Economics Unit

Grade 11 University/College CIE3M

Financial Management

and

Business Organizations

By: Charlotte Aust, Jason Brinder, Shamim Todai, and Jessica Woolard

February 23rd 2010

TABLE OF CONTENTS

GRAPHIC ORGANIZER (Jessica)…………………………………………………………………3

UNIT DESCRIPTION

o Rationale (Jessica/Charlotte)…………………………………………………………..4

o Image of the Learner (Shamim/Jason)……………………………………………..5

o Design process (Jason)………………………………………………………………....…6

UNIT EXPECTATIONS

o Expectations (Charlotte)…........................................................................................8

o Unit Synopsis (Shamim)……………………………………………………….............10

CULMINATING ACTIVITY

o Description (Jessica)………………………………………………………....................16

o Expectations (Charlotte)………………………………………………………............17

o Teacher Process (Charlotte)……………………………………………………….....18

o Student Process (Charlotte)………………………………………………………......23

o Assessment plan (Shamim)……………………………………………………….......26

o CA Handouts

A- PROCESS

Description of roles (Shamim)...................29

BRole signups for teacher (Shamim) .........30

CRole signups for students (Shamim).......31

DSimulation description (Charlotte)..........32

EClient profiles (Shamim)...............................33

FReflection template (Charlotte).................40

GRecord keeping sheet (Shamim)...............42

HCompany list (Jason).......................................43

IStock outcomes (Jason).................................44

JBusiness investment outcomes (Jessica)....48

KRandom scenarios (Jessica).........................49

L- ASSESSMENT

Group participation self-asses (Shamim)...50

MChecklist for simulation (Charlotte)........51

NCheckbric for simulation (Charlotte)......52

OReflection rubric (Charlotte).......................53

PPresentation rubric (Jessica)......................55

QPresentation peer-assessment (Jessica)57

LESSON PLANS

o Lesson 1- To Spend or Save? That is the Question (Jason)…………........59

Lesson 1 Appendices..................................................................................62

o Lesson 2- Nothing is Ever Free: Personal Financial Planning (Shamim)..65

Lesson 2 Appendices..................................................................................69

o Lesson 3- Getting Down to Business: Business Organization in Canada

(Jessica) ………………………………………………………..............................75

Lesson 3 Appendices..................................................................................79

o Lesson 4- Achieving Bang for Your Buck: Profitability (Charlotte)......94

Lesson 4 Appendices...............................................................................101

2

Financial Management and Business Organizations

CIE3M: The Individual and the Economy

University/College

Culminating Activity: Put Your Money Where Your Mind Is!

Students will act as investment advisors in a role-play group activity. They will decide how to invest their client’s money

and justify their decisions using financial management strategies and economic reasoning.

Expectations & Performance Indicators:

Expectation: identify the financial

planning principles that people

follow when they budget, invest, and

save

Performance Indicator: Students will

reflect on their investment strategies

and justify them within the context

of financial planning principles.

Expectations: evaluate, using financial

criteria (e.g., yield, rate of return,

liquidity, risk), the appropriateness of

different types of financial assets at

different stages of life

Performance Indicator: Students will act

as financial managers and advise clients

on what financial assets to invest in given

their client’s unique characteristics and

preferences

Lesson Overview

LESSON # 1- Spend/Save/Invest……………………

LESSON # 2- Personal Financial Management……..

LESSON # 3- Business Organizations………………

LESSON # 4- Profitability…………………………..

CULMINATING ACTIVITY……………………….

TOTAL

Expectations: communicate the results

of inquiries, using a variety of styles

and forms as well as visual supports

Performance Indicator: Students will

present their scenarios and outcomes to

their client (role-played by their peers)

in an organized and visually pleasing

manner

Unit Evaluation

3 Days

2 Days

3 Days

3 Days

4 Days

15 Days*

Written reflection (analytic rubric)…..……………....… 40%

Group presentation (holistic rubric)……………………..15%

Individual delivery in presentation (holistic rubric)……25%

Self-assessment of group participation……….…..……..10%

Peer assessment of another group’s presentation………..5%

Simulation checklist ………………………...……………5%

*based on 75 minute periods

3

Rationale for the Unit: Financial Planning and Business

Organizations (Unit 3)

The purpose of this unit is to emphasize the economic decision making skills

required in financial planning and to provide students with opportunities to develop

their own decision making and critical thinking skills in this context. Current

economic realities, fueled by unsustainable borrowing, illustrate the importance of

teaching these principles to students. Understanding how to make informed

financial decisions not only improves the student’s economic welfare but also

contributes to the betterment of the Canadian economy through increasing the

financial literacy of Canadian citizens.

This unit uses and applies the skills developed in the previous two units, The

Nature and Importance of Economics and the Supply and Demand and the Market

for Labour. In particular it expands on decision making tools and applies student

knowledge of supply and demand to investment markets. Key concepts of financial

literacy and planning tools for making financial decisions will be introduced to

students and they will be provided opportunities to apply learned knowledge and

skills in real world simulations. Students will also learn the types of businesses that

exist and how they are organized. By examining decision making from both the

macro and micro perspectives, students will understand how financial decisions at

both levels involve risk and individual considerations.

Skills and concepts covered in this unit will be applied in the final

culminating activity, where students act as financial advisors to a client and manage

the client’s asset portfolios during a four year simulation. Student interest is

maintained throughout the unit by simulating authentic careers and real world

activities, appealing to different levels of think inking, and the use of both group and

independent work. The competition component of both the culminating activity,

where they act as competing firms, and stock monitoring, where they act as an

individual investors, will provide real world motivations for engagement within an

inclusive classroom environment.

4

Image of the Learner

The Grade 11 Individual and the Economy is a University/College

preparation course (CIE3M). This unit on Financial Management and Business

Organization is recommended to be used as the third unit in the course, thus

assuming that students have already covered topics including, The Nature and

Importance of Economics as well as Supply and Demand and the Market for Labour.

This implies that students have a familiarity with economic language and are

comfortable using basic economic vocabulary.

The class is modeled after a secondary school that meets and/or exceeds all

provincial standards and is located in the city of Mississauga. The city of

Mississauga is a middle class suburb located west of Toronto. The approximate

number of students in the class is 28 with a near perfect gender split. Although the

students come from diverse cultural backgrounds, majority of the students (75%)

were born in Canada. Half of the students are assumed to be intrinsically motivated

to pursue learning at the post-secondary level while the other half of the class took

this course to fill their timetable and had no real interest in economics or pursuing

theory before taking the course.

The school ensures that every student has access to computer labs and that

the internet is available for classroom research. It is assumed that all students have

access to a computer and internet at home. Although students do have access to

current technologies, the socioeconomic status of students varies from the poverty

line to wealthy.

Students taking this course are between the ages of 15 – 17 and demonstrate

varying level of maturity but high levels of respect towards the teacher as well as

their classmates. They are familiar with the expectations of cooperative group work

and are comfortable with the variety of teaching and assessment strategies used to

accommodate their diverse learning styles. Students are encouraged to participate

in class discussions using proper listening and communication skills. They are able

to read charts and graphs and are capable of analyzing the synthesizing information.

Students are becoming disengaged with the vast amount of foundational

knowledge and have voiced their opinion to have more applied/relevant activities.

