Collaborating with Competitors

advertisement

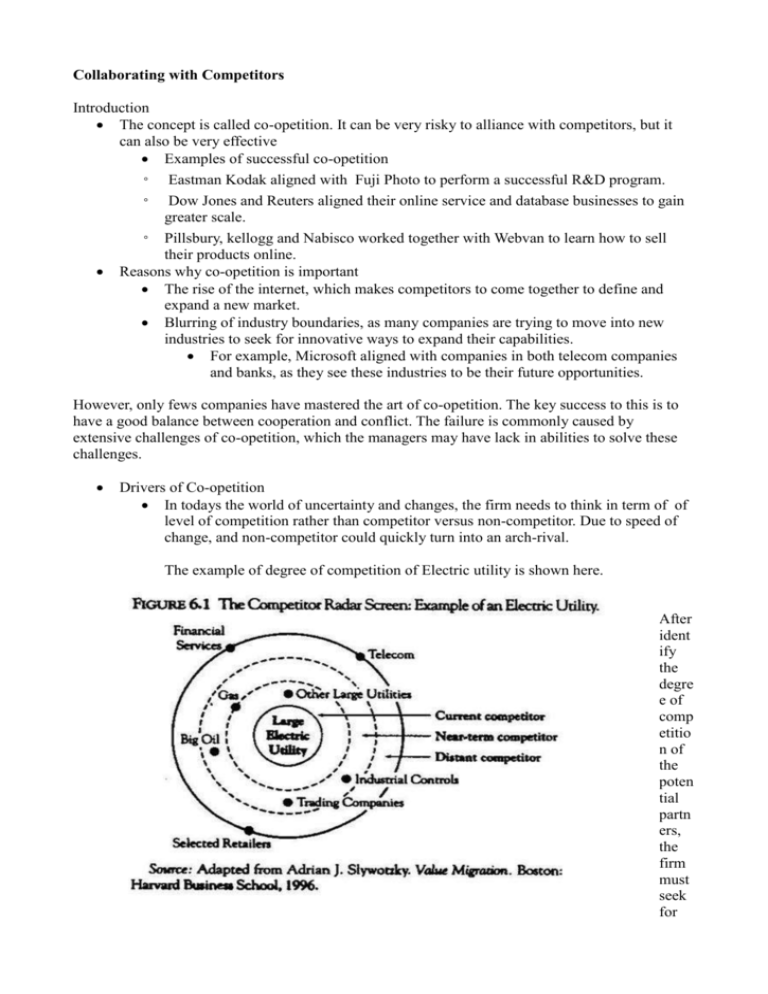

Collaborating with Competitors Introduction The concept is called co-opetition. It can be very risky to alliance with competitors, but it can also be very effective Examples of successful co-opetition ◦ Eastman Kodak aligned with Fuji Photo to perform a successful R&D program. ◦ Dow Jones and Reuters aligned their online service and database businesses to gain greater scale. ◦ Pillsbury, kellogg and Nabisco worked together with Webvan to learn how to sell their products online. Reasons why co-opetition is important The rise of the internet, which makes competitors to come together to define and expand a new market. Blurring of industry boundaries, as many companies are trying to move into new industries to seek for innovative ways to expand their capabilities. For example, Microsoft aligned with companies in both telecom companies and banks, as they see these industries to be their future opportunities. However, only fews companies have mastered the art of co-opetition. The key success to this is to have a good balance between cooperation and conflict. The failure is commonly caused by extensive challenges of co-opetition, which the managers may have lack in abilities to solve these challenges. Drivers of Co-opetition In todays the world of uncertainty and changes, the firm needs to think in term of of level of competition rather than competitor versus non-competitor. Due to speed of change, and non-competitor could quickly turn into an arch-rival. The example of degree of competition of Electric utility is shown here. After ident ify the degre e of comp etitio n of the poten tial partn ers, the firm must seek for potential benefits gained from collaborating with these partners. In the past drivers of co-petition used to be setting standards, sharing risks, and entering emerging markets. However, due to industries changes, and changes in ways of doing business, these drivers have evolved into a four new drivers which are expanding product lines, reducing costs, gaining market share, and creating new skills. Expanding Product Lines Example of this is the alliance between the two rivals, First Union Bank and Charles Schwab to expand their scope of services to their customers and to differentiate themselves from competitors. They do this by allowing allowing first union to use Schwab's OneSource service which is Schwab-branded basket of mutual funds. This helps First union to provide a one-stop financial service to the customers. However, this can create potential competitor. Therefore, this form of co-petition must be well managed. Reducing cost The driver is to share similar type of assets between partners to reduce cost, Since most rivals will share similar types of assets. This type of co-opetition is common among capital intensive industries, such as machinery, oil and gas, and chemicals. Example of this type of alliance is Sony and Ericsson. They aligned their cellphone businesses together to share resources and to reduce cost and to compete with strong rivals such as Nokia and Motorola. Gaining Market Share Companies form alliance to gain market share, and create powerful network. Example, is alliance constellation between car manufacturers and their rivals. The constellation consists of DaimlerChysler, Ford, and General Motors, etc. This big powerful alliance will attract large numbers of suppliers and customers. This allows each companies to gain more market share. However, this alliance need to be manages accordingly to maintain good cooperation relationships. Creating New Businesses This last type of drivers is to combine the capabilities of each alliance members to form a set of new skills, which open the door to new businesses. Example is the alliance between NBC and Microsoft. They create a joint venture together called the MSNBC. Since each of them have different expertise. NBC contribute their broadcasting skills to the alliance, while Microsoft contribute their technical online and computing skills. Together, they create a business that has a mixture of TV and computing. At first this was an alliance between competitor and non-competitor, but soon Microsoft started to expand their business into communication business, while NBC started to move out of their traditional broadcasting. Industry countries are becoming blur, and partners are becoming competitors. Therefore, good management is required. Managing the Risks of Co-opetition This type of alliance, it is more likely that noncooperation between partners will occur, as alliance members are competitors. This leads the the one common risk, which is technology leakage. The technology processes are normally revealed to the alliance partners. Since the partners have similar businesses, and they will be in a look out for these skills. According to Gulati, one of the way to eliminate this risk is to create a joint venture, where the scope of information flows to the partners are limited. Another way is to create some kind of equity swap, where both partners have to rely on one another, which can promote trust and commitment among partners. Another way to avoid risk is to create payoff structure of the alliance. This consist of returns and benefits for each alliance members, and consequences if the partners cheat. Example of payoff structure is the alliance between two arch rivals, IBM, and