Apportionment Guidelines for Beneficiaries – Oct 2012

Apportionment Policy – Guidelines for Pobal Funded Organisations

What is Apportionment of Costs?

Apportionment of costs is the process of sharing an organisation’s expenditure among/across the individual funding streams / programmes that it implements. It relates to central costs that are applicable to more than one funding stream/programme, for example, salaries, general overheads and on-going running costs.

It is important for an organisation to develop, document and implement a method/basis of apportioning costs between the various programmes it manages.

When is an Apportionment Policy required to be submitted to Pobal?

All organisations that have multiple sources of funding and that apply to Pobal for funding towards salary and/or overhead costs (to be incurred in the implementation of that programme), are required to submit an apportionment policy to Pobal.

An Apportionment Policy should be prepared on a per company basis i.e. each company to have one policy only, not an individual policy for each funding stream/programme.

An apportionment policy is required to be submitted to Pobal as per the circumstances outlined above and: a.

on a once off basis at the application stage of a one-off Pobal grant programme (i.e. a programme that awards a specific amount of funding for a set period of time), b.

at the annual planning stage where funding is made to an organisation on an annual basis and the organisation is required to submit annual plans and c.

following a regular review of apportionment that results in a change to the current policy.

When apportionment of costs is not required

When the applicant organisation has applied for 100% funding towards a project and all costs in their entirety can be directly attributed to that project;

When the programmes concerned do not have an administration budget, for example, organisations applying to Pobal for a one-off grant to fund 100% of a specific cost e.g. 100% purchase cost of a suite of computers;

When a flat rate calculation for “indirect costs” can be applied. For some larger organisations with multiple funding streams the apportionment of indirect costs is not a practical or cost effective exercise for either the organisation to implement or for Pobal to verify. Subject to this approach being eligible within the Programme, e.g. the Peace 111

Programme, the applicant organisation reaches agreement at pre-contract with Pobal that indirect central admin costs can be claimed at a rate less than or up to 20% of the direct salary costs to the Programme.

Non-Apportionment of Costs

The implementation of apportionment policy / system is contingent on the capacity of a funding stream/programme’s budget to bear a related cost. Pobal accepts that some funding

streams/programmes do not have an administration budget. Under these circumstances, Pobal is agreeable to costs being charged to a separate Programme provided that the funding streams

/programmes are demonstrably complementary to each other e.g. Free Travel Passholder scheme & the Rural Transport Programme.

Please note that it is highly recommended that when taking on additional funding streams / programmes, that organisations assess the likely level of administration related to them and identify the existing administrative capacity of the organisation. As a rule organisations should actively seek funding for administration to ensure that all costs associated with administrating a programme are provided for.

Objective of Apportioning Costs

The objective in apportioning central costs is to charge each funding stream / programme with the proportion of the costs that fairly reflects their usage of related facilities:

Where, for example, the cost is the Manager’s salary, the cost should be apportioned by reference to the time the Manager spends on each funding stream / programme;

In situations where staff are engaged in a range of separate funding streams / programmes, it is recommended that the relevant staff keep timesheets in order to fairly apportion time and costs between the respective budgets;

Where an organisation apportions salary costs by making a calculated estimate of time spent on individual funding streams / programmes (e.g. 50% LCDP, 50% LEADER etc.), they must be able to demonstrate the basis for the percentage costs charged to the individual budgets e.g. by regularly keeping accurate time records for a typical week or month on which the percentage applied to the programme expenditure returns is then calculated. All timesheets must be certified at an appropriate level.

Apportionment of Central Costs

Where an organisation is managing a number of funding streams / programmes there will be certain costs that are directly attributable to particular funding streams / programmes (e.g. salaries of funding streams / programmes staff, travel and subsistence related to particular events, actions or functions), and there will be central costs that are common to all funding streams / programmes

(e.g. rent, insurance etc.).

Direct Costs

Directly attributable costs should always be charged in full to the related funding streams / programmes.

Organisations should use any opportunity possible to separate the costs of the funding streams / programmes managed (e.g. dedicating particular telephone lines to particular workers, etc.) where practical and cost efficient to do so.

Indirect Costs

There will always be a certain level of central costs that are shared among funding streams / programmes, and a method must be devised to apportion these costs in a fair and logical manner.

Clearly, this can only be done in respect of funding streams / programmes that provide administrative funding.