Special Accommodations

This economics class has 2 stage-four and 1 stage-five English Language

Learners (ELL)1 who work well in groups but have varying comfort levels

presenting. The class is also comprised of one special education student who’s

Individual Education Plan (IEP) states that the individual has poor motor skills and

is accommodated by the use of a laptop computer to type notes. If this requirement

cannot be met, then this student requires photocopied notes from peers (or teacher

notes).

1

Stage 4 ELL students have reached a level of English proficiency to be introduced to the Ontario Secondary School

(OSS) English course selections at the junior (grade 9 and 10) level. Stage 5 ELL learners have had one additional

English as a Second Language (ESL) course than the stage 4 ELL students and are being introduced to the OSS senior

level English course selections (grade 11 and 12).

5

Design Process

The design process was a challenging yet fun experience where all group

members worked together equally to achieve our goals. We were productive from

the moment we started working together, collaborating our efforts and establishing

specific roles for the unit design. During our first meeting we collectively did the EIF

and GRASP tests to make sure we were on the right track. We also had a culminating

activity discussion where we made a basic framework, which is one of the most

important decisions. We also came up with a team name, “The Wall Street

Wanderers” which allowed us to become a real team.

Over the next week we got both the EIF and GRASP tests approved which

allowed us to go forward. We finalized our image of the learner, which helped guide

our culminating activity and consideration of accommodations. After two more

meetings we had a strong sense of what our culminating activity would be so we

itemized the required handouts and met one week later to review and improve

them as a team. We then assigned each member a lesson for which we were

independently responsible. Each team member emailed the planning manager a

bulleted summary of their key concepts covered, assessment tools used, and how it

related to the culminating activity to assure all plans were aligned.

A week prior to storefront, we assembled our unit and edited the appropriate

aspects to ensure that it was up to our high level of standards. We then took a

couple days to individually review the unit and communicated with one another

about any minor revisions via email. For the most part we stayed within our selfassigned roles, however we also came together collectively to contribute to the

storefront concept and preparation.

Through the use of backward design, we believe we have developed an

authentic activity that effectively covers ministry expectations for this course. We

take great pride in the work that we achieved together as a team. Everyone’s efforts

were equally weighted and we took advantage of each individual member’s

strengths.

6

Financial Management

and

Business Organizations

UNIT DESCRIPTION

7

Unit Expectations

Lesson 1: Spend/Save/Invest

Overall Expectations

EMV.02 - explain the principles of sound personal financial planning

ESV.01- analyse the factors that influence consumer demand and satisfaction

in the marketplace

SIV.01 - explain how self-interest in a market makes consumers and

producers interdependent

MEV.01 - use methods of economic inquiry to locate, gather, evaluate, and

organize information from a variety of sources

MEV.02 - analyse specific economic situations, using appropriate economic

concepts, models, and methods of economic inquiry

Specific Expectations

EM2.04 - describe how saving benefits the individual and the economy

EM2.05 - describe different forms of savings income (e.g., interest, dividends,

capital gains, rent) and how they benefit the individual and the economy

ES1.04 - analyse choices and determine the best method of payment (e.g.,

cash, credit, loan, rent, lease) for major consumer purchases (e.g., cars,

accommodation)

SI1.02 - describe the criteria that consumers and producers each use to

determine which of several choices is in their own best interest

ME1.02 - evaluate the usefulness of economic information by considering the

reliability of its source (e.g., authority, expertise, impartiality) and the quality

of its content (e.g., use of logical arguments supported by evidence, absence

of bias, avoidance of unsubstantiated assumptions)

ME2.01 - interpret current financial information from various sources (e.g.,

information from banks or stock markets that incorporates statistics and

forecasts)

Lesson 2: Principles of Financial Planning

Overall Expectations

EMV.02 - explain the principles of sound personal financial planning

MEV.02 - analyse specific economic situations, using appropriate economic

concepts, models, and methods of economic inquiry

Specific Expectations

EM2.01 - identify the financial planning principles that people follow when

they budget, invest, and save (e.g., start saving early, take advantage of

compound interest, recognize the value of diversification)

EM2.03 - evaluate, using financial criteria (e.g., yield, rate of return, liquidity,

risk), the appropriateness of different types of financial assets at different

stages of life

ME2.04 - use methods of economic inquiry (e.g., cost-benefit analysis) to

evaluate an economic choice from the perspective of affected stakeholders

8

Lesson 3: Business Organizations

Overall Expectations

EIV.02 - explain the functions of markets, profits, and the process of

economic decision making in the private sector

MEV.02 - analyse specific economic situations, using appropriate economic

concepts, models, and methods of economic inquiry

Specific Expectations

EI2.04 - compare the characteristics of the different structures of business

organizations (i.e., sole proprietorship, partnership, corporation,

cooperative)

EI2.05 - compare the characteristics of firms and of competition in perfectly

and imperfectly competitive markets (e.g., monopoly and oligopoly)

SI3.01 - describe examples of how the self-interest of different stakeholder

groups may conflict (e.g., consumers and producers, workers and

management/shareholders)

ME2.03 - use economic models (e.g., competitive market) to analyse

economic relationships and to forecast outcomes (e.g., how changes in supply

and demand will affect price and output)

Lesson 4: Profitability

Overall Expectations

ESV.04 - describe the economic rights and responsibilities of citizens

EIV.02 - explain the functions of markets, profits, and the process of

economic decision making in the private sector

MEV.02 - analyse specific economic situations, using appropriate economic

concepts, models, and methods of economic inquiry

Specific Expectations

ES4.03 - analyse a current issue (e.g., pollution), identifying how the

economic rights of individuals must be balanced by economic responsibility

and public accountability

EI2.02 - explain the importance of profit in the private sector and the factors

that determine the profitability of a business (e.g., demand, production costs,

amount of competition)

EI2.03 - explain how producers determine the most efficient way to use

resources and how much to produce

ME2.02 - use economic concepts (e.g., supply and demand) to analyse and

describe an economic reality or choice

9

Unit Synopsis

During this unit, students will understand the Ontario Ministry of Education expectations of business organizations and

financial management which is an essential necessity for all students. This unit will ensure that Ontario Grade 11 Economics

students taking CIE3M are comfortable with the structure of Business Organizations as well as their own Personal Finance.

The unit is broken down into multiple lessons, simulations as well as presentations. The entire unit requires 15 days,

estimated at 75 minutes per day, for completion of all the lessons, activities, assessments and presentations. During the

presentation component, at the end of the unit, time must be provided for the students to work on and complete the group

presentation and therefore, with one day provided as a work day and a delay of one day before presentations, one day has

been built in where the next lesson must be started to be taught before the presentation date itself. Below is a brief layout of

the days required for the unit:

DAY(S)

DESCRIPTION

1-3

Lesson #1

4-5

Lesson #2

6-8

Lesson #3

9-11

Lesson #4

12

Simulation Day #1

13

15

Simulation Day #2

Work Period – Reflections and

Presentations

NEW UNIT STARTS HERE

16

Presentation Date!*

14

10

Provided below is a synopsis table describing the lesson, teaching strategies and expectations of each lesson of the unit.

