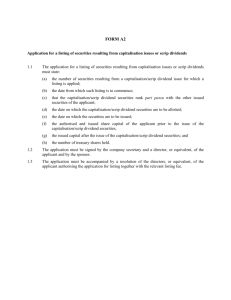

National Stock Exchange of India

advertisement