerships between business leaders and educators. This innovative educational model empowers high school students to successfully go on to higher education and professions of their choosing. NAF sustains a nation-wide network of academies with focused career-themed curricula, high level mentoring by business professionals and real-world paid internships. These academies demonstrate a model that Page 1 of 14 works and is replicable. This model combines the efforts of the private and public sectors to create a program that exposes high school students to careers in the financial services sector. The most dramatic impact of the model is evident in NAF’s innovative approach in public high schools located within our country’s most economically fragile inner cities. The academies are a bridge between corporate America and communities whose young people are often relegated to the margins of our economy and culture. The NAF model works by bringing business people into the public schools and introducing disadvantaged youth to the world of business. Organized as small learning communities, NAF students remain together throughout their high school years with a core group of specially trained teachers. The model provides an environment for these teachers to develop interdisciplinary activities that make learning relevant and capture the interest of students. Specialized NAF courses are jointly designed by educators and industry specialists to supplement and enrich the high school curriculum. Rigorous academic learning is combined with real-world experience and career training which are often lacking for many of today’s high school graduates but critical for doing well in college and in careers. This school design is based on the best practices of successful model schools throughout the country. Design team members visited the following NAF Academy of Finance model sites whose minority populations are experiencing high achievement: √ Bronx School of Law and Finance √ Baltimore NAF High School School Mission & Vision Mission (purpose) The Mission of High School, Inc. is to provide students with the skills and abilities necessary to pursue higher education and careers in the finance and insurance industries through a rigorous and relevant curriculum. The school will accomplish this by: meeting the individual needs of each Academy student, developing a system for personal relationships among staff, students, parents and business partners, and connecting the classroom to real world experiences, especially through internship, mentoring and field work programs. Vision The vision of the Academy is to develop future finance and insurance professionals in a safe, inclusive and respectful environment. The Academy emphasizes academic excellence and, at the same time, preparation for students to pursue careers in the corporate sector. Every student will experience a planned sequence of courses and be involved in activities that will enrich those courses. This combination of academic rigor, technical skills and work experience will provide each student with a competitive advantage in advancing career goals. Student Body Grade Configuration and School Size The Academy will serve approximately 400 students in grades 9-12 by 2011. Year-by-Year Phase In Chart The following are transitional considerations for the August 2009 opening of the Academy: During its first year of implementation, the Academy will serve students in Grades 9 and 10. The current Grade 9 students enrolled in the Freshman Academy at Weaver High School will have seat preference for Grade 10 enrollment at the Academy for entry in August 2009. Grade 8 students will be recruited city-wide for enrollment in Grade 9 in the Academy through the Hartford Choice process. Grade 10 and 11 students currently enrolled in Academy of Finance programs at Bulkeley and Weaver high schools will remain at their schools to complete their course of study. (The NAF Academy programs at these schools will be phased out over the next two years). Governance Structure In order to emulate a business environment and build a culture that replicates career success, the Academy will align its organizational structures and titles to a corporate model management structure. The Academy governance structure will be based on collaboration and partnership and will involve all stakeholders: students, parents, school staff, business and community partners. Page 2 of 14 The Principal The strong leadership of the principal will be essential to the success of the Academy. It is highly recommended that the principal: Be driven by a personal commitment to get every academy graduate into college Has training or expertise in the fields of insurance and finance Can work effectively with business, industry, higher education and community partners Understands and supports strategies to provide meaningful out-of-school experiences for students and ensures that they are integrated with classroom instruction Involves parents in meaningful roles in the school Put students first in all decision making Has firmness and consistency in maintaining good school discipline Has autonomy to hire staff with relevant business experience to ensure robust curriculum relevance to today’s IFS industry needs Academy Dean and Academy Director A Dean of Students will support the principal in establishing a safe environment and school culture that emulates a business atmosphere. A Director of Business Partnerships will build and strengthen partnerships with higher education and business partners