Lesson Title

/ Duration

LESSON 1

Lesson Description

Students will learn how to conduct

appropriate research

Students will learn how to use

internet resources to find relevant

information for purchasing decisions

Students will create a company

profile

Students will then, in Lessons 2 and

3, learn the different options they

have to spend and save

Teaching/Learning

Strategies

(Achievement Chart

Categories)

Athlete Purchase (K/U)

Research (K/U, T/I, A)

Company Profile (K/U,

T/I, A)

11

Expectations

EM2.04 - describe how saving

benefits the individual and the

economy

EM2.05 - describe different forms

of savings income (e.g., interest,

dividends, capital gains, rent) and

how they benefit the individual

and the economy

ES1.04 - analyse choices and

determine the best method of

payment (e.g., cash, credit, loan,

rent, lease) for major consumer

purchases (e.g., cars,

accommodation)

SI1.02 - describe the criteria that

consumers and producers each use

to determine which of several

choices is in their own best

interest

ME1.02 - evaluate the usefulness

of economic information by

considering the reliability of its

source (e.g., authority, expertise,

impartiality) and the quality of its

content (e.g., use of logical

arguments supported by evidence,

absence of bias, avoidance of

unsubstantiated assumptions)

ME2.01 - interpret current

financial information from various

sources (e.g., information from

banks or stock markets that

incorporates statistics and

forecasts)

LESSON 2

NOTHING IS EVER

FREE:

PERSONAL

FINANCIAL

MANAGEMENT

2 Days

Students will get a good idea of how

much they spend on a daily, weekly,

and a monthly basis.

Students will compare differences in

monthly spending dependent on

months to show higher and lesser

spending habits

Students will be able to predict costs

of future endeavors.

Students will plan how much money

they might need in the coming 5

years to pay purchases of their

choice.

Students will draw upon their

knowledge of financial vehicles from

previous lessons and apply it into a

personal financial action plan.

Research Homework

(K/U, I)

Partnered Financial

Planning (K/U, T/I, A)

Exit Card / Reflective

Work (K/U, C)

12

EM2.01 - identify the financial

planning principles that people

follow when they budget, invest,

and save (e.g., start saving early,

take advantage of compound

interest, recognize the value of

diversification)

EM2.03 - evaluate, using financial

criteria (e.g., yield, rate of return,

liquidity, risk), the

appropriateness of different types

of financial assets at different

stages of life

ME2.04 - use methods of

economic inquiry (e.g., cost

benefit analysis) to evaluate an

economic choice from the

perspective of the affected

stakeholders

LESSON 3

GETTING DOWN

TO BUSINESS:

BUSINESS

ORGANIZATIONS

3 Days

LESSON 4

ACHIEVING BANG

FOR YOUR BUCK:

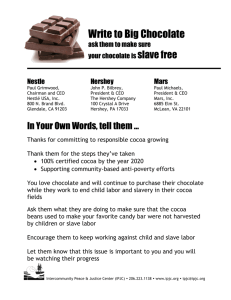

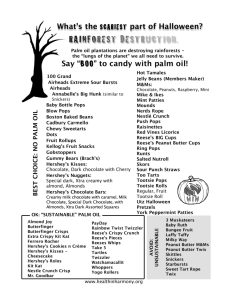

Students will learn the types of

business organizations and identify

the advantages of disadvantages of

each structure.

Students will apply this knowledge

by reading about how different candy

companies emerged and considering

and considering what type of

business structure they would advise

the new companies to choose.

Students will connect to the realworld by researching locallyoperating companies and questioning

the structure of their business model.

Students will communicate their

understanding through minipresentations and a written business

profile

Students will investigate how

businesses are structured in

competitive and non-competitive

markets through brainstorming types

of companies in both markets and

reflecting on similarities and

differences

Students will gain an understanding

of the importance of profit for

businesses in the private sector

Students will identify factors

affecting profitability

Advantages/

Disadvantages matching

(K/U)

Role play (acting as

business consultants) (A)

Group research on a local

company(T/I)

Writing a business

profile (C)

Mini-presentation (C)

Brainstorm (T/I)

Cooperative Learning

Strategies- TPS, Placemat

Adaptation, Numbered

Heads (K/U, T/I, A)

13

EI2.04 - compare the

characteristics of the different

structures of business

organizations (i.e., sole

proprietorship, partnership,

corporation, cooperative)

EI2.05 - compare the

characteristics of firms and of

competition in perfectly and

imperfectly competitive markets

(e.g., monopoly and oligopoly)

SI3.01 - describe examples of

how the self-interest of different

stakeholder groups may conflict

(e.g., consumers and producers,

workers and

management/shareholders)

ME2.03 - use economic models

(e.g., competitive market) to

analyze economic relationships

and to forecast outcomes (e.g.,

how changes in supply and

demand will affect price and

output)

ES4.03 - analyse a current issue

(e.g., pollution), identifying how

the economic rights of individuals

must be balanced by economic

responsibility and public

PROFITABILITY

3 Days

Students will investigate how the

profitability of the business they

investigated in Lesson 3 is impacted

by these factors (will be used in CA)

Students will learn about how

producers determine efficient

resource allocation

Students will critically analyze the

impacts of our current methods of

production on our planet

Students will understand

expectations for CA

Direct Instruction (K/U)

Note-taking from Audio

Clip (K/U, C)

Role Play (Truffles

Decisions) (T/I, A)

Research and Profile

Creation (T/I)

Group Presentations (C)

14

accountability

EI2.02 - explain the importance of

profit in the private sector and the

factors that determine the

profitability of a business (e.g.,

demand, production costs, amount

of competition)

EI2.03 - explain how producers

determine the most efficient way

to use resources and how much to

produce

ME2.02 - use economic concepts

(e.g., supply and demand) to

analyse and describe an economic

reality or choice

Financial Management

and

Business Organizations

CULMINATING ACTIVITY

15

Culminating Activity- Put Your Money Where Your Mind Is!

Major Details

Description

This unit’s culminating activity, Put Your Money Where Your Mind Is, provides

students with an opportunity to apply what they have learned in unit lessons in an

investment simulation. Through role play, students will develop their decision

making-skills while managing a wealthy client’s asset portfolio. The use of group

learning will allow students to learn from one another while intergroup competition

will provide them with additional motivation to succeed within the activity.

The main components of this activity include 1) an investment simulation, 2)

a journal reflection describing decisions made and lessons learned, and 3) a

presentation where student can communicate their scenario and discoveries to the

class. The simulation ensures students have an opportunity to apply their newfound

economic and financial knowledge to make wise decisions in the simulated role play.

By including individual journal reflections each student will be accountable for

articulating their group’s investment strategies. Knowing they are responsible for

journal entries as well as a class presentation will help students think critically

about the choices they make rather than simply invest their client’s money

randomly.

Assessment of the culminating activity consists of a variety of strategies and

students are assessed at the individual and group levels with criteria provided prior

to assessment (see student process). This unit’s lessons are filled with formative

assessment around the skills required to be successful in this activity. Therefore, all

summative evaluation for this unit is associated with the culminating activity. The

teacher will assess each student’s journal reflection (40%) using an analytic rubric;

will assess student presentations using a holistic rubric at the group (content-15%)

and individual (delivery-25%) levels; and will assess their participation in the

simulation (5%) at the group level using a checkbric. A presentation peerassessment checkbric (how accurately a student assesses a peer presentation) and

group participation self-assessment checkbric will also be used to encourage

assessor variety. Rubrics and other assessment tools are provided in Handouts L-Q.

