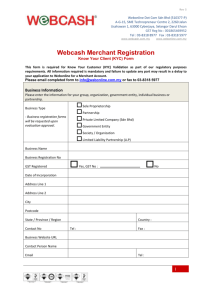

merchant banking

advertisement