in order to extend learning outside the school walls by coordinating internships, job shadowing, mentoring, senior projects, dual credit courses and other learning opportunities. The Academy Dean will teach a minimum of two courses. School Governance Council The School Governance Council will foster collaborative decision-making through a representative body of academy educators, parents, student and community members who will review the school improvement plan, assess the school budget based on student learning goals, and monitor adherence to the school mission. This Council will also make decisions about school-wide concerns, curriculum and assessment and the organization of the school schedule. The Academic Advisory Board/Board of Directors co-chairs will also sit on the School Governance Council to ensure a regular flow of information between the two groups. “Board of Directors,” i.e. Academy Advisory Board The Advisory Board, which will be referred to as the “Board of Directors” to align with business terminology, will include business partner co-chairs, along with a NAF affiliate, and higher education partners with backgrounds in curriculum development, teaching and fiscal expertise. The primary role of the Board will be to provide industry-based guidance in the accomplishment of the Academy’s mission. Parent Leadership Development To assist parents in becoming active leaders, the Academy with its partners will provide leadership training for parents who take on leadership roles in the school. Parents who serve on the PTO or in other leadership roles will be offered training in how to run a business meeting, how to manage a budget, and will learn about the role of policies in a school organization. Additionally, the Academy will assist parent volunteers to organize a PTO which will conduct meetings on a regular basis throughout the school year. The parent group shall function as an independent body in regard to funds, meeting dates, meeting agenda, etc. The president of the parent group will be invited to serve on the School Governance Council. Student Leadership The new high school will involve students in meaningful leadership opportunities that will teach them how to take ownership for their school, their learning and their future. The Academy will include the following initiatives: Student Council: This program will foster student leadership, value and formalize student input, and encourage teachers and staff to support student activities and recommendations. Peer Mediation Committee: This program will encourage constructive communication, assist students in taking responsibility for their actions, and help clarify students’ needs and feelings. Peer mediation has proven to be a strong, helpful tool by producing significant results in decreasing school confrontations and violence. Student Recognition Awards: Student Leader of the Year, Excellence in Internship, etc. Student “Geek Squad”: Students will have the opportunity to assist the Technology specialist in troubleshooting computer problems and needs. Page 3 of 14 Curriculum and Instruction Curriculum Design/Course of Study In alignment with the mission of the Hartford Board of Education the Academy will provide a high quality distinctive high school in which students can attain a high school diploma that reflects a standards-based college-ready curriculum designed to meet the high educational outcomes of the State of Connecticut and prepare all students to be competitive candidates for entrance into a four-year college program of their choice. The course schedule will be organized in a block schedule to provide time for deeper exploration of topics, case study work and hands-on research. Course requirements for grades 9 through 12 will follow district and state guidelines and will include a minimum of : One (1) credit in Strategies for Success Summer Bridge Program Four (4) credits in English.(including English I & II; Literature & Composition I & II) Four (4) credits of mathematics (including Algebra I, Geometry, Algebra II) Three (3) credits of science (including Biology , Chemistry w/lab) Three (3) credits of history (including 1.0 U.S. History, 1.0 International Studies, .5 Civics, .5 Geography) Two (2) credits in world language Two (2) visual and performing arts credits One and one–half (1.5) credit of physical education One-half (.5) credit of health, nutrition and wellness Four (4) credits of Business and Finance One (1) credit Capstone Experience The Capstone Experience (1 credit, required) The Capstone Experience will be organized as a field based experience with deliverables that will complete the student’s business portfolio in an area of particular interest to the student. Job Shadowing and Paid Internships Job shadowing requirements will be completed prior to the paid internship which is experienced during students’ junior or senior year. Paid internships are a requirement for National Academy Foundation Certification. Students connect this experience to the mandatory Capstone course taken during their Senior year. Round table discussions with business partner mentors, such as lunch period forums, will be conducted on a monthly basis during Grade 10 as a further support to students’ successful participation in the paid internship experience. Business Readiness Skills The Academy will infuse into the electives and/or core courses outcome expectations related to students’ readiness for: 1. Corporate Culture, 2. Public Speaking: Presenting for Impact, and 3. Business Leadership