16

Culminating Activity Expectations

Specific Expectations that are being addressed:

EM2.01 - identify the financial planning principles that people follow when they

budget, invest, and save (e.g., start saving early, take advantage of compound

interest, recognize the value of diversification)

EM2.03 - evaluate, using financial criteria (e.g., yield, rate of return, liquidity, risk),

the appropriateness of different types of financial assets at different stages of life

EI2.02 - explain the importance of profit in the private sector and the factors that

determine the profitability of a business (e.g., demand, production costs, amount of

competition)

EI2.04 - compare the characteristics of the different structures of business

organizations (i.e., sole proprietorship, partnership, corporation, cooperative)

ME1.02 - evaluate the usefulness of economic information by considering the

reliability of its source (e.g., authority, expertise, impartiality) and the quality of its

content (e.g., use of logical arguments supported by evidence, absence of bias,

avoidance of unsubstantiated assumptions)

ME2.04 - use methods of economic inquiry (e.g., cost-benefit analysis) to evaluate

an economic choice from the perspective of the affected stakeholders

ME3.01 - communicate the results of inquiries, using a variety of styles and forms

(e.g., reports, essays, discussions, presentations), as well as visual supports (e.g.,

charts, graphs, computer presentations)

17

The Teacher Process

The Culminating Activity will be introduced in the first lesson of this unit. This

allows students to understand how they will be evaluated and to prepare

themselves for the summative assessment portion of the unit. Tasks that are

completed by students throughout the unit will be used in the CA, making the CA

truly authentic. Students will have a deep understanding of the stock profiles and

business profiles they encounter during the CA as they created them.

Each lesson builds on one another and students develop the skills they need to be

successful during the succession of lessons. Each lesson incorporates numerous

connections to the CA and these are explained in greater detail in the individual

lesson outlines.

The following guidelines should be followed to ensure smooth execution of the CA.

Note: the handout titles are bolded and are listed at the point in the unit when they

should be distributed.

Days 1-3: Lesson 1: Spend/Save/Invest

Introduction to the CA:

The CA activity should be introduced on the first day of the unit. While the unit

objectives are being discussed, the CA should be presented and the first page of the

Student Process should be distributed.

Stock Profile Creations:

Students will choose a publicly traded company from the Company List (Handout

H). Students will track their chosen stock over the course of the unit and they must

write a profile for their chosen company. Details about the selection process, profile

criteria and an exemplar can be found in Lesson 1. A selection of these profiles will

be presented to the students during their CA as investment options.

Essential Knowledge and Skills for the CA:

Students will consider several different investment options and learn about the

differences between spending, saving and investing. They will have to make

decisions between these options during the CA. Students will also learn to assess the

reliability of information which will be used to critique the advice of financial

analysts.

Days 4-5: Lesson 2: Personal Financial Management

Essential Knowledge and Skills for the CA:

Students will be asked to consider financial goals that they wish to achieve – which

can be transferred to the CA when considering the goals of their clients. Students

18

will gain insight on how basic financial vehicles work and how they may not be the

best way to achieve their goals but are the safest. Students will be asked to complete

an exit card – which will prepare them for the reflection cards at the end of each CA

year/period. Students will gain confidence from their decision-making experience,

which will help groups make decisions during the CA.

Days 6-8: Lesson 3: Business Organizations

Group Formation:

The CA groups will be assigned during this lesson. This will allow students enough

time to work through the “forming,” “storming,” “norming” and “performing” stages

identified in the literature of group dynamics. Students will partially self-select into

their groups by identifying five people they would like to work with. The teacher

will then finalize groups with the aim of mixing academic achievement, strengths,

gender, and interests. This strategy will ensure heterogeneous groups and prepare

students for the workplace, where they will often work with pre-determined teams

of diverse individuals. This rationale should be explained to the students; however

students should be assured that they will have at least one student from their

selection on their team. This will allow them to feel as though they have input into

the group formation process, validating the end result and ensuring a reasonable

comfort level in the group.

Business Profiles:

Business profiles written by students will be used as possible investment

opportunities for the CA. Although formative, it will be assessed using a checkbric

so students are familiar with one of the tools with which they will be evaluated in

the CA.

Essential Knowledge and Skills for the CA:

Students will develop an understanding of the different types of business

organizations and think about advantages and disadvantages of these types.

Students will use this knowledge when making business investment decisions

during the CA. Students will do mini-presentations regarding their businesses to

increase their comfort level speaking in front of the class. Students will also roleplay as consultants. They will read client profiles of people who want to start a new

business in the sweets industry and offer them advice on what type of business

organization the client should select. This will familiarize them with role-playing

and applying their economic knowledge to make decisions; both skills will be

assessed in the CA.

Days 9-11: Lesson 4: Profitability

CA Details:

It is during this three-day lesson, that the CA will be fully explained. Every student

must have a deep understanding of the process by the end of this lesson in order for

things to run smoothly when the simulation begins on Day 12.

19

On Day 9, the remainder of the student process and the Simulation Description

(Handout D) should be distributed to each student. The Consultant Role

Descriptions and Signups (Handouts A, B, C) should be distributed to each group

and each group must complete the signup sheet for submission the next day.

On Day 10, students will have to submit their role signups. All assessment handouts

will be distributed to every student. These are the Group Participation SelfAssessment(Handout L), the Checklist for Simulation (Handout M), the

Checkbric for Simulation (Handout N), the Reflection Rubric (Handout O), the

Presentation Rubric (Handout P) and the Presentation Peer-assessment

(Handout Q).

On Day 11, the process, purpose and requirements will be discussed again and

questions will be answered. All students must have a firm understanding of what

will take place during the next period.

Business Profiles Profitability Addition:

Students will write an addition to the business profiles they created in Lesson 3.

They will make connections to profitability, which is important to consider when

investing in businesses. There is a greater detail about this addition to the profile in

the lesson outline, including a checkbric for assessment. These profiles will be used

in the CA for business investment opportunities.

Essential Knowledge and Skills for the CA

During this lesson, students learn about profitability and consider the profitability of

several businesses. This is important for the CA as they will have the opportunity to

invest in businesses and they should be considering profitability during this

decision-making process. Also in this lesson, students give a brief presentation and

they peer-assess each other’s presentations. The criteria they use are taken from the

criteria by which they will be evaluated in their presentations in the CA.

Planning for Days 12-13:

It is essential that this setup occur before the first simulation day on Day 12. The

teacher needs to choose five stock profiles written by students that can be used for

stock investment opportunities. There are currently placeholders used in the Stock

Outcomes (Handout I), so if different companies are chosen, the outcomes may

need to be adjusted. This needs to be done prior to Day 12 and the teacher must be

ready to give out the stock profiles and outcomes during Days 12-13.

Similarly, for the business investments opportunities there are currently

placeholders/examples in the Business Opportunities/Outcomes (Handout J).

Business Profiles should be chosen from the ones that students produced during

Lessons 3 and 4. The outcomes can be tweaked based on the profiles selected. It

would be advisable to have outcomes suited to the profiles so that decision-making

20

can be evaluated. In addition to the student-created profiles, the teacher could

create additional business investment opportunities. Business profiles that are

similar to those chosen from the students could be fabricated with small key

differences. This would allow the teacher to evaluate students’ decision-making

abilities because students will have to make choices based on some factor, with all

else held constant.

Finally, the Random Outcomes (Handout K) should be sorted by each of the seven

teams. Some of them may be more appropriate for certain clients and it would make

sense to balance out random events to some extent. Events can be used for multiple

teams and the teacher can create new events. Not only do the events need to be

sorted by team, the events also need to be planned out for when they are going to be

distributed (the options are at the start of Year 2, Year 3 or Year 4). The events

should be on individual strips of paper, ready to be distributed at the right moment.

