merchant banking

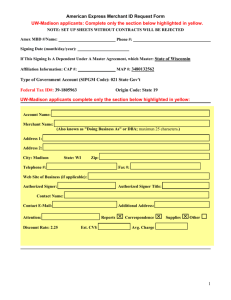

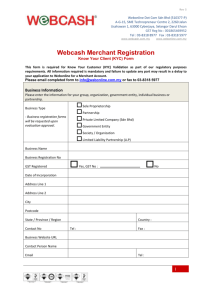

advertisement