and Professionalism. World Language Program Language requirements will follow district guidelines and will meet college requirements for admission. The fastest growing population in Connecticut is one that speaks Spanish as their native language and with a need for financial institutions state-wide to meet the needs of their clients it is important that employees have bilingual skills. Therefore, students will take three years of Spanish. Additional world language offerings will be explored. Health Course Requirement The required Health credit will include integration of the following health issues and initiatives: Making healthy life style choices Managing personal risk Guest speakers from local insurance companies to discuss topics such as healthy life style options NAF Curriculum High School, Inc. will affiliate with the NAF Academy of Finance which provides a sequence of courses and curricula for business and finance courses. The NAF Academy course offerings, as described by NAF, are listed below: Page 4 of 14 Course Description The Academy of Finance curriculum is developed with leading representatives from industry and education to ensure that courses are both current and relevant. By integrating necessary workplace skills in the classroom, students come to understand the connection between academic learning and career success. Strategies for Success This course of study helps to orient students to the world of work and school. This course will be offered in two parts, the summer prior to grade 9 and the summer prior to grade 10. The first part will focus on helping students to develop good work and study habits, develop solid interpersonal skills, learn about school resources, and develop career plans. The second part will start to prepare students for college and helps students to organize and prepare portfolios. Introduction to Financial Services This course can be offered either as a one- or two-semester course to be given in either the ninth or the tenth grade as a means of introducing students to the various sectors for the financial services industry. The objective of this course is to help students learn about both the nature of the careers found in a particular sector and the scope of the work that comprises businesses such as insurance, real estate, public finance, accounting, and the securities industry. Economics and the World of Finance This is a one-semester course in macro and microeconomics that provides an understanding of how our market economy functions in a global setting. It provides students with a survey of economic concepts including all of the twenty-two basic principles recommended by the National Council on Economic Education. In addition, a unit on capital markets acquaints students with the role that markets and securities play in our overall economic framework. Banking and Credit This one semester course presents a survey of the principles and practices of banking and credit in the United States. The students learn about the major functions of banks and other depository institutions, in-house operations and procedures, central banking through the Federal Reserve System and modern trends in the banking industry. The credit component provides an overview of credit functions and operations including credit risk evaluation, loan creation and debt collection. This course culminates in the Fed Challenge project. Securities This is a one-semester course focusing on the roles and functions of a modern securities organization. Through a study of the structure of brokerage firms, the trading process, credit and margin practices, automated processes, and government regulations, students gain an understanding of how a securities firm services its customers and plays an important role in our economy. Students are given the opportunity to relate their knowledge of economics, accounting, and data processing to the operations areas of various sectors of the securities industry. Emphasis is placed on the skills and attitudes necessary for success in business and college. Insurance This is a one-semester course that introduces students to various elements of the insurance industry, including insurance needs and products for businesses and individuals. Students learn about insurance sales, ratesetting, insurance and financial planning, insurance regulations, and careers in the industry. It is often combined with the Securities course. Financial Planning This is a one-semester course that introduces students to the financial planning process and the components of a comprehensive financial plan. Students learn how to prepare a financial plan that includes saving, investing, borrowing, risk management (insurance), and retirement and estate planning. International Finance This one-semester course familiarizes students with topics that relate to international finance, such as identifying current events subjects that deal with international finance , how international finance relations influence their lives, international corporate structures, monetary policy, balance of payments, international Page 5 of 14 trade, and financial markets. Accounting (Two terms required) Curriculum for these courses is provided by the local school or district. The Accounting courses should be completed by the end of the junior year. Business Computer Applications (one term required) Paid Internship Paid, finance-related internship, during summer between junior and senior year. College-Level Finance Course (Preferably fall semester of senior year.) Principles of Finance (or other finance related course) Offered senior year preferably at a four-year institution and taught by a college professor. Suggested Course Sequence This following graph represents the suggested course schedule for High School, Inc. students. SUBJECT GRADE 9 GRADE 10 GRADE 11 Mandatory Summer Bridge (1.0) English (4.0) World Lang (2.0) Social Studies (3.0) Mathematics (3.0) Science (3.0) Insurance & Finance Health (0.5) P. E. (1.5) Art/Music (2.0) Strategies for Success I (summer prior to GRADE 12 Strategies for Success II grade 9) (summer prior to grade 10) English 1 English II English 1H English 2H English Lit and Composition I American Literature English Lit and Composition II World Literature Spanish Spanish Spanish or AP Spanish World Geography or World History Algebra 1 Civics/ Foundation US History Geometry US History or AP US History Algebra 2 Spanish Literature (college credit) Psychology Geometry Algebra 2 Pre-Calculus Calculus Physical Science Biology w/lab Chemistry w/lab Introduction to Financial Services Banking & Credit International Finance Physics or AP Biology Entrepreneurship Securities *Principals of Accounting I & II Business Computer Applications Health/ P.E. Drama Insurance Health/ P.E. Graphic Arts for Business Pre-Calculus Financial Planning Capstone * This is a dual credit college course. Pedagogical Approach and Classroom Design In order to support students in meeting the graduation requirements for entry and success in post-secondary education, the Academy will be guided by the principles of Rigor, Relationships and Relevance. Rigor College-ready curriculum: college readiness, Honors, AP and dual credit courses Variation of time and support to enable all students to access the core curriculum Challenging instruction Page 6 of 14 Relationships Small school environment where staff and students know one another well and students develop a strong sense of belonging to their school community Personalized Learning Plans Advisories: sustained teacher/student relationships and personalized learning environment through systematized student and adult relationships Relevance Authentic connections between what students are learning and the real world outside school walls with a focus on insurance, financial services and technologies Interdisciplinary activities, integrated theme or specialization with relevant, high interest course content Community and business partners an integral part of student work 21st Century Skills The Academy will adopt the Partnership for 21 st Century Skills vision for 21st Century students in Connecticut, the United States and the new global economy. A key theme within this vision is that learning and innovation skills are what separate students who are prepared for increasingly complex life and work environments in the 21 st Century from those who are not. These necessary skills include: creativity, innovation, critical thinking, problem solving, communication and collaboration. The Academy will incorporate the following skill sets in its core and finance and insurance curricula: Creativity and Innovation - Higher order thinking - Self-direction - Communicating new ideas to others - Openness to new ideas and perspectives Critical Thinking and Problem Solving - Exercising sound reasoning in understanding - Making complex choices and decisions - Understanding the interconnections among systems - Identifying and asking significant questions that clarify various points of view and better solutions - Framing, analyzing and synthesizing information in order to solve problems Communication and Collaboration - Articulating thoughts and ideas, clearly and effectively, through speaking and writing - Demonstrating flexibility and willingness to be helpful when making necessary compromises to accomplish a common goal - Assuming shared responsibility for collaborative work Curriculum Design Two major components of curriculum design will be Course syllabi that delineates specific course learning outcomes, guides student work and provides a helpful guide to parents as well A skill set applied and assessed across core and theme-based courses relevant to Insurance and Financial Services occupation. These may include clear communication, data-based decision-making and analysis, ethical comportment and critical thinking. Curricular Support Students will be supported by a clear and viable curriculum that outlines the necessary essential skills and knowledge needed to earn credit for every core and theme-based course. In order to support students in meeting these requirements for entry and success in post-secondary education, the appropriate curricular and instructional supports will be provided to students. Interventions, targeted to the individual needs of students, will provide the necessary safety net for all students to gain access to a college ready curriculum. Time Support Students will be given increased time to meet curriculum requirements through extended year, extended day and/or additional time at a given grade level. Page 7 of 14 English Language Learner Support Approach A Support Services Team consisting of a Literacy Coach, Special Education staff, and an English Language Learner Instructional Coach, will provide both professional development and classroom support to increase educator capacity in instructional techniques that will support instruction for English Language Learners. Intervention Program (2+ years behind; 1 year behind; 5-minutes behind) A tiered instructional approach is suggested as an essential