Finally, a team portfolio (folders) must be put together for each team. Each portfolio

should contain one Client Portfolio (Handout E), 16 Reflection Templates

(Handout F), and 2 Record Keeping Sheets (Handout G). There are seven client

portfolios so one should be assigned to each team.

Days 12-13: Simulation

The schedule for both simulation days is as follows:

5 minutes: Setup

20 minutes: Year 1 decision time (Year 3 for class period 2)

10 minutes: Reflection time

5 minutes: Setup

20 minutes: Year 2 decision time (Year 4 for class period 2)

10 minutes: Reflection time

5 minutes: Cleanup

The teacher must keep a stopwatch going and ensure that the schedule is

maintained.

During the first setup period, teams will be given their portfolio (folder), which will

be kept by the record keeper (or designate). The team should record their team

name as well as their names on the folder. Teams will read through their client

portfolios and prepare for decision time. The teacher must also distribute the Stock

Profiles and the Business Investment Opportunities before the decision time.

The reflection time can be used for the teacher to get prepared for the next year.

During the subsequent setup time, the teacher should be distributing random events

to specific teams as well as the outcomes for the stocks and business investment

opportunities to every team.

21

Day 14:

This is a work period for students. Their reflections are due in Day 15 and team

presentations will occur during Day 16. It is important that the teacher begins this

period revisiting the criteria for the presentation and the reflection and reading

through the rubrics with the students to ensure they are understand the

assessment. The self-assessment for group participation is also due on Day 15 so

students can work on this as well.

Day 15:

Scheduled for this period is the start of the next unit. This gives the students more

time to work on their presentations outside of class time. However, if anything

needs to be rapped up from this unit or from the CA, it can take place during this

day.

Day 16:

This is presentation day. The teacher must assign a peer-assessing group for each

group’s presentation.

22

The Student Process

Put Your Money Where Your Mind Is!

Financial Management and Business Organization Culminating

Activity

Congratulations! You and your renowned team of consultants have been hired to

manage a wealthy client’s portfolio. You will be provided with information about

this client and will manage his/her portfolio over a period of four years. These four

years will take place over two class periods at the end of this unit. The schedule for

these periods is as follows:

5 minutes: Setup

20 minutes: Year 1 decision time (Year 3 for class period 2)

10 minutes: Reflection time

5 minutes: Setup

20 minutes: Year 2 decision time (Year 4 for class period 2)

10 minutes: Reflection time

5 minutes: Cleanup

The knowledge and skills you will learn in this unit related to financial management

and business organization will help you make the best decisions for your client. Each

year you must make the following decisions:

1. How much to save. Savings earn a low rate of interest, at 2% per year, but can

be withdrawn at any point in time.

2. You have the option to buy, sell or hold shares from 5 different publiclytraded companies. You will be provided with the stock profiles as well as

what analysts are saying about the companies each year.

3. You have the option to invest in a number of businesses based on the profiles

you will be provided with.

Simulation Details:

See the Simulation Description Handout for a full outline of the simulation, as

well as the simulation rules.

Manager Roles:

Each member of your team will choose a manager role. The Description of

Roles Handout provides information about the various expectations

associated with each role. Each member of the team must signup for a role.

23

Criteria for Reflections:

1. You will be given time after each decision period to reflect on your decisions

and complete the reflection template. Use this time wisely; it is the time when

your ideas and decisions are still fresh in your mind!

2. You must submit your first two reflection templates at the end of the first

simulation day. They will not be evaluated at this point but this will allow for

a check on your progress. Your templates will be returned at the start of the

next period.

3. All four reflection templates must be completed and submitted at the start of

the second class following the last simulation day.

4. These can be hand-written as you will most likely be able to finish them

during the reflection period in class. However, they must be legible or they

will not be graded. If necessary or preferred, you can submit typed answers.

5. You must also submit one typed paragraph (of at least ten lines) that answers

the following question, “What is the most significant thing you learned from

the simulation and how can you apply this new understanding to your life?”

This is also due on the second day following the simulation.

6. You will be evaluated based on the attached rubric.

Criteria for Presentations:

CONTENT

Slides and presentation sequence- The presentation organized logically with

ideas presented sequentially. An outline slide should be included to let your

audience know how the presentation is structured and help you focus your

ideas. Slides and images should be creative but relevant to information being

presented with no spelling errors or formatting mistakes. Slides should not be

filled with words, use them simply as a guide for your main talking points. View

the online exemplar of a slide decks.

Outcome report- portfolio information for the four years must be reported. This

includes how much you started with, the value after each “year” and the final

value. The total growth (as a percentage of the original portfolio size) must be

clearly reported.

Justification of key decisions/strategies- Several explanations are given to justify

investment decisions which are based in sound economic reasoning. This should

include referencing considerations unique to your client.

Reflection- Includes at least one thing that your firm did well and at least one

thing that could have been done differently. Be sure to explain why you chose

these two examples.

Economic language & understanding- Use economic language appropriately and

often. Integrate the key terms that we have learned over this unit as well as

24

since the beginning of the course. Make an effort to demonstrate your

understanding of key concepts from this unit (i.e. profitability, investment,

interest rates, ownership structure, risk, etc.)

DELIVERY

Confidence and engagement- Look at all audience members when presenting

and avoid using your notes as much as possible. Resist reading off of the slides

(this can be avoided by keeping your slides simple).

Physical communication- Project your voice so that people can hear you at the

back of the room. Use confident body language: avoid crossing your arms,

putting hands in your pockets or fidgeting with items.

Participation- Develop a “script” with your team so people know who is speaking

and when. Be sure that every team member has a speaking role in the

presentation. (Absentee policy: You must notify the teacher of any unavoidable

absences with at least three days notice. Absences as a result of illness require a

doctor’s note or they will affect your mark).

Assessment and Evaluation:

The following table shows the overall evaluation plan for the CA (Details for each

assessment are included in the Assessment Handouts):

Task

Tool

Simulation

Checklist

Simulation

Checkbric

Group

Checkbric

Participation

Analytic

Reflections

Rubric

Presentation Checkbric

Holistic

Presentation

Rubric

Achievement

Chart

Category

Group/

Individual

Assessor

Value

A

T/I, A

Group

Group

Self

Teacher

Formative

5%

T/I, C

Individual

Self

10%

K/U, T/I, C, A

Individual

Teacher

40%

K/U, C

Group

Peer

5%

K/U, T/I, C, A

Group/Individual Teacher

Total

25

40%

100%

Unit Assessment Plan

During this unit, students will be assessed constantly for Knowledge and

Understanding with the use of formative assessments. Understanding the Ministry

expectations of business organizations and financial management is an essential

necessity for all students. This unit will ensure that Ontario Grade 11 Economics

students taking CIE3M are comfortable with the structure of Business Organizations as

well as their own Personal Finance.

The formative assessments will allow the teacher to know where modifications to

the lesson must be made as well as help students be confident that they understand the

course material. Along with formative assessments – which come in a variety of delivery

tools – the culminating activity will use a multitude of assessments, assessment tools

and assessors. This will involve the students in their own learning and assessment

strategy to provide a built-in accountability from the student.

Below is a list of all the assessment tools, strategies and information required for

each of the lessons within the unit as well as a breakdown of the culminating activity

assessment plan.