Overhead costs such as rent, light and heat, stationery etc. must be apportioned.

There are different methods of apportioning these costs e.g. o By reference to staff time, o By reference to floor space occupied by each funding stream / programme, o By reference to actual recorded usage,

Each method is valid provided it results in an unbiased allocation of costs to each funding stream / programme. It is important that the selected method is applied on a consistent

basis to all programmes implemented by the organisation.

Each organisation must use their own judgment in selecting the method that is most appropriate to them and is fair and logical, but must be able to fully justify the method used in the event of audit.

Apportionment may not be done on the basis of notional figures; only actual costs incurred

can be apportioned.

The method of apportionment of overheads should be agreed in writing with Pobal.

It should also be noted that certain capital costs such as office equipment may be apportioned in some circumstances; please refer to eligibility criteria of individual funding streams/programmes.

Review of Apportionment Percentages

Organisations must keep their apportionment of central costs under review as the circumstances of the various funding streams / programmes change (e.g. the completion of some and the commencement of others will mean that the initial apportionment percentages may need to be revised).

Apportionments set at the start of the year should be reviewed on a regular basis and any necessary adjustments made on a cumulative basis in that reporting period and within the financial year.

It is necessary for the organisation to agree revised apportionment percentages in consultation with

Pobal. In this regard, when changing percentages, it is prudent for organisations to discuss the rationale with the relevant Development/Case Officer in Pobal setting out the reason for the change and the basis on which the new apportionment is made. It is important to obtain written approval from Pobal before implementing any changes.

Sample Apportionment Policy

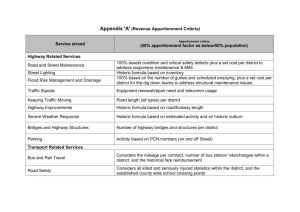

Below are samples of Apportionment Policies. They reflect two possible basis of apportionment and are for illustrative purposes only. Organisations are required to determine the apportionment basis most appropriate to them.

Pobal requires a documented apportionment policy which includes both narrative explanations of the apportionment basis/rationale being utilised and quantitative information, listing the actual percentages being applied in relation to each funding stream/programme, which identifies each of the shared overheads/costs.

SAMPLE 1

ABC Company Limited Apportionment Policy 20XX

ABC Company Limited receives funding from the LCDP Programme, the RTP Programme & from the

HSE. All of these funding streams/programmes include an administration allocation.

Directly attributable costs that relate to a specific programme will be charged in full to that

Programme, e.g. meeting expenses for the LCDP programme will be charged 100% to the LCDP programme.

Indirect costs that are shared and not directly attributable to an individual programme will be apportioned e.g. office rent. Apportioned costs are based on real identifiable costs, not notional costs*, and will be backed up by supporting documentation i.e. an original invoice/receipt, payroll records/timesheets, or an expenses claim.

Apportionment based on staff numbers at ABC Company Limited o The basis of apportionment used by ABC Company Limited in 20XX is its staff numbers. o ABC Company Limited overhead costs that are apportioned on this basis are rent, light & heat, service charges, audit fees, legal fees, printing & stationary and computer maintenance o The following table illustrates the apportionment basis to be applied to costs incurred:

Staff Member

No. days worked on

LCDP Per Week

No. days worked on

RTP Per Week

No. days worked on HSE Per Week

Total No. Days worked per week

A Smith

B Jones

5

2.5

0

0

0

2.5

5

5

C O'Brien

D Cook

E Byrne

F Quinn

Total Days

5

1.5

2

0

16

0

1

0

5

6

0

0.5

2

0

5

5

3

4

5

27

Apportionment

Percentage 60% 22% 18% 100%

ABC Company Limited review our apportionment policy on a regular basis as the circumstances of each programme can change throughout the year. Therefore the policy and the apportionment of costs will be reviewed and any necessary adjustments made on a cumulative basis. We will seek approval from Pobal for any changes to our Apportionment Policy in advance of implementation.

This policy was approved by the Board of ABC Company Limited on xx/xx/xx.

SAMPLE 2

XYZ Company Limited Apportionment Policy 20XX

XYZ Company Limited receives funding from the LCDP Programme, the RTP Programme & from

LEADER. All of these funding streams/programmes include an administration allocation.