component to an intervention process to support achievement for all students. The components of this research-based model include: Decision-making teams that use formative assessments to inform interventions Tiered levels of implementation of high quality instruction/intervention Monitoring of progress Family involvement Considerations for English Language Learners Special Education Research suggests that 80 to 90% of students should be able to be instructionally or behaviorally successful with universal interventions; an additional 5 to 10% should be successful with targeted group interventions, and approximately 1-5% of students would need individualized, intensive interventions. Special Education students will be carefully evaluated so that these interventions are appropriate and individualized for student program application. Instructional Technology The Academy recognizes that technology has revolutionized the financial services industry, creating demanding positions in need of talented applicants who have mastered both the technical and soft skills, including the ability to communicate effectively, solve problems and work as team members. This professional and technical knowledge is more critical than ever as the financial services industry continues to grow. The technology of industry will be infused along with other big picture concepts and skills. The Academy will explore a Computer Applications strand which will include courses in Information Technology, Web Design, E-Commerce and Computer Applications. Homework Expectations Homework will be defined as work which the student is assigned to do out of school on the student’s own time. The purpose of homework will be to advance learning by: Supplementing and reinforcing classroom work Offering increased practice in particular skills Engaging students in independent research Developing initiative, independence, self-direction and responsibility Homework expectations will include: Daily assignment Parental support Adherence to the Hartford Board of Education Policy on Homework Learning Outcomes and Assessment Design Assessment Design The Academy will develop a performance assessment system to evidence Academy successes. Course syllabi will delineate specific course learning outcomes and will guide student work. The Academy will develop a set of skills that will be applied and assessed across core and theme-based courses relevant to Insurance and Financial services occupations. Performance Benchmarks The Academy faculty will incorporate both a formative and a summative evaluation model in order to guide performance and measure outcomes. Feedback loops for curriculum development will enhance the Academy’s ability to be dynamic, responsive and aware of continuous quality improvement. Teacher Capacity The Academy staff will foster authentic, caring and respectful relationships with each other and with students and will share the Page 8 of 14 common belief that all students can achieve at high levels. Teachers will begin their training during the summer of 2009 in preparation for the opening of the new school and will be expected to participate in the school’s mandatory Summer Bridge Program for new students. Theme-Specific Certification Requirements In addition to highly qualified certified teachers in all curriculum areas, teaching staff will include educators who have certification in technical areas in order to deliver proficiently the academy theme courses. Academy teaching staff are also expected to: Have broad academic knowledge as well as depth in their subject; Use a variety of strategies to accommodate individual learning styles and engage students; Coach and facilitate lessons to engage students as active learners rather than lecture to passive students; Supervise and guide each other, plan lessons and courses together, and observe each other’s teaching as a way of continuously improving their practice; Use common planning time to discuss individual student achievement, as well as class and school-wide academic issues; Use common planning time to develop interdisciplinary lessons and courses that focus on essential questions; Teach model lessons learned from professional development to other teachers; Create a Personal Teaching Plan developed in collaboration with his/her supervisor to address individual professional development needs as they relate to improved student learning; Use technology daily to improve student learning; Define benchmarks for improved student achievement; Participate in pathways course content team collaboration to develop interdisciplinary connections for the integration of contemporary issues in the insurance and finance fields; Embed assessment into instruction as part of the learning process; and Individualize and personalize learning whenever possible. Training and Professional Development Program Professional development will be designed as coherent, sustained and sequential opportunities for collaboration to support focus areas of: team-teaching for interdisciplinary study data-based decision making monitoring of student achievement current issues in business, finance and insurance integration of core curriculum and themes Teaming/Collaborative Planning Expectations Academy teachers are expected to work as a team. Teachers will use case study methods and problem-based approaches which integrate knowledge from a variety of disciplines and promote active participation of faculty and students. This approach is a shift from “teacher ownership” of a classroom to being