Lesson 1: Spend, Save, Invest

Task

Athlete

Purchase

Reasoning

Tool

Check for

understanding

Research

Check for

understanding

Company

Profile

Check for

completion

and

understanding

Achievement

Chart Category

Knowledge/

Understanding,

Knowledge/

Understanding,

Thinking/Inquiry,

Application

Knowledge/

Understanding,

Thinking/Inquiry,

Application

Assessor

Teacher

Value

Diagnostic

Self/Peer/Teacher Formative

Teacher

Formative

Lesson 2: Personal Financial Planning

Task

Research

Homework

Tool

Achievement Chart

Category

Check for

Knowledge/Understanding,

completion and

Thinking./Inquiry

understanding

26

Assessor

Self/Peers

Value

Formative

Partnered

Financial

Planning

Check for

understanding

Exit Card /

Reflective

Work

Check for

understanding

Knowledge/

Understanding,

Thinking/Inquiry,

Application

Knowledge/

Understanding,

Communications

Teacher

Formative

Self/Teacher

Formative

Lesson 3: Business Organization

Task

Tool

Achievement Chart

Category

Advantages/

disadvantages

match group

activity

Check for

understandi

ng

Knowledge/Understanding

Self/Teacher Formative

Role Play

Check for

understandi

ng

Thinking/Inquiry,

Application

Self/Teacher Formative

Written

business

profile

Checkbric

Communication

Self/Teacher Formative

Assessor

Value

Lesson 4: Profitability

Task

Factors

Influencing

Profitability

Profitability

Addition to

Business

Profiles

Truffles Note

Taker

Truffles Group

Discussion

Tool

Achievement Chart

Category

Assessor

Value

Observation

Knowledge/Understanding

Teacher

Formative

Checkbric

Thinking/Inquiry,

Application

Teacher

Formative

Self/Peer

Formative

Teacher

Formative

Observation

Observation

Knowledge/Understanding,

Communication

Thinking/Inquiry,

Application

27

“Story of Stuff”

Question

Responses

“Story of Stuff”

Brief

Presentations

Observation

Thinking/Inquiry,

Application

Teacher

Formative

Checklist

Communication

Peer

Formative

Culminating Activity: Put Your Money Where Your Mind Is!

Task

Tool

Simulation

Checklist

Simulation

Checkbric

Group

Participation

Checkbric

Reflections

Analytic

Rubric

Presentation

Checkbric

Presentation

Holistic

Rubric

Achievement Chart

Category

Application

Thinking/Inquiry,

Application

Thinking/Inquiry,

Communication

Knowledge/Understanding,

Thinking/Inquiry,

Communication,

Application

Knowledge/Understanding,

Communication

Knowledge/Understanding,

Thinking/Inquiry,

Communication,

Application

Assessor

Value

Self

Formative

Teacher

5%

Self

10%

Teacher

40%

Peer

5%

Teacher

40%

Total

100%

The assessment tools used in the Culminating Activity, above, are not necessarily

marked at the same percentage weight shown above. Additional calculations will be

required on the part of the teacher. Some assessments are assessed or evaluated on

scales significantly above the percentage weight – for example, the Group Participation

Checkbric that is worth 10% of the Summative evaluation is a 4 part checkbric, with

each calculated out of 33 marks. Therefore, the total possible points equal 132 but it is

only weighted at 10%. Therefore it is the teacher’s responsibility to pay attention to the

assessment weighting scheme outlined above.

28

CONSULTANT ROLES - Put Your Money Where Your Mind Is!

In this activity, you will be working in groups of 4 as a consulting group. Your consulting

group has been hired to spend, save and invest a specific client’s money. The four of you

in your group each have a unique role within your consulting group.

Read the descriptions below and decide who in your group will play each of the

managers. Each group member must be assigned a role and that role will be your role

for the entire project.

A. Market Analyst

Will relay information from the teacher to team members about stock

information and unexpected occurrences as they happen

Will be required to research the investments as your group requires to make

their decision

Will be responsible for facilitating research and having questions answered as

they arise within the group

Will be expected to speak and provide information equally during the

presentation

B. Financial Planner

Will be responsible for keeping the team motivated and on task

Will work alongside all members of the team to make financial decisions

Will be the responsible for finding out how financial calculations are to be done

Will be expected to speak and provide information equally during the

presentation

C. Communications Representative

Will relay information about the presentation between the teach and the group

Will collect and hand in all checkbrick sheets to the teacher from all team

members after every round

Will be expected to speak and provide information equally during the

presentation

Will take the lead role in compiling the information provided from all team

members into the final presentation (for handing in)

D. Record Keeper

Will be responsible for filling in and handing in the record keeping sheet every

“year” of the project – all 4 times

Will be responsible for handing out all checkbricks and assessments to team

members at the appropriate times during the activity

Will be in charge of the portfolio (folder) and records at all times

Will be expected to speak and provide information equally during the

presentation

29

CONSULTANT ROLES - Put Your Money Where Your Mind Is!

Once you have decided on your roles, come up with a creative team name that

represents your Consulting Group’s Identity. Record your consulting team name as well

as your name beside your consultant role.

Record Keeper Fill out this sheet and keep one copy in your team’s portfolio and hand

in the second copy to the teacher.

CONSULTANT GROUP NAME:

CONSULTANT ROLES:

(Come up with a creative Consulting Group name.)

(Fill in one team member’s name beside each role.)

MARKET ANALYST:

____________________________________

FINANCIAL PLANNER:

___________________________________

COMMUNICATIONS REPRESENTATIVE:

____________________________________

RECORD KEEPER:

____________________________________

By writing my name beside the roles above, I hereby agree to fulfill this role and assist

my team members during the entire project.

Teacher’s Copy – To be handed in

30

CONSULTANT ROLES - Put Your Money Where Your Mind Is!

Once you have decided on your roles, come up with a creative team name that

represents your Consulting Group’s Identity. Record your consulting team name as well

as your name beside your consultant role.

Record Keeper Fill out this sheet and keep one copy in your team’s portfolio and hand

in the second copy to the teacher.

CONSULTANT GROUP NAME:

CONSULTANT ROLES:

(Come up with a creative Consulting Group name.)

(Fill in one team member’s name beside each role.)

MARKET ANALYST:

____________________________________

FINANCIAL PLANNER:

____________________________________

COMMUNICATIONS REPRESENTATIVE:

____________________________________

RECORD KEEPER:

____________________________________

By writing my name beside the roles above, I hereby agree to fulfill this role and assist

my team members during the entire project.

Group Copy – To be kept in the portfolio

31

Simulation Description

Your team of consultants will simulate investment decisions and financial

planning for your client.

The simulation takes place over four years, which happen over the course of two

75-minute class periods.

The schedule for each class period is as follows:

5 minutes: Setup

20 minutes: Year 1 decision time (Year 3 for class period 2)

10 minutes: Reflection time

5 minutes: Setup

20 minutes: Year 2 decision time (Year 4 for class period 2)

10 minutes: Reflection time

5 minutes: Cleanup

Each year you must make the following decisions and record them:

1. How much to save. Savings earn a low rate of interest, at 2% per year, but can

be withdrawn at any point in time.

2. You have the option to buy, sell or hold shares from 5 different publiclytraded companies. You will be provided with the stock profiles as well as

what analysts are saying about the companies each year.

3. You have the option to invest in a number of businesses based on the profiles

you will be provided with.

The results of your decisions from the previous year will be shared with you at

the start of the next year.

Simulation Rules

Each team must pay the banker 100,000 at the start of each year to mimic client

spending.