Dell. They has contribute to a successful alliance program as they consider the payoff benefits, they will gain from this alliance. However, to do alliance with competitors is very dangerous, and there are a lot of risks that investors should take them into the consideration. Risk 1: Technology Leakage It is very common that when competitors do alliance together. A company’s core technology or process will fall into a competitor’s hand. The knowledge that the competitors get from you may come back to haunt you if you don’t limit the information scope well. Our partners can be the direct competitors from the alliance. There are some ways to avert this risk. Solutions Reducing risk means controlling the information. One approach is to limit the scope of the alliance. Two companies may share the production line together, but the intellectual properties are still with their own. Another method is to do the contacts that clearly define who owns which technologies, so and how the technologies can be used. Therefore, they can separate the responsibility and keep the technology with themselves. The last approach is to create rules for employees that describe what they can and cannot discuss with the partners Risk 2: Telegraphing Strategic Intention This risk is basically when our partners know the firm’s future strategic plan because of experiences that the partners and your company work together. They can predict your firm’s next move because they already knew the strengths and weaknesses of the firm. Then the partners can use our weaknesses to become their opportunities. Solutions This risk can be reduced by good managing of information, same as above. For example, senior management should teach managers what information is strategic and develop guideline for sharing the information. One approach is to limit the number of staffs that have direct contact to partners. Another way is to establishing a separate site for the alliance that is away from the parent company Risk 3: Customer Defection When a company does an alliance with competitors, its current and potential customers of the company can be in the hand of our alliances, or in other word, our competitors. If the competitors can get into the contact with our customers, it is very dangerous that they can steal our customers. Solutions One is to jointly interacting with customers and never yield full contact to the partners Another is to demand the customers’ access from each other, and having a “mutually assured destruction” approach to collaboration. On one steal each other’s customers. Lastly, allowing partners’ access to customers only when selling a jointly owned product. Risk 4: slow decision making Alliance with competitors usually creates a high level of slow decision making, shallow cooperation or even abandonment. For example, the joint venture between General Electric and Rolls Royce, they join together in order to produce jet engines. Both of them are direct competitors who sell very similar products and have similar markets. Finally, they cannot cooperate and have to cancel the venture after Roll Royce come up with the idea to introduce a jet engine which directly compete to their own joint venture’s engine. Moreover, alliances with competitors usually end up with “a zero-sum game.” This is because if every partner has the same purpose and try to get the same thing, the conflict will occur instead of complementary Solutions: The companies should focus on their effort at different points along the value chain. They should make an agreement on who are responsible in which area. o For example, in Pharmaceutical firms which usually manage their alliance in this way, a small biotech firm develops and produces a drug while a large pharmaceutical company is responsible for selling it. Focus on the basics of sound decision making, meaning that to identify from 10 to 50 of the most important decisions that alliance will encounter and then define which decision makers will participate in those decisions. Risk 5: Business or asset fire sale Alliances between competitors can create the risk of a fire sale, which meaning that the firm will be forced to sell its interest in the alliance at a below-market price. Within 7 years, almost 80 percent of all joint ventures are acquired by one of the partners. The figure would be even stronger when the partners are competitors. This is because they usually focus more on interest in the partner’s business and have less demand for long-term cooperation. Unfortunately, many firms lack of carefulness about the endgame, so they usually fail to lock in a price or pricing formula for their own assets during the negotiation and structuring. Then after they are separated, third party buyers will have much less interest in the assets once they are tied up in a joint venture, so the firm is left with only one real buyer, who is usually their own partner, who is already in a powerful position in order to acquire the assets at a favorable price. Solutions: Avoid falling into a fire sale First one approach is to favor an independent joint venture structure, which can help reduce cost and help increase the interest of other buyers. Another approach is to avoid joint ventures altogether. In conclusion, in order to succeed in terms of co-opetition, firms must wisely manage the risks of alliance; develop the best tool that is suitable for different situation.