an integral contributor to a highly-skilled team of professionals working together to enhance student performance. Teachers will create a learning environment in which they will serve as role models and resources for students, while empowering students to direct their own learning through active participation. School Schedule Length of School Day The Academy will have an extended school day for a period of one hour. During this period students will attend a half hour Advisory Period with the additional half hour for increasing instructional time. Co-Curriculum Programming/Saturday Academies Co-curricular planning and Saturday Academies will include the development of the following programs: College readiness classes at all grade levels College information assemblies for students and parents for college application process and college life Visits to colleges SAT Test Prep Senior College Labs for: FAFSA workshops, scholarship notebooks, scholarship essays Tutorials Summer Bridge opportunity for establishing a college prep culture Credit advancement Page 9 of 14 Summer School/Extended Year The Academy will devise a carefully thought out plan for summer school and extended year activities that will include: A Summer Bridge program Academic enrichments Academic supports Internships Advisory Program Partnerships Role of Partners: Advisory/Curriculum/Embedded Activities Partnerships between business leaders and educators are critical to prepare students for college and professional careers. Business partnerships will secure internships, provide guest speakers, provide job-shadowing experiences, act as mentors, enhance curriculum, and serve on the Academy’s Advisory Board. Additionally, the NAF partnership will provide the school with curriculum based on industry and educational expertise. NAF’s record of success nationally with 90% graduation rates and more than 80% going on to college has garnered the support of corporations, public policy makers and foundations, including the Bill & Melinda Gates Foundation and the Pearson Foundation. Internships/Job Shadows/Mentoring/Community Experiences During junior and senior years students will complete the required internship with one of the Academy’s partners (120 hours). Prior to that, each student will complete a job shadowing experience and/or be provided with mentoring opportunities with an Academy partner. Higher Education Partners The Academy will continue to work with Capital Community College to provide a seamless transition into their new Insurance and Financial Services Associates Degree Program. It will also continue to develop curriculum that will be articulated with them so that students can receive both high school and college credit while attending the Academy. A student’s credits from Capital can then be transferred to the state public college system. Business Partners The role of business partners is crucial to the success of this school. Major partners include: Travelers who has taken a lead role in supporting the Academy mission Franklin Trust Federal Credit Union who has agreed to build a credit union branch in the new school as well as train students to operate the branch. They are also willing to provide mentoring, job shadowing, classroom visitations, lecturing, and internships. Smith Barney (Citigroup) whose participation qualifies the Academy for the annual NAF Citigroup grant which provides staff development and program enrichment activities. The Hartford Financial Services Group MassMutual Waddell & Reed who will provide staff training on financial planning as it relates to the large wealth transfer that is expected as the parents of the baby boomers pass on; who will provide classroom guest speakers on Investments. The Phoenix Companies Bank of America Barnum Financial Connecticut IFS (Insurance & Financial Services) Cluster who will serve as a member of the school’s Advisory Council and School Governance Council and thus act as conduit to the insurance and financial services industry. The IFS representative will share with the School Governance Council reports that track high growth jobs and skills associated with high-demand occupations within three segments of industry: banking, insurance and financial services. Page 10 of 14 The following business organizations are additional potential business partners: Prudential ING Group UnitedHealth Group IBM Consulting Services Hartford Steam Boiler/AIG RBS/Citizen’s Bank New Alliance Bank Aetna ConnectiCare VantisLife Insurance Microsoft GlobeOp Financial InSource, LLC PricewaterhouseCoopers UBS Financial Services Wealth Management Advisors Webster Financial Corp. Cigna X L America, Inc. TD Banknorth MetLife Sovereign Bank People’s United Bank Insurity KPMG Community and Business Partnerships The Insurance & Finance Academy Design Team developed the following criteria and protocols as guidelines for the collaborative work of the partnerships. Each business partner will define what aspects of the guidelines are most suitable for involvement with the school. All curricula and course outlines are designed with a focus on insurance and financial services and reviewed by the school’s Advisory Committee. IFS partner companies can provide case studies and/or classroom projects. Visits to and site tours of companies are tied to the curriculum and include preparation prior to and follow-up after the visit. Industry speakers are frequent guests and visits are aligned with subject matter. Innovation and competitiveness is rewarded through IFS industry-sponsored