If a team requires funds, but has no cash on hand or in a savings account, the

team can borrow from the bank at a rate of 29% per year.

By the end of the 20-minute decision period, your group must have completed

both sets of records- one must be submitted to your teacher at the end of the 20

minutes and your group holds on to the other one.

Team portfolios, including ALL sheets distributed in this process, must be

returned at the end of each class period.

No speaking allowed during the reflection periods.

32

CLIENT PROFILES - Put Your Money Where Your Mind Is!

In this activity, your consulting group has been hired to spend, save and invest a specific

client’s money. Your client profile is described below. Please read it carefully as it will

help you in your financial decisions.

CLIENT:

Melinda Bates

ASSETS:

$500,000.00

INCOME PER YEAR:

$1,000,000.00

DESCRIPTION OF CLIENT:

Melinda Bates (age range: 40-50) is the wife of a wealthy technology giant. She is

a stay-at-home, independent woman with a good chunk of change of her own. She has

hired to your consulting group to help her increase her wealth.

She has come to you with $1.5million of capital (including assets and income) in

your first year as consultants. Every year after that, she adds an additional one million

dollars to her capital for you to spend, save or invest.

Melinda wants to make as much money as she can no matter what. Her goal is to

double her capital every single year – i.e. make $3million at the by the end of the first

year, $6million by the end of the second year, $12million by the end of the third year and

finish with $24million dollars by the end of your 4-year consulting contract.

There is one thing to note about Melinda. As much as she wants to make lots and

lots of money, she hates losing money. If you lose any of her money, be sure that she will

ask you to explain exactly why you lost her money. She expects to be convinced that you

had considered all possible options and that the one you chose was the best – even if it

caused her to lose money.

33

CLIENT PROFILES - Put Your Money Where Your Mind Is!

In this activity, your consulting group has been hired to spend, save and invest a specific

client’s money. Your client profile is described below. Please read it carefully as it will

help you in your financial decisions.

CLIENT:

Laurene Rowell

ASSETS:

$2,500,000.00

INCOME PER YEAR:

$500,000.00

DESCRIPTION OF CLIENT:

Laurene Rowell (age range: 35-55) is the wife of the famous Pear Computers. She

is a very busy business woman and doesn’t have time to speak to you about her finances.

She has hired your consulting group to help her manage and invest her money.

She has come to you with $3million of capital (including assets and income) in

your first year as consultants. Every year after that, she adds an additional five-hundredthousand dollars to her capital for you to spend, save or invest.

Laurene trusts your consulting group and wants you to make the best decisions

for her money. She hasn’t specified an end target goal for her money, but like anyone,

she hopes that it will go up. She wants to make more money than a general or high

interest savings account will give her.

There is one more thing about Laurene. She is a very busy woman and basically is

allowing you to play with her money. If you can make her a lot of money, she is likely to

re-hire you as her financial consulting team for a long, long time to come. If you lose her

money, she will make sure you never get hired again by anyone. So make her proud!

34

CLIENT PROFILES - Put Your Money Where Your Mind Is!

In this activity, your consulting group has been hired to spend, save and invest a specific

client’s money. Your client profile is described below. Please read it carefully as it will

help you in your financial decisions.

CLIENT:

James Palsillie

ASSETS:

$7,000,000.00

INCOME PER YEAR:

$0.00

DESCRIPTION OF CLIENT:

James Palsillie (age range: 35-45) is one of the co-founders of the infamous and

historic technology hoopla that is The BlueBerry. He is a very confident businessman

and although he is co-founder, he still manages to find time to spend and invest some of

his own money – like buying NHL hockey teams. James has hired your consulting group

to help him manage and invest some of his money.

He has come to you with $7million of capital (including assets and income) in

your first year as consultants. Here’s the catch! That is all you will have, James will not

be giving you any more money to invest. So as years go by, you will only have the capital

and interest earned from your decisions. He will NOT be giving you any additional

money.

James wants you to make the best decisions for his money. He doesn’t have a goal

that he is working towards as he is financially set for the rest of his life. James was told

that your consulting group is one of the best and so he decided to give you $7million to

show him how good your consulting group really is.

There is one more thing about James. James is allowing you to play with his

money and do whatever you want. You can choose to make him a lot of money or lose it

all. James is very particular about his finances and so no matter whether you make him

money or lose his money, you better keep detailed and meticulous notes about where

every penny went. He will ask you for it.

35

CLIENT PROFILES - Put Your Money Where Your Mind Is!

In this activity, your consulting group has been hired to spend, save and invest a specific

client’s money. Your client profile is described below. Please read it carefully as it will

help you in your financial decisions.

CLIENT:

Mr. Jash Woolaust

ASSETS:

$1,500,000.00

INCOME PER YEAR:

$52,140.00

DESCRIPTION OF CLIENT:

Jash (age range: 25-35) is a high school economics teacher and just won a small

part of the lottery. He and his colleagues buy a bunch of group tickets every month and

this was their lucky month. Jash’s share of the winnings is $1.5million. He is a really good

economics teacher and knows a lot about the markets but doesn’t have the power to

click buy or sell when it comes to personal investments. Therefore, he has hired your

consulting group.

He has come to you with just over $1.55million of capital (including assets and

income) in your first year as consultants. In every additional year, he will give you

another $52,140.00 to spend, save or invest – that is his annual income. He’s giving you

all his money to deal with so don’t let him go bankrupt.

Jash wants you to make the best decisions for his money. He wants to make his

money now grow as quickly as possible but needs to be certain that he will not lose his

money. As an economics teacher, he knows that the markets fluctuate and therefore will

be following all of your decisions.

There is one more thing about Jash. Jash is very particular about his money. This

is the first time he has seen this much money. All of his debts are paid off and now he’s a

millionaire. He wants to make sure that he stays that way and preferably his money

grows. He is very scared about losing money so make sure you document all your

choices and explain why so that he can understand all of your decisions. He asks you

don’t lose ANY of his money.

36

CLIENT PROFILES - Put Your Money Where Your Mind Is!

In this activity, your consulting group has been hired to spend, save and invest a specific

client’s money. Your client profile is described below. Please read it carefully as it will

help you in your financial decisions.

CLIENT:

Robert Mattinson

ASSETS:

$100,000.00

INCOME PER YEAR:

$440,000.00

DESCRIPTION OF CLIENT:

Robert Mattinson (age range: 15-25) is a rising star in Hollywood. He has had a

couple huge blockbuster hits and has spent most of his earning on his brand new

mansion in East Los Angeles. He is constant asked for autographs and is given new

movie scripts all the time. Unfortunately, you never get to meet him but you’ve met with

his accountant. His accountant has hired you to spend, save and invest Robert’s money.

He has come to you with five-hundred and forty-thousand dollars of capital

(including assets and income) for you to work with in your first year as consultants.

Each year after that, he will give you another $440,000.00 to add to the capital and

interest from the previous year – and you will spend, save and invest it again.

Robert doesn’t really understand how financial markets work and only cares

about making money. His accountant wants you to make the best decisions for his

money. He has a very simple goal. He wants to be able to buy a couple new cars (a

Porche GT Turbo that costs over $500,000 and the new McLaren that costs over

$600,000) as well as a summer home in the South of France (as you can imagine this

costs a lot of money).

There is one more thing about Robert. Since Robert is a celebrity, if you lose his

money, it’ll be all over the tabloids. At the same time, if you make him a lot of money,

he’ll refer you to his celebrity friends and your consulting group will be in business for

years to come.