Directly attributable costs that relate to a specific programme will be charged in full to that

Programme, e.g. meeting expenses for the LCDP programme will be charged 100% to the LCDP programme.

Indirect costs that are shared and not directly attributable to an individual programme will be apportioned e.g. office rent. Apportioned costs are based on real identifiable costs, not notional costs*, and will be backed up by supporting documentation i.e. an original invoice/receipt, payroll records/timesheets, or an expenses claim.

Apportionment based on floor space occupied by XYZ Company Limited: o The basis of apportionment used by XYZ Company Limited in 20XX is the floor space occupied by each funding stream. This has been calculated by reference to the total floor space available to the organisation as referenced in our lease agreement. o XYZ’s overhead costs that are apportioned on this basis are rent, electricity, service charges, accountancy fees, legal fees, printing & stationary & computer maintenance o The following table illustrates the apportionment basis to be applied to costs incurred.

Programme

LCDP

RTP

Leader

Total

Space Occupied

1400 sq ft

600 sq ft

1200 sq ft

3200 sq ft

Apportionment % based on Space Occupied

44%

18%

38%

100%

The total floor space is 3200 sq ft as outlined in our rental agreement and the total number of desks in the office is 16 and this forms the basis for the above split.

XYZ Company Limited review our apportionment policy on a regular basis as the circumstances of each programme can change throughout the year. Therefore the policy and the apportionment of costs will be reviewed and any necessary adjustments made on a cumulative basis. We will seek approval from Pobal for any changes to our Apportionment Policy in advance of implementation.

This policy was approved by the board of XYZ Company Limited on xx/xx/xx.

SAMPLE 3

123 Company Limited Apportionment Policy 20XX

123 Company Limited receives funding from the LCDP Programme, the RTP Programme & from the

Millennium Partnership Fund. All of these funding streams/programmes, except for the Millennium

Partnership Fund, include an administration allocation.

Directly attributable costs that relate to a specific programme will be charged in full to that

Programme, e.g. meeting expenses for the LCDP programme will be charged 100% to the LCDP programme.

Indirect costs that are shared and not directly attributable to an individual programme will be apportioned e.g. office rent. Apportioned costs are based on real identifiable costs, not notional costs*, and will be backed up by supporting documentation i.e. an original invoice/receipt, payroll records/certified timesheets, or an expenses claim.

Apportionment based on staff numbers at 123 Company Limited o The basis of apportionment used by 123 Company Limited in 20XX is its staff numbers. o 123 Company Limited overhead costs that are apportioned on this basis are rent, light & heat, service charges, audit fees, legal fees, printing & stationary and computer equipment

&maintenance.

Funding Restriction 20XX

The funding received by 123 Company Limited from the Millennium Partnership Fund has a specific term/condition restricting the apportionment of indirect administration to 10% as agreed with the funders.

The funding received from the Millennium Partnership Fund and the work delivered for the

Millennium Partnership Fund is complimentary to the work of the LCDP. 123 Company Limited is apportioning the indirect costs related to the Millennium Partnership Fund to the LCDP on the basis of the complimentary work undertaken.

The following table illustrates the apportionment basis to be applied to costs incurred:

Staff Member

No. days worked on

LCDP Per Week

No. days worked on

RTP Per Week

No. days worked on Millennium

Partnership Fund

Per Week

Total No. Days worked week per

A Smith

B Jones

5

2.5

0

0

0

2.5

5

5

C O'Brien

D Cook

E Byrne

5

1.5

2

0

1

0

0

0.5

2

5

3

4

F Quinn

Total Days

0

16

5

6

0

5

5

27

Apportionment

Percentage 60%

Adjusted

Apportionment

Percentage per funding restriction 68%

22% 18% 100%

22% 10% 100%

123 Company Limited reviews our apportionment policy on a regular basis as the circumstances of each programme can change throughout the year. Therefore the policy and the apportionment of costs will be reviewed and any necessary adjustments made on a cumulative basis. We will seek approval from Pobal for any changes to our Apportionment Policy in advance of implementation.

This policy was approved by the Board of 123 Company Limited on xx/xx/xx.

123 Company Limited will continue to seek savings and efficiencies in our administration and overhead costs so as to achieve value for money and prioritise the provision of direct services to our target beneficiaries.

*notional costs are imaginary, speculative or conceptual i.e. something that has no actual existence.