math or other similar related-content contests with possible ties to the current statewide math contest. Business in-kind support: internships, mentoring and job shadowing, as well as an annual ‘dress for success’ clothes drive. The Academy includes the utilization of proven programs such as CBIA’s Y.E.S Academy which uses corporate volunteers to teach employability skills. Externships are provided to Academy teachers to become more educated on today’s insurance and finance environment. Students collaborate with business partners in community service efforts such as Habitat for Humanity & Rebuilding Together that will instill a sense of corporate social responsibility and aligns with the school mission. Funding opportunities with industry partners are under discussion and could include: --Scholarships for enrollment in the AS Degree in Insurance and Financial Services at Capital Community College --Grants for contest expenses --Underwriting of transportation and meal expenses for field trips, job shadow days, etc. --Seed money for student bank accounts --Operating funds --Teacher/staff training/development --Teacher/staff externship transportation and meal costs --Travel expenses for design team to observe similar academies High School/College Readiness Plan of Study and Transition Planning Eighth graders from the elementary/middle schools will have an opportunity to apply to the Insurance & Finance Academy through the Hartford School Choice process. Eighth graders will have an opportunity to visit the campus during the school year when classes are in session so that they can interact with current students. Incoming students should have a commitment to the unique four-year program including the longer school day, course expectations, internship and school uniform. Students who meet the criteria will be able to take dual enrollment classes in their senior year, giving them both exposure to college rigor and college credit for their classes. These will be developed through Capital Community College and other colleges. Professional skills are part of the curriculum in each class and a design element reflected in the culture of the school. Students are expected to arrive on time and be prepared for classes, to treat each other with respect and to dress appropriately (appropriate business attire). Each student, along with Academy staff, will design a Personalized Learning Plan which will generate questions about the future, express goals for personal learning and devise pathways to college and the adult world. Page 11 of 14 Dual Credit/Advanced Placement Prior to the school’s opening and during the first year of implementation, the school will develop further articulation agreements with local colleges and universities for dual credit courses. Additionally, a minimum of two AP courses will be offered. Select courses will allow college credit towards an Associate Degree in Insurance and Financial Services at Capital Community College. Career Explorations The school will develop multiple opportunities for: Visits to college campuses Learning about college options Earning college credits through dual credit and summer courses Collaborative activities with college students School Culture & Climate Student Advisory System The Student Advisory will be a critical component to the development and success of the Academy; it will ensure that no student becomes anonymous, guarantees each student an advocate and supports the learning program and personal growth of each student through nurturing individualized attention. Personalizing the Academy through the advisory system will provide the means to better meet the learning needs of each student. The advisory system will be formally structured and may allow for up to one credit as an elective course. Business-oriented Environment and Unalterable Practices to Establish Culture and Climate There is an unmistakable common belief that all students can learn; high expectations for students underline that belief. A business-oriented environment will permeate the Academy. Students know why they are in school and can articulate it. Teachers are passionate about the content they teach. Continuous improvement is part of the culture of the Academy. Staff and students understand that mistakes are part of growing and essential for learning. Students wear uniforms reflective of a business environment. Staff have a professional dress code. Staff and students wear IDs. The school develops a partnership among teachers, parents and students who work together to raise student achievement. The policies and practices in the school recognize diversity. The school environment is safe for both teachers and students to experiment with new ideas. Everyone rallies around the Academy vision; there is a common belief that failure is unacceptable. The focus is on student-centeredness rather than teacher-centeredness. There are clear expectations for acceptable behavior, procedures, routines and consequences. Every student is known well by at least one caring adult in the school. A system is in place for counseling students who repeat disruptive behavior. School Compact The school will devise a School Compact agreement committing families, students and school staff to work collaboratively to help each student reach his or her potential. The Compact will establish agreed upon targets for improving student outcomes, will identify conditions that must be created in the school and the community to enable outcomes to improve, and will specify shared