37

CLIENT PROFILES - Put Your Money Where Your Mind Is!

In this activity, your consulting group has been hired to spend, save and invest a specific

client’s money. Your client profile is described below. Please read it carefully as it will

help you in your financial decisions.

CLIENT:

Gordie Whye

ASSETS:

$4,500,000.00

INCOME PER YEAR:

$75,000.00

DESCRIPTION OF CLIENT:

Gordie Whye (age range: 60-70) is a retired hockey player who, over his years of

playing, has created a name for himself. Even after retiring, he still makes about seventyfive thousand dollars in commercials and endorsements. He is a household name in

Canada’s Hockey history.

He has come to you with over $4.57million of capital (including assets and

income) in your first year as consultants. He has promised that he will give you an

additional $75,000.00 every year after that for you to invest as well. As a retiree, he

doesn’t have much income and wants to be assured that you will not lose any of his

money.

Gordie wants you to spend, save and invest his money by making the best

decisions possible. He is not too concerned about making tens of millions of dollars but

rather he is more concerned about losing his money. Since he is getting older, he wants

to make sure that he always has enough money on hand to pay for medical bills and

luxuries whenever he wants.

There is one more thing about Gordie. Gordie took all of his risks when he was

younger and on the ice. He doesn’t want to hear any surprising news from your

consulting group about unexpectedness in the markets. He wants you to be on the top of

your game and be able to look out for what will happen in the future. Basically he wants

you to make the best possible decision at all times when it comes to his money.

38

CLIENT PROFILES - Put Your Money Where Your Mind Is!

In this activity, your consulting group has been hired to spend, save and invest a specific

client’s money. Your client profile is described below. Please read it carefully as it will

help you in your financial decisions.

CLIENT:

Bobyn Rihanna Fenty

ASSETS:

$2,800,000.00

INCOME PER YEAR:

$1,200,000.00

DESCRIPTION OF CLIENT:

Bobyn Fenty, a.k.a. Rihanna (age range: 20-30) is a well known recording artist.

She has made it big after signing a recording contract with one of the largest record

labels in New York City, Mockafella Records. She is a huge artist and is known amongst

all age groups but is particularly well known to adolescents and young adults.

She has come to you with $4million of capital (including assets and income) in

your first year as consultants. She will give you an additional $1.2million every year

after that for you to spend, save or invest as well. As an artist, she likes her money, her

dough, her cheddar, her green and doesn’t like losing any of it.

Rihanna wants you to make the best decisions for her money. She is looking to

buy one of the most expensive properties in New York City. Since New York City is really

expensive, she is going to need at least $20million to buy the dream property that she

has been looking at. Just remember, Rihanna loves to shop and always needs to have

spending money to buy luxuries whenever she wants.

There is one more thing about Rihanna. Rihanna is a very generous woman and

likes to give back to her community and to those who need it. Therefore, she asks that

you donate at least 10% of her capital to charity every year. She also likes to change her

charity every year so that she can help as many people as possible. Make sure you keep

record of these donations because she’ll need to know about it when the media

interviews her.

39

Reflection Template

1. Describe the decisions you made as a group this year.

2. Describe the thought process behind each of your decisions.

3. Is there any decision that you disagreed with? Why?

Reflect on your decisions and the results from the previous year.

4. Describe the positive outcomes of your decisions.

5. What are the causes of these outcomes?

40

6. Describe the negative outcomes from your decisions.

7. What are the causes of these outcomes?

8. Given the chance to go back, how would you change your decisions? Why?

41

CLIENT: ________________________________

GROUP: ____________________________________

On this sheet, record the consultant’s agreed upon decision to spend, save or invest. Be as detailed as possible.

You will use this same sheet to record all of your decisions over the 4 year period that you have been hired for by

your clients.

Unless otherwise instructed, the last column will be filled out by the teacher.

Investment Description

Spent, Saved

or Invested

Capital

($ Amount)

Example: CIBC Savings Account

Saved

$50,000.00

Example: Google Stock (Low Risk Stock)

Invested

$10,000.00

RANDOM SCENARIO LOSSES OR EARNINGS

TOTAL

42

Total Earned/Lost

(Capital + Interest - Losses)

Company List

Yahoo! Inc. (YHOO)

Garmin Ltd. (GRMN)

Sirius Satellite Radio, Inc. (SIRI)

HJ Heinz Co. (HNZ)

Heartland Inc. (HTLJD.OB)

Lockheed Martin Corporation (LMT)

Dr Pepper Snapple Group, Inc. (DPS)

Sara Creek Gold Corp (SCGC.OB)

Pepsico, Inc. (PEP)

World Wrestling Ent (WWE)

Boston Scientific Cp (BSX)

Domino's Pizza, Inc. (DPZ)

Royal Bank of Canada (RY.TO)

Bank of Montreal (BMO)

Starbucks Corp. (SBUX)

Apple Inc. (AAPL)

GameStop Corp. (GME)

Synovus Financial Corp. (SNV)

Adventrx Pharmaceuticals, Inc. (ANX)

Microsoft Corporation (MSFT)

USA Video Interactive (US.V)

Fortuna Silver Mines Inc (FVI.TO)

Randgold Resources Limited (GOLD)

SPDR Gold Shares (GLD)

Diamond International Exp (DIX.V)

Nike Inc. (NKE)

General Dynamics Corp. (GD)

Research in Motion LTD (RIM.TO)

43

Nike

(NKE)

John’s Advice

Lisa’s Advice

YEAR 1

Current Price: 62.50

Nike is releasing their new sweat absorbing shorts.

BUY

Nike is a fast and growing company. BUY

Gamestop

Corp.

(GME)

Current Price:

John’s Advice

Lisa’s Advice

I love videogames! BUY

Videogame piracy is lowering videogame sales.

SELL

USA VIDEO

INTERACTIVE

CRP

(US.V)

20.25

Current Price:

0.04

John’s Advice

Lisa’s Advice

You always want to be on top of new technologies. BUY

Software is constantly changing. Too risky. SELL

SPDR Gold

Shares

Current Price:

John’s Advice

American dollar is unstable.

BUY

Gold is rising. BUY

Lisa’s Advice

DR Pepper Snapple

Group, Inc.

(DPS)

John’s Advice

Lisa’s Advice

104.09

Current Price:

27.33

New line of healthy drinks should increase profits.

BUY

It’s all about the H20. SELL

44

Nike

(NKE)

John’s Advice

Lisa’s Advice

YEAR 2

Current Price: 67.57 Year 1 Price: 62.50

New CEO, restructuring basketball division. HOLD

New CEO means new endeavours, risky but exciting.

BUY

Gamestop

Corp.

(GME)

Current Price:

John’s Advice

New videogame systems should increase profits.

BUY

Won’t be able to restock products fast enough! BUY

Lisa’s Advice

USA VIDEO

INTERACTIVE

CRP

(US.V)

John’s Advice

Lisa’s Advice

18.10

Current Price:

0.05

Year 1 Price:

20.25

Year 1 Price:

0.04

Deal with Microsoft can make technology mainstream.

BUY

Deal with Microsoft can mean BIG profits. BUY

SPDR Gold

Shares

Current Price:

John’s Advice

Lisa’s Advice

It seems like gold is going to rise forever. BUY

Gold is rising. BUY

DR Pepper

Snapple Group,

Inc.

(DPS)

John’s Advice