responsibilities of schools and communities to create the conditions for continuous improvement. In addition to the School Compact, a Memorandum of Understanding will be devised by the Advisory Board (corporate partners and NAF affiliates) which will articulate standards of academic and personal behavior and other expectations for participation in the internship program, field trips and associated business partnership activities. These will include good attendance and punctuality, and a record of compliance with the School Compact. Student Orientation and Bridge Programs Orientation to the Academy will be provided at the start of each academic year for new students and will include a review of the School Compact. A Summer Bridge Program will be required for all entering Grade 9 students. This program will provide an induction into the Academy and an opportunity to meet faculty. Page 12 of 14 School Uniforms All students in the Academy will be required to wear a uniform that will distinguish them as young professionals. Behavior Support Program Student behavior and conduct play a crucial role in the business student’s academic, civic, and social development. The standard for Academy behavior and its support program will be guided by the: √ Hartford Public School Code of Conduct and Discipline √ Code of Conduct from national and state student organizations (CTSO) √ Corporate codes of conduct from the insurance and financial services industry √ Mentoring programs provided by business partners who will model positive behaviors Parental Role In Academics The school will place a very high commitment on parent participation. To that end, parents will have a voice and opportunity for collaboration with Academy staff and partners through the following initiatives: The creation of a parent organization Representation on the School Governance Council An Annual Stakeholders Meeting, similar to an Annual Stockholders Meeting when parents and the other stakeholders will have an opportunity to voice their opinions on the direction of the school and any other concerns that they may have Mini-Courses for parents, such as Financial Planning, to increase their participation in the school and provide a service to them. This will not only help in creating a culture of learning at home but also provide a needed service to the community. An end of year awards ceremony will be held to recognize our students, teachers, parents, corporate sponsors, and members of the community. . In School Culture/Climate Parent presence and participation in the school will help to mitigate behavioral problems and reinforce the mission of the school to produce motivated, informed, and ethical students. The culture of the school will be explained and emphasized to both parents and students. Parent participation will help to inculcate the culture of the school. Parent voice and participation can support a culture that is a fusion of school and business and help promote real life business procedures, such as preparing a resume, writing a cover letter and using business and school terms interchangeably, such as entry level for freshman, supervisors for sophomores, etc. Support Services Special Education Program With the assistance of the Support Team and Special Education staff each student’s records, such as CMT scores, grades, special needs and other such relevant information will be carefully reviewed to determine programs that will best meet the needs of each student. Support Services Model Summer sessions will be available to bring all students to acceptable performance and meet all the district, Connecticut, and federal standards. Each student will have two mentors, one faculty member and one student. The mentoring student will earn community service hours. The mentoring student will receive an evaluation on how effectively he has trained and mentored his charge. The student will be evaluated much like managers in business. Benchmarks and yardsticks will be created to aid the mentoring student in knowing what is expected of him and his advisee. A personalization system, such as an advisor—advisee program will be put in place so that each student has an opportunity to be known well by at least one adult. In this way student needs can be met in a timely manner. A Personalized Learning Plan will be in place for each of the four years the student is at the Academy. This Plan will include student goals, activities, college aspirations, course plan and completion, and capstone research topic. Page 13 of 14 Application Process Enrollment in High School, Inc. will follow the district timelines and procedures for the Hartford School Choice process. Additionally, promotional materials and presentations will be delivered to the middle schools and guidance counselors to encourage enrollment into the Academy. A school webpage will offer complete and updated information for all current and future students. Every student who is accepted for enrollment into the school must attend an interview as a further requirement for acceptance. School Zone High School, Inc. will enroll students from city-wide. During its first year of implementation, the Academy will serve 200 students in Grades 9 and 10. The current Grade 9 students enrolled in the Freshman Academy at Weaver High School will have seat preference for Grade 10 enrollment at the Academy for entry in August 2009. This is a one year transition plan. Grade 8 students will be recruited city-wide for enrollment in Grade 9 through the Hartford Choice process. Page 14 of 14